Taking the right decisions has always been key for the success of organizations. If we look back, intuition and experience were the most important factors in decision-making. However, nowadays an enormous amount of data is being produced. Organizations can easily obtain that data but still struggle to implement data-driven decision-making in their daily operations. Organizations that are able to use data in their decisions, are significantly outperforming those that are not. In this article we try to answer the question why some organizations find it difficult to adopt data in their decision-making process, and we take away the typical concerns of organizations.

Introduction

We live in a time where data is becoming increasingly important as we are getting better in capturing and utilizing the enormous amount of data that is generated by everything we do. This leads to more accurate decision-making as we are able to better predict what will happen than ever before using the abundance of available data. Examples are numerous: the health care industry is able to predict sickness and success rates of treatments, the retail industry can better market their products, banks can more accurately predict fraud, and supply chain departments are able to constantly monitor how many products are needed when and where.

However, despite the fact that the benefits of data-driven decision making are evident and easy to understand, a multitude of organizations still struggle to embed simple data-driven decision making in their day-to-day practice as the capabilities needed to enable this are seen as unobtainable. In this article we explain the importance of data-driven decision making and we elaborate on how a typical organization can easily adopt simple data-driven decision making by utilizing technology that is readily available.

Before we turn to how an organization can implement this type of decision making we will elaborate on the idea of data-driven decision making itself and we will describe what has caused the emergence of this managerial style. Next, we will explain how an organization can benefit from it and lastly, we will give practical advice on how KPMG, with the help of Microsoft technology, can assist in the transition from intuition to logic.

What is data-driven decision making?

So what is data-driven decision making? As the name suggests, this type of decision making is based on actual data rather than on intuition or observation. It uses facts, metrics and other data to steer strategic choices that align with an organization’s goals, objectives and initiatives. This of course contrasts with basing decisions on gut feeling, simple observation or personal experience. Data-driven decision making quantifies and objectifies the rationale behind a decision. This does not only enable an organization to make a better choice; it also helps with analyzing the results of that decision afterwards.

The interest for this type of decision making has dramatically increased. According to a global survey held by the Business Application Research Center ([BARC]), answered by over 700 organizations, 50% of organizations agree that data is critical for decision-making and should be created as an asset in their organization, and two-thirds believe it will be in the future. However, only one-third of enterprises currently use data in their decision-making even though almost all organizations expect to do so in the nearby future. Interestingly, there is also a difference between high-performing organizations and laggards, as the best-in class organizations base their decisions up to 30% less on intuition and gut feeling. The results of this global survey perfectly describe the paradox between organizations understanding the need for data-driven decision making and the inability to actually implement this in their organization.

Before we dive further into the concept of data-driven decision making it is important to stress the fact that data does not replace the intuition or experience of a manager. They co-exist and can be seen as two sides of the same coin, as the quality of the manager is still of critical importance to form a decision. What data-driven decision making does, is providing managers with a foundation to base their decision on. Sometimes this strengthens the beliefs of the manager, and sometimes it goes straight against it. Either way, the manager plays a crucial role in making the final decision. Moreover, for those decisions for which little quantitative data exist, the decisions based on intuition and experience still outperform purely data-driven choices.

Data-driven decision making follows the five phases that are shown in Figure 1. It all starts with defining a data-driven strategy that is carried across the organization. Next, the key areas in which data-driven decision making can bring the most benefit should be identified to have a clear focus. An organization can then pinpoint the target data that is needed to form a data-based choice. The next step is to actually collect and analyze the data that was identified and finally, an organization should form a decision based on the analysis.

Figure 1. Process of data-driven decision making. [Click on the image for a larger image]

As can be seen, data-driven decision making starts with a strategic choice and should be an integral part of the business process to make it a success. It starts top-down but to fully embed this type of decision making in an organization, the benefits need to be clear in the entire organization, as all layers play a role in the process.

Why should an organization define a strategy where data-driven decision making is at the heart of the business? That is the question we will answer in the next section.

