In our previous Compact article entitled ‘Taxes in ERP systems: are the (im)possibilities properly recognized?’ we provided an overview of the impact of taxation on ERP systems in general. This article offers deeper insight into impact of VAT on ERP systems and gives a clear view of the fact that correct and efficient VAT treatment within ERP systems is no routine matter. As in other business areas, substantial implementation effort is needed to achieve this goal. Our own experience has made it evident that in many cases efforts in the field of VAT implementation display too many shortcomings, resulting in non-compliance and inefficiencies. We observe an increasing demand for a specialism which combines knowledge-intensive VAT legislation and supply-chain knowledge with ERP implementation techniques. This combination can scarcely be found in one individual. Specialist teams with a knowledge overlap are required to tackle the challenges. This article draws from the practical experiences of such a team.

Introduction

Enterprise resource planning (ERP) vendors and system integrators (SI) are making significant efforts to ensure that ERP implementations comply with the regulations prevailing in the markets where their customers operate. These efforts depend on expert knowledge that is scarcer as the matter becomes more complex. As the economy becomes global and IT-reliant, approaches used in ERP system implementation are being compelled to cope with the increasingly complicated situations induced by contemporary supply chains ([Goos08]).

In a previous article we introduced the general framework that is applicable for the combination of taxation and ERP technology ([Bigg07]). Three case studies emphasized the importance the combination:

- Value-added tax (VAT), as an example of indirect tax, gives rise to complex situations which should be handled by ERP systems either automatically or by manual interventions.

- Customs, which also is classified as indirect tax, is supported by the triad of ERP systems, warehouse management systems (WMS), and often specific (tailor-made) customs applications, Customs Management Systems (CMS), which need to communicate properly through sophisticated interfaces.

- Transfer pricing deals with setting prices, terms and conditions in accordance with the arm’s-length standard when selling goods, services or rights for the use of intangible property to group companies.

It is self-evident that ERP systems play a crucial role in supporting business processes into which the overall tax processes have been incorporated. This article focuses on issues that companies face with respect to correctly addressing VAT within ERP systems, especially SAP. First, we explain the nature of the complexity of the VAT and ERP domains by indicating the underlying issues with which businesses are confronted. Secondly, we give an overview of the SAP modules that are relevant for the embedding of VAT within SAP, and we explain the basic principles of the VAT determination process. Next, we explain our experiences with actual VAT implementation projects within SAP. We conclude by describing the next steps with respect to VAT for companies that already run an ERP system or are engaged in an ERP implementation process.

Large international companies face complex VAT requirements

The complexity of business operations and the complexity of ERP software packages contribute to repeated customization needs for ERP systems: changes in rules or in the markets where the products are sold must be reflected in the ERP system and its support for the various functions that constitute the economic activity of the supplier ([Goos08]).

In current implementation practice, VAT, as a generic requirement, is assumed to be addressed partly by the vendors and partly during the implementation process itself, when ERP customizing settings must realize the correct and efficient handling of VAT.

In a study of large ERP environments, we have observed that automated VAT handling within ERP systems is not always implemented in an optimum way. Further study has revealed the lack of attention to VAT issues and the degree of exposure to risks in the operations. In this study, a number of VAT risk exposure criteria were determined, indicating whether or not companies have high exposure to complicated VAT situations ([KPMG07]). The most important criteria are:

- Distributive trade activities. Goods that are shipped directly from a company’s vendor to its client lead to one of the most complex VAT situations because there is only one supply while there are several taxable transactions. These scenarios typically occur at companies’ reselling units (see frame for more details on these kinds of activities). Different properties of the transaction play a role in the determination of correct VAT treatment. For example, the applicable incoterms decide whether the transaction qualifies as an intracommunity transaction or a domestic sale.

- Different types of establishments in different countries. Having branches in more than one country requires a more complex organizational design within the ERP system. The enterprise model must support the fiscal requirements on invoices.

Within VAT regulation, the actual goods flow is the determining factor of the required VAT treatment. If companies have different types of establishments, such as warehouses, storage deposits or reselling units, the place from which the goods are sent is the crucial determinant. Therefore, it must be indicated for each type of establishment whether or not it may act as a stock holding unit from which goods are sent. - The combination of supply of goods and services. VAT determination for service deliveries differs considerably from the VAT rules for the supply of goods. Place-of-supply rules for services depend on the nature of the service delivery, which is generally not taken into account within VAT determination. In order to automate the VAT derivation for services, additional VAT derivation functionality within the ERP system is required.

