Ten years ago, the first BigTechs started to compete in the European payment market by leveraging their already established large customer base, state-of-the art technology, data processing capabilities, extensive marketing funds and brand recognition. The consequences of BigTechs entering the European payment market is a topic which is increasingly addressed by researchers and regulators. Nevertheless, the question remains what the influence of the entrance of BigTechs to the European payment market will be and how BigTechs will change or limit the role of the incumbents. For this reason, this article will build further upon existing research by investigating the following research question: What are the direct and indirect influences of BigTechs providing payment services on the European payment market?

Introduction

Traditionally, there are few service providers on the payment market (primarily the major banks, credit card companies and (electronic) payment institutions). Due to regulatory and technology forces, BigTechs are entering the European payment market. This article defines BigTechs as large technology companies with extensive established customer networks, dominant in their respective industries (ecommerce, social media, payments, etc.).

In 2007, Payment Services Directive 1 was introduced to make the European payment market more competitive by allowing parties other than banks to provide payment services. Three years later, Amazon was the first BigTech to enter the European payment market by obtaining an E-Money license in Luxembourg. In 2015, the revised Payments Services Directive 2 (PSD2) was announced to come into force within the next years. In 2018 with the go-live of PSD2, the European Economic Area (EEA) payment market (hereafter, European Payment Market) entrance, barriers to non-banks were lowered even further by introducing innovative services that enable licensed non-banks to leverage existing bank infrastructures to access client information (account information services) or to initiate payments.

After the PSD2 announcement, other BigTechs such as Alipay, Facebook and Google entered the fray by obtaining their own respective E-Money licenses. The E-Money license enables BigTechs to provide E-Money services as well as payment services in the EEA. BigTechs entering the payment market did not come as a surprise. In a market that is known for legacy systems, BigTechs saw an opportunity to compete with incumbents by offering the ease and speed in payment services that in an age of instant gratification was demanded by both customers and businesses. Furthermore, BigTechs could leverage their already established large customer base, state-of-the art technology, data processing capabilities, extensive marketing funds and brand recognition to enter the European payment market. This also applies for other financial services, as described by the Bank for International Settlements: “Building on the advantages of the reinforcing nature of the data-network-activities loop, some BigTechs have ventured into financial services, including payments, money management, insurance and lending. As yet, financial services are only a small part of their business globally. But given their size and customer reach, BigTech’s entry into finance has the potential to spark rapid change in the industry” ([BIS19]).

There are however differences in the approach that each BigTechs is taking to develop and provide payment services in Europe. For example, Apple is developing new payment capabilities through partnerships with incumbents of the Financial Sector (i.e. Apple Wallet, Apple Credit Card), whereas Facebook is developing their own digital currency. BigTechs also differ from each other in the roles they take in the Payments ecosystem. Some function as intermediaries between clients and suppliers to facilitate payments on their platform, while others issue electronic money directly to clients. In the future, BigTechs might choose to provide PSD2 enabled services (payment initiation services and/or account information services) by accessing the client’s bank’s back-office, given the client provides consent.

The consequences of BigTechs entering the European payment market will be increasingly addressed by regulators. For example, the Dutch Authority for Consumers & Markets (ACM) has recently started to conduct a market study into the activities of large tech companies in the Dutch payment market. With the investigation into Google and Apple, among others, the regulator hopes to unravel the potential consequences this will have for consumers and companies ([Rode19]). What the influence of the entrance of BigTechs to the European payment market will be and how BigTechs will change or limit the role of the incumbents remains to be seen. For this reason, this article will further build upon existing research by investigating the following research question:

What are the direct and indirect influences of BigTechs providing payment services on the European payment Market?

In order to be able to answer the research question, seven BigTechs that have entered the European payment market (obtained a European payment license or entered in partnerships with already licensed parties) and BigTechs that could enter the European Payment market in the future are analyzed against the following:

- Target market, defined as geographical locations in which BigTech currently provides payment services – including electronic money services – and their presence of payment services in the EEA.

- Payment capabilities, defined as the extent to which BigTech is able to provide payment services and to what extent BigTech is licensed to provide payment services in the EEA.

- Competitive advantages, defined as the differentiating factors to which BigTech has an advantage over other BigTechs providing payment services in the EEA. The differentiating factors are current service/product offering in the EEA market and existing client base.

The following BigTechs have been selected for this research: (1) Alipay, (2) Alphabet, (3) Amazon, (4) Apple, (5) Facebook, (6) Tencent and (7) Microsoft. The selection is based on the diversity of each BigTech with regard to its home market, payment capabilities, competitive advantages and their potential to expand their financial services in the EEA.

This article is structured as follows: We will first provide a history of BigTechs entering the European Payment market. Next, we will provide an overview of when BigTechs obtained payment licenses in the European payment market, and then give an in-depth analysis of seven BigTechs by analyzing their present and future potential to disrupt the European payment market. We will also explore the indirect influences of BigTechs on the European Payment market. One example is the trend towards consolidation of financial services on (social) platforms. We will specifically focus on China, where WeChat started integrated payment services into its social platform. We will then illustrate possible ways for incumbents in the payment market to respond to BigTechs. Finally, the conclusion will provide an answer to the main question of this article:

What are the direct and indirect influences of BigTechs providing payment services on the European payment market?

