Many organizations are moving towards SAP S/4 HANA. The implementation of this new SAP backbone provides a once in a decade opportunity to increase tax compliance while at the same time reducing associated costs. This article outlines the key considerations relevant for tax decision makers, both from an opportunity as well as a point of attention perspective.

Introduction

With many organizations already transitioning to SAP S/4 HANA or starting the implementation in the next 1 to 3 years, the tax function is called to action to reassess the corporate tax strategy and transformation roadmap on key elements like sourcing, processes, technology (in essence, the total cost of tax compliance). This article first of all describes the necessity of revamping and digitizing tax processes of the tax function to reduce total cost of compliance while maintaining, and preferable increasing, the quality of tax returns. With this necessity in mind, SAP S/4 technology solutions are described and assessed in terms of how these can contribute to this digital transformation of the tax function. The focus will be on taxes that have their main data and process footprint within SAP S/4, like value added tax (VAT), goods & services tax (GST) etc.

Since a business case should also cover key attention points, the overview shared also outlines key considerations for tax managers to be able to make balanced choices.

The end of an era: goodbye classic tax function

The world of tax is changing rapidly as highlighted by the Organisation for Economic Co-operation and Development in the publication called Tax Administration 3.0: The Digital Transformation of Tax Administration ([OECD20]). According to the Forum on Tax Administration Commissioners (FTA) , the future of tax administration is something of a break with the current approach which relies on active, and sometimes burdensome, voluntary compliance by taxpayers and on resource-intensive investigations plus audits to address tax non-compliance.

In the FTA 3.0 foreseen end-state, tax authorities and tax paying organizations require to be data-driven, event-based with real time corrected and validated data and prompt interoperable ecosystems between the organizations and the tax authorities on a global scale.

Looking back at 2015 and before, the world of tax looked completely different. The classic tax end-to-end process could be described as combination of

- regular business processes that were creating tax-relevant transactions on an ongoing basis in SAP R/3 and ECC environments and

- a separate and usually disconnected compliance process to be started during the end of period to extract, adjust and submit tax returns to the tax authorities.

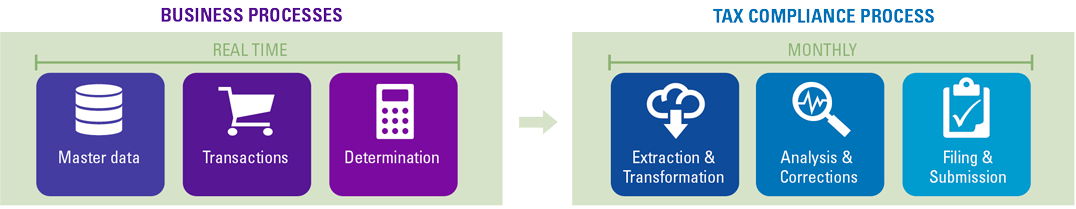

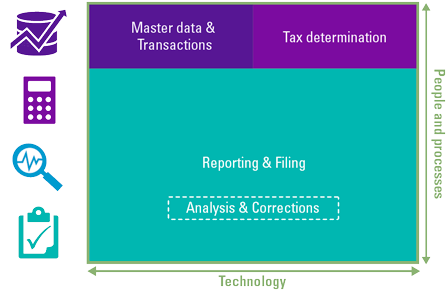

As shown in Figure 1, based on master data, transactions take place on a real-time basis for tax determination. On the other side of the coin, on a more periodic basis, the tax compliance process is executed to generate the tax return using some form of extraction, data manipulation and compliance checks.

Figure 1. The classic end-to-end tax process. [Click on the image for a larger image]

With a periodic reporting requirement and corresponding business process to support this filing, tax departments had sufficient time windows to review the data that is submitted to the authorities and make corresponding adjustments if required.

Data integrity and compliance checks were reduced to random sample checks or basic if- else checks applied in MS Excel, based on manually fetched data from tax compliance reports in SAP. The consideration of sophisticated tax compliance checks was more a could have then a should have discussion as there was plenty of time to manually correct afterwards and still have a timely submission to the tax authorities. Moreover, back then the tax authorities generally had a more lenient approach when it came to corrections and adjustments after the fact and were not excessively making use of technology and data analytics themselves in their control and audits.

