Consumers, regulators and investors are becoming increasingly more demanding in the areas of food safety, modern slavery, working conditions, environmental and social impacts. RBC (Responsible Business Conduct) has become the new norm and companies are expected to better identify, report and reduce risks as well as adverse impacts throughout their supply chains. However, identifying such risks is challenging for most businesses due to the complexity of supply chains. In recent years, companies took a closer look at blockchain as a promising technology to help address pressing issues in supply chain due diligence.

This article provides a critical look at how blockchain technology can play a role in responsible supply chains as well as the benefits and challenges of applying the technology.

Introduction

Supply chains are complex, fragmented and involve a large number of suppliers and intermediaries throughout the world. Therefore, organizations face multiple challenges related to the management of information in supply chains due to inconsistent, fraudulent, limited or missing data. Traditionally, information flow transfer is collected via the exchange of paper documentation, shared database or repository, traceability software or audits. Most of the time, these transfers are time consuming, cannot easily be shared or synchronized due to different data formats or architecture and the information is difficult to verify, measure or is simply missing, resulting in more complex due diligence processes.

In recent years, blockchain technology has been viewed as a disruptive technology that can address inefficiencies in supply chain management by creating more transparency in the value chain (e.g. Volvo Cars has recently announced that it will make use of the technology to track the cobalt used in its electric car batteries ([Volv19])). Even though most companies are still at an experimental stage, this technology has already been used in a significant number of supply chain initiatives across different sectors with varying degrees of success. Improved access to verifiable data, increased transparency and trust, as well as identifying potential risks can help companies know what is going on in their supply chain and address any issues found.

The article analyzes the role blockchain can have in responsible supply chains. First, the challenges faced in supply chain due diligence will be assessed. Next, how a technology solution such as blockchain could facilitate due diligence, its potential benefits and any implementation hurdles will be explored.

Due diligence and its challenges for responsible business conduct in supply chains

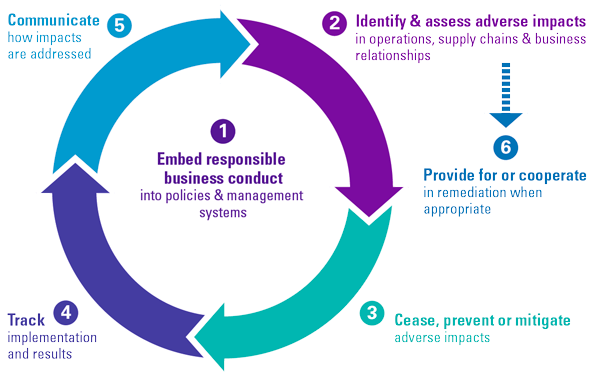

Consumers and other stakeholders are increasingly demanding access to more accurate information on the origin and journey of goods, as well as the conditions throughout the supply chain ([Whit18]). This means that companies are expected to play a stronger role in identifying and reporting risks and actual adverse impacts throughout their supply chain and take appropriate action to prevent them. In order to do so, companies should be able to conduct meaningful supply chain due diligence. This is the process of identifying and addressing adverse impacts in the supply chain, such as forced (child) labor and deforestation. However, companies often face obstacles that directly affect their ability to conduct meaningful supply chain due diligence. To help them in this process, the OECD has created a due diligence framework with supporting measures as highlighted in Figure 1.

Figure 1. Due diligence process and supporting measures (extracted from [OECD19]). [Click on the image for a larger image]