BigTechs payment licenses in Europe

PayPal was the first pioneering BigTech to enter the European payment market in 2007; Amazon was soon to join in 2010. Noticeable is the fact that from 2018 onward, a tipping point was reached. With three of the biggest e-commerce platforms already licensed in the European market, it became unavoidable from a competition perspective for other large platforms to join. Most BigTechs chose an Electronic Money (E-Money) license. Unlike payment institutions, E-Money institutions are entitled to issue electronic money and are therefore allowed to store client funds for a longer period of time. Directive 2009/110/EC established a legal basis for E-Money issuing in the European payment market. Electronic money represents a monetary value that is stored electronically or magnetically. An electronic money institution stores the monetary value in a central accounting system (the enterprise’s server), or it may be stored on an electronic carrier like a chip. This monetary value can then be used to make payments at other parties than the one that issued the electronic money.

Examples of electronic money include plastic gift vouchers that can be used to pay in shops and webshops ([DNB20]). Electronic money institutions are licensed to issue electronic money. Under PSD2, licensed (E-Money) payment institutions are allowed to passport their payment services to other European member states. Through passporting, BigTechs licensed in one European member state, can explore business opportunities in other European countries.

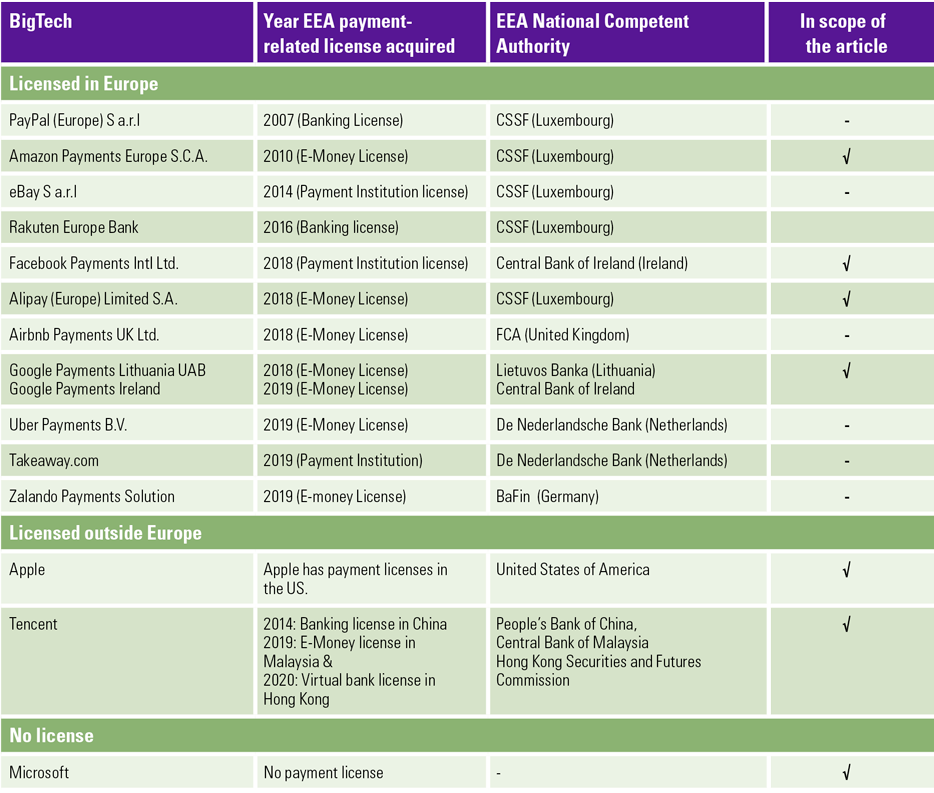

Table 1 provides an overview of BigTechs with a payment license in Europe and BigTechs which could provide payment service in Europe in the future.

Table 1. BigTech licenses for payment subsidiaries in the EEA derived from the EBA register of payment and electronic money institutions under PSD2 ([EBA20]). [Click on the image for a larger image]

