ISO 20022 will be the new exclusive standard for payments messages globally. Consensus is being reached about the definition of this message standard. This new standard allows the banking network involved in payments to innovate and modernize. As a result, banks will be capable of improving customer satisfaction and operational efficiency. Implementation has been planned for the majority of infrastructures. Coordination is required among participants to ensure benefits are obtained.

Introduction

Almost 10 years ago, financial institutions went through a regional regulatory project with the creation of SEPA for Euro payments. The national clearing systems of 32 European countries all became SEPA-compliant providing a harmonization of retail flows for all participants. The global ISO 20022 migration will open a cross-regional project. The ambition is now to harmonize the execution of payment instructions in foreign currencies and to adopt a common data format, i.e. ISO 20022 payment messages.

This is a major update for high-value payment systems and SWIFT by replacing proprietary formats including the SWIFT MT format, which has been in place for several decades. The adoption of a common standard aims to enable more interoperability between the network participants dealing with cross-border banking flows. Continuously growing over time, the fragmented network has caused more complexity and higher cost for its members. No single standard in the global payment network is used by local and foreign financial institutions within the hundreds of high-value payment systems.

Without interoperability, the participants experience friction at each intersection of two distinct systems. The financial institutions embrace the vision of interoperability for a global payment network, i.e. the ability of systems to exchange and make use of information without boundaries. Compared to train transport, the standardization of the rails allowed trains to travel from one country to another without stopping at national borders. National infrastructures agreed on a series of rules and practices to facilitate traffic on railways. ISO 20022 will provide a payments rails with interoperability at global level, leading to major improvements in global payments processing.

This article delves into the details of ISO 20022 and demonstrates the extraordinary challenge to achieve standardization for local, regional and international payments. First, standardization of payment systems is confronted with a non-standardized condition. Following the definition of a global standard, which requires consensus among the players, it is described how the financial institutions face a coordination challenge to implement the standard consistently. The planning and execution steps are finally considered with the perspective of challenging implementation approaches for banks, including the example of NIBC Bank, and further anticipated benefits for the industry.

Standardization challenges and opportunities

Although the consensus of a standard for financial transactions has been found by means of ISO 20022, the development of this single technical standard is still not a unified process. Network participants need to agree on a default mode of operation.

Since 2016, financial institutions have regrouped into certain payments market practice groups to discuss and describe the use of ISO 20022 for high-value and cross-border payments. For instance, a first task force had concentrated its efforts on defining message guidelines for high-value payment systems while a second task force tailored ISO 20022 to cross-border payments and reporting. These committees coordinated the preferences and participants’ local requirements against universal needs for a global payment market using common message definitions.

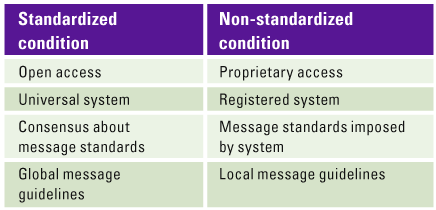

Creating common market practices with ISO 20022 among countries and gaining consensus among network participants, resulting in a broader standardization, is a challenge. There are studies suggesting that a reduction of innovation can be perceived in the context of standardization compared to a non-standardized condition (Blin13]). Nonetheless, the ultimate goal of ISO 20022 is to build interoperability between systems for the greatest number of participants.

What is ISO 20022?

ISO 20022 is a standardization approach (methodology, process, and repository) ([ISO20]) that offers common building blocks and design patterns for financial messages. ISO 20022 standardizes common data objects from the various market infrastructures and offers a common terminology for all financial institutions. The ISO 20022 methodology contains a central dictionary of common business concepts to create market guidelines for exchanging financial data.

