Introduction

In the Compact 2019/4 article “Digital Auditors, the workforce of the future” ([Lijd19]), audit professionals from KPMG touched upon the topic of digital excellence in the KPMG Financial Statement audit segment, and what would be needed to achieve the status of a “Digital Auditor”. An auditor with the ability to provide relevant insights with enhanced analytics and statistics based on the data of audit clients and maximizes efficiency and quality by innovating their own audit engagements. In this article, we want to reflect on that vision, and we want to make auditors a promise that will make the Digital Auditor, the workforce of the future, a reality.

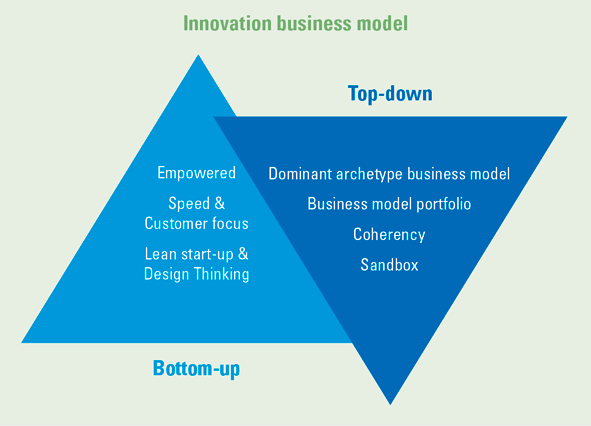

Innovation governance: top-down or bottom-up?

The agile way of working, machine learning and robotic process automation have been making their mark in the past 10 years. It is no surprise that with the appearance of these buzzwords, innovation departments at all kinds of corporates have started to appear as well. Most companies have an innovation department as the core “ideation station” for innovative solutions within their business. These departments work top down by visualizing need for change and actioning that with initiatives for research and development. This stimulates innovation, that’s for sure, but is it the only choice for a company that wants to closely follow the state of the art? It doesn’t have to be.

The top-down approach is based on the principle of induction. Management sets a goal, a budget, a set of KPIs and a timeline, and their employees use the resources they get appointed to identify potential solutions to reach that goal. This innovation model drives innovation with a focus on business model, company strategy, a vision for the future, the company’s KPIs and therefore has a more strategic angle, although there is less room for the voice of every employee. This makes it a dominant archetype business model, but it also stimulates coherency. Many companies with the top-down approach choose to place their innovations in a sandbox setting, which means that they are developed within an entity separate from the rest of the business.

Top-down innovation models have very clear upsides. These models improve the likelihood that innovative ideas become solutions that are implemented in a business. They also align with the company’s long-term strategy, and are therefore on the roadmap of the board of management. A top-down innovation model is always focused on big changes with a limited number of individuals in charge. It is aimed at long-term, (most of the time) high-cost investments and defined by formal processes and a hierarchical structure.

Bottom-up innovation models are the direct opposite of the top-down models. In these models, innovative ideas are generated by many employees in all kinds of roles in the company at all levels of experience. In bottom-up models, board members do not state the name of the game. They leave that to their employees. Leaders in bottom-up innovative companies focus on aspiring innovation champions who collaboratively detect and define ideas to capture value within the business, stimulating design thinking and a start-up mentality. The management board acts as a funnel that selects the right ideas to pursue, but in theory they are willing to try (almost) everything to make things better within their company. This creates empowered employees and high-speed innovation possibilities. It also drives focus on customers instead of on the business as a whole. To do that effectively and efficiently, certain systems need to be in place.

For example: the priorities of the company are to be clearly understood by its employees. Priorities that need to match the business strategy and business roadmap. However, the most important thing is time and resources ([Baum14]). Time to investigate and try, and resources to decide if it is better to buy or build. The pitfall in this model is that there is so much innovative ideation going on all of the time, that it is hard to funnel all of these ideas into actions. And how do we cancel certain initiatives if misaligned with the company’s goals? These concepts need to be crystal clear for a bottom-up approach to work effectively.

Figure 1. Innovation business model (source: [DeMe22]). [Click on the image for a larger image]

Tesla is a real top-down innovator. This is a company that drives innovation, initiated and fueled by the vision of the founder and senior leaders in the company. The pure ambition of Musk and the employees who buy into his grand ideas make the vision of innovation a reality. It is also a company that is very focused on one thing: building the best electric cars in the world, with “focus” being the keyword to remember. Most of Tesla’s innovations are focused on that specific goal and product line.

