The combination of social media, the smartphone and the tablet has had a significant impact on society today. Millions of users share their personal experiences, ideas, perspectives and dreams through these channels. People also influence each other’s choices of brands and products by means of a simple “like.” This digital “word-of-mouth advertising” is unambiguous and simple, and it bridges the private and business use of social media channels. In this article we look at the current trends within social media in the financial sector. We sketch an overview of social media, consider current initiatives for social media services and discuss data analysis opportunities for financial players.

Introduction

In searching for the right savings account, the most suitable travel insurance or the ideal investments, consumers until recently contacted their bank, insurer or broker, described their goals to the chosen advisor, looked at the different options with the advisor and chose a suitable product in consultation with the advisor. The initial choice of financial institution was usually made on the basis of an existing relationship, familiarity with the brand, or the outcome of a comparison made by an independent party. The socalled consumer to business relationship between client and service provider remained close and confidential. Personal and financial matters were seldom if ever discussed outside the closed office of the advisor.

Social media has broken these earlier taboos. Nowadays users are happy to talk about their financial experiences. They’re shifting the boundaries between private and public information, thereby affecting the financial value chain: the focus is moving from producers to consumers and, at the same time, causing a change in the conduct of professional financial service providers.

In 2013, one issue dominated the agendas of decision-makers in the financial services sector: “client centricity.” Following the financial crisis in 2008, the sector took steps to create an equal, open (European) market with product and price transparency. Services, products and costs now must be explained to clients more simply and more transparently. The complexity and risks of financial products must be minimized.

At first sight, the goals of client centricity and the (unintended) consequences of social media with respect to transparency and openness appear to be very compatible. Financial institutions are, therefore, everywhere on the social media channels. However, the question remains whether the traditionally closed financial institutions are ready for the change to openness and transparency.

The purpose of this article is to inform the reader about the current state of affairs. Before discussing the current initiatives of the financial sector in social media, an overview is presented of what exactly social media is all about. In addition to the most recent steps by service providers, future opportunities and challenges in the field of social media and data analysis are also considered so that, in the end, we can assess and present the role of social media for the sector.

Social media: a phenomenon

Traditionally, consumers used the internet to read and consult its available content, or to buy products. But, more and more, internet users are personally creating content and becoming more active with blogs, wikis and other social media platforms, such as YouTube, Facebook and Twitter. With internet penetration above 90% of the population, of which 70% are members of one or more social media networks ([Mark12]), the Netherlands is a prime example of how consumers have embraced the social media phenomenon.

The business model behind social media networks is focused on promoting information sharing. A direct consequence is a constant flow of up-to-date, personal data that is partly public. Social media thus offers unique access to consumer opinion and also offers financial companies the chance to play an active role in the day-to-day lives of their clients.

Given the enormous potential of social media, a proper understanding of its possibilities is essential. The social media honeycomb framework ([Kiet11]) offers such an analysis, and defines seven characteristics (see Figure 1).

Figure 1. Social Media Honeycomb.

Some of these seven characteristics, such as “identity,” “sharing,” “chats” and “groups,” are self-evident. They form the backbone of the majority of social media sites and are responsible for a large part of the volume of information that a network produces.

Additionally, the characteristics “relations” and “reputations” play an increasingly important role. Based on the identity, conduct and behavior of a user, a mature social media network will suggest suitable information, content or groups for the user to access. What can make a network even more interesting, however, is the approval of friends or acquaintances. Facebook’s “like,” LinkedIn’s “endorsement” or YouTube’s “thumbs up” not only generate recommendations for content, but show users what their friends are interested in and influence their choices for products or services.

This makes consumer approval increasingly valuable for brand identification and marketing, and for selling products and services; thus, it is crucial for the financial sector. The correct use of approval, however, assumes that a financial institution properly understands the role social media consumers play in the value chain.

