At the core of every insurance company lie its actuarial processes, which are used to price insurance policies, and to determine how much capital should be reserved to meet future insurance obligations. The analytical nature of these processes and the computerized implementation thereof have made insurance companies into early digital companies in the previous century. However, the insurance sector nowadays is one of the sectors with the lowest degree of innovative digitalization, despite the increasing pressure on profit margins from a saturated market and regulatory requirements. A lot can be gained by modernizing the actuarial processes.

Introduction

Insurance companies have always been digital companies to some extent. Although policies were underwritten face to face at local brokers, at the core of each insurance company actuaries have always derived prices and reserves by working with ‘big data’, even long before it became a buzz. The rise of the internet caused many local brokers to disappear, as customers grew accustomed to buying our policies online. The current saturation of the insurance market and pressure from increasing regulatory requirements compel insurers to decrease their cost levels even further to remain competitive, so there is a natural push for further digitalization.

However, while insurers appear to be digital companies because of the online distribution channels that the customers see, the insurance sector is one of the segments with the lowest degree of innovative digitalization. Current cautious initiatives often center around innovating customer experience, but there is less talk of innovating back-office processes and systems, e.g. the financial administration process. Although the actuarial processes were once frontrunners in the digital world, they haven’t changed much over the past decades, and there is a lot to be gained by modernizing them.

The actuarial process

Simply put, actuaries determine the prices of insurance policies, and calculate and report on how much the insurance company needs to reserve on their balance sheet to fulfil their (future) insurance obligations, and how much risk capital they should hold to keep meeting these obligations in times of financial stress. They use large amounts of (historic) data, assumptions, and complex mathematical calculations to estimate the expected claims and risk involved as accurate as possible. Their processes are repeated frequently throughout the year, to quote fair prices for the policies, and to report financially on the insurance portfolios of the company – both to management and the regulator. Essentially, these processes lie at the core of the insurance company.

Most of these processes and the involved IT environments were conceived a long time ago, in simpler times with less regulatory (reporting) requirements. The calculations were performed either with specific actuarial software, offered by only a few vendors, or with MS Excel spreadsheets. The extract, transform, and load (ETL) process to feed the data into the calculations, and the process to feed the outcomes of the calculations to consecutive IT systems (e.g. finance systems), were mostly manual processes.

Over time, the role of actuaries and the requirements of their processes and systems have changed significantly. The implementation of Solvency II in 2016 coerced insurers to revise their processes and systems to be able to report on the solvency capital requirement and own funds, on top of the regular IFRS/local reporting requirements. For many insurance companies it took several years to understand the full impact of the regulation on their businesses. It was challenging to determine how it would impact their figures and future profitability, and the possible consequences of management actions to steer the company. This has ultimately led to a consolidation of the insurance market, in which actuarial processes and systems were regularly combined, instead of replaced, and in which the multiple data sources and administration systems were often kept intact, rather than consolidated into a single source of truth. Sometimes the systems were rationalized, usually with a loss of historic information.

Currently, the insurance industry faces the introduction of IFRS17. This new accounting standard introduces additional challenges for the actuarial processes and systems, and how they should interact with other systems within the company. Once again, significant changes are required in order to be in full control of all necessary input data, to be able to perform the additional calculations, and to generate the additional reports required by the standard.

Although the requirements changed, and processes and systems were amended to accommodate them, in essence they did not change tremendously. The number of data sources and the amount of necessary data increased, but the ETL process is still very often a manual process, as the systems used are often disjunct unable to communicate. Calculations were added on top of calculations to derive the additional required metrics, instead of revising the existing calculations to efficiently yield the additional outcomes. Also the reporting process remains a predominantly manual process, in which the efforts increased, as more reports need to be produced. The processes and systems ‘changed’, but with more of the same elements. This is understandable because a complete redesign would require a considerable amount of time and effort.

By holding on to the traditional design of the processes and systems, whilst the requirements changed, it now usually takes several weeks to complete the actuarial reporting cycle. The manual efforts make the processes slow and error prone. Some calculations can even take over 24 hours nowadays, which can cause significant delays when errors are found. Therefore, actuaries are often predominantly occupied with making sure their processes are completed on time, rather than focusing on their core responsibility of analyzing and explaining the results and movements therein, and improving their models.

