Companies are struggling how to measure and report on their Environmental, Social, and Governance (ESG) performance. How well a company is performing on ESG aspects is becoming more important for investors, consumers, employees, and business partners and therefore management. This article tries to shed a light on how companies can overcome ESG reporting (data) challenges. A nine-step structured approach is introduced to give companies guidance on how to tackle the ESG reporting (data) challenges.

Introduction

Environmental, Social and Governance (ESG) aspects of organizations are important non-financial reporting topics. Organizations struggle with how to measure ESG metrics and how to report on their ESG performance and priorities. Many organizations haven’t yet defined a corporate-wide reporting strategy for ESG as part of their overall strategy. Other organizations are already committed to ESG reporting and are struggling to put programs into place to measure ESG metrics and to steer their business as it is not yet part of their overall heartbeat. Currently, most CEOs are weathering the COVID storm and are managing their organization’s performance by trying to outperform their financial targets. Besides the causality between the climate developments in our weather; from a sustainability perspective the waves are becoming higher, the storm is increasing rapidly as ESG is becoming the new standard to evaluate an organization’s performance.

How well a company performs on ESG aspects is becoming an increasingly important performance metric for investors, consumers, employees, business partners and therefore management. Next to performance, information about an organizations’ ESG metrics is also requested by regulators.

Investors are demanding ESG performance insights. They believe that organizations with a strong ESG program perform better and are more stable. On the other hand, poor ESG performance poses environmental, social, and reputational risks that can damage the company’s performance.

Consumers want to increasingly buy from organizations that are environmentally sustainable, demonstrate good governance, and take a stand on social justice issues. And they are even willing to pay a premium to support organizations with a better ESG score.

Globally, we are seeing a war on talent, with new recruits and young professionals looking for organizations that have a positive impact on ESG aspects because that is what most appeals to them and what they would like to contribute to. Companies that take ESG seriously will be ranked at the top of the best places to work for and will find it easier to retain and hire the best employees.

Across the value chain, organizations will select business partners that are for example most sustainable and are reducing the overall carbon footprint of the entire value chain. Business partners solely focusing on creating their value based on the lowest costs will be re-evaluated because of ESG. Organizations that will not contribute to a sustainable value chain can find difficulties in continuing their business in the future.

The ESG KPIs are only the tip of the iceberg

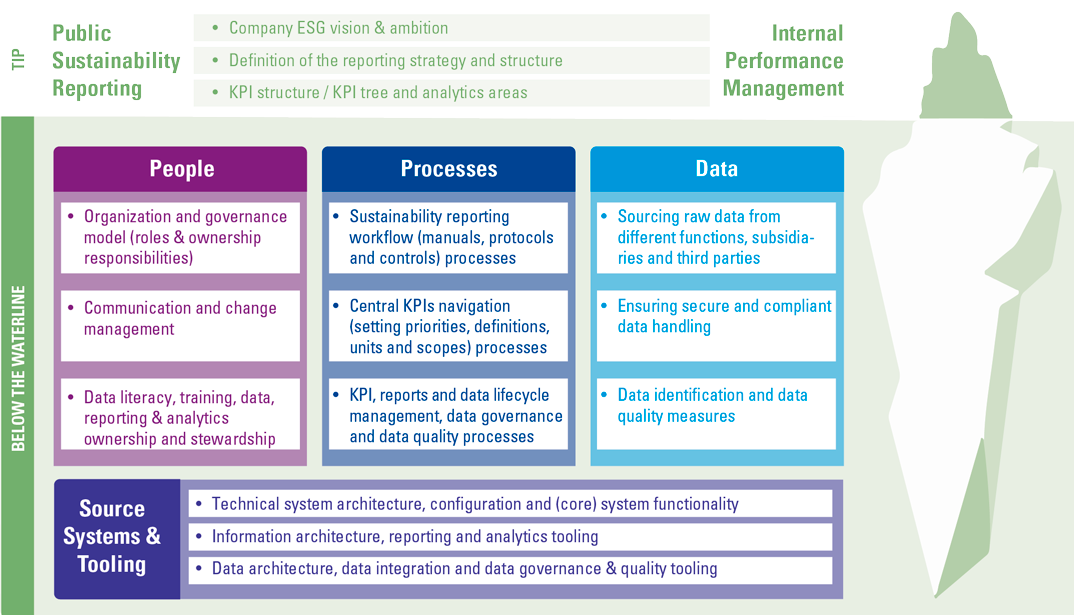

The actual reporting on ESG key performance indicators (KPIs) is often only a small step in an extensive process. All facets can be compared to an iceberg, where only certain things are visible to stakeholders – the “tip of the iceberg”: the ESG KPIs or report in this case. What is underneath the water, however, is where the challenges arise. The real challenge of ESG reporting is a complex variety of people, processes, data and systems aspects which need to be taken into account.