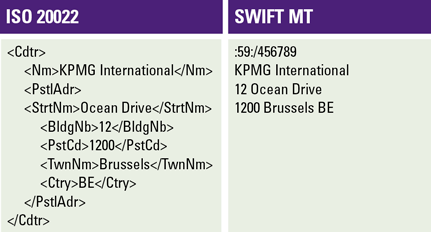

Table 1. Comparative view of data of the creditor within ISO 20022 in Extensible Markup Language (XML) and SWIFT MT. [Click on the image for a larger image]

This is happening in practice

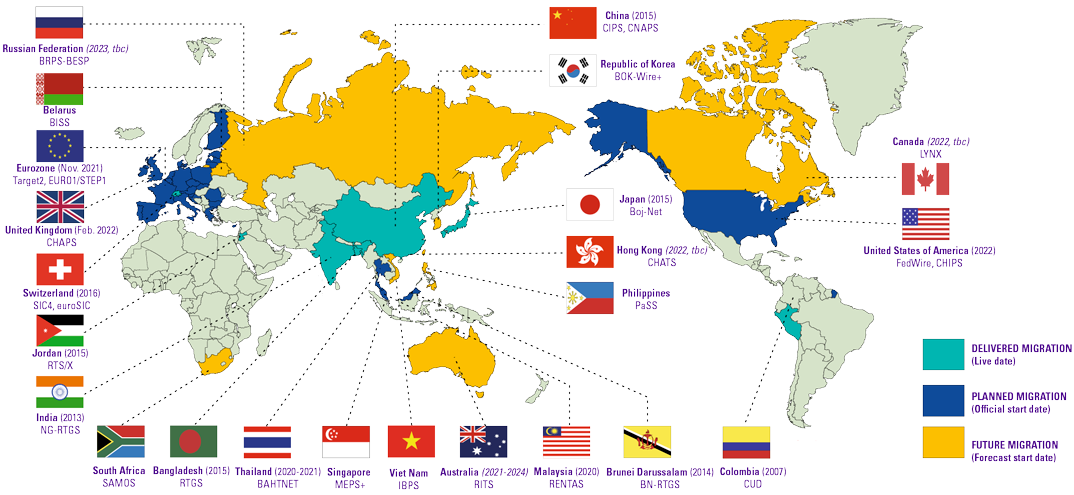

By modernizing payment infrastructures, especially for their low-value and real-time payment systems, some markets have already switched to ISO 20022 years ago. Asia, China and India have modernized their high-value payment (HVP) systems, ahead of western countries. Only the main traded currencies (e.g. USD or GBP) are still relying on proprietary messages and SWIFT MT within their HVP systems. The big shift towards a standardized network will eventually occur with the migration of these market infrastructures (e.g. EUR as of 2021). In the coming years 2021-2025, two dozen HVP systems will adopt ISO 20022. According to SWIFT, the usage of the ISO 20022 will represent 79% of the world’s total HVP volume of settled payments today (and respectively 87% in terms of value) at the end of the migration announced by HVP systems.

Figure 1. Overview of HVP Systems across the world and migration state. The figure is based on information provided by SWIFT and country-specific HVP system providers. [Click on the image for a larger image]

Benefits of standardized messaging through ISO 20022

The global adoption of ISO 20022 appears to be the long-awaited upgrade of the high-value payment systems and associated network functionalities. Since the creation of the SWIFT network, financial institutions have pursued the automation of their processes and looked for ways to generate more economies of scales. The correspondent banking model became a global but restrictive network. In a few years, the extendable usage of ISO 20022 will potentially meet the technical requirements to deliver interoperable services between domestic and cross-border schemes.

This long-standing model will benefit from the adoption of ISO 20022 as a future-proof standard to replace the current 30-year-old MT format. Many alternative systems circumventing correspondent banking have emerged in the past. These non-standardized networks can offer disruptive technology but still require the players to register, follow their particular implementation guidelines and comply with their exclusive message types. With the adoption of non-SWIFT messaging networks, competing closed-loop systems entered into service for a limited number of pre-registered participants without improving the global accessibility of financial institutions.

Table 2. Conflicting models between standardized systems such as ISO 20022 and emerging non-standardized closed-system solutions. [Click on the image for a larger image]

Given its global adoption, ISO 20022 has the potential to improve current payment services and deliver more value to financial institutions and the broader financial ecosystem. Financial institutions will also seek innovation among standardization. An example of innovation is payment-tracking capabilities offered by solutions such as SWIFTgpi. By standardizing technology, the interoperability also increases. Combining transaction management with structured and richer financial data indicate possibilities for even greater global payment innovation in the payment landscape.

Leveraging on ISO 20022, banks can take advantage of implementation efficiencies, increases of interoperability and compatibility, and a reduction of switching efforts (“lock-in scenario”).

- Implementation efficiencies intend to reduce the marginal costs of connecting more participants with different technology requirements. When each participant uses the same technology standard, similar methods of integration can be used each time a new participant is added.

