The challenge in a fast changing business landscape is to dynamically manage execution of a strategy, based on relevant and actual insights. Enterprise Performance Management (EPM) powers organizations to do so anywhere and anytime. We expect a tremendous shift towards fact-based – and real-time – decision-making in the next decades. A shift that is currently still in its infant stage.

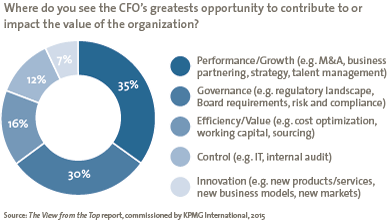

A fact in 2015: CEOs have raised the bar when it comes to what they expect from their CFO. Global KPMG research “The View from the Top” leaves no room for misunderstanding in this respect: 35% of CEOs see the CFOs greatest opportunity is contributing to better performance and growth. This is a clear signal that the role of the CFO and more in general, the finance function, is evolving. What we need is well-rounded multidisciplinary leaders with solid ideas for business growth and increasing shareholder returns. EPM offers CFOs help to live up to these high expectations.

However, other KPMG research points out a problem in the current maturity stage of EPM: many organizations fail to actually translate business insights into actions. To optimize the value from EPM, a company must focus on not just technology solutions but also improve processes and invest in people with the right skills. Unfortunately, the vast majority of organizations have not done this well across all three levers, which currently limits EPM’s contribution. To realize the full potential of EPM, and thereby bring the finance function to the next level, this focus has to change. The evolutionary path for the finance function is challenging: in the past, people in this function were considered bookkeepers; nowadays, they are (supposed to be) analysts; their future challenge is to become innovators.

Predicting accurate scenarios for a timeframe of 30 years is impossible. Having said that, one thing seems inevitable. In the next decades we will overcome most problems in the development and implementation of information technology (IT) as IT becomes a commodity. It will become extremely simple to interconnect humans and devices and to deploy applications on all the data these connections generate.

Currently, we already see a number of trends in the EPM landscape that point to this “end scenario” for IT. A multitude of disruptive technologies is already changing the potential of EPM; new entrants are rapidly lowering the cost; inexpensive state-of-the-art analytical capabilities offer possibilities that were hard to imagine five years ago; and the emergence of cloud solutions seems to be unstoppable. All these trends point in one direction: an abundance of readily available data with accessible real-time insights that enable the finance function to shift into the innovator role and to contribute to growth.

More specifically, there are two trends we expect will manifest themselves in the next decades. The first one is the blurring line between external and internal data. Currently, most insights from EPM solutions are still largely based on the use of internal data. However, the true (predictive) value lies not in the use of data in itself, but in the combination of data sources, especially with the emergence of an inter-connected world where sensors are everywhere, on every device and in every human part. Nowadays, most management information is still based on internal data. In 30 years’ time, we will probably not even be able to note the difference between external and internal data. Still, with this abundance of readily available and accessible data, the key to value will still be who best leverages the information.

In fact, according to KPMG’s global research, 85% of top-performing CEOs believe the greatest strategic value of a CFO lies in the application of financial data analysis to achieve profitable growth. This requires more than just constantly measuring, analyzing and anticipating data from across clients, markets and channels – it takes someone to tell the story. Financial data alone is not going to tell whether your customers are unhappy or a competitor is about to upend your business model; actionable insight requires pulling data across the entire value chain to create value from that knowledge.

The second major trend is more profound. It is about a radical shift in management responsibilities that will take place when we move into more fact-based decision-making. Nowadays, management is considered an “art”: decisions are largely based on experience in combination with gut feeling and guided by management information. It is our human nature to interpret the past and use this as the basis for our judgements of the future. We must radically alter this, as algorithms will simply outperform our human capacities, based on the presumption that “people are more predictable than particles” – a well-known Stephen Wolfram quote. The future will see a range of smart algorithms that shape business decisions based on real-time data from a rich variety of sources. Humans may not even understand why and how these decisions are made. In the words of Ian Ayres, in his book Supercrunchers: “Instead of having the statistics as a servant to expert choice, the expert becomes a servant of the statistical machine.”

This challenges our deep beliefs and values. Most managers believe that they are pretty good at decision-making, certainly better than a soulless algorithm. With algorithms taking over, their influence and their value are reduced. The quintessential question is how will their new role be shaped? The honest answer is we don’t know. Perhaps we could draw an analogy with the role of computers in airplanes. We know that autopilots can safely fly and land a plane, even better than their human peers. Nevertheless, we still have pilots on board. Will there be a similar scenario for managers? Another option is that a new breed of managers will rise: a new innovative class that is capable of spotting unexpected opportunities. These will be the survivors, and winners, in the future world of interconnections and algorithms.

Reference

The View from the Top report, commissioned by KPMG International, 2015.

Morris Treadway is Global Financial Management and EPM Lead at KPMG Management Consulting.

Teo Griffioen is Director Financial Management and EPM at KPMG Management Consulting in the Netherlands.