Social media offers consumers a global podium to spread their message without interference. This could be an opinion, an idea, confirmation or a reaction about or to received information. This enables a single client to ruin reputations or damage brands. If disgruntled clients were to mobilize their networks, the financial sector could also have to deal with major public relations challenges. These networks (consisting of satisfied or unsatisfied clients) could unite in a forum, exacerbate problems and spread incomplete, incorrect information. Overall, (financial) companies are losing influence over consumers through the advent of social media

Summary

Social media offers the financial sector an opportunity to get to know consumers better and a way to approach clients directly. Social media also offers consumers a 24/7, global podium for their message (positive or negative). This will reduce the influence of the sector in favour of the client. The client puts him- or herself at the center. Given the degree of success of social media, the sector has no other choice than to actively support this phenomenon: “like” the client as a friend?

Social media: current initiatives in the financial sector

At present, 75% of retail financial institutions are engaged in at least one social media platform. This is more than are involved in any other digital channel. Expectations are that 87% of all financial institutions will be using social media at the end of 2013.

Social media has changed the behavior of consumers. Whereas clients on the internet were only readers in the past, they have now also become writers via social media. Whereas clients were previously happy to search for content, they now want the content to come to their preferred social media channel. Where clients were previously mostly interested in news producers, they are now mainly interested in the news from their social media friends.

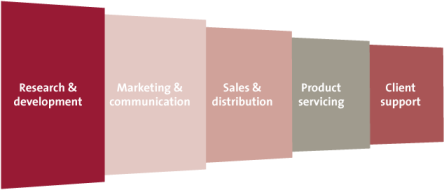

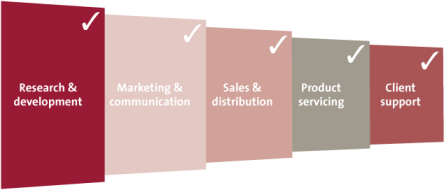

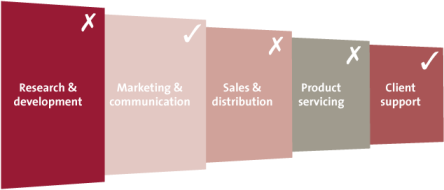

Financial institutions have to adapt their online services, with the relationship with the client being decisive and the adaptation reflecting the changed behavior of clients. The use of social media in the financial sector is very diverse. Based on a number of examples from the banking, insurance and capital market segments, we discuss current initiatives and, in some cases, look at how these initiatives fit in the value chain of a financial institution (see Figure 2).

Figure 2. Generic value chain of a financial company.

Banking

For the banking segment, we focus on the developments at four banks. Fidor Bank from Germany and KNAB from the Netherlands are new players in financial services. For these banks, we briefly describe the integration between their business models and social media. The other two are top banks, CIMB and Barclays. We look at how CIMB uses social media for marketing and product placement purposes. At Barclays, we focus on a SoMoLo (Social, Mobile, Local) service.

In the banking segment of the financial sector, Fidor Bank is a model in the field of innovation and social media. Fidor Bank (“fidor” is Latin for “trusted”) got its banking licence in 2009 and does not have a physical branch network, but built its services around a digital client forum.

Fidor Bank supports different digital channels. It is represented via its own website and the social media channels Facebook, YouTube, Twitter and Google+. The bank distinguishes itself in the field of openness and freedom. Some examples:

- A client of Fidor Bank is allowed to consult independent advice outside from the bank’s own advisors – an example of crowd sourcing.

- A client of Fidor Bank may offer other clients loans or accept loans from other clients – an example of peertopeer funding.

- A client of Fidor Bank may personally decide which services he/she uses – an example of client centricity.

- A client of Fidor Bank may rate products, services and advisors in- and outside Fidor Bank – an example of an “approval” tool.

- A client of Fidor Bank has a single account that shows all the transactions and positions – an example of client centricity.

- A client of Fidor Bank is proactively asked to contribute to thinking about the future of Fidor Bank – again an example of crowd sourcing.