- Increases of interoperability by means of the ability of systems to exchange and make use of information without boundaries. It increases operational effectiveness between the network participants dealing with cross-border banking flows.

- Lock-in reduction anticipates on reduced costs of switching to another participant if a participant in the network does not deliver as expected. If another participant complies with the same standardized technology, switching effort is reduced.

Other benefits of ISO 20022

Besides benefits resulting from global message standardizations, the ISO 20022 format provides more benefits for network participants. Humans and machines benefit from ISO 20022 due to richer and more structured data. Technically, ISO 20022 has some key advantages compared to the MT legacy format. It works with non-Latin alphabets and has a set of characters ten times bigger than MT messages for customer-to-bank payments. The operators can also easily capture information out of the Extensible Markup Language (XML) files thanks to its meaningful tags. In addition, applications can extract more data and parse the payment files more accurately. As a result, the processing of payment instructions will likely go faster and through less exception handling. The automation of payment systems offers the possibility to execute instantaneously a transaction through different market infrastructures.

Furthermore, ISO 20022-compliant payment instructions contain contextually relevant data. These files contain extended remittance information and structured data to clearly describe and identify the parties of the transaction. Agility in complying with new regulations is also a great promise offered by the common standard given its extensible language and use of external codes list. As a consequence, payment processing, monitoring and reporting functions will benefit from ISO 20022. For instance, the anti-money laundering and compliance function can examine the sanction risk through new scenarios, such as ‘payment on behalf’, focusing on specific data elements. Sanction filtering algorithms will understand the rich structured party data avoiding misinterpretation of name, address or other creditor and debtor details written in the payment message.

In addition to an enhanced process, the end-to-end transaction management can benefit from a direct and correct reconciliation of payment instructions. ISO 20022 offers a new range of data elements including end-to-end reconciliation references. Furthermore, corporates and the banks can also use analytics insights from rich ISO 20022 data and cash management services including invoicing, reporting, cash forecasting, treasury and liquidity management can become more performant on the long run.

Implementation challenges

The global implementation of ISO 20022 poses coordination challenges to all banks. There are differences in the approach and the timeline chosen by market infrastructures and banks to implement ISO 20022.

Implementation timelines in the global regions

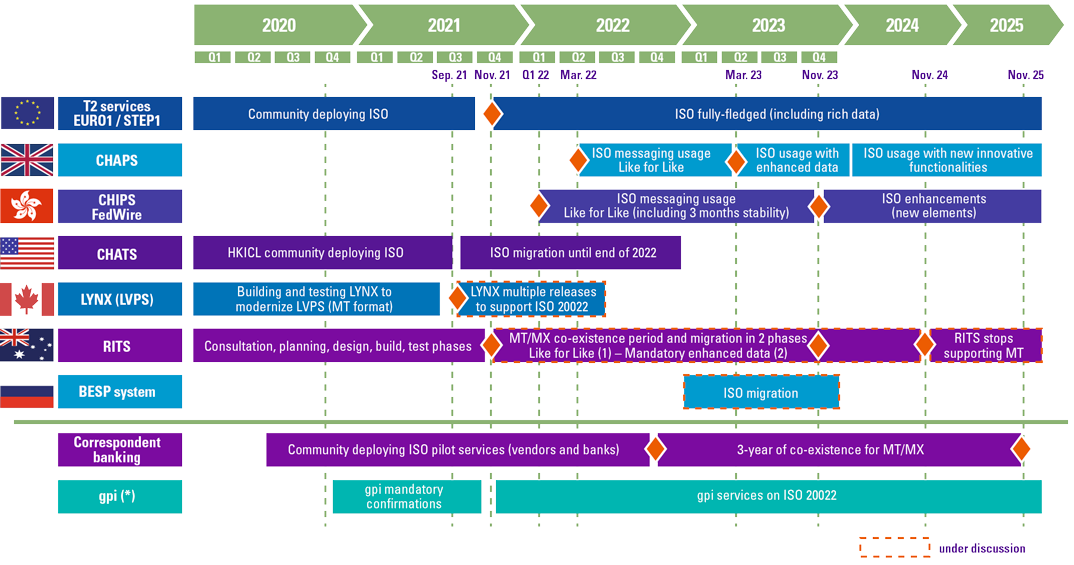

Although SWIFT has created a large coexistence period for both standards, the migration is not eased by the adoption of multiple strategies for each payment market infrastructure. Originally, SWIFT proposed a 4-year timeline with the usage of ISO 20022 as of November 2021 for cross-border and reporting payments. Recently, the decision was taken to postpone this to the end of 2022 ([SWIF20]).

