RegTech is the term used for technology that facilitates the delivery of regulatory requirements more efficiently and effectively than existing capabilities ([FCA15]). It is thought that regulatory oversight and compliance will benefit tremendously from current technological progress by letting technological breakthroughs tackle the rise in volume and complexity in legislation. RegTech is seen as a new industry with the potential to lower costs for existing stakeholders, break down the barrier of entry for the new FinTech players, eliminate existing barriers with the regulatory lifecycle and possibly enable a (near) real-time regulatory regime.

Introduction

The New York Times Magazine article ‘The great A.I. awakening’ ([Lewi16]) tells the story of how cognitive technology revolutionized the Google Translate service, significantly improving the quality of its output. Translation has traditionally been a highly skilled profession, requiring among others language skills, domain know-how and creativity. Until Google embraced Artificial Intelligence (A.I.), the Google Translate service, introduced in 2006, had improved steadily, but spectacular advances hadn’t been made in recent years. Subsequently, the service is used to support the translation of text, but has so far not replaced ‘professional’ translators. However, the improvements in translation introduced in November 2016 have made such an impact that users of the service have started to challenge each other to recognize a Google translation from a ‘professional’ translation. Google’s chief executive Sundar Pichai explained during the opening of a new Google building in London in November 2016 that the progress was due to an ‘A.I. driven’ focus and that the development responsible for the gain in performance took only 9 months.

One year earlier in November 2015 the FCA, the UK Financial Conduct Authority, openly stated its support for the use of new technology to ‘facilitate the delivery of regulatory requirements more efficiently and effectively than existing capabilities’ ([FCA15]). The set of technologies that the FCA expects to revolutionize the regulatory domain are called RegTech. Similar to Google, new technologies such as A.I., machine learning and semantic models are seen as the driver to ‘predict, learn and simplify’ regulatory requirements ([FCA16]). Will RegTech have the same impact for regulatory compliance as A.I. had for Google Translate, or is RegTech a media hype?

This article provides a concise introduction into RegTech and in particular the Semantic Web. It describes the current role of the Semantic Web within the domain of regulatory compliance by focusing on two important requirements: 1) accessing legislative documents and 2) referencing legislative documents. The article makes use of examples of European regulation for the financial sector, but can be used to address legislation issues in general.

Regulatory Technology (RegTech) overview

The UK Financial Conduct Authority (FCA) was the first supervisor to use RegTech in an official document in 2015. It made a ‘call for input’ from all regulatory stakeholders in November of that year that resulted in a feedback statement published in July 2016 ([FCA16]). In this report, the responses of over 350 companies were clustered using the following four main RegTech topics, describing the technology/concepts applicable to tackling regulatory challenges:

- Efficiency and collaboration: technology that allows more efficient methods of sharing information. Examples are shared utilities, cloud platforms, online platforms.

- Integration, standards and understanding: technology that drives efficiencies by closing the gap between intention and interpretation. Examples are semantic models, data point models, shared ontologies, Application Programme Interfaces (API).

- Predict, learn and simplify: technology that simplifies data, allows better decision making and the creation of adaptive automation. Examples are cognitive technology, big data, machine learning, visualization.

- New directions: technology that allows regulation and compliance processes to be looked at differently. Examples are blockchain/distributed ledger, inbuilt compliance, biometrics.

The topics identified by the respondents to the call for input provide an overview of concepts that can be used to achieve efficient regulatory compliance. Specifically regarding access to and identification of regulation, the respondents made additional suggestions:

- define new (and existing) regulations and case law in a machine readable format;

- create consistency and compatibility of regulations internationally;

- establish a common global regulatory taxonomy.

Similar RegTech studies by other organizations, such as the Institute of International Finance ([IIF16]), have more or less identified the same technologies to support regulatory compliance. The question remains: what is the current status of these technologies? Have these technologies been applied already within the domain of regulation? Is RegTech a case of ‘old wine in new bottles’? To examine this, it is useful to look at the regulatory lifecycle itself, i.e. those steps that every company has to follow to comply to rules and legislation.