Figure 1. Overview of aspects related to ESG reporting. [Click on the image for a larger image]

In this article, we will first further introduce ESG reporting including the required insights of the ESG stakeholders. After this we will elaborate more on the ESG data challenges, and we will conclude with a nine-step structured approach how to master the reporting and data challenges covering the “below the waterline” aspects related to ESG reporting.

ESG is at the forefront of the CFO agenda

The rise in the recognition of ESG as a major factor within regulation, capital markets and media discourse has led CFOs to rethink how they measure and report on ESG aspects for their organization.

Finance is ideally positioned in the organization to track the data needed for ESG strategies and reporting. Finance also works across functions and business units, and is in a position to lead an organization’s ESG reporting and data management program. The (financial) business planning and analysis organization can connect ESG information, drive insights, and report on progress. Finance has the existing discipline, governance and controls to leverage on the required collation, analysis and reporting of data with regard to ESG. Therefore, we generally see ESG as an addition to the CFO agenda.

ESG as part of the “heartbeat” of an organization

Embedding ESG is not solely focused on the production of new non-financial report. It is also about understanding the drivers of value creation within the organization and enabling business insights and manage sustainable growth over time. Embedding ESG within an organization should impact decision-making and for example capital allocation.

The following aspects are therefore eminent to secure ESG as part of the company’s heartbeat:

- Alignment of an organization’s purpose, strategy, KPIs and outcomes across financial and non-financial performance.

- Ability to set ESG targets and financial performance and track yearly/monthly performance with drill downs, target vs actual and comparison across dimensions (i.e. region, site, product type).

- Automated integration of performance data to complete full narrative disclosures for internal and external reporting and short-term managerial dashboards.

Embedding ESG into core performance management practices is about integrating ESG across the end-to-end process – from target setting to budgeting, through to internal and external reporting to ensure alignment between financial and non-financial performance management.

An important first step is related to articulate the strategy which is about translating the strategic vision of the organization into clear measures and targets to focus on executing the strategy and achieve business outcomes. ESG should be part of the purpose of the organization and integrated into the overall strategy of an organization. In order to achieve this, organizations need to understand ESG and the impact of the broad ESG agenda on their business and environment. They need to investigate which ESG elements are most important for them and these should be incorporated into the overall strategic vision.

Many organizations still run their business using legacy KPIs, or “industry standard” KPIs, which can allow them to run the business in a controlled manner. Conversely, this is not necessarily contributing to the strategic position that the organization is aiming for. These KPI measures are not just financial but look at the organization as a whole. Although the strategy is generally focused on growing shareholder value and profits, the non-financial and ESG measures underpin these goals, from customer through to operations and people/culture to relevant ESG topics.

The definition of the KPIs is critical to ensure linkage to underlying drivers of value and to ensure business units are able to focus on strategically aligned core targets to drive business outcomes. When an organization has (re-)articulated its strategy and included ESG strategic objectives the next step is to embed it into its planning and control cycle to deliver decision support.

In addition to defining the right ESG metrics to evaluate the organizational performance, organizations struggle with unlocking the ESG relevant data.

Data is at the base of all reports

With a clear view of the ESG reporting and KPIs, it is time to highlight the raw material required which is deep below sea level: data. Data is sometimes referred to as the new oil, or organizations’ most valuable asset. But most organizations do not manage data as it was an asset; not in the way they would do for their buildings, cash, customers and for example their employees.

ESG reporting is even more complex than “classic” non-financial reporting

A first challenge with regard to ESG data is the lack of a standardized approach in ESG reporting. Frameworks and standards have been established to report on ESG topics like sustainability. For example, the Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board’s (SASB) which is widely used in financial services organizations. However, these standards are self-regulatory and lack universal reporting metrics and therefore a universal data need.

Even if there is one global standard in place, companies would still face challenges when it comes to finding the right data whereas data originates from various parts of the organization like the supply chain, human resources but also from external vendors and customers ([Capl21]). The absence of standard approaches leads to lack of comparability among companies’ reports and confusion among companies on which standard to choose. The KPI definition must be clear in order to define the data needed.

In April 2021, the European Commission adopted a proposal for a Corporate Sustainability Reporting Directive (CSRD) which radically improves the existing reporting requirements of the EU’s Non-Financial Reporting Directive (NFRD).

Besides a lack of a standardized approach, more data challenges on ESG reporting arise:

- ESG KPIs often require data which isn’t managed till now. Financial data is documented, has an owner, has data lifecycle management processes and tooling but ESG data mostly doesn’t. This affects the overall data quality, for example.