- Quantities of different products. Products can have a different VAT rating in each member state of the EU. The basis for correct product rating lies in the accuracy and maintenance of master data. If master data maintenance is not centralized, risks may arise as a result of sales of the same product in different categories in different countries.

If sales activities are restricted to domestic business, VAT treatments of sales transactions can be automated relatively easily. However, large international companies are exposed to most of the above-mentioned criteria. Standard functionality within ERP systems does not guarantee the correct handling of more complex VAT requirements. Therefore if companies are exposed to one of the main criteria that are mentioned above, they should enhance attention to VAT issues that arise from the ERP system.

In contrast to income tax, VAT is a reporting tax. This means that tax authorities always check afterwards on correct VAT reporting. If companies are not VAT compliant, they risk penalties and the reimbursement of VAT for the past five years with interest. The amount of fines may increase very quickly, which confirms the importance of being VAT-compliant.

Harmonization of VAT in EU is simply make-believe

VAT regulation in the European Union is harmonized by means of the EU VAT Directive 2006. This means that main rules regarding the determination of the place of taxable transaction and definitions are the same for each member state. Furthermore, each member state uses the same type of turnover tax system, VAT. The objective of harmonization of a common VAT system in the EU should result in competitive neutrality, which ought to lead to the same tax burden for similar goods and services in each member state whatever the length of the production and distribution chain ([EUcd06]).

But anyone who believes that this harmonized VAT system actually results in equal VAT rules and requirements for each EU member country is misguided. Tax rates and some major exemptions are not harmonized. Important examples of non-harmonized exemption rules are the reverse-charge mechanism, country-specific invoice requirements, and VAT declaration report standards. Furthermore, legally required invoice texts that should be printed on the invoice differ from country to country.

Penalties resulting from violating VAT rules even differ from country to country. For example, some countries impose penalties for incorrect invoice numbering, while others do not. The same applies for not reporting reverse-charged VAT.

The EU VAT directive allows countries to make their own interpretation of these VAT issues. It is exactly those exemptions that form the complex part of EU VAT legislation. Country-specific rule-setting makes compliance with all relevant regulations even more complicated.

Standard ERP enterprise models often contradict VAT regulation

Companies generally use ERP software to support and increase the effectiveness of their business operations. Enterprise modeling is the concept of translating a business model of a company into ERP software (e.g. modeling of plants, warehouses, factories, sales offices, etc). Typically one of the first discussions is the choice between a single kernel and use of different kernels for different divisions, operating units, or even countries.

The current trend is that large companies frequently opt for a division-centralized implementation of their ERP system. However, from a VAT perspective, it might be more logical to implement ERP systems based on geographical location in order to comply more easily with national regulations. When, for example, a division appears in more than ten countries, the ERP system of this division has to be configured in such a way that all transactions made by the divisions comply with specific national VAT regulation.

Companies are faced with choosing between a standardization of business processes per type of business (e.g. division-based or product-based) or making taxes a leading principle and organizing their supply chain to gain optimal tax advantages. If taxes are the leading principle, corporate tax is the main driver, while VAT is always secondary. This results in the need for additional effort within the ERP-customization in order to comply with the applicable VAT requirements.

From a business perspective, the standardization per division is a more logical step because it enables business processes to be centrally designed and maintained in a single kernel.

Commissionaire model, strip-buy-sell structure …. or both?

From a tax-efficiency perspective, we observe that companies often opt for a commissionaire structure. This structure is also known as the classical principal-toller-agent (PTA) model. The principal is the major centre of a company that contains the major business responsibility. It formulates the contracts with customers and performs invoicing. Principals always remain owner of the goods that are sent to customers. For corporate tax reasons, principals are often established in Switzerland because of the advantageous tax regime there. Tollers are manufacturers that produce on behalf of other parties (e.g. the principal), for which the toller is rewarded with a tolling fee. Agents (the actual commissionaires) are often limited to the performance of order entries, and only act as intermediaries to customers. They are rewarded with a commission fee by the principal. The PTA model has a major impact on VAT consequences, because there is no change of ownership between the principal and tollers or agents who belong to the same company.

