Grexit, Brexit, Trump, referenda, and the rise of populism in the European Union. 2016 was an uncertain and turbulent year in terms of political risk. For companies and investors, existing economic trends suddenly became less certain. Political risk is a term that is not regularly encountered in the risk frameworks of financial institutions. However, unexpected changes in policies could significantly impact existing business models. A hotly debated topic is to what extent the development of digitalization and policies of globalization have contributed to the emerging political risk in Western democracies, and how companies could anticipate such risk.

Introduction

Brexit, Trump and populism in the European Union; these events in 2016 led to an increased interest in political risk in Western democracies. But what has caused this recent intensification of political headwinds? An argument is that digitalization, globalization and other contemporary society characterized developments have put traditional forms of organization, governance, law enforcement and justice under pressure. In 2014, Citibank warned of what they called Vox Populi risk, a new variation of political risk defined as shifting and more volatile public opinion that poses ongoing, fast-moving risks to the business and investment environment. Indeed, earlier digitalization such as the development of the internet have eroded many traditional sectors of the world economy. In the meantime, a new wave in digitalization (blockchain, robotics) will hit affect internationalization momentum. While developments of digitalization have also created new lines of work, a large part of the electorate in Western democracies is less fortunate with these developments. People who have lost their jobs, and who are less flexible to adapt to the new economic circumstances. Brexit and the election of Donald Trump as President of the United States could be seen as a backlash from this section of the electorate. This trend in electoral behavior is seen as a new form of political risk in Western economies, and could have a significant impact on how companies will anticipate their strategy and investments. The challenge for businesses is to address these concerns of the electorate, while at the same time remaining innovative and competitive in the globalized economy.

The modern definition of political risk

Since the end of the Cold War, many believed the world to be moving towards a model of universalization. A famous example is Francis Fukuyama, who argued that increasing interconnected and interdependent markets would lead to one definite model of liberal democracies and free-market capitalism ([Fuku92]). Borders would become of less importance and nationalism would make place for internationalization. Because of interdependency and mutual economic interests, international and national conflicts would occur less frequently. In addition, the exponential growth of digital innovations would make the world a ‘global village’ and create a better understanding between different cultures. In other words, because of globalization and digitalization political risk would become less relevant in a modern digitalized and globalized world.

The field of political risk is ‘the type of risk faced by investors, corporations, and governments that political decisions, events, or conditions will affect the profitability of a business actor or the expected value of a given economic action’ ([Matt11]). A risk previously mainly applied when conducting business with oil states or emerging economies. But due to the recent political developments in traditionally stable Western democracies, political risk increasingly lies in the West as well.

In January 2016 Citi Research concluded that ‘the sense that political risks have actually increased in a more globalized and inter-connected world is hard to escape’. Citi Research distinguishes the traditional ‘Old Geopolitical Risks’, e.g. military conflict, weak and failing states, unconventional weapons risk etc. and what is called ‘New Socio-Economic Risks’, which includes Citi Research’s own concept of Vox Populi risk. This includes the rise of new and non-mainstream parties, populism and more protests and referenda. Although there have been periods of Vox Populi risk throughout history, the difference today is that these events are happening in the world’s most developed markets, many of which have enjoyed a sustained period of growth and improvements in living standards and are integrated into the global economy and financial system. What is causing this change? Citi Research believes Vox Populi risk is being fueled by growing perceptions of incoming inequality and anxiety about globalization, particularly amongst the middle classes. In developed markets, this has resulted in new and alternative political parties which are having an impact on the public and economic policies ([Citi14]).

The post global financial crisis also saw the return of political risks to developed economies. Citi Research’s Political Analysis stated in its research that it now spends at least as much time monitoring non-mainstream party politics in developed economies as the emerging market-based geopolitical risks, for the first time in 20 years. The annual average number of elections, government collapses and mass protests (called Vox Populi risk events) have increased by a remarkable 54% since 2011 compared to the previous decade. In addition, they see little sign of this trend of political risk reversing ([Citi14]).

Globalization and digitalization: are they interdependent?