Direct influence of BigTechs entering the European payment market

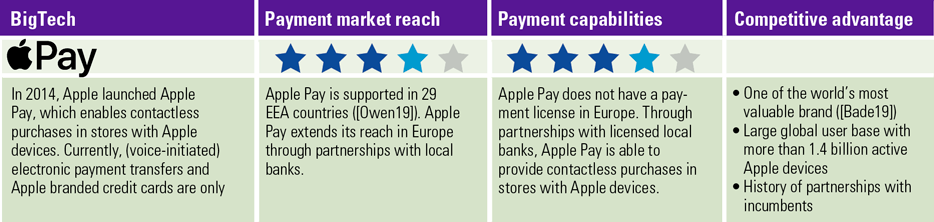

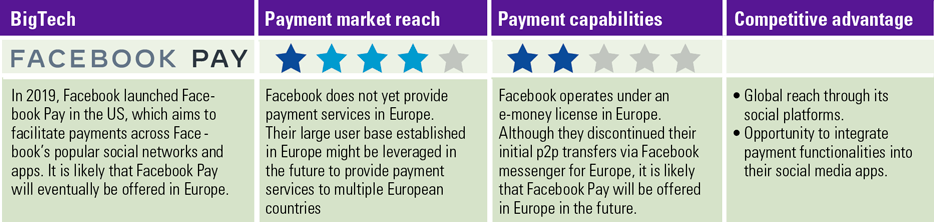

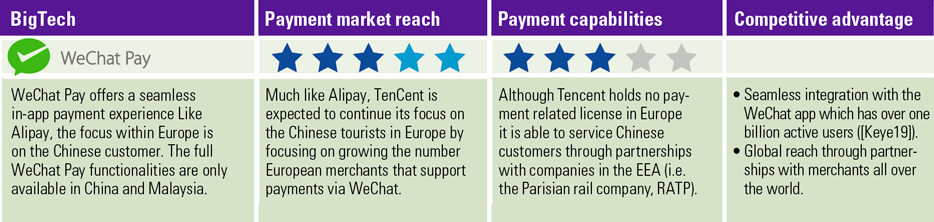

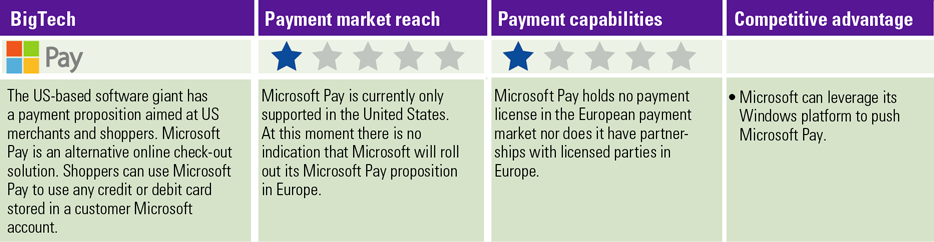

The entrance of BigTechs in payment services has influenced the European payment market and society as a whole. In this section, we analyze the payment propositions of Alphabet, Alipay, Amazon, Apple, Facebook, Tencent and Microsoft. For each BigTech, the target market, payment capabilities and competitive advantages will be detailed below.

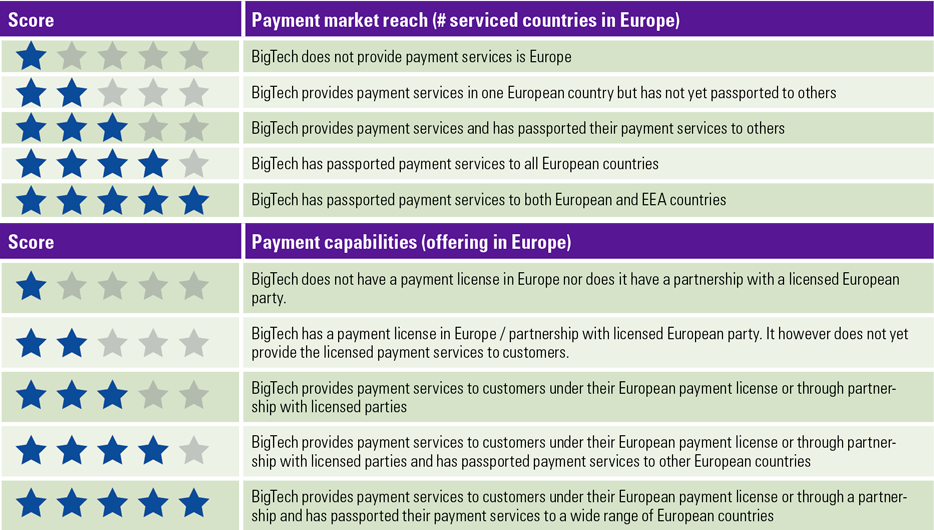

In order to visualize the reach of payment services and payment capabilities in Europe, we displayed each BigTech using a “Harvey balls” graph. The first part of Table 2 provides a description of the different possibilities for both payment services reach and payment capabilities in Europe.

For each BigTech, payment market reach, payment capabilities and competitive advantages have been scored on a range of one to five stars. The second part of Table 2 describes how BigTechs are rated on the payment market reach and payment capabilities. The light blue stars in the BigTech table indicate the future potential regarding payment market reach and payment capabilities in Europe.

Table 2. BigTech payment market reach, payment capabilities and competitive advantages. [Click on the image for a larger image]

Table 2 (continued). BigTech payment market reach, payment capabilities and competitive advantages. [Click on the image for a larger image]

Indirect influence of BigTechs entering the European payment market

As described in the previous section, BigTech has a direct and indirect influence on the payment market and the financial sector as a whole. The indirect influence relates to the bar these new product/services set in terms of pricing, quality and user interface for other more traditional services and products. This also applies to the financial sector in general and the provisioning of payment services.

Changing consumer behavior

Customers are used to services offered by BigTechs and expect a similar user experience for all services they consume. The customer expects similar functionalities and quality as well as innovative products and services in the financial sector. This includes real-time insights that are easily accessible 24/7. The consumer needs of today, and those of the future, need to be addressed by payment service providers, since the consumer will demand a service that is easy to use, smart and secure ([KPMG18]). BigTech and FinTech companies are able to operate leaner business models and deploy state-of-the-art technologies since they have no legacy systems. The products and services of BigTech are changing customer expectations and force incumbents to react and innovate to be able to live up to the new expectations of customers. In order to find these services that meet its demands, the customer seeks growing advice from peers, is willing to adopt new technology and is less loyal and willing to cherry-pick.

Data-driven business models

An important driver for BigTech companies to enter the financial services industry is the potential access to new sources of data ([FSB19]). By offering payments services, insight is gained into the financial situation and spending habits of the customer. This data can be of such value that the main business case can be built around it. Hence, a payment service can be offered for free to the customer while the money is made on data exploitation activities (i.e. target advertising) ([Klei19]). This type of revenue model is new for banks and other financial institutions but is the essence of business models of free services of BigTech companies (i.e. Facebook, Gmail). BigTech companies have the capability to leverage on the collected data, since they have the analytical tools required to be able to process and interpret data ([Mano18]). This enables them to anticipate their customers’ needs and impact their conduct. With the obtained data, BigTech companies can offer better targeted payments products, reach consumers that may not be served otherwise, and leverage customer relationships ([Mano18], [Dono18]). Data-driven business models may make payment services more accessible for a wider public, although they also raise privacy concerns. For example, the recent report of the Official Monetary and Financial Institutions Forum ([OMFI20]) on global public confidence in monetary, financial and payment institution, suggests that BigTech companies are the least trusted party to perform the role of digital currency provider.