- Required data is not available. As a consequence, the required data needs to be recorded, if possible reconstructed or sourced from a data provider.

- Data collectors and providers’ outputs are unverified and inconsistent which could affect the data quality.

- Processing the data and providing the ESG output is relatively new compared to financial reporting and is in many occasions based on End User Computing tools like Access and Excel which could lead to inconsistent handling of data and errors.

- The ESG topic is not only about the environment. The challenge is that a company may need different solutions for different data sources (e.g. CR360 or Enablon for site-based reporting (HSE) and another for HR data, etc.).

Requirements like CSRD make it clearer for organizations what to report on but at the same time, it is sometimes not clear to companies how the road from data to report is laid out. Looking at these data challenges mentioned above, it is also important for organizations to structure a solid approach on how to tackle the ESG challenges which will be introduced in the next paragraph.

A structured approach to deal with ESG reporting challenges

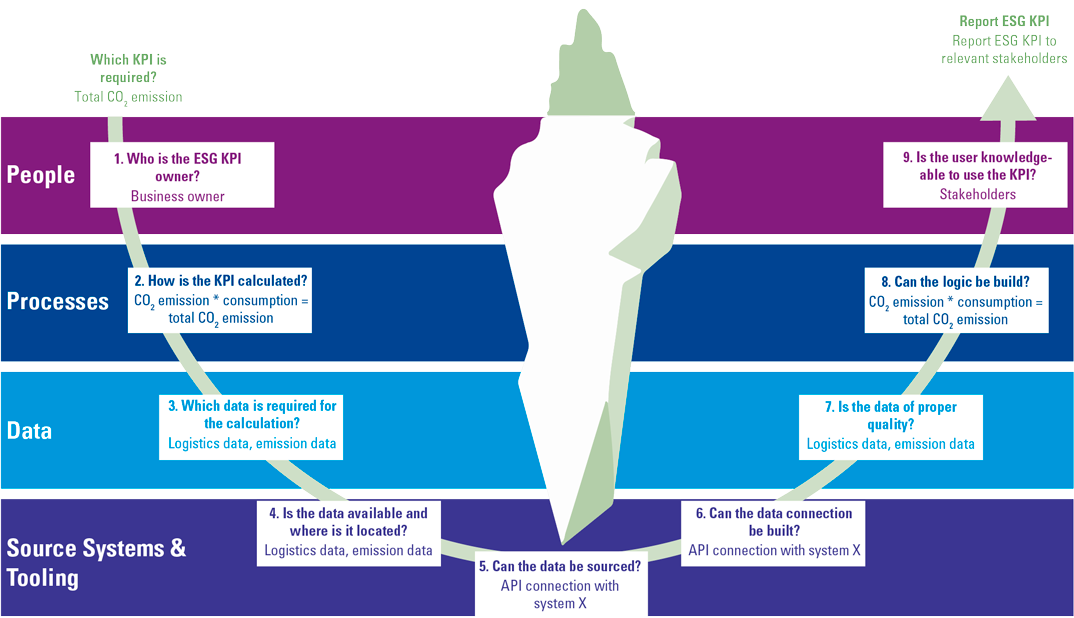

The required “below the waterline” activities can be summarized in nine sequential steps to structurally approach these ESG challenges. Using a designed approach does not cater for all but will be a basis for developing the right capabilities and to move in the right direction.

Figure 2. ESG “below the waterline” steps. [Click on the image for a larger image]

This approach consists of nine sequential steps or questions covering the People, Processes, Data and Source systems & tooling facets of the introduced iceberg concept. The “tip of the iceberg” aspects with regard to defining and reporting the required KPI were discussed in the previous paragraphs. Let’s go through the steps one by one.

- Who is the ESG KPI owner? Ownership is one of the most important measures in managing assets. The targets and related KPIs are generally designated to specific departments and progress is measured using a set of KPIs. When we look at ESG reporting, this designating is often less clear. Having a clear understanding of which department or role is responsible for a target also leads to a KPI owner. It is often challenging to identify the KPI owner since it can be vague who is responsible for the KPI. A KPI owner has multiple responsibilities. First and foremost, the owner is responsible for defining the KPI. Second, a KPI owner is an important role in the change management process. Guarding consistency is a key aspect, as reports often look at multiple moments in time. It is important that when two timeframes are compared, the same measurement is used to say something about a trend.

- How is the KPI calculated? Once it is known who is responsible for a KPI, a clear definition of how the KPI is calculated should be formulated and approved by the owner. This demands a good understanding of what is measured, but more importantly how it is measured. Setting definitions should follow a structured process including logging the KPI and managing changes to the KPI, for example in a KPI rulebook.