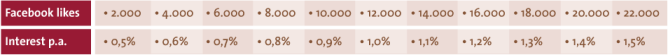

The interaction via social media channels is also innovative. For example, a new client can register via Facebook Connect. Moreover, Fidor Bank is the first bank in the world where the interest on the account depends on the number of Facebook “likes.” The more “likes,” the higher the interest (see Figure 3).

In 2013 Fidor Bank was awarded a Bank Innovation Award [Bank13] for its “Like-Zins” initiative. This is the first user-driven interest rate in a real banking environment. Facebook users can directly influence the credit interest paid on their bank deposit. “Liking” Fidor directly rewards customers for their activities around Fidor Bank in the social network ecosystem. The underlying rules for raising the interest rate are that as soon as 2000 “likes” are logged, the interest rate paid on the bank balances of the entire Fidor checking-account customer base is raised by 10 basis points per year, capped at a total rate of 1,5% per year. As of a couple of months ago, the Fidor Bank Facebook community had affected an increase in the interest paid by Fidor Bank on Fidor checking accounts by 0.5% to 0.7%.

Figure 3. Fidor Bank: ‘likes’ versus interest increase (up to 1.5 per cent).

In addition to the above financial services, Fidor Bank also offers its clients entertainment on the site www.brokertainment.de. Via this service, a client can, on the basis of a small number of financial instruments, place a small bet with the aim of getting to know the financial markets better, in a playful manner.

Figure 4. Fidor Bank: integration of social media and value chain.

Apart from client-related innovation, Fidor Bank also widely uses partnerships, including Smava for peertopeer loans, Bertelsmann for the distribution of services in online games and Hyperwallet for international payments. Most recently, Fidor and Payward have announced an exclusive partnership. Payward is producer of the Kraken digital currency exchange. Further plans in the field of cooperation include open-software APIs for social development and support from the client community for product and service development.

Fidor Bank has introduced a business model in which clients have a central role and social media is interwoven into the DNA of the bank.

CIMB Malaysia: 1.176.506 facebook likes

CIMB Group is a leading ASEAN universal bank, the largest Asia Pacific investment bank outside of Japan, and one of the world’s largest Islamic banks. Their 1,176,506 Facebook “likes” show that CIMB “gets” social media. On the CIMB sites you can actually engage with the bank by, for example, voting on the design of their latest credit card, or taking part in games to win prizes.

CIMB Malaysia launched a clearly defined social media strategy in 2011, one that was implemented across countries in ASEAN with equal success. It included an entire re-branding exercise over social media and launch of marketing campaigns, which have increased sales by over 45%. CIMB Group plans to launch more products through social media by year-end, targeting the Generation Y (Gen-Y), according to Deputy Group Chief Executive Officer and Head of Consumer Banking Renzo Viegas.

The Kwik Account is a new product from CIMB Bank that offers some innovative features:

- The Kwik account is an account that a client can open online, anytime and anywhere without going into a branch, giving the client immediate use of the account.

- The Kwik account allows the client to send and receive money immediately by keying in a friend’s or family member’s email address or mobile number (instead of account number) to transfer funds within CIMB Bank.

- With the Kwik account the client can make online purchases, pay bills, reload mobile prepaid credit, remit funds and more.

Social media is evidently a key component of CIMBs marketing and customer communication strategy.

Barclays, UK: Pingit, payment service for smartphones

Barclays is the biggest retail bank in the UK. In February 2012, Barclays introduced the smartphone app Pingit, which supports Apple’s iPhone, Android and BlackBerry. With Pingit, users can make payments using only the telephone number of the recipient. Pingit is positioned as a SoMoLo (Social, Mobile, Local) service.

Pingit has a number of unique characteristics:

- A Pingit user does not have to be an existing client of Barclays.

- A Pingit user can register online with Barclays.

- A Pingit user can make a payment to a nonPingit user.

- A Pingit user can receive/send money via several telephone numbers (maximum four).

- A Pingit user can send a payment request.

- A Pingit user can initiate both local (in the UK) and international payments.