The Regulatory lifecycle

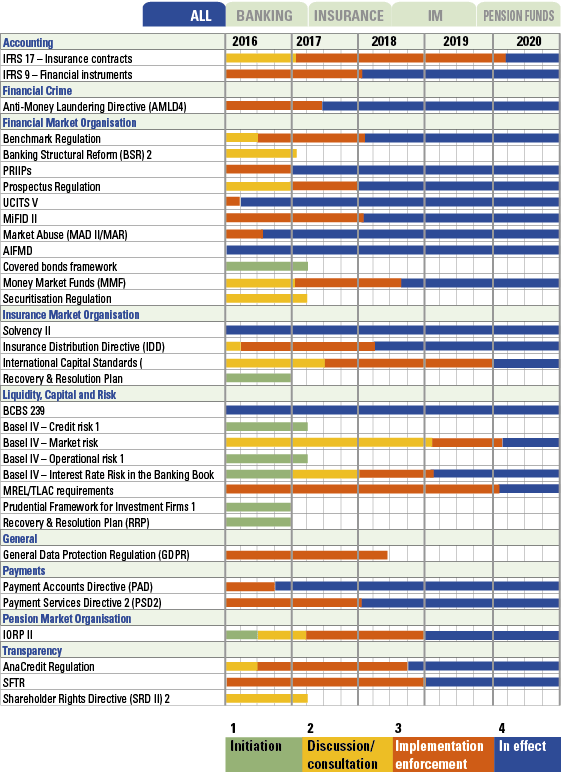

Much has been said about the nature, size and complexity of financial sector regulation before and after the crisis of 2008. Many of the newly imposed rules address issues identified since then. In addition, the regulators have introduced or are in the process of introducing legislation, rules and standards specifically to cover technological developments, such as: legislation and/or guidelines for High Frequency Trading (HFT), automated/robo advice, digital payments, the distributed ledger technology and digitization in general. Thus, although the crisis itself is almost ten years old, introduction of new legislation or recasts of older rules continues and has become a way of life. Legislation itself can be discussed using four phases: 1) initiation, 2) discussion/consultation, 3) implementation/enforcement and 4) in effect (see Figure 1).

Figure 1. Regulatory Horizon Financial Sector ([KPMG17]). [Click on the image for a larger image]

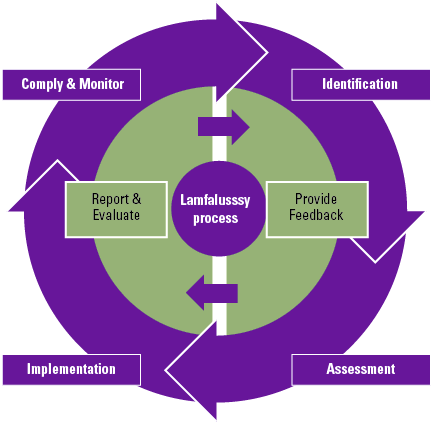

However, it is generally agreed that legislation by itself is not the key to lower risks and a healthy economic environment. The ability of the stakeholders (industry and supervisors alike) to identify, assess, implement, comply to and monitor regulatory obligations is also important (see Figure 2). Early identification of and access to legislation is vital to enable those responsible to meet their responsibilities. It allows the stakeholders to provide feedback to legislators and authorities involved in writing and amending legislation. The next step in the regulatory lifecycle starts once a regulation has been officially accepted by the legislative bodies and consists of an impact and gap analysis by relevant organizations and supervisors. Following this assessment, stakeholders have to implement the identified requirements and address the resulting gaps. Once the implementation has taken place, industry and supervisors have to monitor regulatory compliance and report to the supervisors where required, thus closing the circle.

Figure 2. The Regulatory Lifecycle.

A regulatory lifecycle is determined by economic and political events and by the formal regulatory process as defined by the legislator (see the box ‘The Lamfalussy process’).