- Which data is required for the calculation? A calculation consists of multiple parts that all have their own data sources and data types. An example calculation of CO2 emission per employee needs to look at emission data, as well as HR data. More often than not, these data sources all have a different update frequency and many ways of registering. In addition to the difference in data types, data quality is always a challenge. This also starts with ownership. All important data should have an owner who is, again, responsible for setting the data definition and to improve and uphold the data quality. Without proper data management measures in place ([Jonk11]), the data quality cannot be measured and improved which has a direct impact on the quality of the KPI outcome.

- Is the data available and where is it located? Knowing which data is needed brings an organization to the next challenge: is the data actually available? Next to the availability, the granularity of the data is an important aspect to keep in mind. Is the right level of detail of the data available, for example per department or product, to provide the required insights. A strict data definition is essential in this quest.

- Can the data be sourced? If the data is not available, it should be built or sourced. An organization can start registering the data itself or the data can be sourced to third parties. Having KPI and data definitions available is essential in order to set the right requirements when sourcing the data. Creating (custom) tooling or purchasing third-party tooling to register own or sourced data is a related challenge. It is expected that more and more ESG specific data solutions will enter the market in the coming years.

- Can the data connection be built? Nowadays, a lot of (ERP) systems have integrated connectivity as a standard, this is not a given fact for many systems, however. Therefore, it is relevant to investigate how the data can be retrieved. Data connections can have many forms and frequencies like streaming, batch, or ad-hoc. Dependent on the type of connection, structured access to the data should be arranged.

- Is the data of proper quality? If the right data is available, the proper quality can be determined in which the data definition is the basis. Based on data quality rules for example for the required syntax (for example: should it be a number or a date) the data quality can be measured and improved. Data quality standards and other measures should be made available within the organization in a consistent way in which again the data owner plays an important part.

- Can the logic be built? Building reports and dashboards require a structured process in which the requirements are defined, the logic is built in a consistent and maintainable way and the right tooling is deployed. In this step the available data is combined in order to create the KPI based on the KPI definition in which the KPI owner has the final approval of the outcome.

- Is the user knowledgeable to use the KPI? Reporting the KPI is not a goal in itself. It is important that the user of the KPI is knowledgeable enough to interpret the KPI in conjunction with other information and its development over time to define actions and adjust the course of the organization if needed.

Based on this nine-step approach, the company will have a clear view of all the challenges of the iceberg and required steps that need to be taken to be able to report and steer on ESG. The challenges can be divers starting from defining the KPIs, the tooling and sourcing of the data or data management. Structuring the approach helps the organization for now and going forward, whereas the generic consensus is that the reporting and therefore data requirements will only grow.

Conclusion

The demand to report on ESG aspects is diverse and growing. Governments, investors, consumers, employees, business partners and therefore management are all requesting insights into an organizations’ ESG metrics. It seems like the topic is on the agenda of every board meeting, as it should be. To be able to report on ESG-related topics, it is important to know what you want to measure, how/where/if the necessary data is registered and having a possible approach towards reporting. ESG KPIs cannot be a one-off whereas the scope for ESG reporting will only grow; the ESG journey has only just begun. And it is a journey that inspires to dig deeper into the subject and further mature for which a consistent approach is key.

The D&A Factory approach of KPMG ([Duij21]) provides a blueprint architecture to utilize the company’s data. KPMG’s proven Data & Analytics Factory combines all key elements of data & analytics (i.e., data strategy, data governance, (master) data management, data lakes, analytics and algorithms, visualizations, and reporting) to generate integrated insights like a streamlined factory. Insights that can be used in all layers of your organization: from small-scale optimizations to strategic decision-making. The modular and flexible structure of the factory also ensures optimum scalability and agility in response to changing organizational needs and market developments. In this way, KPMG ensures that organizations can industrialize their existing working methods and extract maximum business value from the available data.

Read more on this subject in “Emerging global and European sustainability reporting requirements“.

References

[Capl21] Caplain, J. et al. (2021). Closing the disconnect in ESG data. KPMG International. Retrieved from: https://assets.kpmg/content/dam/kpmg/xx/pdf/2021/10/closing-the-disconnect-in-esg-data.pdf

[Duij21] Duijkers, R., Iersel, J. van, & Dvortsova, O. (2021). How to future proof your corporate tax compliance. Compact 2021/2. Retrieved from: https://www.compact.nl/articles/how-to-future-proof-your-corporate-tax-compliance/

[Jonk11] Jonker, R.A., Kooistra, F.T., Cepariu, D., Etten, J. van, & Swartjes, S. (2011). Effective Master Data Management. Compact 2011/0. Retrieved from: https://www.compact.nl/articles/effective-master-data-management/