In the Eurozone, the high-value payment systems (TARGET2, EURO1) are keeping the date of November 2021 as the starting point for the modernization of their infrastructure. The US market infrastructures (CHIPS, FedWire) will start switching to ISO 20022 in 2022, a few months behind EU systems. The UK payment system will start implementing ISO 20022 in the same period. In Australia, the recent consultation of the local network participants confirmed the desire of the banks to start by 2021-2022, following the overall trend.

Looking only at the timeline, the complexity does not lie in putting together the milestones or consolidating the global roadmap. In fact, dealing with different approaches at project management level is the critical exercise to secure the benefits and mitigate the risks. Tailoring their implementation strategy across regions will be key for banks. Each bank will opt for its best implementation approach, optimizing its market presence and leveraging its business model and connectivity choices in the payment ecosystem. For instance, the EURO high-value payment systems imposed a strict compliance deadline with ISO 20022 by November 2021 putting forward a “big bang” approach for banks operating in this region. Other actors such as the Bank of England or the Federal Reserve have already opted for intermediary milestones. The UK and US inter-bank settlement systems designed a phased approach by which a “like-to-like” conversion is performed for at least a one-year period, followed by a full implementation of the ISO 20022 format specifications.

Different levels of requirements are created for exchanging financial data with different payment systems, leaving room to opt for a full implementation or “like for like” conversion for cross-border payments in the first years. SWIFT started to design complex mapping rules between SWIFT MT and ISO 20022 to assist its members during the coexistence period.

While banks are operating under budget constraints and low-interest rate margins, the prioritization of projects and resources allocation will be key to offer competitive and innovative payment services for their customers. As an example, the banks leveraging on the SWIFT network will face another major transformation piloted by SWIFT. By the end of 2020, every bank will have to confirm universal transactions to the SWIFTgpi tracker.

Figure 2. Overview of global regions ISO 20022 implementation timelines, as of March 2020 timelines may shift. The figure is based on information provided by SWIFT and country specific HVP providers. [Click on the image for a larger image]

Banks and roles

Given the magnitude of change and the different approaches per regions, the global transaction banks will need to assimilate these different scenarios and follow any modification of the timelines. Some banks will also phase their implementation of the standard and select a few corridors to be ready to process ISO 20022. Some banks will take a closer look at the co-existence period to optimize and prioritize their choices.

A co-existence period offered by the financial industry enables banks in a budget-constrained situation to gradually migrate and adequately configure their portfolio of projects. Being non-compliant over time, even for the smallest banks, will result in a higher risk on operations. Considering the implementation of ISO 20022 in high-value payment systems, the usage of the common standard will have an impact on the activities of financial institutions even for the indirect network participants.

Financial institutions could consider the conversion of MT messages to ISO 20022 messages and vice-versa as a simple, cheap and fast solution. However, this solution is not technically optimal and could turn out to be a poor choice in the long run. The translation of the files can truncate some ISO 20022 data elements and as a consequence minimize the benefits of ISO 20022 for the network participants. Banks will be able to benefit from additional services provided by network facilitators (e.g. SWIFT’s transaction platform) and software vendors to ease their migration towards ISO 20022 and decrease the risk of information loss as a result of the direct conversion from ISO to MT.

Banks choosing to waive their migration will not be able to offer the same level of services at the same time. Therefore, the correspondent banks that will start using these enhanced message types will favor relationships with banks that are fully compatible with the standard. In addition, many corporates operate with multiple banks through their payment channels. Subsequently, these businesses could adapt their payment strategy and redirect their payment flows through the banks that opted for the fully-fledged migration approach.

Systems and vendors

The ISO 20022 migration will require a complex modification in information technology and process landscape for the financial institutions. The SWIFT MT standard is deeply anchored in the Financial Services industry. This message format has been around for such a long time and was adopted so widely that banks are likely to identify internal systems communicating by means of MT messages. The impact can go beyond the direct payment chain and related systems connected to the SWIFT network.