The Lamfalussy process

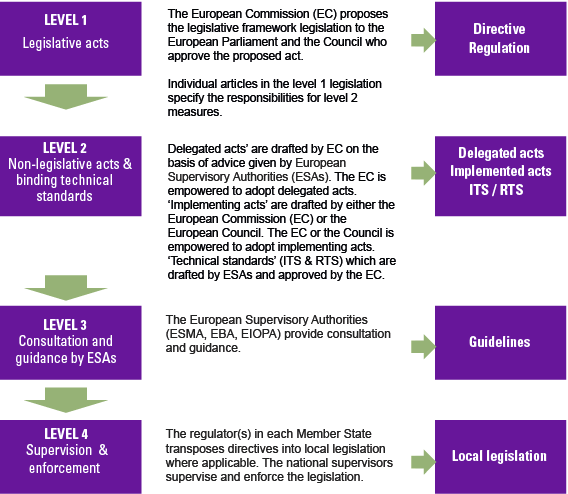

Development of EU financial service industry regulations is determined by the Lamfalussy process, an approach introduced in 2001 (see Figure 3). The Lamfalussy process recognizes four levels (1 to 4). It may take up to ten years before all acts, standards and guidance required by the four levels are drafted, discussed, approved and enforced.

Figure 3. The Lamfalussy process. [Click on the image for a larger image]

The initiation of numerous applicable regulations in combination with an elaborate regulatory process means that regulation requires management attention, creativity, technological and human resources plus significant capital expenditure by all stakeholders. Not to comply is not an option, as non-compliance has legal and public consequences for financial companies such as reputation, trust and penalties. Therefore, stakeholders have to get it right. First and foremost it is important to identify, access and capture the correct requirements from the regulations: ‘show me the boy and I will show you the man’. However, there are barriers to overcome; the most significant are discussed in the next section.

Barriers to access, interpretation and linkage

What are the barriers to legislation? First of all, there is the question of copyright. Recent research has shown that ‘the current uncertainties with respect to the copyright status of primary legal materials (legislation, court decisions) and secondary legal materials such as parliamentary records and other official texts relevant to the interpretation of law, constitute a barrier to access and use’ ([Eech16]). The same paper states ‘that legal information should be ‘open’. It seems that the strong focus on licenses as an instrument to ensure openness has buried the more fundamental question of why legal information emanating from public authorities is not public domain to start with, doing away with the need for licenses’ ([Eech16]). Europe has addressed this issue in the Public Sector Information (PSI) directive. This directive provides a common legal framework for a European market for government-held data. The consistent application of the directive in national legislation remains an issue.

Apart from the copyright issue, there is the barrier due to the differences in legislation between individual EU member states and the differences between the European Union and member states. The language of the legislation is an obvious difference. Legislation at member state level is published in the official language(s) only. There is not a single common language that is supported by all member states.

The development of legislation at member state level differs significantly as well. There is no common legislative process, like the Lamfalussy process, and no compatible legislative model shared between member states. For example, in Germany detailed rules are mostly written directly in the legislation. However, UK legislation is far less detailed and companies look at what the UK prudential authority (PRA) and the conduct authority (FSA) publish in their respective rulebooks.

Member states also make use of ‘gold-plating’. Gold-plating is defined by the European Commission as ‘an excess of norms, guidelines and procedures accumulated at national, regional and local levels, which interfere with the expected policy goals to be achieved by such regulation’ ([EC14]). Gold-plating undermines the ‘single market’ principle of the EU and the level playing field within one European market. The practice of gold-plating is a barrier to access to national markets, it restricts scalability and it creates extra costs for cross-border companies.

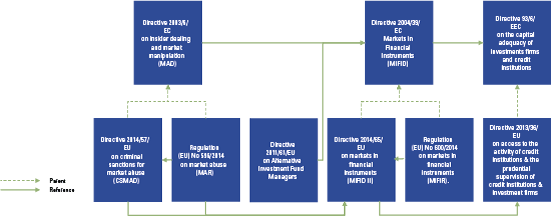

The question of linkage remains. Current legislation is characterized by numerous direct and indirect references to other international, regional and national legislation, policies and standards (see Figure 4). This is due to different causes.

Figure 4. Linkage European Legislation. [Click on the image for a larger image]

One of the causes of linkage is the actual legislative process. The European legislative process, including the Lamfalussy process, supports the concept of a legislative directive and a regulation. A regulation applies directly to all member states and is binding in its entirety, whereby a directive must be transposed to national law and is binding with respect to its intended result only. The consequence of such a legislative model is that national legislative text and policies refer or link directly to applicable European regulations.