Since SAP is at the heart of the business processes that create tax relevant data that is subsequently reported to tax authorities, the setup of SAP with respect to tax is key. However, many organizations consider making changes to the SAP system as difficult, costly and complex. Therefore, the SAP system is treated as a given that cannot be changed. As such, any tax budget spent on technology improvements were primarily spent on technologies supporting the tax compliance process and less on designing and improving the master data, tax relevant transaction data entry and tax determination in the source SAP system.

So why change now?

Over the last 5 years, the tax authority’s demand for detailed digital data has grown extensively worldwide. More and more countries require the electronic submission of detailed transactional data. In many Latin American countries, such as Mexico, tax authorities have set up e-invoice systems for taxes that require transactions to be validated by and reported to the tax authorities in real time. This trend is already being seen in several Asia-Pacific jurisdictions and some countries in Europe as well (e.g. Hungary and Italy).

Many tax authorities are also investing more and more in data mining and other analytic techniques to test data accuracy, verify tax compliance, and discover tax compliance patterns across businesses and industries. With an increasing number of jurisdictions imposing Standard Audit File for Tax (SAF-T) reporting requirements for taxes, it seems that predictions about the impending death of the periodic tax return could be on the mark as predicted by the Forum of Tax Administration.

Increased tax reporting demands

Tax authorities are becoming more digital, demonstrated by the increasing reporting requirements implemented across the globe.

Frequency

It is impossible to discuss tax requirements without mentioning real time reporting. To collect all taxes, tax authorities want to be informed as soon as possible of transactions with a tax treatment, just after the event or within less than a week.

Depth

Not only do organizations need to report on a more frequent basis, an increasing set of supporting and underlying details need to be submitted along with the high-level tax related financial figures. Whereas it was first sufficient to submit financial figures mapped to the various applicable boxes, in some countries it is required that additional files are submitted with transactional and master data related to the underlying sales and purchase transactions.

Breadth

Next to the need of filing more detailed reports on a more frequent basis, it is also required to submit more reports that zoom in on additional areas of operation, such as bank statements, fixed assets, goods movements, dividends, license rights and so on.

Format

Finally, the technical data format of the reports becomes more diverse and require additional technology components to facilitate the submission. Nowadays, besides MS Excel we see that XML, PDF and J-SON become the standard. For submission, specific APIs are required to submit the returns to the tax authorities. These data format and technology requirements are not harmonized at all and differ across countries.

The need for tax compliance by design

Whereas before, tax teams could examine and, if needed, correct data before reporting it on tax returns, an increasing number of tax authorities now receive the required data in real time. This means that authorities are able to assess tax compliance of the submitted data before the tax payer was able to make required adjustments.

Tax data quality and data governance are becoming much more important as a result. With less to no time available to correct and analyze after the fact before submission to tax authorities, we see that getting in data ‘first-time right’ and quality tax determination in the SAP system becomes a necessity. This means that tax functions should consider being tax compliant by design as a must-have requirement to generate accurate and complete tax relevant data in real time. Technology plays a crucial role in this shift, which in terms of SAP S/4 is outlined in the next section in more detail.

SAP S/4 HANA: a once in a decade digital event and opportunity for the tax function to rebuild the SAP foundation

The introduction of a new ERP system is an ideal opportunity to redefine existing ways of working or introduce new ways of workings enabled and accelerated by technology. The implementation of SAP S/4 HANA is no different. Before we describe the impact on tax in more detail, we need to introduce SAP S/4 HANA. As explained by [Emen19], there is a difference between SAP S/4 and SAP HANA.

Difference between SAP S/4 and SAP HANA

The functional front-end: S/4

SAP S/4HANA, which is short for “SAP Business Suite 4 SAP HANA”, is the new ERP SAP core application environment for the coming years to cover all day-to-day processes of an organizations (such as order-to-cash, source-to-pay, plan-to-make and record-to-report). It is the successor of SAP R/3 and SAP ERP and is optimized for SAP HANA in-memory technology, which triggered various functional changes. For instance, the concept of master data (business partners) has been simplified, as well as the way financial transactions are posted without subledgers involved.

The backend technology: SAP HANA

SAP HANA technology can be best described as a modern database technology. What makes it different from a classical database technology is that data is stored in a column-oriented way and that data is stored in-memory.

This way of storing and interacting with data provides a magnitude of faster data access possibility and in extension faster querying (data and analytics) and processing.