In the last three decades it has been seen that globalization and digitalization have gone hand in hand in shaping our world in an unprecedented manner. While the global economy has been changing rapidly since the industrial revolution at the end of the 19th century, the exponential growth of technology has changed our world faster than ever before. Since 1990, manufacturing jobs have moved to countries with lower income standards, and at the same time digital technologies have vastly improved. Less people are now needed for the same amount of work. The digitalization and globalization of the economy has eroded national sovereignty, reshaped conceptions of materiality and place, and facilitated new circulations of culture, capital, commodities, and people.

While globalization and digitalization complement each other, they are not mutually dependent. Digitalization comes forth as a more natural and logical process of evolving and innovating for less efficient processes. As humans we constantly strive for improvement and efficiency to increase our standard of living. While digitalization eroded many traditional sectors of the world economy it has also created new lines of work. A large scale study by Deloitte in 2015 ([Delo15]) showed the impact of technology on the economy of work between 1871 and 2011. The research concluded that technology has broadly created more jobs and that each development has not directly replaced human workers without finding new jobs for them.

But the policies for globalization of the labor force have almost completely eradicated certain types of sectors in developed countries while not bringing much in return for the people working in those particular industries. Manufacturing work is now vastly over-represented in China, India and other developing markets compared to, for instance, Europe. The difference between globalization and digitalization is that the first is mainly a conscious political choice, while the latter is mostly client demand driven.

Due to the spread of the internet and related technological innovations, the global economy has, and still is, undergoing a fundamental structural change. This change is mainly driven by innovative-oriented and technology-oriented companies, whose business models are based on the possibilities of the internet. The internet and the current trend of digitalization have influenced and changed the dynamic of almost all industries. The last years have seen the impact of new driving forces. Today’s marketplace is strongly affected by the progress of information technology and digital information goods are gaining more importance within the economic cycle. But nowadays it is even more important to consider digital technology as a driving force for change. Looking towards the future, digital technologies will restructure branches of trade and industrial sectors through continuous innovations. On the one hand it has created the possibility to expand business areas or implement new business segments. On the other hand it displaces the ‘traditional marketplace’ due to a faster and cheaper supply chain. This can lead to a full automation of business processes in which traditionally humans fulfilled the interaction processes of the service provisions. The rapid development of robotics is a clear example of this. A further outcome of digitalization is that the value-chain of the company changes. Service companies, but also companies who are producing physical products are faced with information intensive value-chains that have changed the traditionally productivity-driven employment within society in a radical manner.

The combination of the process of digitalization and the policies favoring globalization have strengthened each other. In recent years it is not only traditional manufacturing jobs that have been disappearing. According to research in 2014 by the UWV (the Dutch Employee Insurance Agency), the financial services sector in the Netherlands was particularly hit hard by both globalization and digitalization ([UWV14]). As a large sector in the Netherlands (banks, insurers, pension funds, insurance brokers), the share of the total number of jobs of employees remained stable until 2006 (3.6 to 3.8 percent of total jobs). This share dropped to 3.2 percent in 2013. Meanwhile the production in the financial sector has decreased much less since 2008 than the number of jobs. According to the UWV, the cause of this employment contraction are the ongoing technological developments. Administrative processes within these sectors are becoming increasingly automated, and decision rules are now mostly defined in software. But many jobs involving IT support, of which many have replaced the traditional jobs in the financial services sector, are moved offshore ([Dunk16]). This leads to a substantial reduction in personnel which will be further completed in the coming years. Obviously, the (financial) crisis has also played a role: banks are having severe problems as there is less need for financial services and banks are more cautious about providing loans. Since the world economy is now getting back on track, the UWV predicts an increasing demand for financial services employees in the short term, but also expects employment will continue to decrease in the long run.