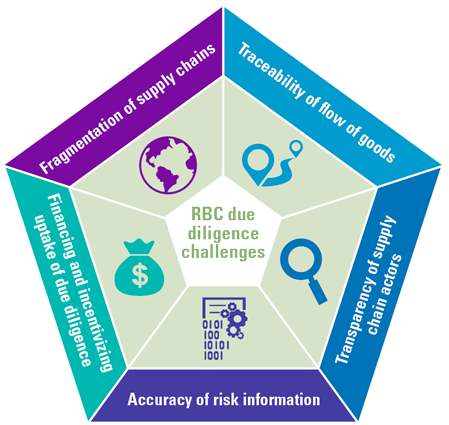

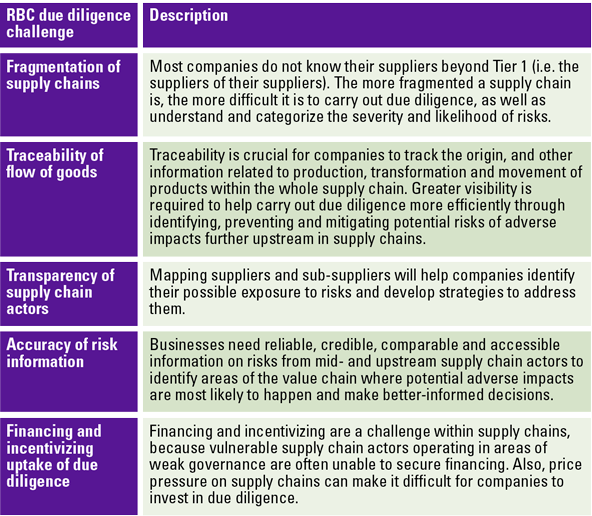

The challenges corporations face when implementing due diligence for responsible business conduct are highlighted in Figure 2 and detailed in Table 1.

Figure 2. Responsible Business Conduct (RBC) due diligence challenges (extracted from [OECD19]). [Click on the image for a larger image]

Table 1. Description of Responsible Business Conduct (RBC) due diligence challenges in supply chains. [Click on the image for a larger image]

Businesses in many industries and governments have acknowledged that the use of technology can be transformational for the flows of goods, money and information. The following section will investigate how a new buzzword, blockchain, could facilitate the supply chain due diligence process.

What is blockchain?

Understanding blockchain and distributed ledger technology

Blockchain is part of Distributed Ledger Technology (DLT), the umbrella term for technologies that store, distribute or exchange value publicly or privately ([OECD18]) between entities in a network based on shared transaction ledgers. In this article the word blockchain is used to describe the usage of distributed ledgers in general, in line with popular usage of the term.

In a distributed ledger, copies of transactions are automatically shared among entities of a network, resulting in a synchronized flow of information between stakeholders, helping to address inefficiency related to information asymmetry. Key features of blockchain relevant to the accuracy of supply chain information are:

- Immutability and decentralization. Blockchain is designed to be an ‘append-only’ data structure. Historical transaction data cannot be deleted, and no single party can change transactions recorded in the shared ledger because the ledger is maintained by multiple parties.

- Single source of truth. All nodes in a blockchain network share the same state of the shared ledger, creating a single source of truth for all parties in the value chain.

- Security. Blockchain relies on cryptography for data security to ensure the integrity and availability of the transactions in the shared ledger.

See previous articles in Compact, for example [Spen17] and [Houg16], for additional information on blockchain technology.

Can blockchain facilitate supply chain due diligence?

The natural question to ask is whether blockchain can improve how due diligence is being conducted. In total six key benefits of a blockchain solution are highlighted below.

Benefit 1: Real-time data traceability

If all actors in a supply chain log their interactions in a shared ledger this could potentially create traceability and a complete chain of custody for the entire supply chain. Reliable data tracing the flow of goods and services across a supply chain is considered a critical aspect of the OECD due diligence process and a shared ledger providing real-time data traceability could enhance a company’s due diligence process. For example, a local distributor in a consuming country would be able to trace the bottle of wine sold back to the original grape producer. Therefore, in case of a problem (e.g. contaminated products), a targeted product recall can be realized instead of a full recall.

Company example Pooley Wines ([Futu18])

Pooley Wines increased their supply chain transparency by providing consumers with detailed traceability and audit information of supply chain actors.

Benefit 2: Transparency of supply chain actors and practices

A shared ledger would create more visibility across actors in the supply chain. Furthermore, a blockchain solution could be used by actors to publish their RBC policies. A shared ledger can also enable transparency of payment data, particularly where there is high risk of exploitation of vulnerable production networks such as homeworkers. To further strengthen the company’s due diligence processes, third-party assessors could be given permission to publish assessment results in a way that is easily accessible by other relevant supply chain actors.

