This study posits the existence of four distinct variations within smart contract technology and proposes a taxonomy to organize and categorize these types. We will exemplify three practical applications of this technology, showcasing how these examples effectively illustrate the categories outlined within the proposed taxonomy. This taxonomy can serve as the foundational basis for constructing a risk analysis framework.

Introduction

This contribution will focus on smart contracts and explores one central question: which types of smart contracts must be distinguished? While the views presented here are based on academic research done in a legal context ([Vers23]), the definition of ‘smart contracts’ that this contribution maintains is purely technical: smart contracts are immutable computer programs that run deterministically in the contract of a blockchain platform (see [Anto19]). The legal aspects of such technology are relevant nonetheless, as smart contracts might be used in a manner that creates a considerable legal impact. Proposed practical applications of this technology concern transactions, transfers, or administrations of rights, interests, or entitlements that users rely on. Creating an environment in which such reliance is justified and protected, potential users of this technology ought to evaluate whether blockchain and smart contract technology can indeed produce the legal effect essential for their specific business case. Even for those business cases in which the technology might not perform a legal function, there might still be a legal risk. If the technology is used by an organization, it replaces software applications that might fulfill the same function but operate in a fundamentally different manner. This could, as is often touted, be cheaper, faster, or more reliable, but might also expose the organization to novel legal risks. An understanding of how blockchain and smart contract technology functions, how it is used in a specific organization, how it differs from the more traditional solutions that it replaces, and any interactions it may have with the relevant organizational context, will help mitigate any such future risks. A framework that outlines the effects, impact, and risks of this technology provides the guidance necessary for this: a smart contract taxonomy could form the basis of such a framework.

One important preliminary observation must be made: smart contracts are, despite their rather unfortunate name, not legal concepts. They are technological concepts. Therefore, any analysis of such concept must, at the very least, have due attention for their technological underpinnings and practical applications. Considering the above, this contribution will take four steps. First, a general overview of blockchains and smart contracts will be given. Secondly, the different types of smart contracts will be outlined. In this section, we will pay attention to types of smart contracts that might enjoy legal relevance. This is pivotal for those wishing to use this technology in a context where transactions are made in a manner that is enforceable and provides legal certainty for themselves, their partners, or their clients. Subsequently, in the third part, the practical impact of this taxonomy will be illustrated. This illustration will provide insights in the extent to which this technology is sufficiently mature and provides sufficient added value for organizations. Lastly, in the final paragraph, we will present evolutions, and applications of this technology in the context of which this taxonomy might be used. The overarching purpose of this contribution is to provide an overview of types and uses of smart contracts and provide guidance on how a taxonomy based on those types of smart contracts could be used by those considering using this technology.

Background and technology

Smart contract technology is rooted in a rather radical context. The initial proposal for smart contracts was published in Extropy, a journal that describes itself as a ‘Journal for Transhumanist Thought’ ([Szab96]). The decision to publish in this journal suggests a particular ideology, that of transhumanism. Central values of this ideology are ‘boundless expansion, self-transformation, dynamic optimism, intelligent technology, and spontaneous order’ ([More93]). These values suggest that the underlying ideology is effectively a rather extreme variation of techno-liberalism. Especially the principle of ‘spontaneous order’ makes this clear. Some have described this as ‘[an idea] distilled from the work of Friedrich Hayek and Ayn Rand, that an anarchistic market creates free and dynamic order whilst the state and its life-stealing authoritarianism is entropic’ ([Thwe20]). Such concepts were popular in the community that laid the groundwork for the technology that is in focus here. Known also as ‘crypto-anarchists’ or ‘cypherpunks’, the goal of this community was to develop technology that would enable economic and social conduct in a privacy-conscious manner and outside the reach of governmental authorities ([Ande22]). The efforts of this community have played a pivotal role in the technological developments that have ultimately culminated in blockchain-based smart contract platforms. As a result of this, the principles adhered to by this community are ingrained in the technology to this very day.