Barclays indicates that 80% of the people who receive a Pingit payment register as a user. The bank set up a service that first serves the needs of consumers and thus takes on competition with new players for payment systems. However, in October 2013 Barclays disclosed that the Pingit payments app has over a million registered users, 25,000 of which are small businesses.

KNAB is an online banking initiative of Aegon, a Dutch international insurer. KNAB (BANK spelled backwards) was launched on the Dutch market in September 2012 and wants to put its clients first. Apart from making payments, clients can save, invest, have their investments managed and make a deposit. In addition, they can keep a budget book and draw up a financial plan.

KNAB does not have a branch network but offers its services via its website and an iPhone app. In addition, KNAB is on LinkedIn, Twitter and Facebook.

KNAB was the first Dutch bank to introduce an integrated concept with a number of social media characteristics:

- Clients of KNAB get a total overview of their financial position, including accounts at other banks.

- Clients of KNAB can approach independent advisors via KNAB; KNAB does not receive any commission for this.

- Clients of KNAB can rate advisors of KNAB.

- Consumers and clients may approach KNAB during working hours (between 8 a.m. and 10 p.m.) via chat.

Using their social media username, consumers can participate in the KNAB live community. Moreover, KNAB has introduced a service that will automatically transfer money from a savings to a current account when the latter slides into overdraft, which theoretically saves the client from having to pay penalties or interest.

With KNAB, Aegon introduced an innovative banking concept that focuses on good service provision and includes several social media characteristics. The bank was aiming to welcome 30,000 clients within its first year. However, it seems that potential customers are as yet unwilling to switch banks, irrespective of obvious benefits (RTL13]).

Capital markets / investment management

Innovation has been a hallmark of the capital markets segment of the financial sector for a long time. This segment is also characteristically international. These two aspects are reflected in our selection of notable initiatives in this segment. We have chosen two trading platforms: eToro, a global forex platform based in Cyprus, and Zecco, a US broker started by two Dutch nationals. Both parties have been awarded numerous prizes for their ground-breaking business model.

eToro is a social media trademark established in Cyprus in 2007. With eToro, clients can use different internet-based services to trade in foreign exchange, commodities and indices. eToro is accessible via different channels, such as its own website and Facebook. eToro also supports Apple’s iPad/iPhone and Android and BlackBerry devices.

By means of free lessons and a demo account, eToro supports gradual introduction to trading. The eToro service consists of a trading and market application and features social media characteristics:

- eToro clients are encouraged to follow other, more experienced traders – an example of the social media characteristic “relationships.”

- eToro clients can draw up their own index and share it with other eToro clients. This enables eToro clients to follow several traders and instruments.

- eToro clients can participate in trade challenges to assess themselves against others – an example of the social media characteristic “groups.”

- eToro clients can follow forex news on the eToro blog.

- Based on the performance of a trader and their own risk tolerance, eToro clients can determine their own strategy – an example of the social media characteristic “reputation.”

eToro has 3 million users across 200 countries in its trading community. This community and the way individuals in the group can learn and benefit from each are ground breaking. The latest eToro innovation is the significant simplification of the customer sign-up process. New eToro users are now able to join in minutes by entering basic information, as opposed to scanning traditional identification documents such as bank statements and passports. Overall, eToro delivers a quick, user-friendly and secure experience befitting a global service provider.

Zecco, US: trade application on Facebook

Zecco is an online broker established in the US in 2006. With Zecco, clients can trade in shares and options via different internet-based services. Zecco’s services are also accessible via different channels, such as the web browser and Apple’s iPhone and Android devices.

In 2011 Zecco launched a unique Facebook application called Wall Street. With Wall Street clients can deal directly on the stock market via Facebook. Wall Street has a number of unique characteristics:

- Every Facebook user can use up-to-date share prices and statistics via Wall Street.

- Every Facebook user can access the discussion groups via Wall Street.

- Every Zecco client can receive quotes and trade in shares in a safe Facebook environment.