Why organizations will benefit from data-driven decision making

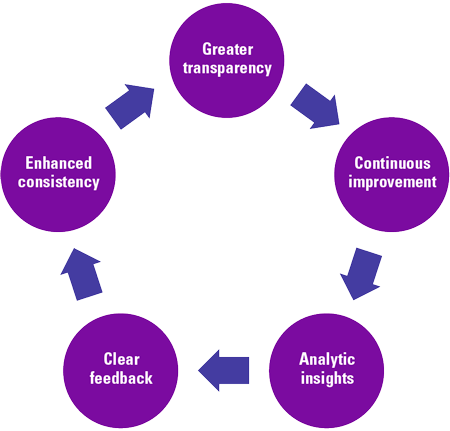

Earlier, we already gave a few examples on how data-driven decision making enables organizations to better predict the future such as the more precise prognosis of success rates of treatments or the increased accuracy of the prediction of fraud. Using data insights, it becomes possible to make more informed decisions that will in turn lead to a better performance. Moreover, basing your decisions on data also ensures that management reports and day-to-day operations rely on a stable and non-subjective basis. More generally speaking, data-driven decision making has a positive impact on the five pillars that are depicted in Figure 2.

Figure 2. Impact pillars of data-driven decision making. [Click on the image for a larger image]

1. Greater transparency

The first benefit of data-driven decision making is the increase in transparency and accountability. Because data is objectifiable, internal and external stakeholders can understand why decisions are made and the organization as a whole becomes more transparent. For an organization, this means that their strategy becomes easier to explain making sure alle stakeholders are on board. Another benefit of the use of data that can be objectified is that it helps with communication between departments as there is one source of truth which fosters collaboration. Moreover, threats and risks can be identified earlier, and the morale of employees is promoted as they can easily see the outcome of their work.

Data-driven decision making also increases the accountability as the data can be accessed during and after the decision is formed. This helps with internal and external audits and personal liability concerns are largely mitigated.

2. Continuous improvement

Another advantage of data-based decision management is that it can lead to continuous improvement. As the amount of data increases and the technology to analyze that data becomes more and more available, the accuracy of the decision gets better over time. Also, because this type of decision making is not reliant on the knowledge or skill level of managers, it is easier to scale up and rapidly implement decisions as more data becomes available.

3. Analytic insights

Data-based decision making helps with solving complex problems as it enables management to test different scenarios and compare outcomes. It also speeds up the decision-making process as the analysis is done automatically. An organization can use real-time data and past data patterns to get valuable analytical insights that significantly increases the performance of the organization.

4. Clear feedback

Another advantage of data-driven decision making is that it ensures a feedback loop. It helps to do research into what is supposed to happen and what is not, making sure the organization is able to formulate new products and market them, as well as assist in setting up a collections strategy for example. This also means that trends can be identified even before they occur. Using historical data, an organization can predict what will happen in the future or what they need to adjust for better performance. This can help to maintain a good relationship with customers as an organization can introduce new products that constantly meet their changing preference.

5. Enhanced consistency

Lastly, embedding data-based decision making in your organization will help consistency over time. As people within the organization know how decisions are formed, they can reproduce and take actions accordingly to simulate and improve the outcome. If the entire workforce is involved in the process around the data-based organization, it will drive consistency even further as their skills are trained as well as their ability to work with data increases.

The five pillars that are positively impacted by data-driven decision making enable a typical organization to form better decisions that are more robust and can be replicated or adjusted as time progresses. It is important to note that a data-based strategy is not only for tech-savvy organizations, but can be used in all organizations. It can simplify and speed up the processes concerning all types of decisions. There are plenty of examples of where a typical organization can benefit from data-driven decision. Think of forecasting your cashflow using historical data on when customers pay their invoice. Customer payment data can also be used to adjust your collections strategy or payment terms. A typical organization can also use data to set the correct price of products based on marginal revenue figures, or they can analyze what their marketing budget should be based on brand awareness. The examples are countless and with the development and increased availability of business intelligence software, organizations without deep-rooted technical expertise are able to analyze and extract insights from their own data. This means that every organization can produce reports, trends, visualizations and insights that facilitate their decision-making process.