The extent to which this is the case becomes clear when blockchain-based smart contract platforms are compared to more classic technological solutions that might be supplanted or supplemented by this technology. Such technology might include, for example, online marketplaces, supply chain management tools, and payment solutions (see [Thol19] and [Reve19]). Blockchain and smart contract technology distinguishes itself from these classic solutions through five key aspects: the first three of which are a result of blockchain technology, whilst the last two are a result of the smart contracts capability that some platforms might have.

First, blockchain platforms are, in principle and up to a certain extent, immutable. This means that not one single party or group of parties can alter the state of information on the platform. This immutability applies on both a transaction and recordation level. The former of which is a result of the public-key encryption that is foundational to the platform, whilst the latter is a result of the way distributed consensus regarding the state of information is reached among the parties on the platform ([Anto17]). Secondly, the platform is transparent. A certain degree of transparency is necessary as the state of information on the platform is maintained by the parties collectively. This means that, rather than relying on a single centralized party charged with maintaining the state of information, the parties do so collectively. To perform the task necessary for this, certain information contained within the transaction and certain information regarding the transactions need to be available to the parties. A certain degree of transparency is therefore inherent to the system. This transparency, however, is not absolute. These platforms are built on a system based on public-key cryptography. This means that parties operate on these platforms using their public key. This public key therefore functions as a pseudonym. Examining the transparent platform can yield a wealth of information regarding transactions, including details such as the sender, recipient, value, and time. However, the cryptographic foundations of the platform do shield the identity of the natural persons behind the public key. Therefore, the third key aspect is pseudonymity.

Some blockchain platforms provide features that go beyond merely maintaining a record of past transactions. Such platforms provide the option for persons to program on the platform. If the programing that such a platform enables is sufficiently flexible and allows for sufficient complexity, it becomes possible to create entire software applications on that platform. Compare, for example, the Bitcoin blockchain with the Ethereum blockchain: where the Bitcoin blockchain is designed to transact with a cryptocurrency and, in light of this purpose, enjoys very limited programming capabilities on the platform itself, the Ethereum platform is designed from the ground up to enable the creation of decentralized applications. The Ethereum platform therefore incorporates a Turing-complete programming language that enables the creation of full software applications ([Bute13]). The term ‘smart contracts’ precisely denotes these software applications. This illustrates why smart contracts are technical concepts and not legal concepts (see on technology also [Weer19]).

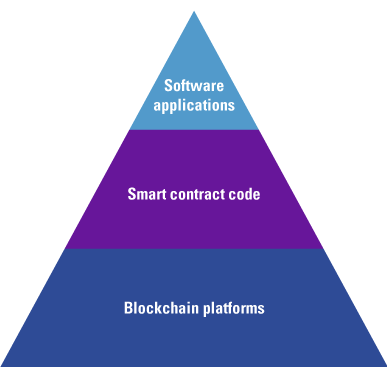

Figure 1. Technology overview. [Click on the image for a larger image]

Smart contracts are, in other words, code that exists on a blockchain platform: if the platform allows for sufficient complexity and flexibility, it becomes possible to program that smart contract code into software applications, also referred to as smart contracts (see Figure 1). Smart contracts are therefore pieces of software rather than legal agreements. As a result of their software-character, the conditions contained within their code are executed automatically and independently of any human action. Moreover, smart contracts exist on the same platform as the assets that are being transacted with, and the records being modified through, the smart contract. This means that the smart contract can interact directly and immediately with those assets or records. No (third) party is required to give effect to the predefined consequences stipulated in the smart contract. Consequences as stipulated in the smart contract are, in other words, automatically enforced when the conditions are fulfilled. Hence, automatic execution and automatic enforcement are the final two characteristics introduced by smart contract technology.

