Can you – as a financial professional – imagine what your job would be like without Microsoft Excel? We can’t. As hilarious this may be to some readers, we cannot deny that Excel has completely changed the way a financial professional works. However, there are significant limitations of working with Excel. Who hasn’t faced the issue of working with datasets that are simply too large for Excel to handle? When you become a digital (financial) professional you will find new ways to approach these kinds of daily challenges.

Re-inventing yourself as a high-level professional in the current digital era

A solid process in combination with technology and a balanced team is key to delivering services in today’s society. Introducing new technologies in an established industry, such as finance, can be a challenge: the user community and other parties involved need time to adjust to new ways of working. In highly regulated environments the risk-averse attitude is quite high because the organizations need to comply with a multitude of applicable regulations. The proven predominantly manual approach is the known path with its daily struggles and provides limited opportunities for innovations. In practice, you see that innovations are going at a much faster pace than the corresponding laws and regulations. This can lead to a climate in which it can potentially become harder to innovate. Organizations in highly regulated environments can still innovate and profit from the benefits of new technologies if they include sufficient check-and-balances during the development and implementation phase.

We – three colleagues who work fulltime or part-time for the Digital Assurance and Innovation (Daní) department of KPMG – would like to share our personal experience regarding contributions to the ongoing digital transformation. The focus of Daní is the transformation of the financial audit process. One of the main drivers for our transformation is the need to improve efficiency and the desire to improve the quality of our services. These improvements can be made by automation or standardization of procedures, for example. This digital transformation leads to new ways of working. To prepare the organization for this digital transformation we facilitate trainings in data analytics. We feel that for an organization to be able to embrace a digital transformation, its employees should have the necessary skill set to thrive in this changing environment.

In this article, we will focus on the different learning opportunities that are available for financial experts to increase their digital literacy within the organization. First, we will present an overview of six Dutch universities with a wide range of studies related to the digital transformation of the audit process and our journey of becoming a digital professional.

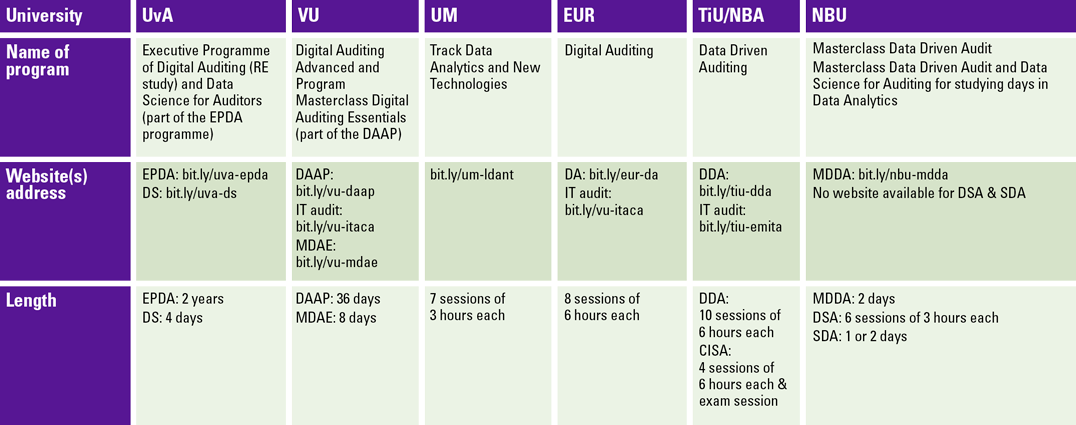

Table 1. Overview of studies relating to digital auditing. [Click on the image for a larger image]

Table 1 provides insights into the different learning opportunities that are available for financial experts. In the remaining part of this article, we will share personal experiences of VU and UVA program alumni. One of these alumni will share his experience through a tailored KPMG post-master that was presented at the Jheronimus Academy of Data Science. Overall, we think that all of the above-described learning opportunities can be valuable. Which one would be the most valuable to you naturally depends on your background and personal needs. However, we believe that for every financial expert there is a program available that can improve your digital literacy irrespective of your background.