The PTA model significantly differs from a strip-buy-sell model, for example, where a reseller function replaces the agent function, with the main difference that resellers become owner of the goods. This gives rise to distributive trade activities which are very complicated for VAT (see frame, distributive trade activities).

In practice, we also see a combination of strip-buy-sell models and the commissionaire structures, which makes the correct handling of VAT even more complex.

So far, we have emphasized the general consequences of high VAT exposure on ERP systems. Because a significant number of large international companies run SAP, we shall now focus on SAP in the following sections.

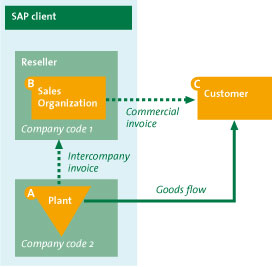

One of the main aspects that heighten the complexity of VAT situations is the existence of distributive trade activities. These kinds of activities occur at the reselling units of companies within strip-buy-sell structures. In our previous article, we addressed one of the main scenarios difficult to implement correctly in an ERP system: triangular (or ‘A-B-C’) transactions. These are transactions where goods are sold twice but only are shipped once. Three or more parties are involved, where one or more parties acts as a reseller. Resellers become the owner of the goods but never physically receive them. Final customers receive the goods from the producing plant (party A) and receive an (commercial) invoice from the reseller (party B), see Figure 1.

From a SAP perspective, the applicable overview for the situation where the producing plant and the reseller belong to the same company is depicted in Figure 1. Rectangles within the SAP client represent the different company codes in the system. Goods are always sent from plants that are connected to company codes. If the company code of the reselling company differs from the company code of the plant from which the goods are sent , an intercompany invoice is sent from company code 2 to company code 1, and the scenario is classified as a distributive sale (triangulation). The triangle represents stock of goods within a plant.

Figure 1. Distributive trade activity within SAP.

This is a generic scenario of which many variants are possible. One can think of geographical variants where the countries in which the three parties are located differ. This leads to different VAT treatments which must be recognized and handled correctly by the ERP system. Another, more VAT-technical, variation is the difference in transportation responsibility, which indicates whether transport is arranged in chain A-B or in chain B-C. The incoterms that apply to the transaction play an important role in this case. Different transport arrangements result in different VAT outcomes of the triangular scenario.

VAT determination in the details of SAP

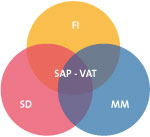

At first sight, VAT derivation seems to be a financial process and should consequently take place in the SAP finance (FI) module. This is partly true because VAT bookings are ultimately reported in the VAT book in the general ledger within SAP FI. However, actual VAT determination from a sales perspective starts within the SAP Sales and Distribution module (SD). After creating a sales order or a quotation, for example, the pricing schemes are executed for the first time. The standard VAT derivation functionality is embedded in these overall pricing schemes. Based on available transaction data (e.g. combination of customer, sales organization) the system decides which pricing scheme to choose. As mentioned earlier in this article, the goods flow forms the leading principle for VAT. In order to be able to follow the goods flow within SAP, the third SAP module that is used during the VAT derivation process is the materials management (MM) module, see Figure 2. Goods (and even services) are sent from plants to customers. Information about materials and plants is maintained in the SAP MM module.

Figure 2. VAT is embedded in different SAP modules.

The SAP customizing settings within these three modules combined must be the basis for a correct embedding of VAT within SAP.

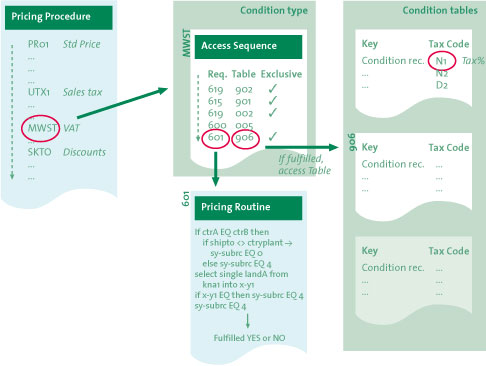

Although FI and MM are important to VAT accounting and correct material and plant master data respectively, the SD module is the centre for VAT derivation. Here VAT is determined using the SAP condition technique, which is one of the most complex features within SAP. The main elements used in the condition technique are:

- Condition type. Representation of daily activities (e.g. discounts, surcharges, VAT, etc.) within SAP. The standard SAP VAT condition type (MWST) is included in the pricing procedures. The condition type is the main source for the VAT decision logic within SAP.