A smart contract taxonomy

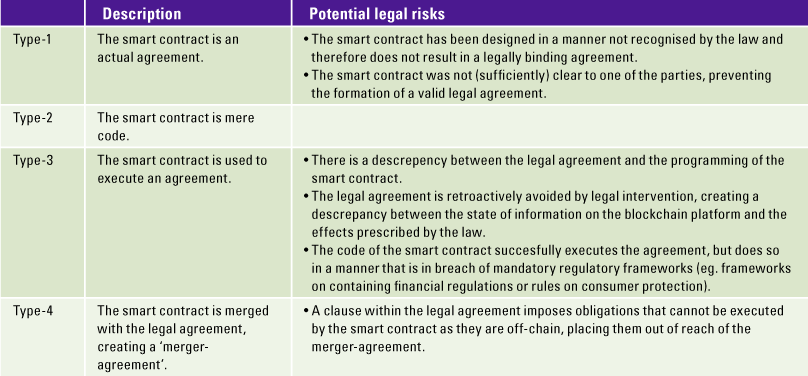

The purpose of a smart contract taxonomy is to organize the different variations of the technology that are currently being developed. Doing so provides a structure that can be used as the foundation of a more elaborate framework on the basis of which the legal risks created by this technology can be mapped out. The taxonomy distinguishes four types of smart contracts. It should be noted that a very similar taxonomy has been adopted by the European Law Institute as well ([ELI23]).

Type-1 smart contracts: software as a self-executory agreement

The first variation of smart contracts describes a piece of software in which the offer and acceptance coalesce. The relationship between the parties who transact by way of the smart contract is therefore governed by the smart contract ([Werb21]). It has been suggested that, in such a situation, the code might effectively ‘be’ the legal agreement as it constitutes the externalization of the parties’ consensus and proof of the content of the rights and obligations between the parties ([Tjon22]). Situations where this might be the case could, for example, be found in the context of decentralized finance (or ‘DeFi’). Think of, for example, platforms that enable parties to provide digital assets as security for a loan. Such platforms require smart contracts that stipulate and enforce the rights and obligations that the loans and securities require. If that smart contract is the sole instantiation of the agreement between the parties, that smart contract must be treated as defining the legal relationship. In such a case, the smart contract could be equated to the legal agreement.

Type-2 smart contracts: mere code

At their very core, smart contracts are nothing more than software. They are technological concepts rather than legal concepts. The great majority of smart contracts are just that; mere code. If such smart contracts do not fulfill any function that has a legal relevance, they are just software. This could be the case, for example, when a smart contract determines when a container leaves a ship that has entered a certain port. Such smart contracts might fulfill a pivotal function in a software suite but are of no legal relevance. These smart contracts are referred to as the second type of smart contract. Most smart contracts fall in this category.

Type-3 smart contracts: executory tools

The third variation in the taxonomy describes a situation in which a smart contract is distinct from a legal agreement, yet remains potentially legally relevant. In these situations, the smart contracts exist on-chain and parallel to a legal agreement that exists off-chain. In this case, the smart contract is used to give effect to the rights and obligations outlined in the legal agreement. Such a smart contract is therefore a tool that executes (part of the) legal agreements. Allen shows that smart contracts are ideally suited to be used as such executory tools ([Alle22]). If, for example, a soda machine, by way of a smart contract, orders a new batch of soda cans from the manufacturer, this smart contract is used to execute part of the overarching framework agreement that exists between the operator of the soda machine and the manufacturer of the soda cans ([Nave18]).