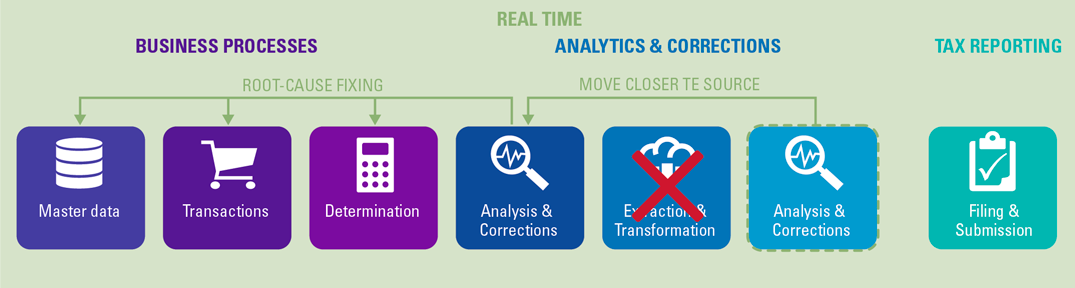

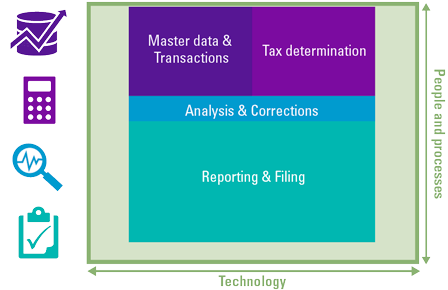

If we take SAP S/4 HANA on the one hand and tax analytics and processes on the other hand, we see that elements in existing process have become obsolete or can be performed or supported differently. As illustrated in Figure 2, tax data generation and tax compliance checking occur on a real-time basis. This is possible as data extraction and transformation is not required anymore, and the SAP HANA database is able to analyze significant amount of data in real time.

The goal of analytical checks has become two-fold: checking compliance of the transactions in the first place, but also providing insights to the tax function to identify root-causes. By tackling these root-causes in the earlier stages of the business process (e.g. correcting master data and changing tax determination rules), the system becomes more tax compliant by design with every iteration.

Lastly, the filing and submission is either performed automatically or involves last mile reporting only and not a combination of compliance checks and reporting.

Figure 2. The end-state: a real-time and integrated tax analytics and reporting process. [Click on the image for a larger image]

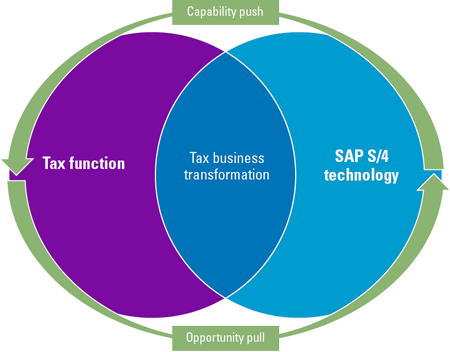

The end-state as shown in Figure 2 is a typical example of tax business transformation. To summarize the role of technology, Figure 3 describes how supply and demand come together on a high level.

Figure 3. The interaction of the tax function on the one hand and technology for business transformation on the other hand. [Click on the image for a larger image]

Basically, SAP S/4 HANA is an example of capability push to the tax function which changes existing ways of working within the tax function. At the same time, we have a capability pull from the tax department to be compliant by design. In the next section we will describe how these two forces come together and trigger a tax business transformation that results in an end-to-end process as described in Figure 2.

Reducing the total cost of tax compliance by transitioning from classic to real-time and integrated end-to-end process