How you can enable data-driven decision making

In the previous sections we explained why the implementation of data-driven decision making became a top priority for many managers in all kinds of sectors and industries. The benefits are evident and seem easily obtainable. However, numerous organizations still struggle to embed simple data-driven decision making in their organization. In this section we will explain how you can enable this type of decision making with the use of existing technology and the right mindset.

Earlier we identified five steps in the process to reach data-driven decision making. The first three blocks relate to the organization’s strategic choice to start the process and to think of areas and data that are necessary to form the decisions that are backed by data. Usually, organizations do not find it difficult to complete those first steps. The challenges arise in the last two steps that are highlighted in Figure 3, where the actual analysis and decision-making takes place, which is what we fill focus on in this section.

Figure 3. Enabling the process of data-driven decision making. [Click on the image for a larger image]

The collect & analyze step refers to, as the name already suggests, not only the collection of data but also the visualization of that data to make it understandable and relatable. Building this kind of capability on your own, especially for a mid-size organization with a focus on other core activities, can be very complex, which is the exact reason why those organizations choose to not go down that road. However, as we already implied before, existing technology can be leveraged to effectively and quickly implement and scale up data-driven decision making. KPMG, in combination with the capabilities of Microsoft Dynamics 365, can help with that transition.

Dynamics 365 is a combination of interconnected systems that combine CRM and ERP capabilities using modular applications. It offers an integrated solution in which all your data, business logic and processes are stored. This means that, instead of having siloed functions with separate databases, all capabilities are integrated and can leverage on the underlying common data model. Dynamics 365 offers, on top of this, out of the box reports using PowerBI that can be used as a basis for data-driven decision making. It for example enables you to identify people that are most likely to buy based on customer profiles; it can be used for connected field service utilizing Internet of Things; or allows you to adjust your collections strategy based on customer payment data. As mentioned earlier, this is all standard functionality and is readily available to everyone.

Although the possibilities are endless, KPMG suggests starting small with quick wins that prove the benefits of data-driven decision making within your organization. This also allows for a simple introduction without immediately diving into unexplored functionality.

One of the key areas that can immediately profit from data-driven decision making is an organization’s finance process. An organization typically already collects all customer, vendor, bank and other data in their finance system. This data, when used right, can immediately be leveraged to improve your decision-making when it comes to questions like: what is my cashflow forecast? Or how should I set my prices to generate the most revenue? These kinds of questions can be easily answered by Microsoft Dynamics 365 for Finance using out of the box reports and even a machine-learning functionality to for example accurately predict your cashflow. It is also possible to run various forecasts on your budget or project to determine the perfect rate for your employees. For an organization whose focus is not primarily on business intelligence, this means that they can still leverage on sophisticated tools that aid in decision-making therefore increasing their accuracy and in turn their performance. As we saw earlier, organizations that are able to implement data-driven decision making, perform significantly better and Microsoft D365 is one of the tools that can be used to get started with this way of working.

Until now, we primarily focused on the most important drivers of the implementation of data-driven decision making, such as the tooling and the strategy. However, there are other factors that we cannot neglect. One of those is the trust that an organization needs to have in their data. In 2016, KPMG International commissioned Forrester Consulting to examine the status of trust in Data and Analytics by exploring organizations’ capabilities across four Anchors of Trust: Quality, Effectiveness, Integrity, and Resilience. A total of 2,165 decision makers representing organizations from around the world participated in the survey. The study showed that, on average, only 40 percent of executives have confidence in the insights they receive from their data. This means that even though the capabilities are within reach, organizations still find it difficult to trust the results of a data-driven approach. This is usually caused by data that is cluttered and of poor quality. KPMG assists organizations with getting their data clean and clear by analyzing the four Anchors of Trust. As we like to say, there are no decisions without Trusted Analytics. After analyzing an organization, KPMG is able to detect the data flaws and how to solve them. By building an organization data model from the ground up, data-driven decision making becomes trustworthy, effective, and easy to use.