BigTech companies may utilize their platforms to offer financial services, directly as a service provider or indirectly as an intermediary. They are able to add payment services and other financial services to their service offering to leverage their existing customer base ([Mano18]). By bundling services, BigTech companies can create a super app/platform in which the borders between financial services and other services disappear (e.g. the social platform WeChat). The incumbents of the financial service industry are unable to replicate those bundles of services and therefore cannot offer this level of integration between different types of services. BigTech companies can leverage their role as intermediary since they control the platform through which financial service providers can be offered directly or indirectly. Moody’s ([Dono18]) expects that banks will lose a portion of their distribution of retail financial services to BigTech companies.

Looking forward

The described developments regarding changing consumer behavior, the introduction of data-driven business models and the platformization of financial services are expected to continue to change the European payments sector in the future. The ongoing digitalization of the financial services and society as a whole is a key driver for these developments. European regulations are also enforcing these developments. European regulations such as PSD2 are created to open up the financial sector to the innovations of FinTechs. For example, PSD2 enables the offering of Account Information Services, which is a data-driven proposition. Account Information Services offer licensed entities with explicit consent of the account holder, the opportunity to get access to, collect and consolidate payment account information (transaction data) from (multiple) banks or other payment service providers. New European regulations (potentially a PSD3) might open up the European payment market in the future, or alternatively, impose more restrictions on parties such as BigTechs that want to compete in this market in order to limit their control over the data of the customer.

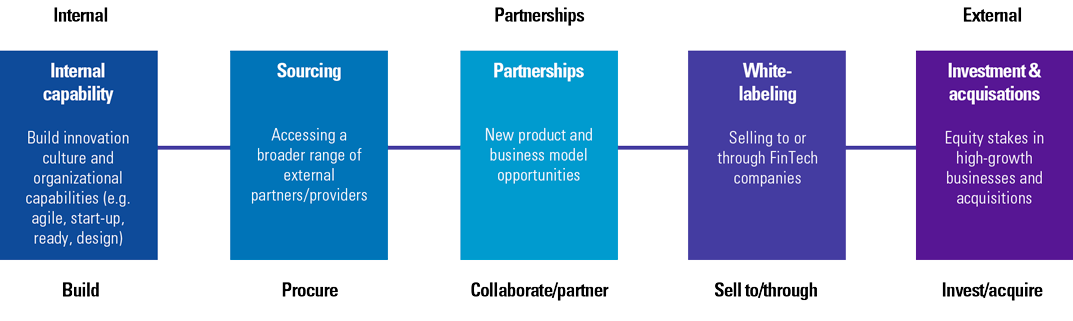

Ways for incumbents to respond to the EU Payment market

Through the entrance of BigTech into the payment market and the financial sector as a whole, and the indirect influence of BigTech, incumbents are forced to respond in order to remain competitive. In general, there are five ways in which incumbent financial institutions are responding to innovations that are initiated by FinTech and BigTech companies (see Figure 1).

Figure 1. How existing players are responding. [Click on the image for a larger image]

In order to remain relevant, incumbents of the financial sector are reconsidering their role in the value chain:

- The largest Institutions may aim to become an intermediary (platform) in order to compete with the BigTech platforms. This scenario requires the financial institution to open up to FinTech companies or other smaller financial institutions and act as an intermediary (Sourcing) ([FSB19]). Payment service providers may extend their services by offering services from third parties through their channels. They could for example source an existing Account Information Services solution from a third party.

- Financial institutions may connect to large platforms of either large incumbents or Big Techs and are likely to focus on a specific niche rather than to play the platform role themselves. In this scenario the financial institutions specialize in a specific product or service and offers the product or service through an intermediary (Whitelabeling) ([FSB19]). Payment Service providers could make their payment infrastructure available to third parties and let the third party connect its customer-facing application to the infrastructure (i.e. Apple Pay).

- Financial institutions, regardless of their size, can choose to enter into a partnership with BigTechs in which the banks provides access to the Financial services industry and its related infrastructure, the Banking as a Service (BaaS) proposition (i.e. Apple has an partnership with Goldman Sachs through which it is able to offer the Apple credit card) (Partnership) ([FSB19]).

Conclusion

BigTech is directly and indirectly changing the European payment market and Incumbents are forced to respond in order to remain competitive. The rapid rise of Tencent and Alipay as market leaders in the mobile payment market of China underline that. Although the starting point in China was different, the direct and indirect influence of BigTech on the EEA payment market is also substantial. Facebook could potentially follow the example of WeChat in China by disrupting the EEA payment market by rolling out payment propositions through its social platforms and is well positioned to do this through its EEA payment license. As discussed, Apple chose a different route by leveraging the existing infrastructure of incumbents through its Apple credit card and Apple Pay. The latter, for example, has boosted the adaptation of mobile payments in the Netherlands.

None of the BigTech payment propositions have been rolled out in its full potential within the European payment market. In case this full potential is reached and BigTechs become major players in the European payment sector, several scenarios could develop. For example, BigTechs actively competing in the European Payment market could introduce a new set of innovative services offered both by BigTechs and the Incumbents to remain competitive, ultimately benefiting (corporate) clients.