- Access sequence. Search strategy that is used by SAP to find valid data for each condition type. Access sequences contain accesses (to which condition tables are connected) that are executed successively.

- Condition table. Table that contains condition records in which the actual outcome of the condition type is determined. Condition records are identified by a combination of fields (keys).

- Pricing routines. Programmed requirements that are connected with each access in the access sequences. These routines contain several checks to determine whether or not the applicable condition table may be accessed.

All those single elements are part of SAP customizing. The relation between these condition elements are depicted in Figure 3.

Figure 3. Condition technique in SAP related to tax.

It will be no surprise that the correct customizing of the VAT condition technique within SAP is a complex matter and requires very specific knowledge of both SAP and VAT. The standard SAP VAT condition type is ‘MWST’, which is an abbreviation of the German translation of VAT – ‘Mehrwertssteuer’. The MWST condition type is linked to the similarly named access sequence MWST, which consists of three condition tables: one table for VAT on domestic transactions, one table for EU cross-border transactions, and a table for non-EU export transactions.

Besides SAP customization,, extra VAT determination rules which are programmed through tailor-made user exits (ABAB coding) can also be designed. Companies exposed to more complex VAT scenarios should extend the standard VAT functionality that is available in SAP in order to fully automate their VAT determination process. Additional VAT relevant data must be reflected in the VAT determination process, which can be done by building additional user exits or adding new customized condition tables to the standard MWST access sequence.

Standard SAP functionality covers basic VAT scenarios

The standard VAT functionality delivered within SAP covers most of the frequently occurring VAT scenarios such as domestic transactions and simple, direct intracommunity supplies. These transactions comprise the majority of invoice flows. For companies that only perform domestic or straightforward business supplies, this standard functionality is sufficient. As mentioned earlier in this article, large international companies operating on a global scale are exposed to more complex VAT scenarios. An example of this is the reseller concept, described in detail earlier. The main reason why standard VAT functionality is not sufficient is the lack of a sufficient set of VAT determinants. A VAT determinant is a ‘variable with a pre-defined semantics in VAT-regulation which is filled in by a company’s business processes and can be translated directly to the set-up of the SAP configuration.’ Important VAT determinants are: ship-from country, ship-to country, and local presence of VAT registration numbers.

We have identified sixteen VAT determinants that steer the final decision of which VAT treatment ought to be chosen by the system ([Zege07]). Theoretically, all possible combinations of specifications of the VAT determinants may lead to explicit VAT requirements for SAP. In actual practice, there is a strong overlap of the VAT requirements that follow from the specification of the VAT determinants. To get a hold of this overlap, groups of VAT determinants with the same property, as seen from a fiscal perspective, are bundled together. These VAT patterns uniquely represent the VAT requirements that are applicable to a specific situation. Companies must be able to identify which VAT patterns match their supply chain processes in order to align SAP customization with the VAT demands that are legally required.

The standard SAP VAT set-up does not take into account all possible VAT determinants, so that the more complex VAT scenarios are not covered by the standard VAT decision logic within SAP.

Next steps for companies using or implementing an ERP system

During the past two years, we have carried out several projects concerning VAT automation within ERP systems. A main distinction in the type of project lies in the degree to which companies have already automated their VAT derivation within the ERP system. Companies that already have a high degree of VAT automation and want to further improve the current VAT functionality should gain insight into the working of the current solution. This insight helps companies to decide whether or not further improvement possibilities may enhance the total degree of automated VAT derivations and reduce risks due to less manual interventions.

For companies that are implementing an ERP system, this comparison between current and desired situation is not necessary, because no VAT automation is yet available.