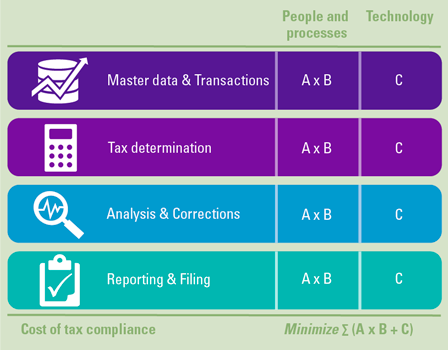

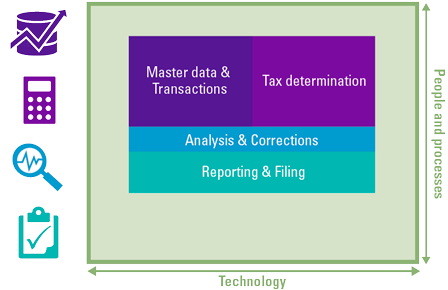

What has been discussed so far primarily focuses on the qualitative aspect of the tax process and the residual risk when reporting tax returns to the authorities. Besides the external pressure of the increasing need for quality data and accurate and complete tax returns, there is an accelerated CFO ‘buzz’ within organizations regarding transformation and digitization. The main objective is to reduce costs on recurring back-office processes like tax and finance. Let us try to make this objective more tangible by using a simple mathematical model. Figure 4 shows four drivers of compliance costs: master data & transactions, tax determination, analysis & corrections, and reporting & filing. These cost drivers can be specified further in two categories: people and processes on the one hand, and the technology involved on the other hand. The actual costs involved can then be calculated as follows per bucket:

- people and processes: time spent (A) multiplied by the FTE rate (B)

- technology: annual costs of supporting technology (C)

This results in a total cost equation of the sum of people and processes and technology involved across four drivers.

Solving the aforementioned equation will optimally result in a minimal total cost of tax compliance. The next question is: how do we achieve such a minimal total cost of tax compliance?

Figure 4. The total cost of tax compliance is driven by four elements. [Click on the image for a larger image]

To make this more visual, imagine the total cost of tax compliance as a square of two axis. The horizontal axis describing the amount of money spent on technology to support the end-to-end tax process; the vertical axis describing the people & process activities involved and the total cost of tax compliance being the area of the square. While minimizing costs, tax departments are also looking to increase value and quality throughout the process. Since these ambitions are more qualitative in nature, for simplicity purposes this has been left out of the equation. Let us take you through the journey of a classic tax department to the future tax department.

Figure 5. The combination of people & processes and technology results in the total cost of tax compliance. [Click on the image for a larger image]

Square 1: Current state – the classic tax function

Figure 6. Classical tax functions focus primarily on the periodic compliance and reporting process, highly dependent on people and processes, less data-driven. Technologies used are slow to adapt, not integrated, and contain redundant features. [Click on the image for a larger image]

Looking at Square 1 in Figure 1, classic tax departments have their main people and technology (if any) focus on compliance reporting & filing process. There is no clearly defined and designed analysis & corrections process, which is usually part of the monthly reporting and filing process as mentioned before. Moreover, there are hardly any people, processes, and technology available to improve master data, transactions and tax determination in the ERP system in order to create data that is ‘compliant by design’. With many people involved on labor intensive basic compliance checking and reporting, processes and data are not being optimally set up and technology investments in compliance process automation being inefficient, the current costs of tax compliance are to be considered to be high.

Square 2: Transforming state – recurring analytics, improve processes and determination

Figure 7. At Square 2, tax functions spent more time on correcting data, processes and tax determination. Processes are more efficient and technology dollars are spent more effectively. [Click on the image for a larger image]

By introducing a designated analytics process and adequate data management solutions, tax departments gain detailed insights in the quality of tax relevant master data and tax determination within SAP, have the ability to spot erroneous transactions and automate data gathering, transformation and reconciliations before feeding data in the reporting and filing process. The more frequent and closer to real-time these analytics can be run, the more adequate root causes for errors can be identified and followed-up, (master) data, processes and tax determination improved, and less time spent in the reporting & filing process. As a result, the total cost of tax compliance decreases and technology and time spent is allocated to more data, processes and determination activities compared to Square 1 as highlighted by Figure 7 and is already reduced by 15-30%.

Square 3: Transformed state – compliance by design

Figure 8. Compliance by design with first-time right data and limited manual activities. [Click on the image for a larger image]

In the transformed state, data, process and determination improvement projects have paid off. The system is optimally designed to process data and calculate taxes correctly without human intervention and projects and tech investments will obtain better return on investment and will be optimized. As a result, the technology costs are limited to recurring operating expenses. Efficient data analytics and data management solution feed the continuous reporting & filing process which is a streamlined process with limited process steps and manual work. Compliance by design has been achieved, reducing the total cost of tax compliance on average between 40% and 60%.