The future of actuarial processes

Redesigning the actuarial processes might cost a considerable amount of time and effort, but we believe insurance companies can significantly benefit from taking the decision to do so. With the current processes, CFOs face uncertainties and sometimes unexpected movements in the biggest liability on their balance sheet. Under tremendous time pressure they have to assure they disclose the right reports with regard to their regulatory environment, the applicable accounting standards, and for their own management requirements. The dynamic environment that they work in constantly requires them to alter and shorten their processes, whilst expecting more from their output, and expecting it more often. Therefore, the current processes are at risk of becoming too slow and uncontrollable to timely produce all the necessary reports.

Today’s requirements call for harmonized and controlled actuarial processes, that leverage on integration, optimization, and automation.

- Integration: The data sources, calculation systems, and reporting systems should be able to communicate without manual interference.

- Optimization: The data handling and modelling philosophies should be designed for flexibility and scalability. Calculation times should be optimized by redesigning the models with today’s requirements in mind, and by utilizing capabilities such as parallel processing.

- Automation: Repetitive manual parts of the processes, such as the ETL process, should be automated as much as possible.

A wide range of tools and techniques are available to achieve this. For example, robotic process automation can be used to automate the repetitive manual steps of the process, and can even go as far as connecting data sources and calculation/reporting systems if no systematic connection can be made between them. Optimization of calculation times can be achieved by redesigning the actuarial models in an efficient way, but maybe even more so by setting them up in such a way that parallel processing can be used. With this technique, each core of a CPU or GPU can process a part of the calculation in parallel, rather than a single core performing each part of the calculation in sequence. This will speed up the process even on a local machine, but its true potential is achieved when used in a cloud environment, in which one can temporarily increase the number of virtual calculation cores used when calculations are performed, and scale down whenever they’re not needed, to keep costs at a minimum.

But if it were that simple, why haven’t all insurance companies transformed yet? Part of the reason is that spreadsheet environments and common commercial actuarial modelling software suites don’t always (fully) allow for the use of modern IT solutions, or at an additional fee on top of already expensive license fees (e.g. by offering hosted cloud services at an additional charge). Therefore, insurers have to decide whether they will keep using their current actuarial software, or replace it either with a commercial out of the box solution, or an inhouse developed solution, which is not an easy choice. Moreover, the time pressure on the implementation of new standards and substantial investments in existing systems often make it more natural to recondition them, rather than to replace them for a more optimal environment. Apart from that, these existing systems need to function continuously to perform the reporting process, making it hard to replace them while they need to be used.

In our view and experience, however, innovative digital actuarial platforms can be developed and/or implemented in parallel to the current systems. Portfolios and features can be added gradually over time, while the existing systems generate all the required reports. The old systems can be decommissioned as soon as the respective portfolios and features have been implemented and tested. Although the change may sound big, and probably expensive at first, these innovations will pay for themselves in the long run, as they will immensely increase the efficiency of the actuarial processes.

KPMG Integrated Insurance Platform

For insurance companies that want to digitalize their actuarial processes and systems using an inhouse developed tool, KPMG has developed the KPMG Integrated Insurance Platform (IIP) as a kickstarter. KPMG IIP was developed according to the principles of integration, optimization, and automation, and digitalizes the actuarial modelling & reporting processes for life, pension, and disability insurers.