Company example Provenance ([Prov16])

Provenance has implemented a blockchain solution that traces yellowfin and skipjack tuna fish in Indonesia. Whenever a fish is caught, the fisherman tags it with an RFID chip and records it onto the blockchain using a mobile phone. Therefore, all actors and products are visible on the shared ledger and the path of the fish can be followed from catch to consumer.

Benefit 3: Fraud reduction

If all actions of supply chain actors are logged on a shared ledger and outputs from earlier actors are used as inputs for next actors, this creates transparency of the flow of goods and reduces the potential for fraud – provided that robust digital twins have been established for the goods and there is quality control on the actions registered. For example, a wine producer cannot produce more wine than grape harvest received from the grape grower. Easy access to information on the blockchain adds to the efficiency of focusing due diligence activities, as information relating to risks would be easier to triangulate and verify.

Company example Barksanem ([Bark19])

Barksanem (Mineral industry) uses blockchain to promote financial inclusion and fraud reduction by incentivizing formalization of artisanal and small-scale minerals through the use of virtual currency.

Benefit 4: Smart contracts

If actors and their assets are digitized on a single platform, this provides the opportunity for cross-organization automatization, enabling processes to take place without human interaction. In the blockchain context, the use of automatization to facilitate the execution of a business transaction is commonly referred to as a “smart contract”. This results in cost reduction and efficiency gains for all parties involved. Smart contracts further reduce the risk of non-compliant behavior in the supply chain and lead to greater formalization of relationships and information exchange.

Company example AB InBev ([Slav19])

AB InBev (Agricultural sector) uses blockchain to promote financial inclusion, fair payment, and supply chain efficiency by connecting directly with small-scale farmers through smart contracts and mobile banking services.

Benefit 5: Cost efficiency

The efficiency and automatization potential yielded by a blockchain solution could free up capital that was previously used to support individual operations (e.g. bureaucracy linked to product shipment transfer). However, there is a still a challenge to make sure that the costs and efficiency dividends are fairly shared. Some of these efficiencies may be the result of greater uptake and value chain cooperation.

Company example CargoX ([Barl19])

CargoX has developed a blockchain solution that simplifies the processing of Bills of Lading, the most important documents in the global logistics industry. The solution enables to complete a full document ownership transfer in a matter of minutes, instead of days or weeks. This saved time makes the whole process more efficient and reduces the cost of delays.

Benefit 6: Financial Inclusion

Vulnerable supply chain actors operating in areas of weak governance (e.g. artisanal miners, farmers, home workers) often face challenges securing financing due to their inability to provide financial information and background to banks or difficulty in even accessing financial institutions. This can lead to those individuals turning to illicit sources of finance and logistical support for their operations, which in turn can perpetuate their problems. Being part of a blockchain system could create financial inclusion either through secured and efficient transaction with an exchangeable virtual currency or through creating more detailed records of business transactions in order to apply for banking services.

Company example Moyee Coffee ([Tren19])

Moyee Coffee has implemented a blockchain solution that includes all of its Ethiopian smallholders involved in the production of coffee. This enables fair payments and allows consumers to know precisely the origin of their coffee.

It is important to note that while the use of blockchain technology can address a number of due diligence challenges, increased supply chain traceability and transparency from the use of this technology does not replace the entire supply chain due diligence process, but it will facilitate it. Actual ‘boots on the ground’ will still be needed to perform audits and investigate whether the situation in real life matches what is reported digitally via the blockchain. While there will be advantages through a blockchain solution, these will not come for free. Lessons from past initiatives on the implementation of blockchain has revealed several obstacles that need to be tackled. These are outlined below.

Challenges companies may face adopting blockchain

Understanding the challenges is necessary to develop a critical look at whether blockchain is an appropriate solution to due diligence challenges and business needs. In total, eight technical and non-technical challenges have been identified.

