After the financial crisis, another phenomenon is now on the brink of blotting the financial service landscape: fintech (financial technology). Fueled by struggling traditional players and changing client demands, fintech start-ups are growing exponentially in size and number. This makes it relevant to specify and analyze the current fintech domain. What is actually meant by fintech, and what drives its growth? Who are the most relevant players, and do they pose a serious threat to existing financial service paradigms?

Introduction

Developments in fintech are bringing both opportunities and threats to established financial services. After spending time purely surviving the crisis, innovation is now high on the corporate agenda. Financial technology is one of the hottest sectors in the world’s financial realm. In terms of funding, fintech start-ups are evolving twice as rapidly as similar companies in Silicon Valley. Banks and insurers are no longer placing their bets on large-scale homegrown IT projects but are increasingly looking to external financial technology providers. Fintech start-ups are on the rise and are changing the way in which people save, borrow, send money abroad and pay for things. As large banks round up millions committed to fintech, this world is moving faster than ever before.

This article explains the concept of fintech, elaborates on factors that contribute to the sudden upsurge of fintech, introduces a categorization as well as examples of fintech companies, and closes with a short overview and remarks on the impact for banks.

What is fintech, why is it relevant?

The post-financial crisis world is a different one, while many financial service firms have remained the same. Financial service firms still operate as they operated prior to the crisis – merely doing so in fewer markets and with progressively fewer people in order to drive down costs. Digitization has increasingly enabled the financial service industry to introduce self-service solutions, such as ATMs that have replaced tellers, websites instead of call centers, and dedicated apps to offer customers a mobile experience for the most important website features. Under the label of ‘customer empowerment’, financial institutions have been able to make considerable cost savings. As regulators leaned heavily on the financial sector, the incumbents had to focus on capital efficiency, returns and suitability. Driven by capital constraint, stringent liquidity ratios and regulatory changes, banks came under heavy fire. These developments caused financial service providers to look inward, focusing on internal restructuring activities instead of prioritizing the needs and wants of the customer.

Meanwhile, the expectations of the customer have changed radically. With trust and loyalty for financial institutions at a bare minimum, customers are open to new ideas and seek services that connect to their daily needs. We are now facing a customer base that expects convenient, innovative, real-time services that enable them to bank and spend money when and how they want. Consumers expect their service providers to follow suit or are happy to jump on the bandwagon of new products and services.

The gap between changed expectations and traditional services provides ample opportunity for fintech players to develop new products and services. The word ‘fintech’ has been borrowed from ‘Finance’ and ‘Technology’, and is used to describe technology-driven solutions that now flood the market. This article focuses on emergent fintech companies (small, innovative firms using new technology), entering the financial services sector, a segment that can be divided into:

- those that use new technology to bring financial services directly to consumers – thereby competing with or even disrupting traditional financial services. Examples of start-ups in this segment are peer-to-peer lending platforms that compete with banks for SME lending.

- those that use new technology to strengthen or optimize the enterprise market – including banks, hedge funds and other financial service businesses. The start-ups in this space allow financial services to digitize their products and services and thus create new possibilities for their clients. Here we also find solutions that focus on improving processes and the back office of financial service firms. For example, new techniques on visualization and data analytics are used to improve the client view and data availability, leading to more efficiency and effectiveness within the financial service domain.

Before we provide examples of companies in both these categories, it is important to shed more light on the fintech domain and playing field.

The rise of fintech

The sheer amount of money involved in financial services is just one of the reasons why the tech world has taken an interest in that domain. Banking is also a possible field of disruption, as companies typically possess legacy technology and have not yet found efficient ways to deliver relatively simple services. In this context, the mortgage lending start-up Lenda (which recently raised $1.54 million) provides a perfect example of disruption. This company closes refinance loans three times faster than the industry average – 21 versus 64 days and is striving to bring it down to 7 days.

Most fintech start-ups differ from their web/mobile-only counterparts, as the founders often have a background in the financial service industry. They have the experience and network to bring the innovation to market. In the post-crisis era, many employees in financial services – suffering from low morale – exchanged their pinstripe suits for hoodies as they abandoned their careers in investment or retail banking to jump into the uncertain world of a start-up. Last year’s bonuses provided the stepping stone to building a company and raising a round of funding. The excitement of working for an early-stage company, the flexibility, the high level of responsibility and limited hierarchy remain very attractive. In fact, in the latest City Job Satisfaction Survey (Financial News), almost 65 percent of investment bankers with 11 to 20 years’ experience said they were reconsidering their future in the industry.