Optimizing the equation through SAP S/4’s ERP system and tax solutions

As indicated, the implementation of a new ERP system, like SAP S/4 HANA, is a once in a decade opportunity to set the basis right. However, it is important to explain what is meant by “basis” from a system perspective. A distinction can be made in terms of:

- the S4 application (core) out of the box

- the S4 application with additional solutions as provided by SAP like the SAP Tax Service, SAP Document Compliance, SAP Tax Compliance (Management), and SAP Advanced Compliance Reporting1

This means that SAP introduced specific solutions for tax. Many SAP clients have worked with SAP ECC 6.0 for two decades up until this day and were able to meet compliance requirements and deadlines. However, we do need to acknowledge that a significant number of organizations introduced point solutions in the end-to-end compliance process, ranging from data warehouses to reporting solutions. Looking at this trend where data leaves the SAP environment and business operations are completed in other solutions, SAP introduced a new suite of tax solutions to fulfill the end-to-end compliance and reporting requirements of most organizations

In the next section, we will cover both options and discuss the opportunities and items to keep in mind while optimizing the equation as highlighted before.

Master data & transactions – the S/4 ERP application

If we look at the heart of an ERP system that supports business operations, we find the key business processes that using master data create transactions that are saved in the system as data. It goes without saying that the quality of the setup of the data and processes has a direct effect on the next stages of the compliance process. A common saying is “garbage in is garbage out”, which in the context of this article can best be translated into “garbage created in tax-relevant core processes results in more issues in the next (reporting) stages of the compliance process”.

Unfortunately, many organizations work with an ERP system that has evolved over the years and has been shaped and formed in such a way that most business requirements are met. Due to various reasons, we find that the requirements of the tax function are not always met by the ERP system, thereby creating compliance and reporting burdens. One option to alleviate the tax function from this burden would be changing or upgrading the ERP system.

However, the setup of the ERP system is usually considered to be fixed as making changes to an operational ERP system that fulfills most business requirements (unfortunately not fully for tax) is deemed too risky or too costly. Moving to a new ERP system fortunately presents an opportunity to set the basis right. As indicated already, SAP S/4 out of the box (i.e. the core) does not introduce major changes for tax compared to the SAP ECC predecessor.

SAP S/4 out of the box – what to keep in mind

No significant changes for tax from a functional perspective

Looking at the SAP S/4 core from a tax perspective, in terms of out of the box features related to tax determination, billing document creation, and posting, no significant deviations compared to the predecessor (ECC 6.0) are applicable. In other words, processes in terms of functional steps to be executed in the ERP system related to tax are not significantly revamped.

It is possible though to set up the SAP system across multiple areas in an optimal way to approach compliance by design.

SAP S/4 out of the box – opportunities

Simplified master data

Master data is key as it is used by all core processes. With the introduction of SAP S/4 HANA, the master data concept has been simplified and renamed to business partners, where a single business partner can have multiple roles (e.g. customer, vendor, and so on). If from the start a complete structure/template for VAT customer tax classifications and withholding tax classifications is used, accurate and complete information is available for tax determination. This similarly holds when using a complete template for VAT material tax classifications (for sales) and tax indicators (for purchase).

Standardized account determination

In addition, for the determination of tax accounts, a complete chart of accounts template is to be used with sufficient tax accounts to account for the various events, including penalties from tax authorities as well as local placeholders for country-specific reporting requirements. Having a complete chart of accounts in place ensures a sufficient level of detail for reporting, for instance related to the total tax payable.

Future-proof tax setup and controls

SAP allows for various configurations related to tax, for instance related to tax on sales and purchases, withholding tax, and controls. When set up correctly with compliance by design in mind, it is possible to have a future-proof configuration that allows for sufficient level of control.

Real-time insight based on a single source of truth

With the powerful HANA database behind SAP S/4, transactional and analytical processing takes place in one system. This means that no data needs to be replicated to other systems (like data warehouses) for analysis. As a result, long data copy throughput times and data completeness reconciliations are not applicable anymore. In other words, one system can be used for the full data lifecycle from transactional processing to data to analytics to insights to follow up.

Tax determination – native S/4 tax determination vs. external engine

One major element for the tax department is the moment tax is being calculated or determined. At this stage, compliance reporting obligations are created. As “garbage in is garbage out”, if tax determination is suboptimal, more compliance and reporting checks with corresponding corrective measures down the line are required. However, tax determination in SAP is a complex topic for some organizations. One of the reasons is that tax in SAP is spread out across the main SAP modules:

- Sales & Distribution for tax in pricing using the condition technique

- Financial Accounting for the definition of tax codes, percentages and account assignments, for instance for VAT and withholding tax

- Materials Management for tax in purchasing, such as in purchase info records, the condition technique or preceding documents

Secondly, the tax determination has been setup long ago during the SAP ECC implementation. As business processes and models evolve, the original designers and subsequent knowledge of the design have left the company, current tax and IT responsible are hesitant to review and change the design thoroughly and only make minimal / quick fixes when a change of tax legislation enforces them to make a change in the SAP system.