The smart contract is in hierarchical relationship with the legal agreement in which the smart contract is subservient to the legal agreement. However, the fact that the smart contract is subservient does not mean it is irrelevant or unimportant. After all, determining the content and validity of a legal agreement is done by assessing all relevant facts and circumstances, and the meaning that the parties to the agreement could reasonable have attributed to the agreement in light of those relevant facts and circumstances ([Kran20]). The technology is designed for contexts where parties transact remotely with minimal knowledge of each other’s identity. Consequently, reliance on factors beyond the smart contract executing the legal agreement is likely limited in determining the content and validity of such agreements. Therefore, as parties increasingly utilize this technology in a pseudonymous environment and lean on the smart contract as the executory mechanism, there is a diminishing pool of relevant facts and circumstances available for determining the meaning and validity of the underlying legal agreement. It follows from this that the more the parties apply this technology in a pseudonymous environment, and the more the parties rely on the smart contract as an executory mechanism, the less relevant facts and circumstances are available that can be used to determine the meaning and validity of the underlying legal agreement. In other words, the more parties rely on the smart contract as a tool to execute the separate legal agreement, the more important the smart contract will be in giving meaning to the legal agreement and determining the validity of that legal agreement.

Type-4 smart contracts: merger agreements

Lastly, there are smart contracts that exist in a form that makes them both machine-readable and human-readable. In the context of the taxonomy, this is the type-4 smart contract. An example of this is the Ricardian contract ([Grig22]). The feature of creating one single entity that is both machine-readable and human-readable at the same time, creates the option of creating a legal agreement and transforming it into a type-4 smart contract. Such a smart contract exists simultaneously on a blockchain platform in code, and therefore enjoys the benefits offered by the platform, while remaining susceptible to human comprehension. This fourth variation of smart contracts therefore describes an amalgamation that consists of two parts but exists as a single entity and, provided it meets the legal requirements, might be capable of producing legal effect. It must be noted that this final variation of smart contract technology is, at least to this day, largely theoretical.

Practical application

The preceding sections of this contribution have detailed the differentiating elements of the technology and how such technology might be categorized in a taxonomy that could be used to clarify the legal risks caused by implementation of smart contracting technology. See Table 1 for an overview of the taxonomy and an overview of examples of potential legal risks that might surface in the context of the different types of smart contracts. This final section aims to showcase three groundbreaking applications of the technology – currently being explored, tested, or even deployed – and to apply the taxonomic framework to these examples. Applying the taxonomy to these real-world examples will provide a general overview of the legal risks that exist and insights into the severity of such risks. Three such applications will be considered.

Table 1. Overview of taxonomy including potential legal risks. [Click on the image for a larger image]

Applications of smart contracting technology and use of the taxonomy

Blockchain technology has been used as a foundation upon which different applications have been developed. The most well-known and most successful of such applications are the cryptocurrencies. Revolutionary as they might have been, in their core these cryptocurrencies offer relatively limited application. Cryptocurrencies use the underlying technology to enable the exchange of value in a distributed environment. This means that transactions between persons are now possible without any centralized party charged with tasks that would commonly be performed by a centralized party. Such tasks include, for example, whether a party has the right to make a transaction, determining whether the party is who they claim to be, or whether the units that the party is attempting to transfer have not be transferred previously. Solutions based on this technology are gradually being adopted by more established financial institutions. The Hong Kong Stock Exchange, for example, has been testing this technology since 2016 to enable a more seamless trade between Hong Kong and Mainland China ([HKMA17]). Launched in October of 2023, the final product is built through smart contracts, optionally available to users, and is presented as providing a more connected and more transparent settlement platform ([HKEX23]). The smart contracts used in the context of this example are predominantly type-2 smart contracts, meaning that they are mere code and have no legal relevance. It might be that the smart contracts that are employed in the context of settlement might have some legal relevance, but since the code is unavailable it is impossible to determine whether and to what extent this is the case.