Non-technical challenges

Challenge 1: Embedding RBC due diligence

Incorporation of RBC considerations in a blockchain solution may include human-based inputs such as on-the-ground social compliance audits. The outcomes of these audits should be uploaded onto the blockchain in order to ensure transparency among the different actors. The challenge to prevent fraudulent audits and include representative activities during those audits remains exactly the same, unless a way to include data & analytics to prevent and detect flaws in audit quality is found.

Challenge 2: Inclusion of informal actors

Often times, there are low-income smallholders in the very upstream of the supply chain who operate without a working contract and are practically anonymous to downstream players. Given that this part of the supply chain has a higher risk of human rights violations, a blockchain solution would have to find a manner to incorporate these actors (e.g. by using scalable mobile infrastructure capabilities that tend to be better developed than traditional infrastructure in developing countries).

Challenge 3: Value chain cooperation

All actors in the value chain need to collaborate to create a blockchain solutions. It can be challenging to work in a joint initiative and work together with many competitors from the same industry. Clearly, an initiative is more likely to succeed if the number of value chain participants is relatively small, resulting in an easier governance management. For example, the blockchain start-up VAKT ([Tesf19]) was created by a small group of key stakeholders in the North Sea crude oil trade: three major oil companies, three large banks and three trading houses, with the objective to reduce time spent on operations and make trading more efficient.

Challenge 4: Standardization of data model

All participants need to agree on the definitions used in the shared ledger. This will require collaboration with value chain actors in a non-competitive way in order to create a common language. This would enable actors to link their outputs to the inputs of different actors. However, the incentives to adhere to agreed definitions may vary from actor to actor.

Challenge 5: Governance

A governance structure needs to be in place to define roles and responsibilities for the participants in the network. This structure will address, among others, validation and approval of changes actors make in their own IT platforms so they still synchronize with those of other participants.

Technical challenges

Challenge 6: Interoperability

Currently, many companies are already using their own IT systems to manage business processes. Since these systems are based on own definitions, there will likely be incompatibility when linked to the blockchain network, meaning that the output of one actor cannot directly be used as input for the next one. Until these systems become synchronized, data flows from actor to actor in a blockchain will likely create an additional burden. Another aspect to consider is how linkage of different blockchain initiatives would work in practice.

Challenge 7: Asset digitization

Products may undergo several transformations along the supply chain (e.g. grape to wine to wine bottle) and the challenge lies in digitizing each one of these stages while maintaining a proper link between the physical product and its digital counterpart. The risk at this stage involves correct payments being done for digital twins of non-existing products or incorrect payments for existing ones. Ideally, smart contracts should cover this, but for them to operate optimally it requires ‘correct’ information to be introduced on the blockchain, which is compatible between the different actors.

Challenge 8: Data transparency vs privacy

Companies often confuse transparency with privacy. While permissioned ledgers help define who can or cannot gain access to information, a balance needs to be found between revealing ‘enough’ information to provide due diligence transparency and retaining corporate privacy.

Conclusion

Companies face a number of challenges when conducting effective due diligence for responsible business conduct. This article considers the role blockchain technology may have in facilitating responsible supply chains. Having explored both the potential benefits of a blockchain solution as well as the corresponding implementation challenges, the following can be concluded:

- Blockchain has the potential to provide near real-time updates of supply chain information, allowing better control and visibility in localizing risk hot spots and performing risk mitigation.

- Access to genuine information uploaded throughout the supply chain will mean improved access to verifiable inputs and outputs.

- Blockchain can deliver more transparency and increased accuracy of supply chain due diligence information, enabling a dynamic and effective due diligence process.

- The development of blockchain initiatives could benefit from multi-stakeholder cooperation to create consistent and coherent rules, answer key governance questions, and ensure integration of RBC principles.

A common recurring question for any blockchain project is whether the objectives of the project could have been achieved without blockchain technology. One could argue that if all the different challenges corresponding to implementing a blockchain solution are solved, many of the same value chain transparency benefits could be achieved with traditional database technology. Furthermore, there are very few use cases where blockchain is applied at scale in for instance sector-wide initiatives. The lack of strong use cases is expected to affect the appeal of the solution in the near future ([Gart19]). Ultimately, it is too early to say where, how and when blockchain can add more value to companies than traditional database technology in supply chain due diligence efforts, but there is certainly potential as shown in a series of experiments and pilots.