Perspectives from tech-savvy audit professionals

My name is Aram Falticeanu (senior manager). When I started my career as an auditor, I was eager to learn more about financial statement audits. During the first years I learned a lot of Excel skills and couldn’t imagine a workday without Excel. When I was studying to become a certified financial auditor, I was already keen to learn more about new technological developments. I noticed for example that my powerful Microsoft Excel program was not always suitable for my needs because I was not able to process all the data. During my training-on-the-job I noticed that 1,048,576 is the maximum number of rows with Excel. My datasets were simply too large for Excel and I wanted to explore if there were technical solutions that could help me. Instead of finding more advanced solutions I noticed that a lot of my colleagues figured out how to split, merge, pivot and shuffle a lot of data in such a way that they were able to analyze larger datasets within Excel. The “agile approach” of working with a dataset with millions of rows within Excel could be improved. With a few other tech-savvy colleagues I started making small VBA routines, and later on I extracted the relevant datasets directly from the databases with easy SQL queries into several subsets. This resulted in trying several other new and more advanced IT solutions within my audit engagements. I would often be one of the first users to try these new solutions which, despite some technical challenges, lead to new insights or save time during an audit. As a result, I embraced (new) technical solutions which I incorporated in my daily activities more and more. Nonetheless, this excitement was not always shared by others. It was often quite difficult to convince peers to use these new solutions. This was mainly caused by two challenges: they believe that the mandatory audit methodology was an obstacle; and the unawareness of the available possibilities. To become better at conquering these challenges, I decided to study Digital Auditing at the Vrije Universiteit Amsterdam. I learned how to combine a digital approach with current auditing standards. Furthermore, I learned that dealing with new technologies is relevant, as these technologies could not only increase efficiency, they could also enhance audit quality. For example, doing the cash reconciliation procedure each time with an automated routine in the same way will save time and increase consistency, which will lead to overall efficiency during the audit process. An automated three-way-match routine can, for example, validate the full dataset by reconciling all items instead of a sample on the dataset. The reconciliation of the full dataset will increase audit quality because the auditor can better focus on the outliers and has more insights about the full dataset. These new approaches on cash reconciliation and the three-way-match are examples of digital auditing.

When I brought this knowledge back to my daily work, I met Alwin Lijdsman (senior trainee). Alwin has a background in Data Science, however he is working within financial audit. Resulting in a unique mix of IT and audit knowledge. He taught me some software engineering skills and showed me yet another perspective of technology. I asked Alwin to share his perspective with you as well in this article.

My name is Alwin Lijdsman (senior trainee) and when I started my career as an audit professional, I was surprised by how skilled my colleagues were in using Excel. Nowadays, most people I work with only rely on a keyboard, writing complex formulas and creating crafty macros in their Excel worksheets. Yet, as soon as the words ‘data’ or ‘IT’ come along, most people immediately shy away and refer to the IT auditor in such a way that the silos and segregation between financial auditors and IT auditor will continue to exist. Or they refer to it as something that they don’t understand. I think that is unfortunate, as I believe it is easier to learn the Python for basic data processing than it is to learn VBA for writing macros. (Python is one of the most popular programming languages ([Cass18]) of today for many purposes, including data processing. Visual Basic for Applications is an older programming language developed by Microsoft that can be used to create macros in Excel.)

As an Economics student with a Master’s degree in Data Science (after a short detour in Computer Science), I found that the value of Data Science is in its usage as a tool. Similar to Excel, Data Science – in short – is applying computer science and statistics to solve problems using data in a specific work field. Unknowingly, you might be performing similar tasks in Excel already. However, performing these actions in Python or R is just easier. You can still perform calculations, you can still automate procedures, and you can still visualize data, but all in a more versatile way. Got a large data set? No problem with Python. Do you have to remove special text characters in several columns? A single line of code in R. Imagine how hard these tasks can be within Excel and you can see the value of becoming proficient in using these types of languages.

This makes me wonder: will young financial professionals in 10 or 20 years ask themselves the same question as I did when it comes to using Data Science as a tool? Does combining traditional auditing practices with Data Science techniques lead to success?

In order to truly understand an auditor, you must have some audit experience. In order to become a good programmer, you must understand the basics of computer science. Just put an auditor and a programmer in one room and out comes the audit innovation, right? Extracting and cleaning data? Check. Reading advanced SQL queries? Check. Performing a regression to obtain audit evidence? Check. Unfortunately, it does not work this way, at least not that easily. Not only are programmers with an interest in audit a rare breed, auditors and programmers often do not speak the same language. We hope that the learning opportunities described in this task can help you in becoming the bridge between the two.