As such, Wall Street is the first and only Facebook application that places orders on the stock market directly. This has lead to success. After its merger in 2012 with TradeKing, another early adopter of social networking for traders, Zecco’s combined client base is approximately 500,000 accounts with several billion dollars in client assets.

Figure 5. Zecco: integration of social media and value chain.

Insurers

The insurance market is the next segment of the financial sector we assess for its use of social media. There is a lot of competition in this segment (compared to the banking segment). There are about 170 different labels in the Netherlands ([FX12]) that provide one or more services in the field of healthcare, non-life and life insurance.

To provide a picture of the current social media initiatives we selected three companies/services: the “Speel je toekomst” (“play your future”) platform of Aegon, the Facebook integration of Allianz in Germany and the Facebook integration of Ditzo, an innovative label on the Dutch market.

Speel je toekomst, Aegon, the Netherlands: infotainment

“Speel je toekomst” is an online initiative launched by Aegon in 2011. The platform offers users the ability to simulate their financial future based on their current living situation and future expectations. In a game-like setting, consumers can input data relevant to their pensions and financial situation, play with options and see the consequences for their retirement.

The “Speel je toekomst”‘ platform has a low threshold, uses a web browser and has a number of social media characteristics:

- A “Speel je toekomst” user can log in with his/her Facebook user name.

- A “Speel je toekomst” user can share experiences on Facebook and Twitter.

“Speel je toekomst” fits in with the goal of Aegon to assist consumers in making financial choices. The idea of the platform looks ideal for social media, but integration with social media channels is minimal.

Figure 6. Allianz Deutschland: integration of social media and value chain.

Facebook, Allianz Deutschland AG: infotainment

Allianz Deutschland is present on Facebook and accentuates its “Standort” (location), Munich. The content of Allianz Deutschland on this channel is up-to-date, versatile and surprising; it is also updated every three to four days with interesting themes, such as sport, healthy eating and events. This Facebook page has 230,000 “likes.” Other characteristics include:

- Consumers can participate in a number of betting games.

- Consumers can look at photos, including a number of pages about the Oktoberfest in Munich.

- Consumers and clients can post questions and comments that are answered relatively quickly (within ten minutes).

Allianz Deutschland is a good example of what presence on Facebook can look like. The versatility and response time reflect the behavior of social media users.

Ditzo is a new online label of ASR Netherlands and offers its services exclusively via the internet and the social media channels Facebook and Twitter. The content on the Facebook page is limited, aimed mainly at Ditzo itself, and is updated monthly. The Facebook page has 13,000 “likes.” Other characteristics include:

- Only very limited interaction visible between Ditzo and visitors to the Facebook page.

- Consumers can request a premium via Facebook for different insurance products. After submitting details, consumers are connected to the Ditzo website, where the premium request is processed further.

- Consumers cannot return to the Facebook page via the website.

Ditzo has a moderate presence on Facebook. Communication with consumers is restricted to themes directly related to insurance products, and there is no community.

Summary

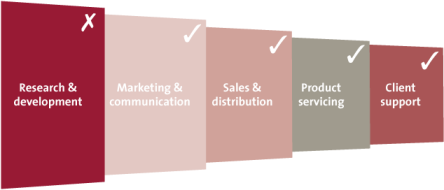

The financial sector has responded to the challenge of social media in different ways. Some companies have embraced the concept with great success and use social media in all five segments of the value chain. Others are at the beginning of the challenge and are concentrating mainly on marketing and communication.

Where a financial institution has absorbed social media into its DNA, clients were also automatically given a central role. There are also examples of companies supporting crowd sourcing or external partners (e.g., Fidor Bank and KNAB).

The SoMoLo concept still has little support in the financial sector. Barclays is an exception with its payment app Pingit. The danger of the wait-and-see strategy is that new rivals may conquer the market. The social media market itself is an example of this.