Winners and losers of the new global village

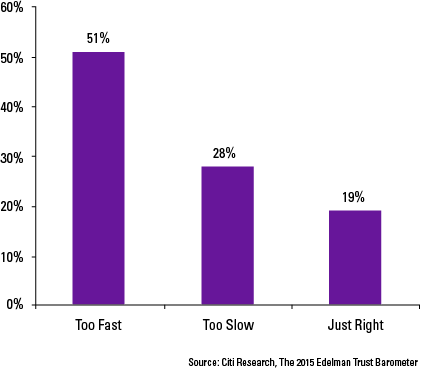

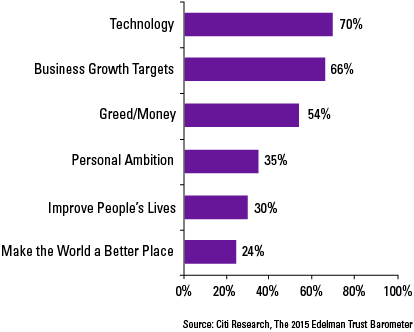

The recent developments in politics have shown new interest in political risk and to find the underlying causes. In that respect the election of Donald Trump and Brexit, the most recent and prominent examples of Vox Populi risk, have shown that a large part of the electorate does not agree with the policies in favor of globalization and have difficulty catching up with the exponential growth in digitalization. Meanwhile at transnational corporations a new wave of digitalization is already on the horizon (blockchain, robotics, enterprise of things) and the job prospects for blue-collar workers are expected to be more threatened than ever before. Hence, it is one of the hottest topics in contemporary Western politics. The current fascination with the potential of new technologies such as robotics and blockchain help reveal the important truth that productivity increases have been the biggest and perhaps the inexorable factor reducing the number of manufacturing jobs. As seen in the previous paragraph, technological innovations now even target the service sectors as well. Most observers expect these developments to continue. In research conducted by Edelman in 2015, it was stated that innovation is also affected by trust and vice versa. The 2015 Edelman Trust Barometer ([Edel15]) finds that more than half of the global ‘informed public’ believe that the pace of development and change in business today is too fast, that business innovation is driven by greed and money rather than a desire to improve people’s lives and that there is not enough government regulation in a number of industries. They also show that countries with higher trust levels overall also show a greater willingness to trust new business innovations. Lower trust is also strongly correlated with more demand for regulation. Given that the group of people surveyed by Edelman were typically highly educated, and therefore among the key beneficiaries of globalization, these attitudes point to a widespread concern about the pace of change and dislocation ([Citi16]).

Figure 1. Stop the world, I want to get off? ‘The pace of change is…’ [Click on the image for a larger image]

Figure 2. Drivers of change in business perceived to be… [Click on the image for a larger image]

So far, the options offered by politicians and businesses for what to do about the loss of jobs are limited. While a large group of the electorate has been confronted with the looming threat of losing their jobs, politicians have promoted more international trade by negotiating free trade agreements and promoting global competition. At the same time many companies have made policy decisions that favor innovation by buying equipment over investing in its own employees and management.

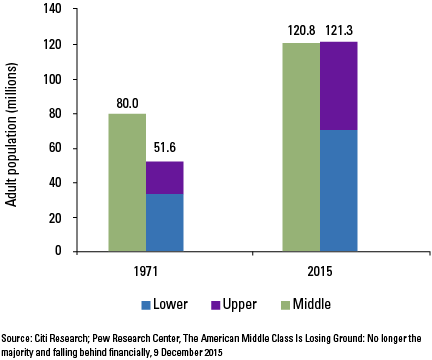

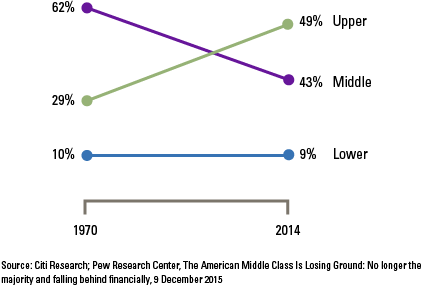

The recent response of the electorate is using the only form of power they have in Western democracies; their right to vote. In his 2016 US Presidential campaign, Donald Trump stated he radically wanted to break with the economic principles that everyone had come to take for granted. More free trade, more trade agreements, more outsourcing of production and services, cheap labor of immigrants, and the transition to a green economy: it has all become less certain. Trump has claimed to revitalize the American middle class. The middle class is defined as those with an income that is two-thirds to double that of the US median household income, after incomes have been adjusted for household size ([Pew15]). Indeed, the middle class of the United States has been marginalized compared to three decades ago. The higher concentration of income and wealth at the top and the stagnation of living standards for the middle class (and those below) have already had a major impact on the public and policy debates in many Western countries.