Next to the inflow of talent and expertise, the accessibility to new technology has also fueled the fire: developments such as Peer2Peer networking, cloud computing, data & analytics, mobile and digital payments serve as an accelerator for new products and services. In the words of Lean Start-up author Eric Ries: “Anyone with a credit card can rent the means of production and compete with you on a first class basis…” It has never been so cheap to bring an idea to market.

Financial services firms have spurred the trend and have setup dedicated fintech funds (to name a few: $250 million Apos Capital, $100 million Santander Bank, $200 million HSBC Bank; $100 million Sber Bank). Investors seem trigger-happy as valuations are at an all-time high. Between 2010 and 2013, fintech deal activity grew by 61 percent (CB Insights). The first quarter of 2014 was the most active on record with $1.7 billion worldwide.

Fintech playing field

Silicon Valley, unsurprisingly, is a strong market for fintech companies that focus directly on the consumer, thereby disrupting traditional services. While the Valley leads the way in terms of total fintech investments ($376 million in the first quarter of 2014), New York follows suit with a rapidly growing ecosystem of innovative start-ups. The New York fintech base is mainly focused on enterprise applications, thereby bringing innovation directly towards established companies in financial services. Although developing and selling an enterprise solution requires a long runway, we see that financial companies are increasingly looking to buy or partner with start-ups (take the emergence of large corporate funds as an example). Gartner estimates that banking and securities institutions will invest $486 billion in IT in 2014 alone.

In Europe, London is the central hub for fintech start-ups and investments alike. London now has four start-up accelerators (structured programs to accelerate the growth of start-ups) focusing solely on fintech: Barclay’s accelerator, the Fintech innovation lab, Level 39 and Start-up Bootcamp. Level 39 is housed on the 39th floor of the One Canada Square building, right in the heart of Canary Wharf, and recently had to expand to level 42 to accommodate the growing number of ventures. The Start-up bootcamp accelerator was announced back in February 2014, supported by big names such as Lloyds, Rabobank and Mastercard.

But fintech is also booming in other European countries. A recent study on fintech companies in Germany, Switzerland and Austria showed that, as a start-up hotspot, the Berlin cluster came out on top, with clusters around financial centers such as Frankfurt, Munich and Zurich following close behind. In the Netherlands, we notice rising interest in fintech as new players (such as Holland Fintech) strive to bridge the gap between start-ups, investors and financial institutions. The Netherlands accommodates three companies appraised in the Fintech 50 (guide to some of the game-changing technologies in Europe): AcceptEmail, Five Degrees and Synerscope.

Dutch Fintech Hackathon

The first Dutch Fintech Hackathon took place on 6 and 7 July. The Hackathon was organized by Rabobank, UtrechtInc, Ordina, Economic Board of Utrecht and TNO. Fifteen teams were challenged to develop a technical solution for “Next Generation Financing” within 48 hours. Teams were able to use APIs of Openbank project, PostNL, OAuth.io, LiquiDYodlee, MyOrder and Paypal. The winner, Paygel, developed a service for easy, fast and secure online payments. The online shopping may just be on a laptop or tablet, while payment is made with Paygel on the mobile device. The customer can execute the payment more easily and quickly because his information is already known in the app. Fritz won the Audience Award with development of an app that allows parents to approve online purchases or payments made by their children.

Source: http://dutchfintechhackathon.nl/

Typology of fintech companies

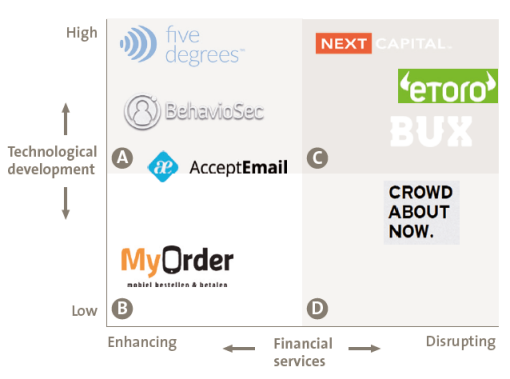

Figure 1 displays a few interesting fintech players and their potential impact on financial services. The model accounts for players that bring their technology directly to consumers (and thereby directly take on financial services) and players that strengthen existing financial service firms. The vertical axis represents the technological development of the solution. Solutions that are technologically advanced face less direct competition and have larger capital requirements to develop their products and services (such as back and mid-office banking software). Solutions with a lower degree of technical development find themselves in a more crowded space (e.g., crowdfunding platforms). We present international as well as Dutch examples in each quadrant, all selected from public lists of top fintech companies.

