Clear and transparent disclosure on companies’ ESG commitments is continually becoming more important. Asset managers are increasing awareness for ESG and there is an opportunity to show how practices and policies are implemented that lead to a better environment and society. Furthermore, stakeholders (e.g., pension funds) are looking for accurate information in order to make meaningful decisions and to comply with relevant laws and regulations themselves. Reporting on ESG is no longer voluntary, as new and upcoming laws and regulation demand that asset managers report more extensively and more in dept on ESG. As a result of our KPMG yearly benchmark on Service Organization Control (hereinafter: “SOC”) Reports of asset managers, we are surprised that, given the growing interests and importance of ESG, only 7 out of 12 Dutch asset managers report on ESG, and still on a limited scope and scale.

Introduction

Before we get into the benchmark we will give you some background on the upcoming ESG reporting requirements for the asset management sector. These reporting requirements are mainly related to the financial statement. However, we are convinced that clear policies, procedures as well as a functioning ESG control framework are desirable to reach compliance with these new regulations. Therefore, we benchmark to what extent asset managers are (already) reporting on ESG as part of their annual SOC reports (i.e., ISAE 3402 or Standard 3402). We end with a conclusion and a future outlook.

Reporting on ESG

In this section we will provide you with an overview of the most important and relevant regulations on ESG for the asset management sector. Most of the ESG regulation is initiated by the European Parliament and Commission. We therefore start with the basis, the EU taxonomy, which we disclose high-over followed by more in detail regulations like Sustainable Finance Disclosure Regulations (hereinafter: “SFDR”) and Corporate Sustainability Reporting Directive (hereinafter: “CSRD”).

EU Taxonomy

In order to meet the overall EU’s climate and energy targets and objectives of the European Green deal in 2030, there is an increasing need for a common language within the EU countries and a clear definition of “sustainable” ([EC23]). The European Commission has recognized this need and has taken a significant step by introducing the EU taxonomy. This classification system, operational since July 12th, 2022, is designed to address six environmental objectives and plays a crucial role in advancing the EU’s sustainability agenda:

- Climate change mitigation

- Climate change adaptation

- The sustainable use and protection of water and marine resources

- The transition to a circular economy

- Pollution prevention and control

- The protection and restoration of biodiversity and ecosystems

The EU taxonomy is a tool that helps companies disclose their sustainable economic activities and helps (potential) investors understand whether the companies’ economic activities are environmentally and socially governed sustainable or not.

According to EU regulations, companies with over 500 employees during the financial year and operating within the EU are required to file an annual report on their compliance with all six environmental objectives on 1 January of each year, starting from 1 January 2023. The EU ESG taxonomy report serves as a tool for companies to demonstrate their commitment to sustainable practices and to provide transparency on their environmental and social impacts. The annual filing deadline is intended to ensure that companies are regularly assessing and updating their sustainable practices in order to meet the criteria outlined in the EU’s ESG taxonomy. Failure to file the report in a timely manner may result in penalties and non-compliance with EU regulations. It is important for companies to stay informed and up-to-date on the EU’s ESG taxonomy requirements to ensure compliance and maintain a commitment to sustainability.

SFDR

The SFDR was introduced by the European Commission alongside the EU Taxonomy and requires asset managers to disclose how sustainability risks are assessed as part of the investment process. The EU’s SFDR regulatory technical standards (RTS) came into effect on 1 January 2023. These standards aim to promote transparency and accountability in sustainable finance by requiring companies to disclose information on the sustainability risks and opportunities associated with their products and services. The SFDR RTS also establish criteria for determining which products and services can be considered as sustainable investments.

There are several key dates that companies operating within the EU need to be aware of in relation to the SFDR RTS. Firstly, the RTS is officially applied as of 1 January 2023. Secondly, companies are required to disclose information on their products and services in accordance with the RTS as of 30 June 2023. Lastly, companies will be required to disclose information on their products and services in accordance with the RTS in their annual financial reports as of 30 June 2024.

It is important for companies to take note of these dates as compliance with the SFDR RTS and adhering to the specified deadlines is crucial for companies. Failure to do so may again result in penalties and non-compliance with EU regulations. Companies should also stay informed and keep up with the SFDR RTS requirements to ensure that they are providing accurate and relevant information to investors and other stakeholders on the sustainability of their products and services as these companies are required to disclose part of this information as well.