Figure 3. Middle-income Americans are no longer in the majority (adult population by income tier, millions). [Click on the image for a larger image]

As can be seen in Figure 3 and Figure 4, the middle class in the United States is under pressure. According to economist Jared Bernstein, the middle class saw jobs go away and businesses fold in the rural communities and smaller cities where they are more likely to live. The middle class has lost factory jobs over the last several decades, as expanding trade and advancing technology pushed the economy away from production work and into services. The workers increasingly came to see trade deals as the culprit — namely the North American Free Trade Agreement with Mexico and Canada in the 1990s and the effort to open up trade with China in 2000. This economic decision has cost America at least 5 million jobs on net (The Washington Post, 2016). Trump courted the middle class by promising a restoration of the old industrial economy by renegotiating trade deals and tariffs on imports and by promising rapid economic growth from tax cuts and deregulation.

Figure 4. The share of aggregate income held by middle-income households in the United States. [Click on the image for a larger image]

This trend is also seen in other Western democracies. Therefore, political risk in the short term has become more important. One would expect that the global markets would respond to this crisis in political risk. Businesses should anticipate on this political risk and adapt to the electorate in order to regain their trust while, at the same time, keep their role as innovators to improve the quality of life.

But how can companies effectively cope with this emerging ‘Vox Populi’ risk? Companies should understand political risk; where it comes from and what could be done to in order to mitigate it.

First, it is important for companies to address the concerns of the electorate concerning the impact of globalization and digitalization on society. As stated, globalized trade policies have been a political choice and the digitalization to a much lesser extent. Meanwhile, the question whether lower production costs from offshored jobs benefit Western consumers remains to be debated. The degree to which price declines benefit consumers is largely unknown. Economist Paul Krugman wrote in 2007 ([Krug07]) that free trade with low-wage countries is a win-lose situation for many employees who find their jobs offshored or with stagnating wages. Two estimates of the impact of offshoring on U.S. jobs were between 150,000 and 300,000 per year from 2004-2015. This represents 10-15% of U.S. job creation. U.S. opinion polls indicate that between 76-95% of Americans surveyed agreed that outsourcing of production and manufacturing work to foreign countries is a reason the U.S. economy was struggling and more people aren’t being hired. Trade can at the same time lead to more goods being available at a lower price, but with the consequence of enduring unemployment and decaying infrastructures (unused factories). But even if changes in trade policy could be enacted, they won’t address the massive productivity-driven job losses in industries like manufacturing. It is important for companies to give their employees certainty. As stated, manufacturing work is now vastly over-represented in emerging markets. When taking a look at Chinese factories, these are still crowded with workers who assemble the products. While the implementation of robotics is on the rise, employees are still far from redundant. In order to mitigate Vox Populi risk in the long run, companies should reconsider the role of offshoring in their policy decisions. Offshoring shouldn’t be completely abolished, but companies should also consider the important role they fulfill in society.

Secondly, retraining workers should become one of the primary objectives for companies facing strategic changes. Instead of merely reaping the benefits of the cost reductions coming with digitalization, companies should invest a substantial amount of these resources into their own employees. In addition, companies should be able to oblige their employees to invest in themselves, whether their job is redundant or not. In Denmark, for example, companies have already adopted a proactive approach into ‘activating’ the unemployed with either on the job training in the public or private sector. In cooperation with the Danish government companies invest in both the employed and unemployed to provide practical job-related training. Underlying this model is a recognition by both the public and the private sector that unemployment in the age of globalization and digitalization is increasingly likely to be driven by a skills mismatch between candidates and the jobs available.

Thirdly, it is important for companies to embrace political risk and anticipate on it. Vox Populi risk comes forth from a certain discontent within a society. Companies should keep track of these societal developments and debates. Instead of losing touch with society, companies should stand within it by taking the leading role and anticipating its important responsibilities. A good example for addressing the concerns of the public is the KPMG True Value, the method that not only considers financial profits, but also calculates the value for society, the environment and the people. Whether a business decision involves outsourcing of production lines, or the digitalization of traditional services. It remains important to look beyond merely the financial gains.