On top of this, there is a separate/isolated OBCD functionality to map tax as found on incoming electronic (EDI) invoices to input tax codes, which emphasizes how tax determination and logic can be found in different places in SAP.

If we turn to SAP S/4 HANA out of the box, the aforementioned setup, by many described as complex, remains unaffected. SAP introduced the SAP Tax Service to determine and calculate taxes to support tax compliance. From a tax digital transformation perspective, we will therefore describe the implication(s) of using external tax engines like the SAP Tax Service opposed to using native SAP functionality.

External tax engine like SAP Tax Service – opportunities

Flexibility and complexity

Looking at the standard out of the box tax determination functionality in SAP S/4, basic scenarios for purchases and sales are supported. It is possible to adapt the standard setup to support more complex scenarios, but this is commonly not experienced as simple and straightforward as changes are required in multiple areas. For businesses that are constantly evolving, for example as a result of M&A activities or supply chain optimizations, having a flexible tax determination mechanism like an external tax engine is considered to be more preferable.

Centralization

Native SAP tax determination takes place inside SAP, which can be sufficient for scenarios where the ERP system is the only main application used for tax-relevant transactional processing. However, there are scenarios where other applications are used, for instance for expense management, incoming AP invoice handling, and so on. Another scenario would be if the organization owns a portfolio of businesses with other ERP systems. In these cases, it can be preferable to have a central location, an external tax engine in this case, that is connected to all these tax relevant applications to take care of the tax determination. Centralization in this case comes with added value in terms of transparency, standardization, and auditability.

User friendliness

As indicated already, tax logic in SAP can be found in multiple places. Although the tax code concept in financial accounting is sufficiently comprehendible for both IT and tax professionals, the condition technique in Sales & Distribution for output tax determination during billing is more difficult, especially if the standard logic of SAP has been adjusted to apply tax treatments in more complex scenarios like chain transactions. Tax engines usually provide more intuitive and visual interfaces to trace tax determination trees and treatments.

Without a doubt, an external tax engine introduces functionalities and corresponding benefits that make it worthwhile to seriously consider. When creating this business case, we recommend the items below to be included.

External tax engine like SAP Tax Service – what to keep in mind

Pre-defined content is usually unnecessarily hyped

Tax engines marketing usually include the phrase that as a customer you can better respond to VAT rate changes as the new tax rates will automatically be added to your tax engine scope. Although it is convenient that for example a new tax rate is added when applicable, the actual efforts involved with adding a new tax rate/code are very limited – in SAP, but also outside SAP. On top of this, it is indeed true that tax rates change more frequently nowadays (for example, what we have seen in multiple countries as a result of COVID), but is not the case that tax rates will change every single day or week.

Supported scenarios

Some tax engines are delivered with predefined supported scenarios, which for instance for VAT is the support of tax treatments related to domestic acquisition of goods (B2B) and export of services (B2C). Note that these out of the box supported scenarios are usually quite basic and can also be supported by native SAP. If your supply chain and corresponding tax treatments can be considered as less complex, implementing a tax engine might be overdoing it if complexity is a main component in the business case. If your business is more complex, we recommend using a flexible external engine. It needs to be considered that the initial setup of the complex logic in the tax engine usually comes with a significant one-off implementation fee.

Impact on systems

One of the rationales usually included in the business case for (external) tax engines is that the tax logic that is custom implemented in the SAP ERP system is taken out of the ERP system, thereby keeping the core clean. We observe however that when external tax engines are connected to a SAP ERP system, some customizations are usually still required. In other words, the core will never be fully clean.

Licensing

Looking at how tax is spread across the three modules in SAP, it is clear that to implement changes to tax treatments, both the IT and tax department are required to make sure that the system is appropriately adapted to apply the new tax treatment(s) and post it correctly in the general ledger. A popular claim by tax engine providers is that when using an external tax engine, less IT efforts are required. This statement is accurate – however, what is usually left out is that it comes at a significant recurring license expense.