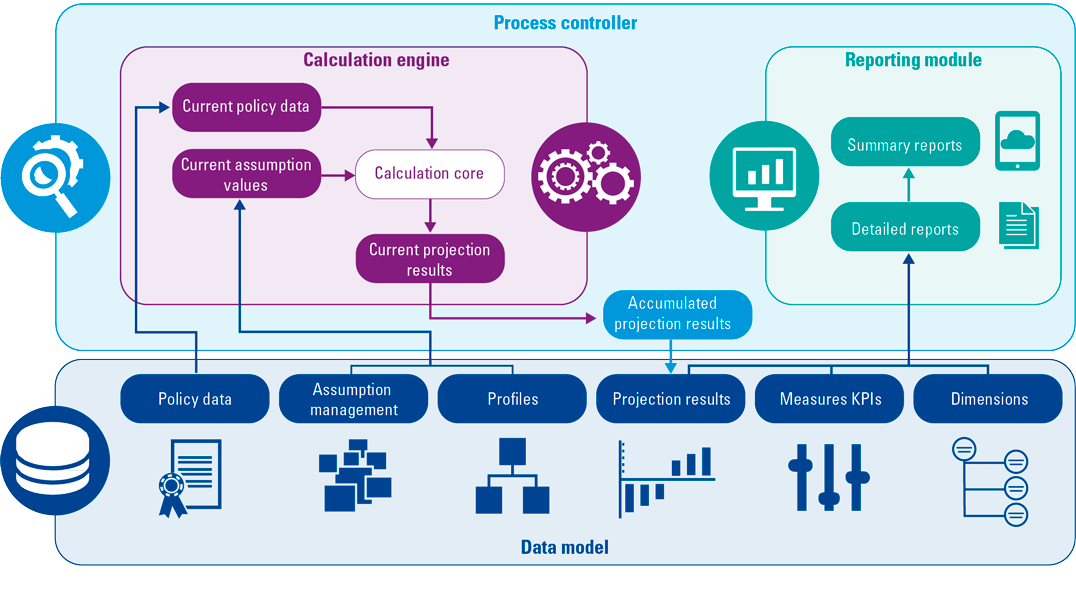

The platform is developed in Python, and consists of four independent modules:

- A robust data model, in which all necessary input data is combined, and all results are stored in an efficient way. The data platform is flexible with regard to data sources, as it can work with any common type of database or spreadsheet.

- The calculation engine provides an environment to build extremely fast actuarial projection models for a wide range of insurance products. The calculation engine allows the user to work with predefined models, and to create its own models to project insurance liabilities for their portfolios in a user-friendly way. These models can be engineered to simultaneously perform the calculations for all the relevant reporting regimes, and the key risk metrics.

- The reporting module provides the user flexibility to both present the projection results at an executive summary level, and provide the option to drill down to the lowest level of granularity to cater to the needs of actuaries/business analysts.

- The process controller automates the entire process: from input data to the production of the report.

Figure 1. KPMG Integrated Insurance Platform. [Click on the image for a larger image]

The main benefits of KPMG IIP are:

- Efficiency & accuracy: The platform leverages on smart actuarial and programming techniques for optimal performance. The automated workflow makes it less prone to manual errors, allows actuaries more time to analyze and interpret results, and shortens the overall process runtime.

- Scalability & flexibility: The platform offers a digital environment to cope with today’s and tomorrow’s business & reporting requirements, due to its scalable and flexible design.

- Controllability: The platform offers a range of automated controls on the input & output data. Also, the source code can be viewed, so the platform is not a black-box solution.

- Affordability: The platform provides an affordable alternative to expensive modelling suites and costly internal development options.

KPMG IIP implementation in the insurance sector

We are proud to say that KPMG IIP is currently live at a Dutch life insurance company. Over the past year all portfolios, including a wide range of different insurance products (traditional, savings mortgages, universal life, and reinsurance contracts), were gradually migrated from their previous implementation in MS Excel to KPMG IIP. The migration was carried out in parallel to the reporting process – the previous models were used for reporting for each product, until the results from KPMG IIP were sufficiently validated – a process for which enough time should be reserved, as the current and new modelling approaches might differ, leading to (slightly) different results, that one does want to understand and explain to be comfortable with the transition. With each product added to the platform, the quality and efficiency of the reporting process for IFRS and Solvency 2 improved significantly. Furthermore, KPMG IIP was also of key importance in the preparations for the implementation of IFRS17, as the MS Excel models did not, and were not suitable, to produce the detailed information required by the new standard for the majority of the products.

More information about KPMG IIP can be found at https://home.kpmg/nl/nl/home/insights/2021/01/kpmg-integrated-insurance-platform.html.

Conclusion

In the past, actuaries and their processes and systems once made insurance companies early digital companies. However, despite an increasing amount of pressure from regulatory demands and decreasing profit margins due to saturation of the insurance market, these processes and systems did not change much conceptually over the past decades, and are now at risk of being unable to cope with today’s, let alone tomorrow’s, demands. We urge insurance companies to reflect on their current actuarial processes and systems, and to consider investing in modernizing them. There is much to be gained by integrating, optimizing, and automating the actuarial processes and systems – it is essential to be able to meet current and future regulatory and business demands, and at the same time actuaries will have more time to focus on quality, and cost levels can be brought down, ensuring competitiveness in a saturated market.