Banks will need to assess the impact on back-end and front-end systems, channels and middleware. The support functions will also be on the edge of substantial updates. The non-exhaustive list includes anti-money laundering, sanction screening, accounting, billing, reconciliation, reporting systems, information retaining and archiving. As a matter of fact, the new message format requires all components to assimilate the ISO 20022 XML files and its new field length, additional fields or character set.

To upgrade these systems, financial institutions are often dependent on third-party vendors. The migration strategy will have to deal with the commitment and new releases planned by their vendors to support the ISO 20022 migration. Knowing beforehand the application components processing payment data required a complete assessment. This task is essential to describe processes and application components, including their owners, users and roadmaps for development, release and trainings.

Financial institutions that grasp the opportunities offered by ISO 20022 can take advantage of their implementation projects to pursue a more ambitious business strategy. The migration will enable fast-moving companies to reengineer their payment value chain at both process and system levels.

Case: NIBC coordinating ISO 20022 compliancy

Above challenges apply to all individual participants in the network, namely the banks that exchange payment instructions through correspondent banking method. NIBC Bank N.V. (hereafter, NIBC) is an interesting example of a bank facing ISO 20022 migration. NIBC is a publicly listed mid-tier enterprise bank offering products and services in North Western Europe from its head office in the Hague, as well as offices in Amsterdam, Frankfurt, London and Brussels.

NIBC interacts with correspondent banks directly and has connectivity to the system TARGET2. These non-SEPA payment messages flows are currently performed using MT-messages and will have to be transformed into ISO 20022 standard. Moving to another standard is not an overnight exercise; it requires internal coordination. Teams of operations and IT are determining the impact shoulder to shoulder. The operations team closely monitors banks communication and is proactively involved in multiple user groups to stay ahead of new developments and detailed requirements in the context of ISO 20022. The IT team determines impact on applications in the payments landscape and assesses priorities in the context of other programs within the bank. Not only are they including their entire payment landscape in the scope, but also dependencies such as mandatory application updates and other large (IT) projects involved within the broader organization. The NIBC ISO 20022 project board consisting of the IT domain lead as well as payments and treasury operations managers set the direction and manage dependencies. KPMG supports in analyzing the impact and developing implementation scenarios.

In this challenge, NIBC is dependent on different implementation timelines from multiple correspondents, as well as application vendors that have different approaches to providing solutions, leading to several challenges.

Challenge 1: Different implementation timelines by correspondents

Each bank engaging in correspondent banking can independently define their own implementation time. NIBC interacts with multiple correspondent banks, as well as the EURO settlement platform TARGET2. Implementation timelines differ between these parties. TARGET2 will perform a big-bang approach. The system will require all its participants to change their message formats on a single day. In contrast, correspondent banks will adapt to the ISO 20022 format over a gradual 3-year period of time, Consequently, NIBC needs to be able to differentiate their adoption of the new format according to the (different) timelines of the correspondent banks. To accommodate this transition period, NIBC needs to be able to differentiate message formatting according to the correspondent bank specific requirements

Challenge 2: Different approaches to providing solutions by application vendors

Correspondent banks have a complex IT architecture integrating multiple software applications processing payment instructions. The application(s) can either be built in-house by the financial institutions or, be designed by third party vendors. These external parties would release new features of their software package during the lifetime of the application. From the perspective of ISO 20022 implementation, banks are dependent on these vendors. From a time perspective, their internal roadmap is tied with the external supply of services for ISO 20022 adoption, as well as internal prioritization of changes. At this stage, the vendors are confronting the adoption of the common standard with diverse approaches and timelines. As banks assess the impact of ISO 20022, the vendor choices add some uncertainty and hazardous dependency.

With these two challenges, NIBC is facing a complex implementation project. Coordination is required with other banks and vendors to plan the implementation.

Challenge 3: From compliancy to future benefits

Due to strict compliance deadlines and a transition period where multiple message types need to be processed, a translator solution could be mitigating risks of not being able to interact with the other bank. The translator solution could allow NIBC to send and receive both MT and ISO 20022 formats while upgrading the systems in the meantime to accommodate the new format.