References

[Bark19] Barksanem (2019). Sustainable economic development through mining innovation. Retrieved from: https://www.barksanem.com/offering/?lang=en.

[Barl19] Barley, M. (2019). Blockchain electronic lading gets green light from shippers. Retrieved from: https://www.ledgerinsights.com/blockchain-electronic-bill-of-lading-gets-cargox-g2ocean/.

[Elleb17] Ellebrecht, A. & Schouten, N.G.J. (2017). Shared ledgers. How shared ledgers facilitate the flow of information between suppliers and buyers in agri-food supply chains. Compact 2017/4. Retrieved from: https://www.compact.nl/en/articles/shared-ledgers/.

[Futu18] FutureIoT Editors (2018). How Pooley Wines uses IoT to improve consumer experience. Retrieved from: https://futureiot.tech/how-pooley-wines-uses-iot-to-improve-consumer-experience/.

[Gart19] Gartner (2019). Gartner Predicts 90% of Blockchain-Based Supply Chain Initiatives Will Suffer ‘Blockchain Fatigue’ by 2023. Retrieved from: https://www.gartner.com/en/newsroom/press-releases/2019-05-07-gartner-predicts-90–of-blockchain-based-supply-chain.

[Houg16] Hough, G. & Spenkelink, H. (2016). Blockchain. From hype to realistic expectations. Compact 2016/4. Retrieved from: https://www.compact.nl/articles/blockchain/.

[OECD18] OECD (2018). OECD Blockchain Primer. Retrieved from: https://www.oecd.org/finance/OECD-Blockchain-Primer.pdf.

[OECD19] OECD (2019). Is there a role for blockchain in responsible supply chains? Retrieved from: http://mneguidelines.oecd.org/Is-there-a-role-for-blockchain-in-responsible-supply-chains.pdf.

[Prov16] Provenance (2016). From shore to plate: Tracking tuna on the blockchain, Retrieved from: https://www.provenance.org/tracking-tuna-on-the-blockchain.

[Seib16] Seibold, S. & Samman, G. (2016). Consensus. Immutable agreement for the Internet of Value, KPMG. Retrieved from: https://assets.kpmg/content/dam/kpmg/pdf/2016/06/kpmg-blockchain-consensus-mechanism.pdf.

[Slav19] Slavin, T. (2019). How AB InBev is using blockchain to improve the lives of smallholder farmers. Retrieved from: http://www.ethicalcorp.com/how-ab-inbev-using-blockchain-improve-lives-smallholder-farmers.

[Spen17] Spenkelink, H. (2017). Blockchain: with great power comes great responsibility. Compact 2017/4, Retrieved from: https://www.compact.nl/articles/blockchain-with-great-power-comes-great-responsibility/.

[Tesf19] Tesfaye. M. (2019). A blockchain platform for oil is making waves. Retrieved from: https://www.businessinsider.com/vakt-blockchain-platform-signs-up-north-sea-oil-traders-2019-2.

[Tren19] Trendforce (2019). Moyee Coffee relies on blockchain technology to make coffee trade transparent. Retrieved from: https://trendforce.one/en/moyee-coffee-relies-on-blockchain-technology-to-make-coffee-trade-transparent/.

[Volv19] Volvo Cars (2019). Volvo Cars to implement blockchain traceability of cobalt used in electric car batteries. Retrieved from: https://www.media.volvocars.com/global/en-gb/media/pressreleases/260242/volvo-cars-to-implement-blockchain-traceability-of-cobalt-used-in-electric-car-batteries.

[Whit18] White, M. (2018). The conscious consumer: Why do so many care about the provenance of products? The Manufacturer. Retrieved from: https://www.themanufacturer.com/articles/conscious-consumer-many-care-provenance-products/.