The response of the incumbents in the European payment market will likely differ, depending on the services that they offer and their relative size. The largest institutions may aim to act as intermediaries for other financial companies (e.g. FinTechs). Small and medium-sized financial institutions may, in turn, connect to the open banking platforms either managed by large incumbents or BigTechs in order to focus on a specific niche. Financial institutions, regardless of their size, can choose to enter into a partnership with BigTechs to offer a Banking as a Service (BaaS) proposition (i.e. Apple’s collaboration with Goldman Sachs through which it is able to offer the Apple credit card).

Finally, the influences of BigTechs entering the European payment market and the way incumbents will respond will become clear in the coming years.

Appendix: Detailed BigTech analyses

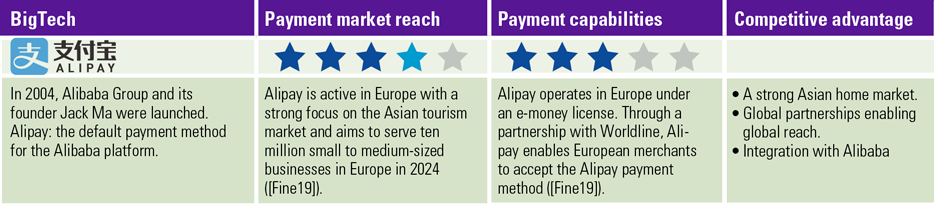

Alipay

Alipay is the payment branch of Alibaba’s FinTech company Ant Financial. Alipay is the default payment method for the Alibaba platform and has partnerships with restaurants and retail chains all over the world.

A. Target market

Alipay is active in Europe with a strong focus on the Asian tourism market and aims to serve ten million small to medium-sized businesses in Europe in 2024 ([Fine19]).

B. Payment capabilities

Alipay operates in Europe under an E-Money license which was issued in Luxembourg ([CSSF18]). Through a partnership with Worldline, which was announced in November 2019, Alipay’s Asian e-wallet partners allow European merchants to accept payments at points of sale that support the Alipay payment method ([Fine19]). Alipay had a 53,8% market share of the Chinese mobile payment market in Q4 2018 ([Keye19]). Next to the provision of mobile payments and wallet services, Ant Financial is providing a whole range of financial services such as wealth management, financing and credit reference services through different labels.

Alipay, together with Tencent, replaced the banks in the mobile-payments services landscape in China. While outside Asia, including Europe, the focus is on facilitating payment services for Asian tourists and merchants through partnerships around the world, Alipay has the technological capabilities and therefore the potential to extend its services in all geographies.

C. Key competitive advantages

Alipay’s key competitive advantages over other players in the market are:

- A strong Asian home market.

- Global partnerships enabling global reach.

- Integration with a leading E-commerce platform (Alibaba)

Summary

Alphabet – Google Pay

Google, as a subsidiary from Alphabet started providing payment services in 2011 with the launch of Google Wallet. In 2015, Google Wallet successor Android Pay was launched and in 2018 rebranded as Google Pay. Google Pay is a digital wallet solution that enables users to make contactless and in-app purchases on, amongst others their smartphones, tablets and smart watches. This solution is accepted at millions of retail outlets globally and supports all major payment networks, including American Express, MasterCard, Visa, Discover (US only), Visa Electron (excluding the US), PayPal, and JCB (Japan and US only). Google Pay is supported by a host of major banks and credit unions in the US.

Furthermore, Google is allowed to provide PSD2-enabled services, which would enable them to analyze customer transaction data to provide a consolidated financial overview and/or initiate payments on behalf of the customer, granted the customer provides consent. Google is looking into the possibilities of PSD2, but has not yet expressed plans to provide these PSD2 enabled services ([Betl19]).

A. Target market

Google Pay contactless payments is supported in 29 countries (14 EEA countries) and online payments purchases (website and in-app) are supported in 74 countries (24 EEA countries) ([GPay20]). Furthermore, Google Pay supports peer-to-peer online payment transfers in the United States of America and India. Finally, Google Pay supports public transportation payments in Australia, Canada, India, Japan, Ukraine, Russia, Singapore, the United Kingdom and the United States ([GPay20]).

Google Pay currently is market leader in India with nearly 60% market share of the local payment market ([FEOn20], [Chan20]). Furthermore, Google Pay has strong relationships with leading banks in multiple markets, predominantly in the United States. Google Pay has a relatively low market share compared to its competitor Apple Pay. The presence of Google Pay in the EEA is limited.

B. Payment capabilities

Much like its competitors, (e.g. Apple Pay, Samsung Pay), Google Pay’s payment service uses Near Field Communication (NFC) to enable users with Android devices to execute contactless transactions at point-of-sale terminals. In India, however (where it was initially known as Google Tez), Google Pay’s payment service is based on QR codes linked to local payments system (Unified Payments Interface). By early 2019, Google Tez reportedly had over 200 million transactions per month.

Next to in-store purchases, Google Pay provides online payment services by enabling users to pay on websites and in apps using the cards saved to the users’ Google Account. Google Pay enables Merchants to add payment services to their websites and apps with the use of Google Pay’s Application Programming Interface (API). Next to websites and apps, Google Pay is also supported by, amongst others, Google Assistant and the payments service provider Stripe. Google Pay allows users to transfer or request money with Gmail, Messages and Google Assistant without any transfer fees ([Loop19]).