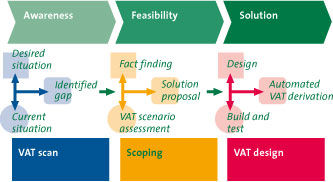

Figure 4 gives an overview of the three situations that may apply to companies in a process of automating VAT:

- Awareness. A certain degree of VAT automation already exists. There is an intention to further improve the current solution. If there is a substantial gap between the current and desired situation there should be awareness of the desirability of improving the current VAT solution.

- Feasibility. The decision has been made to improve the VAT solution. A feasibility study should give insight into the most optimum solution, in which the complexity of applicable tax jurisdiction is compared to the amount of transactions covered by the new VAT solution. The result is a solution proposal with the organizational (divisions/units) and the country (tax jurisdictions) scope for which an automated VAT derivation is developed.

- Solution. The solution phase comprises the actual design and implementation of VAT blueprints based on the optimum coverage scope which finally lead to an automated VAT derivation within the ERP system.

Passing through each of the above-mentioned situations requires extensive knowledge of both the fiscal (VAT) domain as well as the ERP technical domain. Moreover, ERP experts must be able to understand basic VAT technical aspects, and vice versa.

Figure 4. ERP VAT roadmap.

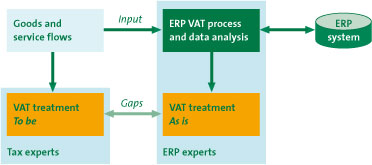

For companies that are already using an ERP system and consequently use the ERP system to derive VAT on outgoing invoices, an ERP VAT scan gives insight into the performance of the VAT derivation mechanism.

In an ERP VAT scan, tax experts analyze the supply chain from a VAT perspective in order to identify all VAT scenarios applicable to the company and to provide each scenario with a correct VAT treatment based on actual VAT legislation. This results in a description of the desired situation (To Be) of the applicable VAT scenarios within the company’s supply chain. It is important that these VAT scenarios are described in such a way that they can be mapped one-to-one to ERP transactional data. Hence, close collaboration between tax and ERP experts is required.

The identified scenarios are a starting point for the ERP process and transactional data analysis in which transactional data are downloaded from the ERP system according to a VAT extraction profile (see Figure 5). By combining transactional data from different tables, it becomes clear exactly which VAT scenario is related to the applicable transaction. Accordingly, all transactional data are mapped to the predefined VAT scenarios prepared by tax experts.

Figure 5. Overview of an ERP VAT scan.

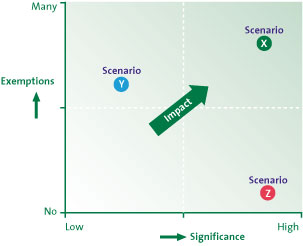

Figure 6 shows a matrix in which each VAT scenario is mapped, based on number of exemptions (gaps) and significance. The higher the total number of exemptions (wrong VAT derivations), the higher the gap between the current and desired situation. ‘Significance’ refers to the product of the total number of transactions and the amount of each transaction separately. As Figure 6 indicates, the overall impact of a VAT scenario rises when significance increases and the total number of exemptions also increases. In general, the combination of high significance and many exemptions is not very likely. The most recurrent VAT scenarios are domestic supply of goods between two companies that are located in the same country (see scenario Z in Figure 6). For these scenarios, VAT is generally derived correctly by the ERP system, primarily based on ship-from country and ship-to country.

Figure 6. VAT scenario impact matrix.

However, VAT scenarios with lower significance (e.g. scenario Y in Figure 6) lead to high potential risks because tax authorities impose high fines and oblige paybacks with retroactive effect for five years. Reselling activities (A-B-C transactions) are an example of such scenarios. Compared to domestic transactions, reselling activities have low significance, but frequently have incorrect VAT derivations.

The final objective is to propose improvement opportunities to enhance the degree of the VAT automation process in order to reduce risks resulting from the obligation to comply with (inter)national VAT regulation.

The ultimate solution for companies is a fully automated VAT derivation without any manual interventions. However, it is a huge challenge to reach this ultimate goal since exemption transactions cost relatively great effort to attain full coverage. Hence, the best solution for companies depends on the type, number and amount of transactions they perform. Because full coverage is almost unfeasible and even not desirable, scoping decisions must be made founded on an underlying business case.