Additionally, an application of this technology that relies on smart contracts other than the type-2 smart contracts can be found within supply chain operations ([Thol19]). According to an IBM survey, there is extensive experimentation with this technology in the realm of supply chains, especially concerning operational and supply chain management ([IBM20]). In such contexts, it becomes crucial to accord due consideration to the legal risks involved. Smart contracts might be used in the context of a supply chain to confirm receipt of goods, record performance, and trigger payments. Such aspects are not only relevant from an operational perspective, but they might also be pivotal from a legal point of view in case a disagreement arises between parties regarding events that happened in the context of the services provided. Some of the smart contracts used in the context of the supply chains are likely to be qualified as a type-3 smart contract. They are executory tools that are used to give effect to the legal agreement or part thereof. As such, there are considerable legal risks that must be taken into account. Consider a scenario where goods are lost in transit, yet the smart contract records the arrival of the container carrying the goods in the harbor, subsequently triggering a payment. Designers and operators should take such eventualities into account. Important questions in this context concern striking a balance between the relatively immutable nature of the platform and the automatic enforcement of the smart contracts. From a legal point of view, such question could emerge in the context of, for example, mistake, fraud, or disagreements about the content of the legal agreement.

Finally, one particularly interesting application of this technology is the creation and transfers of tokens on blockchain-based tokenization platforms. Such tokens function as units on a platform that represent an asset ([Kona20]). Especially the trade of non-fungible tokens has garnered a great deal of attention over the last few years. Whilst for some it might be very exciting to hold a token that represents a cute picture of a cat or a monkey, the technology allows for much more relevant applications. It is, for example, technically possible to have a token represent a claim or a classic financial instrument (see for example [ABN23]).

ABN AMRO was the first bank in Europe to register a digital bond for a Midcorp client on the public blockchain ([ABN23])

‘The entire process of preparing, placing and documenting the bond was digital. Ownership was recorded on the blockchain in the form of tokens that the investors acquired after they had paid for the bond. To ensure custody and security of the investors’ unique keys, ABN AMRO uses a wallet for accessing the digital bond.’

This final example of the implementation of the technology in question potentially introduces type-1 smart contracts in addition to type-2 and type-3 smart contracts. If a platform creates the option to effectively securitize claims or traditional financial instruments by way of a token, and any acquisition or trade of such tokens is limited to the platform alone, it is likely that the smart contract is the sole instantiation of the agreement between the parties. As such, the smart contract should be equated to the legal agreement. This means that all classic legal risks regarding formation, interpretation, and potential vitiation exist on-chain.

Conclusion

Smart contracts have been central to several hypes over the last few years. Those hypes have come and gone, but the development of smart contract technology and the potential applications of this technology has continued. Such developments are slowly giving rise to credible applications that are generating actual business opportunities. The nature of the technology that is at the root of such applications is fundamentally different than the technology it might supplant, and as such it will generate novel risks. Considering the way in which the technology is being applied, the legal risks should not be underestimated. Due to the highly technological nature of these risks, their integration with the organization, and their potential severity, businesses should prioritize preventing these risks proactively rather than mitigating them reactively after they have materialized. The taxonomy presented here provides a clear overview of the different types of smart contracts that exist. Such an overview could help an advisory practice doing exactly that: the taxonomy can be used to leverage technological know-how and risk management expertise to assist businesses in navigating the novel risks that designing and implementing products based on this technology might create.

References

[ABN23] ABN. (2023). ABN AMRO registered first digital bond on public blockchain. Retrieved from: https://www.abnamro.com/en/news/abn-amro-registers-first-digital-bond-on-public-blockchain

[Alle22] Allen, J. G. (2022). ‘Smart Contracts’ and the Interaction of Natural and Formal Language. In J. G. Allen & P. Hunn (Eds.), Smart Legal Contracts: Computable law in theory and practice. Oxford University Press.

[Ande22] Anderson, P. D. (2022). Cypherpunk Ethics: Radical Ethics for the Digital Age (1st ed.). Routledge. https://doi.org/10.4324/9781003220534

[Anto17] Antonopoulos, A. (2017). Mastering Bitcoin: Programming the open blockchain (2nd ed.). O’Reilly.

[Anto19] Antonopoulos, A. & Wood, G. (2019). Mastering Ethereum: Building Smart Contracts and Dapps. O’Reilly.