In November 2019, Google announced project Cache: an offering of personal “smart” checking accounts ([Gore19]). The new service is said to launch in the United States in 2020. The lead partners for project Cache are Citi Bank and Standford Federal Credit Union, albeit Google is exploring how to partner with other banks and credit unions in the U.S. Gaining users for Google Pay in locations such as the United States and the EEA remains challenging for Google, as these countries already have robust financial products. Google is able to differentiate themselves by offering major loyalty perks.

C. Key competitive advantages

Next to Google’s own competitive advantages (brand, size, global market share, technology infrastructure and capabilities ([Matt16])), Google Pay’s specific competitive advantages are:

- Existing user base enables seamless onboarding: one in five people around the world have a Google Account ([Pays19]) and 61% use Google Chrome as their main web browser ([Kern18]). The vast majority of users can add additional information to their existing Google account to enable Google Pay, reducing friction.

- Omnichannel: Google Pay is not tied to a single operating system, as users can already use Google Pay on iPhones and iPads in the United States. Furthermore, users can use Google Pay from any device with any browser and within native Android apps.

- Product integration: leveraging Google’s user base by integrating Google Pay into Google other services, such as: Google Assistant, Gmail and Messages.

However, Google Pay needs to increase the adoption of its payment services in the EEA, given the imminent introduction and expansion of similar services by other BigTechs.

Summary

Amazon – Amazon Pay

Amazon launched Amazon Pay in 2007 ([CBIn19]) to enable their users to pay with their Amazon accounts on external merchant websites and apps. Amazon Pay enables users to use the addresses and payment methods stored in their Amazon account (e.g. credit or debit card accounts).

Amazon Pay charges merchants transaction-based fees. The total fee charged to the merchant includes processing and authorization fees.

A. Target market

Amazon Pay has a significant global footprint, supporting 170 countries for customers. As of January 2019, Amazon Pay is available for merchants with a place of establishment in the US, the UK, Austria, Belgium, Cyprus, Denmark, France, Germany, Hungary, Ireland, Italy, Japan, Luxembourg, the Netherlands, Portugal, Spain, Sweden and Switzerland ([Amaz20b]).

B. Payment capabilities

Next to Amazon Pay, Amazon introduced Amazon Pay Express (a light-weight variation) aimed at smaller Merchants that do not want a full e-commerce integration ([Amaz20a]). With Amazon Pay Express, merchants can get an Amazon Pay button by simply copying and pasting a HTML code to their website.

Furthermore, Amazon opened a chain of convenience stores in the United States, Amazon Go, which enables customers to shop without having to pay a cashier. The “Just Walk Out Technology” automatically detects when products are taken from or returned to the shelves and keeps track of them in a virtual cart. Once the customer is done shopping, they can leave the store without checkout. The customer’s Amazon account is charged afterwards.

Finally, in July 2017, Amazon Pay launch Amazon Pay Places, which allows restaurants to accept takeout orders (“order-ahead”) from customers via the Amazon App. Furthermore, the Amazon app also ventured into in-store payments with its launch of QR code-based in-store payments.

C. Key competitive advantages

- Amazon Pay has hundreds of millions of active Amazon customers globally, including 100 million prime customers transacting in +170 countries.

- Seamless onboarding: Amazon’s large customers base of 33 million active users and 21 million active merchants ([Detr18]) are automatically onboarded with their current Amazon account.

- Amazon Pay is one of the front-runners with voice-initiated payments via Amazon Pay for millions of Alexa-enabled devices.

Summary

Apple – Apple Pay

Apple Pay is the digital wallet launched by Apple in 2014. The service uses tokenization: each transaction is authorized with a one-time unique number using the Device Account Number stored in the eSE (secure element). Apple Pay is supported by Visa, MasterCard and American Express, and numerous local schemes. Apple Pay can also be used as an in-app payment solution: Numerous apps support Apple (Best Buy, Disney Store, Staples, Uber eats, Ticketmaster). Apple Pay’s revenue model includes a fee on each Apple Pay transaction and a monthly fee on active users. These operating fees are paid by participating banks.

A. Target market

Apple Pay is supported in 60 countries of which 29 EEA countries and has been activated on 383 million iPhones globally (43% of all iPhone users) ([Owen19]). Apple Pay extends its reach in Europe with the deployment of the Apple Pay architecture in new countries and new partnership with banks in which they are currently active.

The functionality which enables sending and receiving money with Apple Pay and the Apple Cash ( a prepaid debit card, which can be stored in the Apple Wallet) are currently only available in the U.S. These services are provided by Green Dot Bank, member FDIC. Furthermore, Apple Card is only available in the U.S. The Apple Card is issued by Goldman Sachs Bank USA, Salt Lake City Branch.

B. Payment capabilities

Apple Pay enables secure contactless purchases in stores with Apple devices (e.g. iPhone, Apple Watch) using NFC technology. Furthermore, in the United States, Apple Pay Cash enables users to transfer and receive money with the use of Apple’s Messages app, in apps and on websites. Apple Pay also supports voice-initiated payment transfers with the use of Apple’s voice assistant Siri.

In March 2018, Apple released Apple Business Chat ([Appa18]), which enables users to chat and transfer funds to a limited amount of supported businesses. Apple Business Chat supports integration with the businesses’ CRM systems such as SalesForce, Nuance and LivePerson. Apple Business Chat is supported in the following countries: United Kingdom, Germany, France, Italy, Switzerland, Australia, Japan, Singapore, Hong Kong and Canada.

On August 2019, in collaboration with Goldman Sachs, Apple released the Apple Card in the United States. The Apple Card is a Credit Card (MasterCard) designed to be primarily used with Apple Pay on Apple Devices. The main differentiators from other credit cards are non-existent fees (except for applicable interest charges) and the daily 3-1% cashback reward program ([Appl20]). Interestingly, the physical credit card does not have a visual card number, CVV security code, expiration date or signature.