Figure 1. Examples of fintech companies and their potential impact on financial services.

Quadrant A

Organizations in this quadrant are fintech companies with the ability to support and reinforce conventional FS models. High in technological development, these companies have the necessary maturity level for rapid market penetration.

Five Degrees

The Five Degrees value proposition is called “Matrix”, the company builds the bank in a box (the bank in the cloud). The company builds on the intellectual property of the IT platform of the Icesave bank – a platform that proved to be highly scalable. Matrix is designed to be a fully automated service hub supporting any segment, product or channel, leveraging activity and dialogue in the front office, agility in the mid-office and administration in the back office. AEGON bank KNAB and Credit Agricole Consumer Finance are examples of current clients.

http://www.fivedegrees.nl/

BehavioSec

BehavioSec uses human behavioral patterns to protect online banking environments as well as mobile applications. BehavioSec is able to determine misuse of (mobile) applications by monitoring keystrokes, gestures and mouse movements in real-time. Human behavioral characteristics are analyzed, measured and then used for verification purposes. Within many financial services providers, token-based products (such as passwords and smart cards) are the primary method of information security. However, these can still be lost, duplicated or stolen. An individual’s movement is extremely hard to replicate, making it an effective solution against identity theft.

Danskebank recently performed a pilot with the BehavioWeb product, which was able to effectively distinguish between the correct user and imposters with stolen credentials in 99.7 percent of cases.

http://www.behaviosec.com/

Quadrant B

This quadrant shows fintech companies that enable traditional financial services with a relatively low technological maturity level. In this lower end of the technology axis, there is more competition between concepts.

AcceptEmail

AcceptEmail provides smart billing solutions that replace paper bills. It enables the consumer to pay bills directly via online banking, PayPal or credit card, straight from the e-mailbox. The company combines the billing technology with the intelligence of e-mail marketing and gives billers much more insight and a cost saver. Clients include Allsecur, T-mobile, Reaal and Otto.

http://www.acceptemail.com/

MyOrder (Rabo)

MyOrder simplifies the payment process, providing benefits for the companies and entrepreneurs that have adopted the application as well as realizing advantages for their clients. Payments are performed through your mobile device using only a simple swipe on your screen. End-users making these payments can place orders and pay bills themselves, without the help of a waiter or salesperson.

https://www.myorder.nl/

Quadrant C

These companies have the potential to upset or compete with current financial service models. With revolutionary innovation and a high level of technological development, these companies are perceived as having the ability to disrupt traditional models.

Bux

Bux offers (mobile) trading and is focused on the consumer market. The customers trade with CFDs – products that mimic company stock behavior, thereby avoiding higher costs associated with regular stock trading. The product is reinforced with gamification elements such as battles for the ROI.

http://getbux.com/

Etoro

Etoro is the largest social trading platform, empowering over 2.75 million users in 140 countries. On the Etoro platform every user has an open portfolio – displaying gains or losses over a period in time. The unique element of Etoro is the ability to ‘copy trade’, essentially following the trade behavior of a particular user. Top traders can be followed in much the same way as tracking status updates on Facebook, turning these performers into market experts for individual investors. The investment moves of these top performers can even be copied, making stock trading accessible and attractive to even the most inexperienced of users.

http://www.etoro.com/

NextCapital Group

NextCapital builds digital portfolio management and advice delivery tools that have the potential to reshape the defined contribution (DC) retirement plan industry. The company is leveraging $6 million in new venture capital funding to continue development on automated portfolio management technologies that will disrupt the traditional target-date funds (TDF).

http://nextcapitalgroup.com/

Quadrant D

Fintech companies in this quadrant are known for their groundbreaking ideas. Low on technological development, it remains unclear what the practical implications and impact on existing paradigms will be.