Analysis & corrections – Tax Compliance Management

All compliance processes include a step that involves checking the items that are submitted to the tax authorities. Solutions involved range from reconciliations and basic data checks performed manually by the end user of the report to more automated checks performed in data-warehousing solutions and shown in dashboard environments. The opportunity for business transformation in the first example (manual checks) can almost be called obvious, but this may not be straightforward for the second example as many organizations already make use of dashboard technology. A common complaint is that these dashboard solutions allow for visual inspection of insights only; it is not possible to follow-up on the insights within the same solution, for instance by means of workflows for task distribution. Solution providers are more and more filling this gap of turning data into insights into action. SAP Tax Compliance Management is a good example of such a solution.

SAP Tax Compliance Management – opportunities

Turn insights into action

The TCM solution allows for end-to-end completion of the life cycle from data to analytic to exception to follow up. The follow up can be seen as two stages: conclude on the exception (flag it as correct or incorrect) as well as to take corrective actions.

Other use cases than tax

On a high level, the TCM solution enables connections to data sources, exception checking, follow-up and corrective measures. Although the solution carries as prefix “tax”, these compliance management functionalities can actually be used for any type of exception checking. This means that the solution can be used for other use cases as well, for instance regarding timeliness of payments (for rebates) and control automation in other business processes.

Connection to different data sources

SAP Tax Compliance Management can consume both SAP and non-SAP data. If a SAP S/4 system is used as a basis, it is not required to copy data from the SAP system to the tax compliance solution.

Analyze large volumes of data in real time

As the solution makes use of the powerful SAP HANA database, it is possible to analyze large volumes of data in a short period of time. Given this short execution time (and no data copies being involved as described above), it becomes possible to analyze transactions close to real time.

Audit trail

It is possible to maintain a full audit trail in terms of follow up and remediation.

The loop of data to analysis to insights to action is closed with the TCM solution. On top of this, additional functionalities are included that check many boxes in terms of what a compliance process should look like. There are some additional requirements to be met, which are explained in more detail below.

SAP Tax Compliance Management – to keep in mind

Missing adequate analytics content

The solution supports the end-to-end process from data to insights to action but does not come with adequate analytics content. If we look at value from a compliance perspective, it starts with being able to identify business transactions that are non-compliant. In other words, the end-to-end process is supported out of the box but content (which is key) is not included in the box.

Risk of high number of false positives

A common challenge when evaluating risks using data & analytics is that a high number of exceptions will be raised, potentially for predominantly false positives. Given that the solution supports following up on these exceptions, it could involve significant unnecessary manual work. The solution introduces comprehensive tax rules to minimize the number of false alerts. Under the hood this translates to an additional filter that is applied on the number of exceptions, which could be summarized as an exception rule on top of an exception rule. In addition to these tax rules, automated remediation through machine learning has been made available. The question, however, remains how reliable and effective this new functionality is.

Reporting & filing – Advanced Compliance Reporting

After tax has been determined and compliance checks are performed, the business transactions or financial postings are reported to the tax authorities. If we look at typical (classical) reporting processes, a significant number of reports is run and downloaded from one or more ERP systems by end users. Not only is the generation of structured and regular/periodic (!) reports oftentimes performed manually, to create the file that is submitted to the tax authorities, multiple reports coming from different screens in and outside the ERP system are usually combined. After submission, the reports are usually saved in a file share, SharePoint location or the end user’s personal computer. The manual efforts involved in this periodic work are better utilized in the actual follow-up on these reports (compliance checking for example). Compliance risk is also involved, both related to the risk of human errors as well as reporting timelines not being met or not being able to inspect the audit trail when required.

To tackle these challenges, SAP introduced the ACR (Advanced Compliance Reporting) solution which brings main opportunities for reporting process transformation.

SAP Advanced Compliance Reporting (ACR) – opportunities

Centralized governance

When a single solution for reporting is used, it is possible to have an effortless overview of reporting status and compliance. This way it can be ensured that all reporting obligations in terms of timelines are being met on a continent or even global scale.

Standardized reporting with audit trail

Homogenous reporting using a single technology for all report generation, approval, and submission, reduces the risks associated with manual work related to human errors and throughput time.

Report centralization with audit trail for generation and archiving

Reports are generated from a single technology solution and archived in a single location. The implication is that no data needs to be copied from one system to the other (for example, a data warehouse solution) to generate reports and that all legally required reports with complete audit trail can be accessed with limited efforts involved.

Looking at the aforementioned opportunities, it is clear that existing classical reporting processes are significantly transformed. However, against this background it is important to keep the following items in mind.