C. Key competitive advantages

- Strong UX and one of the world’s most valuable brand ([Bade19]).

- Large global user base with more than 1.4 billion active Apple devices, of which 900 million iPhones.

- Apple partners with Goldman Sachs and MasterCard to launch its own-brand credit card. Combination with Apple credit card in US should fuel further transactional growth.

Summary

Facebook Inc. – Facebook Pay

Facebook Inc. is rolling out payment functionalities to their social platforms WhatsApp, Instagram and Facebook. These platforms combined have over 5 billion user all over the world ([Stat20]). Facebook also has a plan to set up their own digital currency: Libra.

A. Target market

With its social platforms such as WhatsApp, Instagram and Facebook, Facebook Inc., is able to reach users all over the world. Although Facebook decided to discontinue its peer-to-peer money transfer service via Facebook messenger for Europe in June 2019, it is likely that its new payments services Facebook Pay eventually will be offered in Europe. Facebook Pay is a new payment service that will let users send and receive money across the Facebook platforms.

B. Payment capabilities

Facebook holds an EEA payment license which enables them to offer the following payment services:

- execute credit transfers, including standing orders, with the user’s payments service provider or with another payment service provider;

- issue payments instruments and/or acquiring of payment transactions;

- engage in money remittance.

Facebook Pay is currently only available in the US. However, the company plans to also launch the services in other countries. Next to Facebook Pay, WhatsApp Pay has successful been tested in India and is also expected to be rolled out to other countries this year. WhatsApp Pay will be a peer-to-peer that will enable users to transfer money within the instant messaging app. Facebook Pay is more of an integration of cross-platform services through which it aims to offer a pay feature to make transactions on these platforms seamless ([BuTo19]). Facebook Pay and WhatsApp pay may also support Libra in the future. Libra is a permissioned blockchain digital currency which is co-founded by Facebook. The currency and network do not yet exist.

C. Key competitive advantages

- Global reach through its social platforms.

- Opportunity to integrate payment functionalities into their social media apps.

- Holds the required payment license in Europe to roll out payment products in the EEA quickly.

Summary

Tencent – WeChat

Tencent is the company behind the multi-purpose communication, social media and payment platform app WeChat. The payment platform, WeChat Pay, is a payment solution which is completely integrated inside the app.

A. Target market

The full functionalities of WeChat Pay are only available in China and Malaysia. Like Alipay, the focus within Europe is on the Chinese customer. Through partnerships with local merchants Alipay facilitates transactions that are initiated in the EEA by Chinese tourist. The WeChat app is available throughout Europe, however, the payment functionalities are only available for people which have a Chinese or Malaysian bank account.

B. Payment capabilities

Tencent is trying to grow in Europe by expanding its network of merchants that offer WeChat Pay as a payment method ([Keye19]). Tencent currently holds no payment-related license in Europe.

As stated before, Tencent and Alipay dominate the Chinese mobile payment market. WeChat Pay offers a seamless in-app payment experience. However, in the western world Facebook’s WhatsApp is WeChat’s equivalent when it comes to peer-to-peer communication functionalities. Although WhatsApp currently offers no in-app financial services it seems unlikely that WeChat will takes its position as primary communication app in the western world because of the strong position of WhatsApp in Europe.

C. Key competitive advantages

- Seamless integration with the WeChat app which has over one billion active users ([Keye19]).

- Global reach through partnerships with merchants all over the world.

Summary

Microsoft – Microsoft Pay

The U.S. based software giant has a payment proposition aimed at U.S. merchants and shoppers. Microsoft Pay is an alternative online check-out solution. Shoppers can use Microsoft Pay to use any credit or debit card stored in a customer’s Microsoft account.

A. Target market

The payment proposition is focused on the U.S. merchants and shoppers.

B. Payment capabilities

Microsoft holds no payment license in the European payment market and currently offers no payment related services in the EEA. In the US, Microsoft Pay is a fully-fledged online payment method.

C. Key competitive advantages

- Microsoft can leverage its Windows platform to push Microsoft Pay.

Summary

From all the payments propositions of the BigTech companies that have been assessed, Microsoft Pay has the least presence in the EEA region. At this moment there is no indication that Microsoft will roll out its Microsoft Pay proposition in Europe.

References

[Amaz20a] Amazon Pay (2020). Introduction to the Express integration guide. Retrieved from: https://developer.amazon.com/docs/amazon-pay-hosted/intro.html

[Amaz20b] Amazon Pay (2020). Merchant frequently asked questions. Retrieved from: https://pay.amazon.com/help/201810860

[Appa18] Appaloosa Store (2018). Everything You Need to Know About Apple Business Chat (and what to expect from it). Retrieved from: https://medium.com/@appaloosastore/everything-you-need-to-know-about-apple-business-chat-and-what-to-expect-from-it-5e2daa6ec14e

[Appl20] Apple.com (2020). Apple Card. Retrieved from: https://www.apple.com/apple-card/

[Bade19] Badenhausen, K. (2019). The World’s Most Valuable Brands. Retrieved from: https://www.forbes.com/powerful-brands/list/#tab:rank

[Betl19] Betlem, R. (2019). Acht vragen over Googles betaalvergunning. Retrieved from: https://fd.nl/beurs/1284976/acht-vragen-over-googles-betaalvergunning