Especially in the case of large international companies that are exposed to tax jurisdictions other than the European Union alone, it is important to specify exactly which tax jurisdictions are in scope. Two main considerations are important in order to decide which tax jurisdictions must be taken as applicable:

- Benefits: risk reduction due to large amount of total transactions.

- Costs: high design and implementation costs due to complex VAT systems of different tax jurisdictions in the countries in which the company operates.

The actual benefits are hard to quantify. This typically depends on the institutional design of local tax authorities. The Italian tax authorities, for example, are much more rigorous than their Dutch counterparts. The fines differ from country to country, and even within the same country local tax authorities may impose different penalties for different kinds of VAT violations.

We mentioned earlier that the European Union is generally treated as one tax jurisdiction, whereas important VAT topics, such as the reverse-charge mechanism, have different rules in different European member states. These different rule sets influence the creation of the VAT decision trees as part of the VAT design.

The basic principle of VAT derivation enables the use of a phased approach of implementing tax jurisdictions. This means that tax jurisdiction extensions can be implemented in modular fashion, which minimizes regression risks for the previously implemented VAT solutions.

In conclusion

In this article we have tried to explain the main points of interest regarding the complex interrelationship between VAT and ERP systems. We have described the main criteria that lead to complex VAT requirements and the corresponding risks for large internationally operating companies in particular. We can conclude from our experiences in recent projects that many companies are not aware of these risks. We stated that the lack of attention to ERP project organization and implementation methodologies, in combination with the high VAT exposure for companies, should lead to enhanced attention to this very specific field of expertise. It is exactly the combined knowledge of expert tax knowledge and ERP technical knowledge that is required to attack the issues that arise from the tax-ERP spectrum.

Though VAT is harmonized within the European Union, this does not mean that the EU may be treated as one tax jurisdiction where regulation is equal in each member state. Moreover, complex exemptions, such as the reverse-charge mechanism and requirements to apply the simplified triangulation rule, can be determined by each member state. These differences should be embedded in the VAT decision logic of the ERP system.

The concept of ERP enterprise modeling is of major importance to the resulting VAT requirements that originate from the supply chain. Due to the fact that many companies try to set up their supply chain efficiently from a tax (e.g. corporate tax) perspective, complex requirements with respect to VAT arise. VAT is never a leading factor when deciding how to organize the supply chain and how to translate it to the ERP enterprise model. Therefore, additional effort should be devoted to incorporating VAT correctly in the derivation process of the ERP system.

In order to do so, we outlined the VAT derivation process in the SAP ERP system. Different modules within SAP are relevant to the VAT decision process. The standard SAP VAT set-up covers the most common VAT scenarios, but if complex business models are applicable (e.g. commissionaire structure or strip-buy-sell) then additional analysis should be done on the performance of the standard set-up. Again the lack of attention to VAT plays a crucial role in this matter. Due to a lack of attention, international companies often use this standard set-up although they are exposed to more complex VAT scenarios. One can imagine that this is a basis for the occurrence of VAT risks and mishaps.

We have concluded this article with an explanation of the next steps for companies in order to gain more insight into their VAT risks and to subsequently solve their VAT problems. These next steps are based on experiences obtained in recent VAT ERP projects, which gave us much more insight into suitable solution proposals for all kinds of VAT issues and their translation to ERP.

References

[Bigg07] S.R.M. van den Biggelaar, S. Janssen and A.T.M. Zegers, Belastingen in ERP-systemen, worden de (on)mogelijkheden wel onderkend?, Compact 2007/1.

[EUcd06] Council Directive 2006/112/EC of 28 November 2006 on the common system of value added tax OJ L 347 of 11 December 2006.

[Goos08] J.B.M. Goossenaerts, A.T.M. Zegers and J.M. Smits, Value Added Tax Compliance in ERP Systems, submitted for publication in Computers in Industry (January 2008).

[KPMG07] KPMG, Towards Enhanced attention to Value-Added Tax in ERP Systems, unpublished survey, conducted from February 2007 to March 2007.

[Zege07] A.T.M. Zegers, Omzetbelastingwetgeving en ERP-systemen – Een overbrugbare kloof?, Master Thesis, Eindhoven University of Technology, January 2007.