[Bute13] Buterin, V. (2013). Ethereum Whitepaper. Retrieved from: https://ethereum.org/en/whitepaper/

[ELI23] European Law Institute. (2023) ELI Principles on Blockchain Technology, Smart Contracts and Consumer Protection. Retrieved from: https://www.europeanlawinstitute.eu/fileadmin/user_upload/p_eli/Publications/ELI_Principles_on_Blockchain_Technology__Smart_Contracts_and_Consumer_Protection.pdf

[Grig22] Grigg, I. (2022). Why the Ricardian Contract Came About: A Retrospective Dialogue with Lawyers. In J. Allen, Smart Legal Contracts (pp. 88-106). Oxford University Press. https://doi.org/10.1093/oso/9780192858467.003.0006

[HKEX23] Hong Kong Securities Clearing Company Limited. (2023). Synapse Platform Launch. Retrieved from: https://www.hkma.gov.hk/media/eng/doc/key-functions/financial-infrastructure/infrastructure/20171025e1.pdf

[HKMA17] Hong Kong Monetary Authority. (2017). Whitepaper 2.0 on Distributed Ledger Technology. Retrieved from: https://www.hkma.gov.hk/media/eng/doc/key-functions/financial-infrastructure/infrastructure/20171025e1.pdf

[IBM20] IBM. (2020). Advancing global trade with blockchain. Retrieved from: https://www.ibm.com/downloads/cas/WVDE0MXG

[Kona20] Konashevych, O. (2020). Constraints and benefits of the blockchain use for real estate and property rights. Journal of Property, Planning, and Environmental Law, 12(2), 109-127.

[Kran20] Van Kranenburg-Hanspians, K. & Derk, M. T. (2020). De kansen van blockchain technologie voor het contractenrecht. Overeenkomst in de rechtspraktijk, 1, 16-21.

[More93] More, M. (1993). Technological self-transformation: Expanding personal extropy. Extropy: Journal of Transhumanist Thought, 4(2), 15-24.

[Nave18] Naves, J. (2018). Smart contracts: voer voor juristen? Onderneming en Financiering, 26(4), 57-67.

[Reve19] Revet, K. & Simons, E. (2019). Start small, think big: Blockchain technology – the business case using the SAP Cloud Platform. Compact, 2019(1), Retrieved from: https://www.compact.nl/articles/start-small-think-big

[Szab96] Szabo, N. (1996). Smart Contracts: Building Blocks for Digital Free Markets. Extropy: Journal of Transhumanist Thought, 8(16), 50-53.

[Thol19] Tholen, J., De Vries, D., Van Brug, W., Daluz, A. & Antonovici, C. (2019). Enhancing due diligence in supply chain management: is there a role for blockchain in supply chain due diligence? Compact, 2019(4). Retrieved from: https://www.compact.nl/articles/enhancing-due-diligence-in-supply-chain-management/

[Thwe20] Thweatt-Bates, J. (2020). Cyborg selves: A theological anthropology of the posthuman (3rd ed.). Routledge.

[Tjon22] Tjong Tjin Tai, E. (2022). Smart Contracts as Execution Instead of Expression. In J. Allen, Smart Legal Contracts (pp. 205-224). Oxford University Press. https://doi.org/10.1093/oso/9780192858467.003.0010

[Vers23] Verstappen, J. (2023). Legal Agreements on Smart Contract Platforms in European Systems of Private Law. Springer.

[Weer19] Van der Weerd, S. (2019). How will blockchain impact an information risk management approach? Compact, 2019(4). Retrieved from: https://www.compact.nl/articles/how-will-blockchain-impact-an-information-risk-management-approach

[Werb21] Werbach, K. & Cornell, N. (2021). Contracts: Ex Machina. In M. Corrales Compagnucci, M. Fenwick, & S. Wrbka (Eds.), Smart contracts: Technological, business and legal perspectives. Hart.