Another cause of legislative linkage is the initiation of legislation itself. Initiation is a political action and politics occurs at all levels. A large number of international financial sector legislative initiatives are agreed upon at G20 meetings. Other international agreements on environmental, military, human rights or other topics are developed in similar multilateral or bilateral meetings. Consequently, many international organizations play a role in developing legislation or standards resulting in complex, intertwined legislation and rules. This is reflected in the number of organizations that play a role in drafting or monitoring these rules and regulations. The following is a non-exhaustive list of just a few organizations that play a role in the lifecycle of financial sector legislation: the Financial Stability Board (FSB), the International Organization of Securities Commissions (IOSCO), Bank For International Settlements (BIS), the World Bank, the International Monetary Fund (IMF), the Organization for Economic Co-Operation and Development (OECD), the European Central Bank (ECB), the European Commission and the three European supervisory authorities: ESMA (Securities and Markets), EBA (Banking) and EIOPA (Insurance and Pensions).

Access to Regulatory Requirements

In general, despite the above issues, it can be said that the many international, European and national legal resources are currently accessible via the Internet, be it via many different channels. The main access point for EU (financial) regulation is ‘EUR-lex’. EUR-lex is an Internet based service that can be accessed using a browser, RSS feeds or web-services and supports multiple formats like HTML, PDF and XML. National regulation can be accessed via the EU service N-lex. Furthermore, EUR-Lex also supports the search for specific national transposition measures.

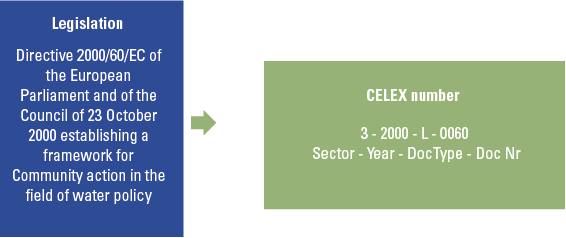

Access to European Union law within EUR-Lex is simplified by the support of CELEX (Communitatis Europeae LEX) numbers. The CELEX number is the unique identifier of each document in EUR-lex, regardless of language. An EUR-lex document is allocated a CELEX number on the basis of a document number or a date. Documents are classified in twelve sectors and CELEX allows for the identification of such a sector. Examples of sectors are: sector 1 – treaties, sector 2 – international agreements, sector 3 – legislation, section 7 – national implementing measures, etc. The sector also defines the type of document supported.

The example of the water framework directive (see Figure 5) clarifies the format of a CELEX number. The water framework directive is a legislative document, hence sector 3, accepted in the year 2000. The legislation sector supports three types of documents: a regulation (R), a directive (L) and a decision (D). In the case of the water framework directive, the CELEX number assigned is thus: 3 (sector), 2000 (year), L (for directive) and 0060 (a sequential document number).

Figure 5. CELEX.

At the member state level all European member states have their own access channels and data formats. For example, in the Netherlands access to and search of legislation is provided via wetten.overheid.nl. In addition, related policies and standards for the financial sector, drafted by the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM), are available via www.toezicht.dnb.nl and www.afm.nl/en/professionals/onderwerpen. Unfortunately, support for other languages but Dutch is limited. The actual legislation (wetten.overheid.nl) is available in Dutch only. Some financial topics are published by the AFM in English. The Dutch Central Bank provides a best practice, as English language versions of all topics covered in their ‘open book supervision’ are available.

The UK has a similar set-up to the Netherlands, with legislation being made available at www.legislation.gov.uk and prudential and business conduct rulebooks available via www.prarulebook.co.uk and www.handbook.fca.org.uk respectively. No other language support but English is provided.

All in all, access to regulation, standards, rules and related policies is possible but highly fragmented. A unique number per document such as CELEX is only used within EUR-lex. The exchange of data relating to legislation is severely hindered by local differences between legal systems at national, regional (EU) and international level. The next sections describe the Semantic Web and related initiatives. The Semantic Web, a set of technology standards that together support access and data formats, enable seamless digitization of law. The European and international initiative address the issue of direct and indirect linkage between the different types and levels of legislation by embracing the Semantic Web.