CSRD

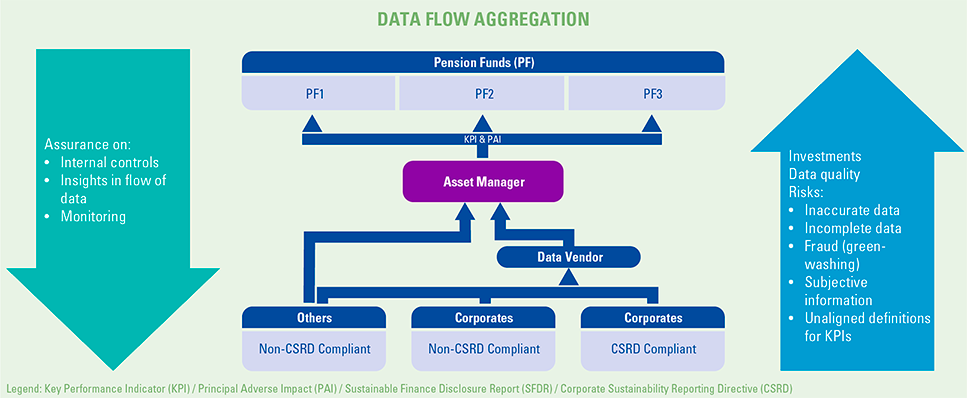

The CSRD is active as of 5 January 2023. This new directive strengthens the rules and guidelines regarding the social and environmental information that companies have to disclose. In time, these rules will ensure that stakeholders and (potential) investors have access to validated (complete and accurate) ESG information in the entire chain (see Figure 1). In addition, the new rules will also positively influence the company’s environmental activities and drive competitive advantage.

Figure 1. Data flow aggregation. [Click on the image for a larger image]

Most of the EU’s largest (listed) companies have to apply these new CSRD rules in FY2024, for the reports published in 2025. The CSRD will make it mandatory for companies to have their non-financial (sustainable) information audited. The European Commission has proposed to first start with limited assurance upon the CSRD requirements in 2024. This represents a significant advantage for companies as limited assurance is less time consuming and costly and will give great insights in the current maturity levels. In addition, the Type I assurance report (i.e., design and implementation of controls) can be used as a guideline to improve and extend the current measures to finally comply with the CSRD rules. We expect that the European Commission will demand a reasonable assurance report as of 2026. Currently, the European Commission is assessing which Audit standard will be used as the reporting guideline.

Specific requirement for the asset management sector

In 2023 the European Sustainability Reporting Standards (ESRS) will be published in draft by the European Financial Reporting Advisory Group (hereinafter: “EFRAG”) Project Task Force for the sectors Coal and Mining, Oil and Gas, Listed Small Medium Enterprises, Agriculture, Farming and Fishing, and Road Transport ([KPMG23]). The classification of the different sectors is based on the European Classification of Economic Activities. The sector-specific standards for financial institutions, which will be applicable for asset managers, are expected to be released in 2024, although the European Central Bank and the European Banking Authority both argue that the specific standards for financial institutions is a matter of top priority due to the driving force of the sector regarding the transition of the other sectors to a sustainable economy ([ICAE23]). We therefore propose that financial institutions start analyzing the mandatory and voluntary CSRD reporting requirements and determine – based on a gap-analysis – which information they already have versus what is missing and start working on that.

Reporting on internal controls

European ESG regulation focusses on ESG information in external reporting. However, no formal requirements are set (yet) regarding the ESG information and data processes itself. In order to achieve high-quality external reporting, control over internal processes is required. Furthermore, asset managers are also responsible for the processes performed by third parties, e.g., the data input received from third parties. It is therefore important for an asset manager to gain insight in the level of maturity of the controls on these processes as well.

Controls should cover the main risk of an asset manager that can be categorized a follows:

- Inaccurate data

- Incomplete data

- Fraud (greenwashing)

- Subjective/inaccurate information

- Different/unaligned definitions for KPIs

In order to comply with the regulations outlined in Figure 1, it is recommended to include the full scope of ESG processes in the current SOC reports of asset managers. Originally, the SOC report is designed for providing assurance on processes related to financial reporting over historical data. In our current society, we observe that more and more attention is paid to non-financial processes. We see that the users of the SOC reports are also requesting and requiring assurance over more and more non-financial reporting processes. We observe that some asset managers are including processes such as Compliance (more relevant for ISAE3000A), Complaints and ESG in their SOC reports. KPMG performed a benchmark on which processes are currently included in the SOC reports of asset managers. We will discuss the results in the next paragraph.