Obviously, many other factors contribute to the surge in the politically unstable climate. These include the debates surrounding immigration, government policies, security and the growing gap between the people and politicians. By focusing on the social values and consequences of business decisions, and addressing the concerns of the people, companies could at least weather some of the social unrest and create social cohesion.

Conclusion

This article touches upon the newly emerging political risks in Western democracies and endeavors to find a possible relationship between globalization and digitalization. A new approach in addressing contemporary political risk is necessary, because in the world of heightened political risk existing certainties for companies are falling away.

It is shown that both globalization and digitalization have had an enhanced effect on the rise of political risk. One of the underlying factors of the most recent political upheavals in the West can be traced back to years of globalization policies and the process of digitalization. Electoral results such as Brexit, the election of Trump and other political uncertainties have shown a backlash of the electorate which come with political uncertainties. These newly emerging risks have been defined by ‘Vox Populi risk’.

In order for companies to mitigate such risk, it is concluded that companies should (1) reconsider the role of offshoring production and finance in their policy decisions, (2) retrain and invest in its own employees and management for a more socially accepted role in society, and (3) embrace the newly emerging political risks from the society they operate in, and invest in the knowledge on how to anticipate it.

References

[Citi14] Taking It to the Streets: What the New Vox Populi Risk Means for Politics, the Economy and Markets. New York: Citi Group, 2014.

[Citi16] Global Political Risk: The New Convergence Between Geopolitical and Vox Populi Risks, and Why It Matters. New York: Citi Group, 2016.

[Delo15] Deloitte, Technology and People: The Job-creating Machine. London: Deloitte, 2015.

[Dunk16] E. Dunkley, Banks increase outsourcing of IT jobs in attempt to cut costs. Financial Times, June 2, 2016, https://www.ft.com/content/0950b37e-27fb-11e6-8ba3-cdd781d02d89.

[Edel15] Edelman Trust Barometer 2015, http://www.edelman.com/global-results/.

[Fuku92] F. Fukuyama, The End of History and the Last Man. New York: Free Press, 1992.

[Guha06] K. Guha and S. Briscoe, A share of the spoils: why policymakers fear ‘lumpy’ growth may not benefit all. Financial Times, August 28, 2006, http://www.ft.com/intl/cms/s/0/5a050c32-3631-11db-b249-0000779e2340.html#axzz2PPuG575g.

[Krug07] P. Krugman, Trouble with Trade. The New York Times, December 28, 2007, http://www.nytimes.com/2007/12/28/opinion/28krugman.html.

[Matt11] H. Matthee, Political risk analysis. In B. Badie, D. Berg-Schlosser and L. Morlino, International encyclopedia of political science (pp. 2011-2014). Thousand Oaks: SAGE Publications, Inc., 2011.

[Murr10] S. Murray and D. Belkin, Americans Sour on Trade. The Wall Street Journal, October 2, 2010, https://www.wsj.com/articles/SB10001424052748703466104575529753735783116.

[Newp11] F. Newport, Americans’ Top Job-Creation Idea: Stop Sending Work Overseas. Gallup, March 31, 2011, http://www.gallup.com/poll/146915/americans-top-job-creation-idea-stop-sending-work-overseas.aspx.

[Pew15] Pew Research Center, The American Middle Class Is Losing Ground. Pew Social Trends, December 9, 2015, http://www.pewsocialtrends.org/2015/12/09/the-american-middle-class-is-losing-ground/.

[Scho05] J. Scholte, The Sources of Neoliberal Globalization. United Nations Research Institute for Social Development, October 2005, http://www.unrisd.org/80256B3C005BCCF9/(httpAuxPages)/9E1C54CEEB19A314C12570B4004D0881/$file/scholte.pdf.

[UWV14] UWV, Sectoren in beeld: Ontwikkelingen, kansen en uitdagingen op de arbeidsmarkt. UWV, December 4, 2014, http://www.uwv.nl/overuwv/Images/Sectoren%20in%20beeld_analyses_def.pdf.