We strive for the highest audit quality in every engagement, although increasing complexity can make this hard. The field of network theory deals with complex systems and enables us to study these systems in a formal way. What can we learn from this research field and how would this impact the audit?

Introduction

Auditing is not a simple task, ask around, try to find an auditor and they will explain to you that an audit is a major and complex undertaking. During the audit, a team of auditors invade the office floors of the auditee for days, weeks or even months. You will find auditors in every corner of your building, organized according to a meticulous planning, executing their job with the utmost precision. The auditors perform a variety of audit procedures until they have collected sufficient evidence to issue their much-valued product, the audit opinion. In this article, we will look at new techniques that could improve this evidence-gathering strategy.

These rigorously designed audit procedures describe how evidence is collected to audit financial positions on financial statements. However, the auditor might be able to optimize the planning of these procedures by taking the interdependencies between financial positions into account. These interdependencies are everywhere, for example, when goods are sold, we expect to receive a payment and we expect that raw goods are bought to replace the sold inventory. These process dependencies create dependencies between the monetary flows in the financial statements.

An interesting question to ask is how these dependencies impact the evidence gathering process. Could auditors optimize their strategy because components depend on each other? This problem of a system of interacting or dependent components is so common that this resulted in a research field of its own, the field of complexity science, and to be a bit more specific, the field of network theory that deals with these kinds of systems.

The recent rise of the complexity research and network theory boosted the understanding of many other complex systems from a data driven perspective, e.g. social networks ([Borg09]), inter-banking network ([Batt12], [Batt16]), product networks between countries ([Tach12]) and metabolic networks in biology ([Estr06], [Rava02]). In this article, we briefly discuss how networks are the common factor in many domain problems, and then we focus on the question: “Can we view the financial statements as a network and how will this impact the audit?”

Capture complexity

Complexity science and network theory are areas which focus on the bigger interconnected picture. Many systems and problems have a natural representation as a network. To be more specific, these systems can be described as a set of nodes and edges that connect the nodes, for example, our social network ([Borg09]), where the nodes are persons and the edges represent friendships. Or the banking networks ([Batt12], [Batt16]), where the nodes are banks and the edges represent lines of credit. One of the more interesting facts is that many of these network algorithms are general but work on various specific systems that can be represented as networks. Therefore, it is interesting to see if other problems can also be represented as networks so we can apply all these general algorithms in new domains.

For example, understanding the outbreak and spreading of the SARS virus ([Bara16]). Where SARS spreads through a social network, people can be Susceptible, Infectious or Recovered (SIR) from SARS. The same SIR model can also be used to understand how computer viruses spread, whereby a computer can be either Susceptible, Infectious or Recovered from a computer virus ([Bara16]). Different domain, different phenomena; the same analysis techniques.

With these types of analyses, we are able to answer domain-specific questions that remained unanswered or difficult to answer before. In the last couple of decades, research activity in the network theory surged, which resulted in new types of analyses on networks. Scientists developed algorithms to answer generic questions like “What is the most important node?” ([Bara16]) or “How are the connections organized?” ([Bara16]). The answers to these questions provide various insights when applied to a specific domain. For example, the question “What is the most important node?” applied to the internet network, helps us understand which nodes we need to protect in order to keep our internet online or how to change the design of the internet to make it more robust. So, what if we can turn data that is readily available in the audit into a network? Can we translate these generic questions to solve specific audit problems?

Financial statements as networks

The balance sheet and profit and loss statement form a network of interacting components that can be studied and understood ([Boer18]). Think of it, financial accounts as nodes in a network and business processes moving the money around in this financial system. Selling goods, buying inventory, receiving payments are the business processes that move value around from one set of financial accounts to another. Similar to blood flows in biological systems, where the heart is the engine that makes everything flow, or to electricity that moves through the electricity grid.

Our research ([Boer18]) proposes to extract a financial statement network from the journal entry data, such as displayed in Table 1.

Table 1. Journal entry data. [Click on the image for a larger image]