Benchmark

By comparing 12 asset management SOC reports for 2022, KPMG observed that 6 out of 12 asset managers are including ESG in their system descriptions (description of the organization), and 7 out of 12 asset managers have implemented some ESG controls in the following processes:

- Trade restrictions (7 out of 12 asset managers)

- Voting policy (4 out of 12 asset managers)

- Explicit control on external managers (4 out of 12 asset managers)

- Emission goals / ESG scores (1 out of 12 asset managers)

- Outsourcing (0 out of 12 asset managers)

We observe that reporting is currently mostly related to governance components. There is little to no reporting on environmental and social components. In addition, we observe that none of the twelve asset managers report on or mention third party ESG data in their SOC reports.

We conclude that ESG information is not (yet) structurally included in the assurance reports. This does not mean that ESG processes are not controlled; companies can have internal controls in place that are not part of a SOC report. In our discussion with users of the assurance reports (e.g. pension funds) we get feedback that external reporting on ESG related controls is perceived as valuable given the importance of sustainable investing and upcoming (EU) regulations. Based on our combined insight from both ESG Assurance and advisory perspective we will share our vision on how to report on ESG in the next paragraph.

Conclusion and future outlook

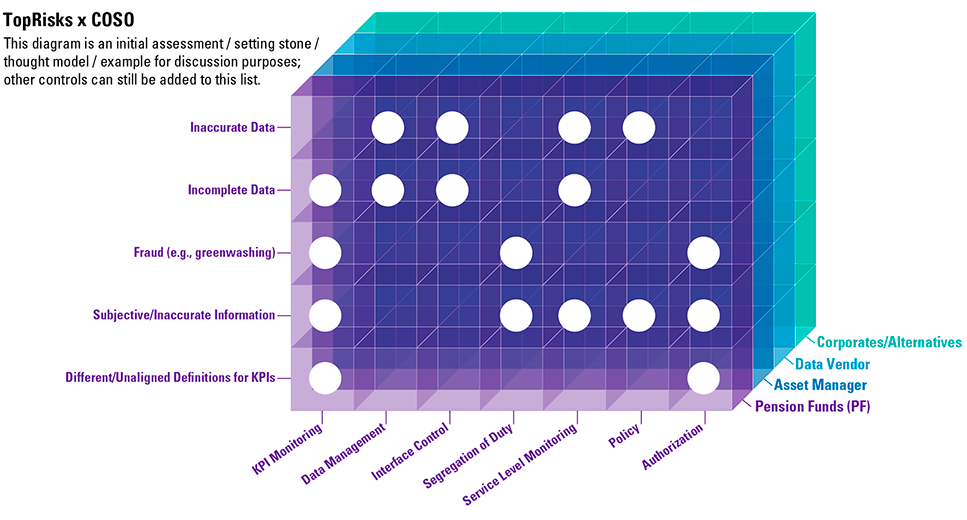

In this article we conclude that only 7 out of 12 asset managers are currently reporting on ESG-related controls in their SOC reports, and still on a limited scope and scale. This is not in line with the risks and opportunities associated with ESG data and not in line with active and upcoming laws and regulations. We therefore recommend that asset managers enhance control on ESG by:

- implementing ESG controls as part of internal control framework (internal reporting);

- implementing ESG controls as part of their SOC framework (external reporting);

- assessing and analyzing with your external (data) service providers and relevant third parties regarding missing controls on ESG.

The design of a proper ESG control framework first starts with a risk assessment and the identification of opportunities. Secondly, policies, procedures and controls should be put in place to cover the identified material risks. These risks need to be mitigated in the entire chain, which means that transparency within the chain and frequent contact among the stakeholders is required. The COSO model (commonly used within the financial sector) could be used as a starting point for a first risk assessment, where we identify inaccurate data, incomplete data, fraud, inaccurate information and unaligned definition of KPIs as key risks. Lastly, the risks and controls should be incorporated within the organizational annual risk cycle, to ensure quality, relevancy, and completeness. Please refer to Figure 2 as an example.

Figure 2. Example: top risks x COSO x stakeholder data chain [Click on the image for a larger image]

References

[EC23] European Commission (2023, January 23). EU taxonomy for sustainable activities. Retrieved from: https://finance.ec.europa.eu/sustainable-finance/tools-and-standards/eu-taxonomy-sustainable-activities_en

[ICAE23] [ICAE23] ICAEW Insights (2023, May 3). ECB urges priority introduction of ESRS for financial sector. Retrieved from: https://www.icaew.com/insights/viewpoints-on-the-news/2023/mar-2023/ecb-urges-priority-introduction-of-esrs-for-financial-sector

[KPMG23] KPMG (2023, April). Get ready for the Corporate Sustainability Reporting Directive. Retrieved from: https://assets.kpmg.com/content/dam/kpmg/nl/pdf/2023/services/faq-csrd-2023.pdf