The Semantic Web

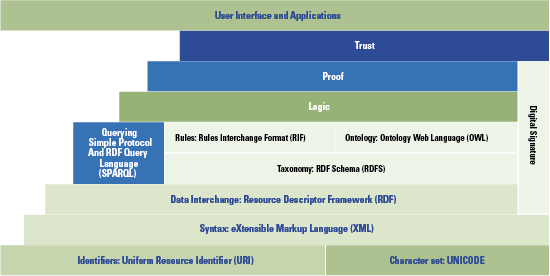

Standardization to access and reference legal documents is underway at both an international and European level. The goal of these initiatives is to allow for harmonized and stable referencing between national and international legislation and enable faster and more efficient data exchange, navigation, search and analysis. The majority of the initiatives build upon the concepts of the Semantic Web (see Figure 6).

Figure 6. The Semantic Web. [Click on the image for a larger image]

The Semantic Web is a concept developed by Berners-Lee, famous for inventing the world wide web and founder of the World Wide Consortium (W3C): the forum for technical development of the Web. The Semantic Web can be defined as ‘an extension of the current Web in which information is given well-defined meaning, better enabling computers and people to work in cooperation’ ([W3C17]). The world wide web is dominated by HTML, which focuses on the markup of the information, allowing for links between documents. Semantic web standards improve on this by focusing on the meaning of the information by supporting among other the concepts of metadata, taxonomy and ontology.

The difference between taxonomy and ontology

The terms taxonomy and ontology are often misunderstood and confused. A taxonomy typically classifies groups of objects that may include a hierarchy, such as the parent-child relationship. An ontology is a more complex structure that in addition to a classification describes the group of objects by naming the attributes or properties of the groups and the relationships between the attributes and groups. The ‘Nederlands Taxonomie Project’ (NTP) is an example of a Dutch taxonomy initiative based on XBRL in the accounting, tax and statistics domain.

The Semantic Web is a stack of complementary technologies (see Figure 6) and supports a wide range of concepts. The bottom layer uses two standards: the Unicode standard to provide the electronic standard to represent characters and the Uniform Resource Identifier (URI). A URI allows the naming of entities accessible on the web. The second layer is based on XML. XML is a language that supports the definition of tags to express the structure of a document and the concept of metadata allowing automated processing. The Resource Descriptor Framework (RDF) standard in the third layer enables the inclusion in documents of machine readable statements on relevant objects and properties. An RDF schema supports the concept of taxonomy (see the box ‘The difference between taxonomy and ontology’). Ontologies, the specification of concepts and conceptual relations, and rules can be defined using Rule Interchange Format (RIF) and Web Ontology Language (OWL). The top three layers of the Semantic Web support logic, the expression of complex information in formal structures, the use of this logical information and the concept of trust (confidentiality, integrity, authenticity and reliability) ([Sart11]). On top of the Semantic Web we find the applications and user interface that makes use of the underlying stack.

All in all, the Semantic Web facilitates access to information, separates content from presentation, supports references to other documents that support the Semantic Web and allows information such as metadata, taxonomy and ontology to be used by other applications and systems.

Akoma Ntosa and the European Legislation Identifier

There are two major but currently incompatible initiatives to harmonize access and references between legal documents based on the Semantic Web. The international initiative is supported by the United Nations and is called ‘Akoma Ntoso’. The European Commission has thrown its considerable weight behind a European initiative called the European Legislation Identifier (ELI).

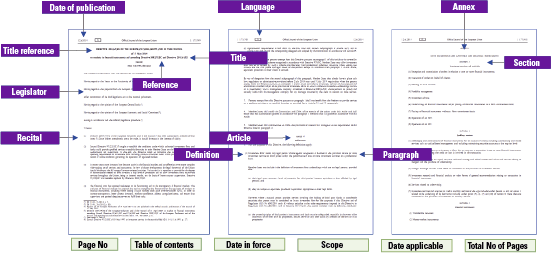

Akoma Ntoso (‘linked hearts’ in the Akan language of West Africa) defines a set of technology-neutral electronic representations in XML format of parliamentary, legislative and judiciary documents ([Akom16]). The main purpose of the Akoma Ntoso is to develop and define a number of connected standards, to specifically define a common standard for the document format and document interchange, a schema and ontology for data and metadata (see Figure 7), plus a schema for citation and cross referencing.

Figure 7. Legislation and metadata. [Click on the image for a larger image]

There are plenty of examples of how and where the Akoma Ntoso standard is used, such as:

- the European Parliament: to document amendments on the proposals of the European Commission and the Council of the European Union, and the reports of the parliamentary committees;

- the Senate of Italy and the Library of Congress: for the publication of legislation.