Social media data analysis in the financial sector

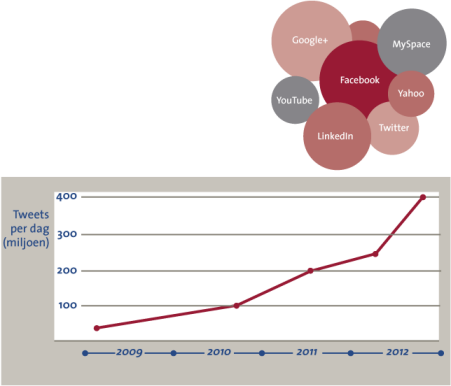

The popularity of social media networks generates an indeterminately high volume (see Figure 7) in constant, up-to-date data about the most diverse issues. Consumers share their personal experiences, ideas, perspectives and dreams and give their frank opinions about labels, products and services. Politicians, government, the press and the corporate sector inform stakeholders through several channels. The speed of this information outpaces that of the traditional media.

Figure 7. Twitter volume and social media sources.

All of this offers perspectives for the financial sector, which itself usually offers digital services and where data is a vital raw material for new products and services. Due to the lack of structure, the use of this source of social media information is a challenge. Nevertheless, provided one can define one’s information need, it is possible to identify and collect useful data from the unstructured data. The applications for this in the financial sector are therefore endless.

Based on a number of examples from the different market segments, we discuss initiatives in the field of social media data analysis. To start with, we look at nonsector-specific applications, followed by examples for our three segments: banks, capital market/investment management and insurers.

Figure 8. Timeu.se: What Do People Do All Day?

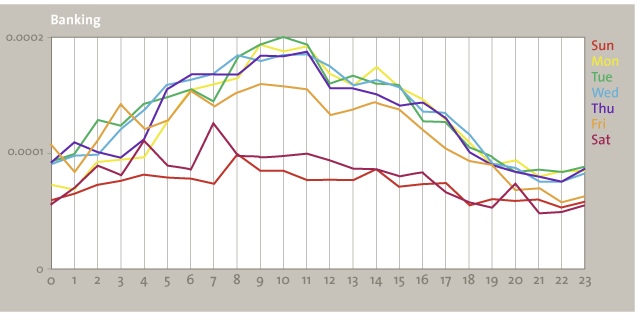

Access to a versatile source of data offers companies the opportunity to collect or verify assumptions for strategy, service and product development and marketing and sales. For example, marketing benefits from the application of social media. By using available data, Twitter messages, a marketing campaign can be better directed. Scott Golder of Cornell University ([Gold12]), for instance, developed an application with which it is possible to establish when people perform a specific action, such as eating breakfast, reading or banking (see figure 8).

This knowledge can be used to determine on which day of the week and at what time an online marketing campaign should take place. Furthermore, the results of a campaign can be directly mapped, among other things, by measuring changes in market sentiment via social media.

Banking

The banking segment is both a consumer and producer of data. Using data from funds transfers, for example, a bank can identify important patterns. This and other quantitative, internal data can be linked to personal data from social media sources. This enriched information can then be used for financing, determining creditworthiness or investment advice.

The link between internal financial information and external public information touches a very sensitive issue: privacy. How sensitive, the following aspect will show.

In June 2012 the German credit-rating agency, SCHUFA, announced a three-year research project. The purpose of the project was to investigate the validity of external data and analyze technologies for collecting data on the internet. SCHUFA indicated in its announcement that information was already being gathered via the internet ([SCHU12]). Furious public and political outrage forced SCHUFA to shelve the project two days after the announcement.

Capital markets / investment management

Capital markets have been traditionally both consumers and producers of data. Data is seen as a product by itself, driving the data-provider business model. Players such as Thomson Reuters and Bloomberg are prime examples of successful companies in this space. The computerization of the stock markets has also resulted in more efficient and transparent markets and ensured an increase in the data volume. Since the beginning of this century, the market data feeds and electronic news feeds have been linked to the trading strategies of the investors.

Through the advance of social media, data providers have already expanded these news feeds with a “sentiment” score directly derived from social media. As a result, the emotion of the “nonprofessional” market can also be included in trading strategies.