CrowdAboutNow

Crowdfunding is developing into a serious option to raise a limited amount of capital. CrowdAboutNow is one of the largest players on the Dutch market and works in close alignment with Dutch regulators. The company strives to connect inspiring ideas and entrepreneurs with as many people as possible. The funding targets for these projects range from 3,000 to 500,000 euros, with an average ROI of 5.3 percent annually. With AFM certification, CrowdAboutNow complies with the relevant legislation, ensuring safe and reliable investment opportunities.

https://www.crowdaboutnow.nl/voorpagina/

After the rise of fintech

Fintech is a trending topic and company valuations are surging to an all-time high. The blue ocean for innovation in financial services is rapidly turning into a red overcrowded space as start-ups stack up products like bricks in a wall. From an investor perspective, we can observe that most companies will not bring their innovation to the market successfully. Factors that play a role are:

- Lack of scale due to high competition and consolidation of similar initiatives

- New or changing regulations impacting the business model, which will attract parties that want to benefit from such changes

- New technology that makes existing fintech companies obsolete; think of Apple Pay that single-handedly killed the business model of several start-ups even before the go-live date.

Let’s take a look at two banking domains that illustrate these factors. Crowdfunding and all comparable peer-to-peer platforms have shown an increase over the last few years, hereby competing with and partly disrupting the lending domain of banks. The volume of crowdfunding projects has increased in the past few years, showing it has become serious business. As the total volume increases we also see the first platforms closing because they have not been able to distinguish themselves and find sufficient investors and/or lenders. It is expected that further consolidation will take place per country but also internationally.

Payments are another domain on which fintech companies are currently focusing. This domain has the highest volume of client transaction, and has proven to be an important force in driving clients toward internet and mobile banking. Optimizing the payment experience for customers is a very visible field of activity, and has attracted the attention of retail and e-commerce companies alike. In addition to new technologies, new regulations are an important driver of change, with the Payment Service Directive 2, for example, as a case in point. In the concept of access to the accounts, the role of third-party providers, in particular, offers potential for new business ideas based on overlay services and e-wallets. The list of potential winners is long.

Do these factors have a negative impact on the outlook of fintech companies? Predicting the future is always difficult, though two statements probably make sense. First, it can be expected that, somewhere within 2 to 5 years, the availability of capital for new start-ups within the financial services domain will decrease as other markets offer greater opportunities. On the other hand, fintech’s ability to improve or even disrupt the banking sector is impressive and will certainly impact the financial sector. Next to start-ups that excel in one area of the finance value chain (e.g., loans, international transfer, stock trading), we expect the rise of greenfield fintech banks. A recent example is Number 26 – a Berlin-based bank that markets itself as the fintech bank. This company binds several fintech concepts together to create a very competitive and complete package. Another German Bank, Fidor Bank, is already active and growing rapidly, merely by using the same philosophy. And in the footsteps of KNAB, a new bank is on the horizon in the Netherlands: Bunq Bank, though its products are still uncertain. As in any investment boom, we will see a small number of winners, consolidations among minor players, and new technology replacing the old.

Closing remarks

In this article, we have attempted to provide an overview of the current fintech playing field. While observing some general developments, fintech remains a topic containing a highly fragmented number of subjects and developments. The rapid expansion of companies under the fintech label, combined with its dynamic character, make fintech hip and happening.

Taking a step back and looking at fintech’s current impact on the financial services sector, some interesting observations can be made:

- Innovation is imperative: although the banking sector has always been known for de-prioritizing its innovation agenda, which was already established practice before the financial crisis. During the crisis, all focus on innovation was lost, while new technological developments were reaching the necessary maturity level to attain efficiency improvements. The banks’ lack of attention to innovation provided ample space for outsiders to flourish, increasing the threat of disruptive models to traditional banking.

- Banks are now desperately trying to keep up. The size, fragmentation, speed of innovative developments and fast market entries are forcing banks to collaborate with third parties. This trend is forcing banks into a cultural shift, urging them to open up their business models to innovation, and changing their infrastructure accordingly.

- When finance meets technology, it fuels the fire. Fintech companies are growing faster than any other technology-driven segment, and banks are quick to round up serious corporate venture funds.

References

KPMG, Funding and Exit Strategies Event, London, July 17, 2014.

http://blog.kpmg.nl/fintech-speed-money-touch-disruption/

http://dutchfintechhackathon.nl/

https://www.crowdaboutnow.nl/voorpagina/

http://www.slideshare.net/SamarthShekhar/fin-techforum-dachstudy201402?related=2