Google is a good example of a company with a bottom-up model, where employees are empowered to innovate. They are even rewarded for failing ([John17]), because Google stimulates them trying something and learning from it. This increases competitiveness for Google because it saves them money, improves efficiency, and helps their employees develop new skillsets. A side effect is that it prevents employees to feel the fear of failure. A bottom-up model creates an environment that drives disruptive innovations. Google even made it one of their trademarks: “Fail fast” which is presented as a given fact in any respected Scrum team.

The difference between Google and Tesla is that Google is much less focused on one product. It is a range of products and services, which means that they work in decentralized teams for every product or service, making it harder to generalize innovations for the company as a whole.

Both the bottom-up and the top-down approach have advantages and shortcomings. However, research by the independent market agency Savanta in 2020 shows that 88% of innovation leaders agree that successful organizations encourage innovation at every level and within every team ([Kasp20]). But what do companies specifically do to create a culture and set of values that support innovation? “A nurturing culture where ‘no idea is a bad idea’ is what is essential to flourish” according to this research paper.

Anastasia Priklonskaya:

“As an audit partner, I work with a lot of different clients in various industries. Every client is on its own innovation journey these days, leveraging technology and data to create valuable insights and process improvements. Digital auditors are able to maximize the effective use of this increasing amount of available data to optimize our audit efforts. Tech-savvy auditors of the Digital Audit track deliver analyses and findings that bring our conversations with clients to a new level. We provide insights that the clients do not have, because they are enriched with industry knowledge and best practices. Data & analytics help auditors to understand clients and their risks better. For me, there is no doubt that smarter use of technology combined with client and industry understanding leads to higher audit quality, which benefits not only our clients, but society as a whole.”

How to radically innovate the audit practice?

Within KPMG Audit we work in decentralized teams, which makes top-down innovation a bit more complicated when creating a solution for every single identified need in every audit engagement. We need tailor-made, customer-focused and efficiently developed innovations. Mainly due to the fact audit engagements have a very limited span of time in which to innovate (they are staffed and planned on a yearly basis) and every engagement team works for different clients with different innovation needs. Therefore, the answer for any audit firm to the above question would be bottom-up innovation. To stimulate innovation within every engagement team KPMG started the traineeship called “The Digital Audit Track”.

The Digital Auditor will become a master in auditing, both literally and figuratively. They will be focused on becoming a certified auditor in the first place. The innovation lies in the fact that they will also become generalists in data science. By encouraging auditors to learn more about data science, we can potentially bridge the gap between data science and auditing, enabling multidisciplinary teams to work together on innovative solutions. As was stated in the Compact 2019/4 article: “To truly understand an auditor, you must have audit experience. To become a good programmer, you must understand the basics of computer science.” This statement proves to be true, since the first batch of digital auditors have shown the promise of many great new innovations to come.

Jeroen Vlek:

“Companies face an ever-increasing dynamic business environment. Simultaneously, their stakeholders want to be better, and timelier, informed about financial and non-financial indicators of the organization. This creates new challenges for our clients and society at large, and also different expectations towards the role the auditor plays. The workforce of the future will be a multi-disciplinary team, consisting of for example digitally native auditors, experts such as data scientists, but also specialists from other domains such as ESG. Managing the transition to the future of audit is essential to stay relevant as ‘stewards of trust’, and to decrease the expectation gap we face as auditors.”

“Approach that led to success stories” – by Aram Falticeanu

Since last year, we have seen wonderful use cases, however, we want to focus on one that shows the power of this track. To quote Johan Cruijff: “You’ll only see it once you get it.” As mentioned in the Compact 2019/4 article, we couldn’t imagine a workday without Excel a few years ago. The new era in which we created a culture in which fast innovation is possible, made a significant difference, especially for frontrunners like digital auditors. There are days that we don’t use Excel at all, but programming languages like Python and SQL that automate our manual work so that we can spend our time more effectively.