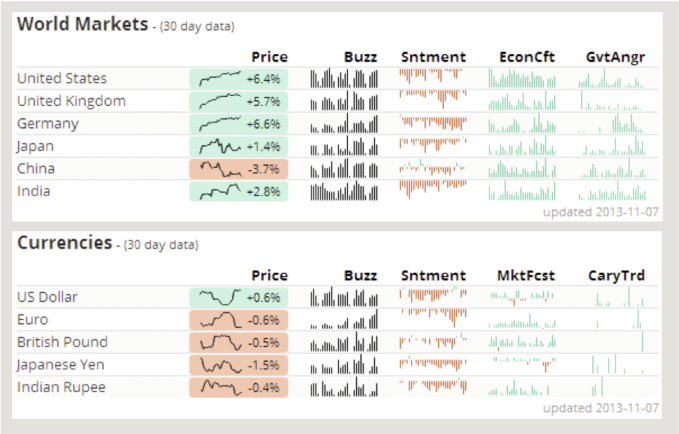

Apart from data vendors there are also specialists, such as MarketPsych, that offer different types of indices (see Figure 9) on the basis of which a dealer can act. These indices anticipate the direction of the market.

Figure 9. MarketPsych Sentiment Charts.

Insurers

The business model and financial results of an insurer are mainly determined by the proper use of data. The actuary of an insurer evaluates risk on the basis of data to monitor the company’s solvency and provisions. The analysis of social media data can be applied to many facets within an insurer.

The US company ISO, a leading provider of statistical, actuarial information and fraud applications, launched a new service to assist claims and fraud inspectors. The aim is to map the presence and behavior of individuals on social media networks, the so-called “web footprint,” and gather related digital information. By using the information when settling a claim the insurer verifies whether the claim is valid and thus prevents fraud. In addition, when contracting an insurance product, an insurer can verify the information as shared by the client on the basis of his/her web footprint.

The data debate: four challenges

Many financial institutions recognize the opportunities for using social media data. Gathering and analyzing it can provide insight into patterns of the clients, the products and the competition. However, using the data should be carefully considered and, at the start, the following questions should be asked:

- Can one offer certainty about the validity of the data? Social media data is primarily generated by the users themselves and is therefore difficult to validate. Is the information a true reflection of the consumers?

- Who else has also access to the data? The data in the form received will become more and more a commodity to which everyone has access. To benefit from the added value of the data, a company will first have to enrich and expand the data.

- When does the data volume exceed the demand? The growing data volume will become a problem for many companies. By using modern analytical techniques, a limited volume of data can be used for different purposes.

- Who owns the data? Who owns data generated from social media is a critical question asked by numerous sectors. A lot of data is created in the public domain, which gives the impression that this question is not relevant. If financial companies are going to offer a greater share of their online services via social media channels, this issue will become weightier.

Summary

For the financial sector, data is a valuable commodity already produced by several companies in the sector as a direct result of their service portfolio. Social media data offers the financial industry the opportunity to enrich internal data and thus create more value, something that looked like an impossible challenge until recently.

Conclusion

The development of social media is difficult to predict. One thing, however, is certain: consumers have fully embraced the networks and adjusted their behavior accordingly. The financial sector will have to reflect this behavior by approaching clients proactively, initiating the dialogue and identifying the points where clients connect with its value chain. Putting the client at the center is no mere theory but a fact. The client as “friend” is the new motto.

Sources

[Bank13] bankinnovation.net

[FX12] www.fx.nl.

[Gold12] S. Golder, timeu.se.

[Kiet11] J.H. Kietzmann et al., Social Media? Get Serious! Understanding the Functional Blocks of Social Media, Business Horizons 54 (3), 2011, pp. 241-251.

[Mark12] www.marketingfacts.nl.

[RTL13] RTL News, Oct. 2013.

[SCHU12] SCHUFA, HPI und SCHUFA starten gemeinsames Web-Forschungsprojekt, www.schufa.de, release 5 June 2012.