Digital Auditor becomes a reality

In order to solve the problem at KPMG, we came up with the Digital Auditor program: we put auditors and programmers in a room for one week and we teach the auditors how to speak the language of the programmers (using the programming language R or Python). At the end of the week, auditors are starting to become fluent and are able to deliver small MVPs (Minimum Viable Products). Auditors can further refine these MVPs by applying them in their daily practice, before they are taken back to the programmers for more robust products. To illustrate this: most of the time the MVP will solve one specific problem and works on a dataset of the auditor that participated within the Digital Auditor program. When the digital auditors refine their MVP, they are allowed to use this within a controlled manner before it will be pushed for full deployment. Most of the time, the digital auditors search for more datasets to validate if the core-functionality is dummy-proof and explore if additional functionalities are necessary.

Extracting and cleaning data? Reading advanced SQL queries? Performing a regression to obtain audit evidence? Check. All taken care of by the Digital Auditor. Of course, the concept of Digital Auditor requires some more time to realize. It requires efforts from both sides; auditors and programmers. Yet, the initial results are worth the invested time and effort. These Digital Auditors can form their own data-driven-approach and that is an important cornerstone to scale digital auditing.

Perspective for more in-depth knowledge with a tailor-made postgraduate course in Data Science

My name is Ivo Hulman (senior consultant) and when I started my career as a Business Analyst, I was eager to learn more about Data Science in addition to my Master in Information Management. More in-depth knowledge would increase my capabilities as a technical expert and therefore I wanted to further develop my technical skillset.

During my search for development opportunities, I came across a new program. In the challenging market for data & analytics, KPMG had teamed up with JADS, a venture between Tilburg University and Eindhoven University of Technology, to educate their new hires in the field of Data Science. This resulted in a postgraduate course in Data Science, specifically tailored to the needs of KPMG. The first group of participants had almost completed the program and the second group was about to start. I decided to apply for the second group, because this program offered me the opportunity to expand my technical skillset, and at the same time provided insights into how KPMG applies these skills in practice.

Over the course of the next 10 months I learned more about a wide range of Data Science related topics, such as Advanced Data Analytics, Artificial Intelligence, Data Lake & Engineering, Legal & Ethical, and Data Entrepreneurship & Innovation. The group of students, which solely consisted of KPMG colleagues, came from various departments within KPMG. This also had the added benefit of getting to know colleagues from departments whom you normally might not come into contact with. Besides, you get a better idea of the knowledge we already have in-house, but that is organized within different departments.

The program helped me to learn more about new technologies and methodologies that further help me within my job as a Business Analyst. For example, I noticed that the business wants to detect unusual transactions at an earlier stage during the audit. These new technologies can help auditors detect unusual transactions which will give them new insights; this is an example of digital auditing. Overall, I think that the JADS program can be of added value for a lot of professionals who already have some sort of technical background. In addition, I think that every financial expert (auditor, controller, investment advisor et cetera) who is working with data and wants to become more data-minded a data-driven and tech-oriented, this course is very relevant.

I feel that any financial expert who often works with Excel can benefit from programs like this one. This program gives you new insights and can help you approach problems in new ways. It removes the limits of thinking in terms of Excel functions and opens up new possibilities to approach problems you face during your work.

Conclusion

Digital audit transformation is difficult. However, staying competitive is a necessity. It helps us become more productive and offers exciting new business opportunities. Innovation tends to move faster than some parts of the organization. To remove these impediments and foster a culture in which innovation is embraced, we believe that education plays a key role. To bridge the gap between business and IT, we need more financial experts who are data-minded. An organization can only successfully innovate if its employees embrace a culture of innovation and are able to spot areas for improvement by using IT. Even though a natural distinction between a financial expert and a programmer will always exist. Being able to speak the same language is one step towards a future where audit and/or finance and IT are fully integrated.

We have presented three cases of people who are currently contributing to the digital transformation of the audit practice within KPMG. Each person contributed in their own way and took a different route, but the most important aspect is that they are all eager to make the digital transformation a success. They all have improved their knowledge by following a training program that would improve their ability to work in a different way. We believe that it is never too late to learn. The future holds a lot of exciting new opportunities to perform your work in a different manner. Becoming more IT-savvy can help remove inefficient repetitive work and focus on what matters. This also applies for a lot of other professions, such as internal auditors, finance professionals, advisors et cetera. To training all (financial) auditors into digital tech savvy auditors will take time, we are not sure how long it will take, but we all managed to master Microsoft Excel at some point. As a society, we have incorporated many technical solutions and devices, such as mobile phones, in our daily activities; we are therefore positive that most will pivot their skillset in the coming years.

Reference

[Cass18] Cass, S. (2018). The 2018 Top Programming Languages. Retrieved from: https://spectrum.ieee.org/at-work/innovation/the-2018-top-programming-languages.