SAP Advanced Compliance Reporting – attention points

Scope and roadmap

Report generation is basically taken out of the SAP ERP system. However, this does mean that logic in SAP ACR should be in place to generate the reports. It is not the case that all reports that can be run out of SAP are already available in ACR. One should therefore pay close attention to the support reports as well as corresponding roadmap.

Complexities involved with custom report definition

If a report is not standard available, it is possible to define custom reports. From hands-on experience the end-to-end process from data to report proved to be less straightforward than expected. This means that support from the IT department is required when end users pose requirements for new (custom) reports.

Embedded analytics

The solution is advertised to come with embedded analytics. However, the nature of these analytics can best be compared to advanced Excel pivot capabilities. In a way this is not a surprise, as the analytical tax compliance solution, as discussed in this article as well, has been introduced for exactly the purpose of advanced analytics.

License

Some of the functionalities are covered by a different license. Therefore, it is required to critically assess functionalities like workflows and manual adjustments that are required in the end-to-end compliance process and whether these are included in the basic or full license.

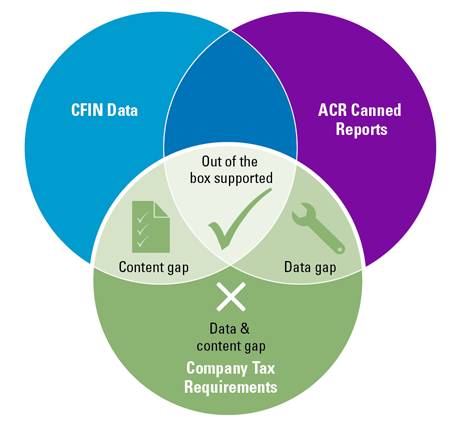

A special attention point: Central Finance (CFIN)

Many organizations are moving to SAP S/4 Central Finance as a first step in their S/4 digital transformation journeys. If SAP ACR is used for reporting out of Central Finance (CFIN), the reports that can be run are limited to financial (accounting) reports as logistical data (for example from SAP ECC6.0 systems that are posted in Central Finance) is not available automatically in Central Finance. Figure 9 shows that not all reports as required by the tax function are available in ACR (content gap). If the report is available, the CFIN system potentially does not contain enough data (data gap) and, even worse, the report nor the data is there (data & content gap).

Figure 9. Not all company tax reporting requirements can be fulfilled in a SAP ACR & CFIN context. [Click on the image for a larger image]

Conclusion

S/4 HANA is the renewed promise of SAP to put more emphasis on providing competing technology services to support the tax function. With the ability to service, integrate and connect the end-to-end tax process in a single platform on a real-time basis, it could be an excellent foundation to be prepared for the Tax Administration 3.0; a perfect trigger to review and reduce the total cost of tax compliance. However, tax decision makers should keep in mind that the solutions offered are still in the early phases of full-scale deployment; they are undergoing rapid changes as solution development is in progress and require additional SAP license costs to work to their full extent. Whether now is the right moment in time for the tax function to introduce SAP S/4 HANA technology is a trade-off between the organization’s current level of tax compliance and the corresponding costs involved. However, it is a fact that tax directors need to decide how to cope with the increased compliance requirements as imposed by tax authorities around the globe. Therefore, we strongly recommend organizations that predominantly operate internationally to explore the SAP S/4 tax solution offering in more detail within the next one to two years.

Notes

- Note that SAP recently combined SAP Document Compliance and SAP Advanced Compliance Reporting into one solution labeled “SAP Document and Reporting Compliance”. Since the core functionalities of both individual solutions have not been changed (and these are put into perspective in this article), in the remainder of this article we will refer to both solutions individually.

References

[Duij21] Duijkers, R., Iersel, J. van & Dvortsova, O. (2021). How to future proof your corporate tax compliance. Compact 2021/2. Retrieved from: https://www.compact.nl/articles/how-to-future-proof-your-corporate-Tax-compliance/

[Emen19] Emens, R.D., Lamers, T. & Wiel, D. van (2019). How audits can be transformed when access to data is no longer the bottleneck. Compact 2019/4. Retrieved from: https://www.compact.nl/articles/how-audits-can-be-transformed-when-access-to-data-is-no-longer-the-bottleneck/

[OECD20] OECD (2020). Tax Administration 3.0: The Digital Transformation of Tax Administration. Retrieved from: https://www.oecd.org/Tax/forum-on-Tax-administration/publications-and-products/Tax-administration-3-0-the-digital-transformation-of-Tax-administration.htm