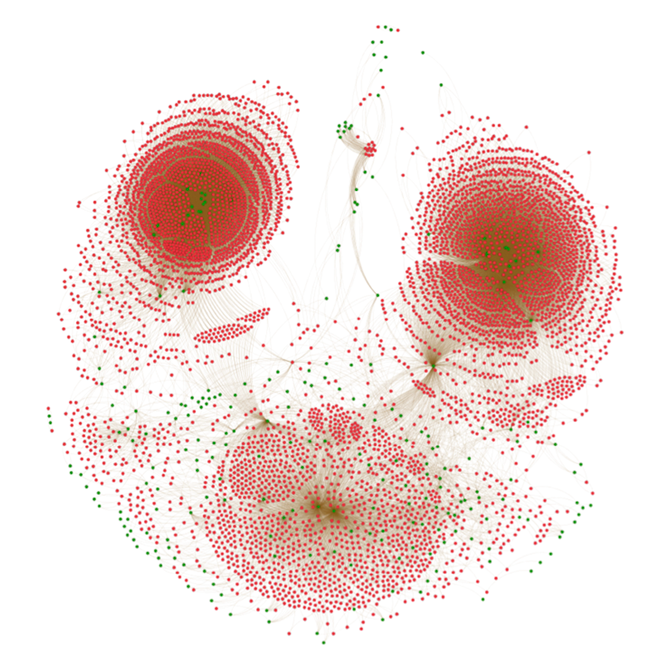

These entries tell us how much monetary value flows in and out of certain financial accounts. The company has thousands maybe even millions of these journal entries describing the money flows in detail. We can construct a network based on these journal entry data where we define two sets of nodes: financial account nodes and business process nodes. The financial accounts tell us what moved; and the business process tells us why it moved. Here, the business process nodes are all unique journal entry patterns, where each pattern represents a process or variation of a process. When we construct a network based on transactional data, we observe a large network which represents all the interactions between the components of the financial statements. In Figure 1 you can see an example of such a network based on journal entry data of an existing company.

Figure 1. The green nodes represent the financial accounts and the red nodes represent the business processes that moves monetary value from one set of financial accounts to another set of financial accounts. [Click on the image for a larger image]

The green nodes represent the financial accounts and the red nodes represent the unique business process patterns. The three clusters that emerge can be thought of as the three beating hearts that pump the money around. This network captures the complexity of the financial statements in a way that can be easily analyzed by computers.

How can these networks be used in the audit? To answer this question, we must look at the audit standards and procedures. Among the many audit procedures one category stands out: the substantive analytical procedures. The substantive analytical procedures enable the auditors to construct predictive models to detect if recorded values are inconsistent with other information available. The network tells us how the financial accounts relate to other monetary flows in the financial system of a company ([Boer18]). The auditor can read two important aspects from the network: first, what flows and second, why it flows. When the why and what are combined, a predictive model can be constructed to check inconsistencies. For example, there is a revenue outflow; the what, due to a sale; the why, and therefore we can predict the movement of goods. In case of no inconsistencies, the auditor can turn this into audit evidence ([Boer19]). This means that other audit procedures might not be required anymore because the auditor could leverage the knowledge of interacting components in the financial statement.

The above description is an example of a case where networks are useful for an auditor, the research field of network theory is much bigger, however. Other domains like biology and chemistry have similar objectives: to understand and predict the behavior of systems. Therefore, a natural question to ask is whether we can borrow techniques from these domains to better understand the financial account balances and monetary flows. This financial statement network representation enables us to develop these generic audit algorithms that can be applied to the specific financial statement networks of the clients being audited.

Conclusion

The creation of financial statement networks is a new and different way to analyze the financial statements. We can use readily available transactional data to create this network. This network can be used to create predictive models for substantive analytical procedures which, in case of no inconsistencies, yield audit evidence.

However, to really understand the possible impact of these networks on the audit, we need to perform more research, although these early results are promising. We don’t know what the future will bring, but we will definitely follow this path to analyze the balance sheet in a data-driven way and we can only hope that it will bring the same progress compared to many other research fields. To be continued …

References

[Bara16] Barabási, A.-L (2016). Network Science. Cambridge University Press.

[Batt12] Battiston, S. et al. (2012). DebtRank: Too Central to Fail? Financial Networks, the FED and Systemic Risk. Scientific Reports, 2(541).

[Batt16] Battiston, S. et al. (2016). Complexity Theory and Financial Regulation. Science, 351(6275), 818-819.

[Boer18] Boersma, M. et al. (2018). Financial Statement Networks: An Application of Network Theory in Audit. The Journal of Network Theory in Finance, 4(4).

[Boer19] Boersma, M. et al. (2019). Audit Evidence from Substantive Analytical Procedures. Oral presentation at the American Accounting Association Annual Conference 2019.

[Borg09] Borgatti, S.P. et al. (2009). Network Analysis in the Social Sciences. Science, 323(5916), 892-895.

[Estr06] Estrada, E. (2006). Virtual Identification of Essential Proteins within the Protein Interaction Network of Yeast. Proteomics, 6(1), 35-40. Retrieved from: https://arxiv.org/pdf/q-bio/0505007.pdf.

[Pole16] Poledna, S. & Thurner, S. (2016). Elimination of Systemic Risk in Financial Networks by Means of a Systemic Risk Transaction Tax. Quantitative Finance, 16(10), 1599-1613.

[Rava02] Ravasz, E. et al. (2002). Hierarchical Organization of Modularity in Metabolic Networks. Science, 297(5586), 1551-1555.

[Tach12] Tacchella, A. et al. (2012). A New Metrics for Countries’ Fitness and Products’ Complexity. Scientific Reports, 2(723).