Accessing data from our clients’ administrative systems with a real-time secure connection (called an application programming interface, or API) makes it possible for us to audit financial administrative systems 24/7. Last year, digital auditors set up such a connection together with our internal IT experts and our clients IT departments to “mine” data for a specific process that happens at our client. We were able to find movements in journal entries that could potentially indicate risks at the moment that they occurred. This gave our digital auditors the chance to act on these risks within a noticeably shorter timeframe than they would have been able to if they used traditional auditing methods. Using process mining solutions, and uncovering the findings that we never identified before, the added benefit of a digital auditor is evident. Their skillset makes it possible to liaise with our clients’ IT department and the financial department at the same time. This is how knowledge is combined to optimize procedures that analyze both the financial and IT systems of clients, with which workflows can be generated to audit those joint datasets using the IT to the auditors’ advantage.

Aram Falticeanu:

“We didn’t only want to facilitate more early adopters. For KPMG it is about enabling the early majority. But we didn’t always have a tech-savvy auditor in our teams, so we decided to broaden the knowledge about digital tools to enable more auditors to achieve that digital spike. With at least one digital auditor in every engagement team, we can ensure that our clients will get the best experience possible. Additionally, we will be able to further improve our audit quality, audit efficiency and provide better insights to our clients. And maybe we can shape the future of the audit practice, using a multi-disciplinary approach when it comes to innovation. Spotting opportunities for innovation and making real innovation tangible in every auditor’s day-to-day work activities. We believe this will make the workforce of the future a reality and opens up the door for more multidisciplinarity in our audit teams.”

Normally, the pressure of the audit is focused on our busy season but by using a more digital approach, we can spread out our work over a longer period with lower pressure, making sure we can focus on the right procedures at the right moment. This is how risk-based auditing should work.

Besides the hardcore data skills, our digital auditors also expand their skills in “data visualization”. Using business intelligence software, they find ways to present findings in an attractive and simple way to make the conversations with our clients easier.

Using software like PowerBI, we can walk our clients through highly complex data analyses in understandable ways. In other words, we make presenting our findings very simple. Our clients receive valuable insights and spend less time on analyzing the digital auditors’ findings. This allows the conversation to get to the core of our findings much quicker compared to when we only used traditional methods for presentation.

We aim to incorporate data-analytics skills and dashboarding skills as a default in the toolkit of the modern auditor by training them from the first day they start within KPMG. In addition to this digital foundation, we want to create the flexibility for auditors to pivot to the needs of our clients with a fit-for-purpose approach. We believe this can be a significant contributor to the successes of our innovations, which will help our clients in the end.

When you are trained in data-analytics capabilities, you see opportunities. And when you see these opportunities, you understand that it doesn’t have to be rocket science to use D&A to your advantage. In other words (borrowed from Johan Cruijff): “You’ll only see it once you get it.”

End note

If you read this article and you imagine your own digital workforce, know that there are many opportunities to make a significant difference. The digital way of working is already part of the new normal for many companies in the Netherlands. Building expertise with respect to that way of working, from the lower levels in the organization and upwards, is something that we see as an important step to drive the agility and customer focus with which a company can innovate. Therefore, we want to encourage you to take a moment and reflect. And make the commitment to start with innovation today!

References

[Baum14] Baumann, O. & Stieglitz, N. (2014, June 12). Don’t Offer Employees Big Rewards for Innovation. Harvard Business Review.

[DeMe22] De Mey, N. (2022). Retrieved from: https://www.pinterest.com/pin/528539706262555165/

[Hall70] Hall, J. & Watson, W.H. (1970). The effects of a normative intervention on group decision-making performance. Human Relations, 23(4), 299-317.

[John17] Johnson, R. (2017, December 15). Why Google rewards its employees for failing. Retrieved from: https://www.linkedin.com/pulse/why-google-rewards-its-employees-failing-ron-johnson/

[Kasp20] Kaspersky (2020, November 16). Bottom-up innovation is near the bottom of modern corporate values. Retrieved from: https://www.kaspersky.com/about/press-releases/2020_bottom-up-innovation-is-near-the-bottom-of-modern-corporate-values

[Lijd19] Lijdsman, A., Hulman, I. & Falticeanu, A. (2019). Digital auditors, the workforce of the future. Compact, 2019(4). Retrieved from: https://www.compact.nl/articles/digital-auditors-the-workforce-of-the-future/

[Mesl13] Meslec, N. & Curşeu, P.L. (2013). Too close or too far hurts cognitive distance and group cognitive synergy. Small Group Research, 44(5), 471-497.

[Pale10] Paletz, S.B.F. & Schunn, C.D. (2010). A social‐cognitive framework of multidisciplinary team innovation. Topics in Cognitive Science, 2(1), 73-95.