Based on Akoma Ntoso, the Organization for the Advancement of Structured Information Standards (OASIS) has started the LegalDocML project. One of the main supporters of this project is Microsoft.

The European system to make legislation available online in a standard format started officially in 2012 and is called the European Legislation Identifier (ELI). The purpose of the ELI is to provide access to information about the EU and member state legal systems ([RDK16]). The introduction of ELI is based on a voluntary agreement between these EU member states, and its goals are similar to Akoma Ntoso, but with a European focus. ELI provides for a harmonized and stable referencing of European and member state legislation, a set of harmonized metadata and a specific language for exchanging legislation and case law in machine-readable formats.

ELI is supported by the following eight EU member states: Denmark, Finland, France, Ireland, Italy, Luxembourg, Norway, Portugal (and the United Kingdom). All nine countries have representatives in the ELI taskforce. In addition to the member states, the task force is also supported by the EU Publications Office.

Both Akoma Ntoso and ELI create a number of potential benefits ([RDK16]) ([AKO16]):

- improving the quality and reliability of legal information online;

- enabling easy exchange and aggregation of information by supporting indexing, analyzing and storing documents;

- understanding of the relationships between national and regional/international legislation;

- encouraging interoperability among information systems by structuring legislation in a standardized way, while taking account of the specific features of different legal systems;

- making legislation available in a structured way to develop value-added services while reducing the need for local/national investments in systems and tooling;

- shortening the time to publish and access legislation;

- making it easier to follow up work done by governments, and promote greater accountability.

Overall both standardization initiatives support the concept of interoperability, transparency and allow for the development of more intelligent cognitive applications for legal information ([RDK16]).

Conclusion

The use of RegTech to bundle and identify technologies that can benefit regulatory compliance is a good initiative. It provides support to meet the obligations and allows all stakeholders to discuss the applicability of these technologies. The use of the Semantic Web to access, navigate and control legislative rules and regulation and encourage interoperability among related IT systems, shows that progress has been made within the regulatory domain. The Semantic Web can support the identification of legislation in a consistent manner, supports the description of the legislation using a coherent set of metadata and publish legislation and case law online in a machine-readable form.

The added value of legislative information made accessible in this way allows simple queries to be made that retrieve legislations from various legislative sources, helping national and cross-border organization to gather a complete set of relevant regulatory obligations. Metadata can be used to produce transposition timelines by type of law.

In general, the use of the Semantic Web in combination with legislative documents allows organisations to carry out control and compliance activities more efficiently in complex legal domains, such as the financial sector, where there is a need to consult numerous laws, regulations and standards from different jurisdictions ([ELIW16]).

References

[Akom16] Akoma Ntoso, XML for parliamentary, legislative & judiciary documents, March 2017, www.akomantoso.org.

[EC14] European Commission, Gold-plating in the EAFRD, Directorate General For Internal Policies, 2014.

[Eech16] Mireille van Eechoud and Lucie Guibault, International copyright reform in support of open legal information, working paper draft, September 2016.

[ELIW16] ELI Workshop, 2016.

[FCA15] Financial Conduct Authority, Call for input on supporting the development and adopters of RegTech, November 2015.

[FCA16] Financial Conduct Authority, Feedback Statement (FS16/4): Call for input on supporting the development and adopters of RegTech, July 2016.

[IIF16] The Institute of International Finance, RegTech in Financial Services: Technology Solutions for Compliance and Reporting, March 2016.

[KPMG17] KPMG, The regulatory horizon, March, 2017, http://blog.kpmg.nl/regulatory-horizon.

[Lewi16] Gideon Lewis-Kraus, The Great A.I. Awakening, The New York Times Magazine, November 14, 2016.

[RDK16] Retsinformation.dk, Easier access to European legislation with ELI, March 2016, www.retsinformation.dk.

[Sart11] G. Sartor, M. Palmirani, E. Francesconi and M.A. Biasiotti (Eds.), Legislative XML for the Semantic Web, Springer, 2011.

[W3C17] W3C, The Semantic Web Made Easy, W3C.org, 2017, www.w3.org.