[BIS19] BIS (2019). BIS Annual Economic Report 2019. Retrieved from: https://www.bis.org/publ/arpdf/ar2019e3.pdf

[BuTo19] Business Today (2019). What is Facebook Pay and how is it different from WhatsApp Pay? Retrieved from: https://www.businesstoday.in/technology/news/facebook-pay-what-is-it-how-different-is-it-from-whatsapp-pay-check-details-here-payment-service/story/390167.html

[CBIn19] CBInsights.com (2019). Everything You Need To Know About What Amazon Is Doing In Financial Services. Retrieved from: https://www.cbinsights.com/research/?s=Everything+You+Need+To+Know+About+What+Amazon+Is+Doing+In+Financial+Services

[Chan20] Chandrashekhar, A. (2020). Google Pay India learnings will be taken to global markets: Alphabet CEO Sundar Pichai. Retrieved from: https://economictimes.indiatimes.com/tech/internet/google-pay-india-learnings-will-be-taken-to-global-markets-alphabet-ceo-sundar-pichai/articleshow/73934899.cms?from=mdr

[CSSF20] CSSF (2020). Commission de Surveillance du Secteur Financier Luxembourg. Retrieved from: supervisedentities.apps.cssf.lu

[Detr18] Detrixhe, J. (2018). Amazon could learn from the Chinese tech giants. Quartz. Retrieved from: https://qz.com/1492756/amazon-pay-could-learn-from-the-success-of-alibabas-alipay/

[DNB20] DNB (2020). What is an electronic money institution? Retrieved from: https://www.toezicht.dnb.nl/en/2/51-227911.jsp

[Dono18] O’Donoghue, R. & Padilla, J. (2018). Big tech—A real threat to financial firms in retail services. Moody’s. The Law and Economics of Article 102 TFEU, 2nd edition. London: Hart Publishing.

[EBA20] European Banking Authority (EBA) (2020). Register of payment and electronic money institutions under PSD2. Retrieved from: https://eba.europa.eu/risk-analysis-and-data/register-payment-electronic-money-institutions-under-PSD2

[FEOn20] FE Online (2019). Google Pay the king of UPI payments in India with $110 billion in annual transactions. Retrieved from: https://www.financialexpress.com/industry/banking-finance/google-pay-the-king-of-upi-payments-in-india-with-110-billion-in-annual-transactions/1711291/

[Fine19] Finextra (2019). Alipay target: Serve 10m European SMEs by 2024, Finextra,. Retrieved from: https://www.finextra.com/newsarticle/34765/alipay-target-serve-10m-european-smes-by-2024

[FSB19] FSB (2019). BigTech in finance: Market developments and potential financial stability implications. Retrieved from: https://www.fsb.org/wp-content/uploads/P091219-1.pdf

[Gore19] Gorey, C. (2019). Cache: Google’s new banking project aiming to dominate big tech. Retrieved from: https://www.siliconrepublic.com/companies/google-cache-banking-explained

[GPay20] Google Pay (2020). Find supported payment methods for contactless purchases. Retrieved from: https://support.google.com/pay/answer/7454247

[Kern18] Kerns, T. (2018). Gmail now has more than 1.5 billion active users. Retrieved from: https://www.androidpolice.com/2018/10/26/gmail-now-1-5-billion-active-users/

[Keye19] Keyes, D. & Magana, G. (2019). Chinese fintechs like Ant Financial’s Alipay and Tencent’s WeChat are rapidly growing their financial services ecosystems. Retrieved from: https://www.businessinsider.com/china-fintech-alipay-wechat?international=true&r=US&IR=T

[Klei19] Klein, A. (2019, June 16). Is China’s new payment system the future? Brookings Institution. Retrieved from: https://www.brookings.edu/research/is-chinas-new-payment-system-the-future/

[KPMG18] KPMG International Cooperative (2018). Me, my life, my wallet, 2nd edition. Retrieved from: https://assets.kpmg/content/dam/kpmg/xx/pdf/2018/11/me-my-life-my-wallet.pdf

[Loop19] Looper, C. de (2019). PayPal vs. Google Pay vs. Venmo vs. Square Cash vs. Apple Pay Cash. Retrieved from: https://www.digitaltrends.com/mobile/paypal-vs-google-wallet-vs-venmo-vs-square-cash/

[Mano18] De la Mano, M. & Padilla, J. (2018). Big Tech Banking. Journal of Competition Law & Economics, 14(4), 494-526.

[Matt16] Matthews, J. (2016). What are Google’s Competitive Advantages? Retrieved from: https://turbofuture.com/internet/What-are-Googles-Competative-Advantages

[OMFI20] Official Monetary and Financial Institutions (2020). Digital currencies: A question of trust.

[Owen19] Owen, M. (2019). Apple Pay activated on 383 million iPhones, worldwide. Retrieved from: https://appleinsider.com/articles/19/02/20/apple-pay-activated-on-383-million-iphones-worldwide

[Pays19] Paysafe.com (2019). Google Pay: Can merchants afford not to get on board? Retrieved from: https://www.paysafe.com/blog/google-pay-can-merchants-afford-not-to-get-on-board/

[Rode19] Rodenburg, S. (2019). ACM start studie naar betalingsverkeer door big tech. Retrieved from: https://www.rtlz.nl/tech/artikel/4893401/acm-onderzoek-betalingsverkeer-tech-apple-google-facebook-amazon

[Stat20] Statista.com (2020). Most popular social networks worldwide as of April 2020, ranked by number of active users. Retrieved from: https://www.statista.com/statistics/272014/global-social-networks-ranked-by-number-of-users/