A translator solution in this way provides flexibility to make changes at their own pace. However, by using the translator, the bank might not yet adhere to a common standard through all interactions in the payment chain between systems and correspondent banks. In this context, one should keep in mind why payment messaging is moving to ISO 20022. This is where the potential benefits of future payments appear. Adhering to this standard can lead to reaping the full benefits of the enhanced messages but only if processes and IT are adopted to the new standard. Benefits include, for example, improved transaction monitoring of messages but also easier reconciliation of payments or in general more straight-through processing.

NIBC (assisted by KPMG) determined and considered multiple scenario’s including risk-mitigating options in order to adopt the new standard in accordance with the correspondent banks and TARGET requirements. As an outcome, reachability and compliancy is ensured.

Recommendations towards banks

Related to the NIBC case study, some elements underpin the next steps towards defining ISO 20022 migration:

- Depending on the architecture and arrangements, banks need to set expectations with application vendors and determine (internal) responsibility. If the contracts with third-party application vendors cover this change, they should provide a roadmap to compliance;

- Besides compliance, this is an opportunity to reengineer the payment value chain and associated support functions. Customer expectations have changed dramatically, and ISO 20022 migration is the momentum to improve the systems’ landscape. Such an ambitious and strategic decision will holistically reduce legacy processes and systems as part of the complete payment chain renewal, as opposed to a silo migration of individual services.

- The transition approach from MT to ISO 20022 is depicted as a choice between several scenarios: a ‘big bang’ approach, a ‘step-by-step’ process delivery (e.g. incoming before outgoing messages), a short-term translation solution followed by a full implementation;

- The financial institutions can set up a project management office to involve the right stakeholders and skilled staff members for the project.

Conclusion: referring to the paradigm

Referring to differentiating a standardized from a non-standardized condition, the need for standardization results in a coordination challenge, as participants need to agree on a default mode of operation. Consequently, consensus and cooperation between participants to agree on the standards definition and implementation need to be reached. Regarding ISO 20022, consensus has been achieved regarding message standards. While ISO 20022 keeps evolving, common market practices for high-value payment systems have been published, and the industry has a roadmap to harmonization.” ([SWIF17]). It is now up to the industry to prove effective harmonization of payments messaging by effectively implementing ISO 20022 and leveraging the full benefits of the common standard.

References

[Blin13] Blind, K. (2013). The Impact of Standardization and Standards on Innovation. Nesta Working Paper 13/15. Retrieved from: https://web.archive.org/web/20170829215500/https:/www.nesta.org.uk/sites/default/files/the_impact_of_standardization_and_standards_on_innovation.pdf

[BoE19] Bank of England (2019). RTGS Renewal Programme. Retrieved from: https://www.bankofengland.co.uk/payment-and-settlement/rtgs-renewal-programme

[ECB19] European Central Bank (2019). T2-T2S CONSOLIDATION. Retrieved from: https://www.ecb.europa.eu/paym/target/consolidation/html/index.en.html

[FedW19] FedWire (2019). Fedwire Funds Service ISO 20022 Implementation Center. Retrieved from: https://www.frbservices.org/resources/financial-services/wires/iso-20022-implementation-center.html

[ISO20] ISO (2020). Introduction to ISO 20022 – Universal financial industry message scheme. Retrieved from: https://www.iso20022.org/about-iso-20022

[PC19] Payments Canada (2019). Corporate plan 2019-2023. Retrieved from: https://www.payments.ca/sites/default/files/pc_19_corporateplan_en.pdf

[RBA19] Reserve Bank of Australia (2019). ISO 20022 Migration for the Australian Payments System – Issues Paper. Retrieved from: https://www.rba.gov.au/publications/consultations/201904-iso-20022-migration-for-the-australian-payments-system/

[SWIF17] SWIFT (2017). High Value Payments Plus (HVPS+) – the next stage step towards ISO 20022 Harmonisation. Retrieved from: https://www.swift.com/news-events/news/high-value-payments-plus-hvps_the-next-stage-step-towards-iso-20022-harmonisation

[SWIF20] SWIFT SCRL (2020). New approach to ISO 20022 adoption. Retrieved from: https://www.swift.com/standards/iso-20022-programme/timeline?tl=en#topic-tabs-menu

[TCH19] The Clearing House (2019) . CHIPS ISO 20022 Program General Introduction. Retrieved from: https://www.theclearinghouse.org/-/media/new/tch/documents/payment-systems/chips_iso_20022_migration_overview.pdf