In addition, embedding data-driven decision making can also be challenging as people and processes within the organization might need to change. As mentioned earlier, an organization should start the implementation top-down as it shows the involvement and support of management. To make sure that this support is carried across the entire organization, it is important to then focus on quick wins and the easier part of the implementation. If needed, KPMG can assist with this transition. Combining the experience gained from working across thousands of functional transformations, KPMG created an implementation methodology called Powered Enterprise that follows the leading practices of all those transformations, using the latest technologies. It offers fully re-designed business functions, operating models and processes that can be accessed straight away. This shortens the implementation time and offers out of the box solutions, making sure that your organization can implement data-driven decision making as efficient as possible.

Conclusion

Data-driven decision making can help organizations make better choices as we are able to better predict the future. However, many organizations still struggle to embed this type of decision making in their day-to-day practice because of perceived complexity and the absence of the right capabilities. We argue that, with the rise of new technologies, complexity diminishes, and the necessary capabilities can be easily obtained. Tools like Microsoft Dynamics 365 offer out of the box functionality that can help transform your business processes. Using the standard advanced analytics and business intelligence capabilities that are included in such a tool, you can start small with data-driven decision making. Moreover, real-time dashboards can be leveraged to get instant insights in your organization. To make sure the implementation of data-driven decision making is a success, KPMG can help overcome data trust issues and, using the experience of countless transformations, leading practices become available that prevent common pitfalls from happening. This means that data-driven decision making is finally knocking on all doors, big or small, and we suggest letting this in.

References

[BARC] Business Application Research Center (n.d.). Global Survey on Data-Driven Decision-Making in Businesses. BI Survey. Retrieved August 5, 2021, from: https://bi-survey.com/data-driven-decision-making-business

[Durc21] Durcevic, S. (2021, April 30). Why Data Driven Decision Making is Your Path To Business Success. Datapine. Retrieved from: https://www.datapine.com/blog/data-driven-decision-making-in-businesses/

[Jaco21] Jaco, M. (2020, July 27). Being a Data Driven Business: The Advantages and How to Apply It. ZIP Reporting. Retrieved from: https://zipreporting.com/en/data-driven.html

[KPMG20] KPMG (2020). Guardians of trust. Retrieved from: https://assets.kpmg/content/dam/kpmg/xx/pdf/2018/02/guardians-of-trust.pdf

[McEl16] McElheran, K. & Brynjolfsson, E. (2016, February 3). The Rise of Data-Driven Decision Making Is Real but Uneven. Harvard Business Review. Retrieved from: https://hbr.org/2016/02/the-rise-of-data-driven-decision-making-is-real-but-uneven

[Mill21] Miller, K. (2021, April 23). Data-Driven Decision Making: A Primer for Beginners. Northeastern University Graduate Programs. Retrieved from: https://www.northeastern.edu/graduate/blog/data-driven-decision-making/

[Ohio21] Ohio University (2021, March 8). 5 Essentials for Implementing Data-Driven Decision-Making. Retrieved from: https://onlinemasters.ohio.edu/blog/data-driven-decision-making/

[Pehr20] Pehrson, S. (2020, June 19). What is Microsoft Dynamics 365? Pipol. Retrieved from: https://pipol.com/what-is-microsoft-dynamics-365/

[Rex] Rex, T. (n.d.). The Benefits Of Data-Driven Decision Making: How To Achieve It In 2021. Personiv. Retrieved June 22, 2021, from: https://insights.personiv.com/blog-personiv/the-benefits-of-data-driven-decision-making

[Roth18] Roth, E. (2018, October 2). 5 Steps to Data-Driven Business Decisions. Sisense. Retrieved from: https://www.sisense.com/blog/5-steps-to-data-driven-business-decisions/

[Soft21] Softjourn (2021, June 18). Data-Driven Decision Making. Retrieved from: https://softjourn.com/blog/article/data-driven-decision-making

[Stob19] Stobierski, T. (2019, August 26). The Advantages of Data-Driven Decision-Making. Harvard Business School Online. Retrieved from: https://online.hbs.edu/blog/post/data-driven-decision-making

[Tayl19] Taylor, A. (2019, December 6). 3 powerful benefits of data-driven decisions. Ruby. Retrieved from: https://www.ruby.com/3-powerful-benefits-data-driven-decisions/