Because of its ability to provide unforgeable proof of ownership and authenticity of watches through digital certificates, Blockchain can benefit consumers by creating trust in pre-owned market transactions and transparency on brands’ commitment to environmental sustainability. In this article, we review the drivers behind the adoption of blockchain technology in the luxury watchmaking industry during the last few years. We will take a close look at how Blockchain is being used to create digital twins of watches to ensure the traceability and authenticity of watches, with particular attention to the case study of Breitling, one of the pioneering watchmaking companies in the use of blockchain technology. Finally, we will take a glimpse at how the collection of luxury watches may become a fully digital experience through the launch of non-fungible watches, or digital-only watches.

Introduction

Blockchain has often been referred to as the internet of the future and its potential for disruption has been compared to the changes brought by the Internet to our way of life since the turn of the century. First appearing in 2008, when developers under the pseudonym of Satoshi Nakamoto published a white paper defining its model, Blockchain has since found applications in the world of crypto currencies and in organizations’ supply chains.

If a few years ago the adoption of Blockchain in the luxury watch industry seemed to be a hype, nowadays it has become a mature trend that is changing the relationship between watch owners, collectors, consumers in general and luxury watch brands. An increasing number of brands are adopting Blockchain to implement digital IDs or “Digital Passports” for their watches in order to grow their Direct-to-Consumer (DTC) channels and increase their margins – by cutting out intermediaries (i.e. multi-brand retailers) – and better connect with consumers and take control of the customer relationship.

A 2021 McKinsey study forecasts that about 2.4 USD billion in annual watch sales, spanning the premium to ultra-luxury segments, will shift from multi-brand retailers to direct-to-consumer brands by 2025 ([Beck21]). Driven by the young consumer segment, with Millennials and Generation Z leading the way, the e-commerce of luxury watches will be the fastest-growing direct-to-consumer (DTC) channel, rapidly expanding from just 5% of sales in 2019 to between 15% and 20% by 2025.

What is Blockchain technology?

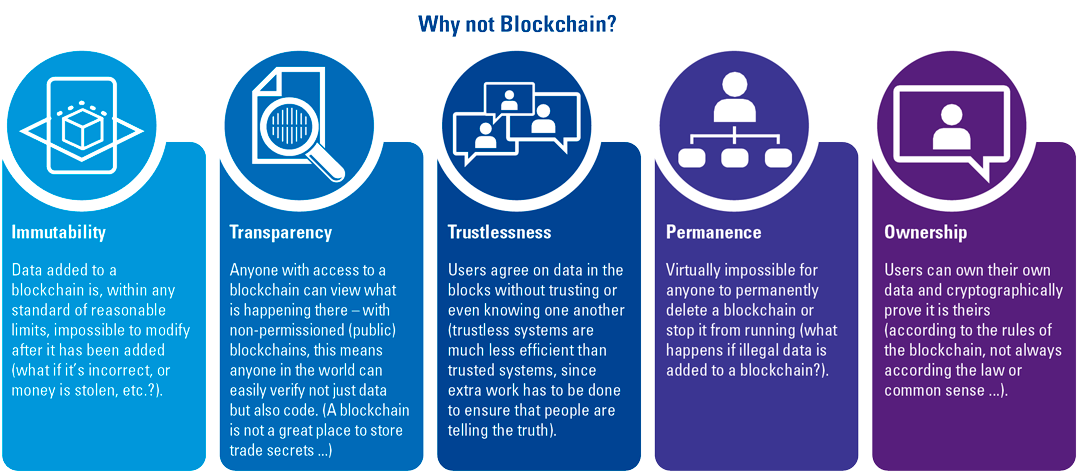

Blockchain is a digital ledger, decentralized and distributed over a network, structured as a chain of registers responsible for storing data. It is possible to add new blocks of information to the chain of registers (i.e. blockchain), but it is not possible to modify or remove blocks previously added to the chain. Encryption and consensus protocols guarantee security and immutability across the blockchain. The result is a reliable and secure system, where our ability to use and trust the system does not depend on the intentions of any individual or institution (see Figure 1).

Figure 1. Blockchain Fundamentals. [Click on the image for a larger image]

Blockchain enables the digitalization and storage of the identity of a watch as a block onto the digital ledger as a digital ID (e.g. think of it as a “digital passport”) and this identity cannot be tempered with. Throughout the life cycle of the watch, the owner will be able to add blocks of information to the existing first identity block – e.g. additional information on servicing and lost and found – and form a chain of blocks representing a chronology of events relating to the watch. This chronology, or chain of blocks, ensures the traceability and transparency of the watch and therefore its authenticity and ownership.

The digitalized identity of the watch is created through non-fungible tokens (NFTs): unique cryptographic tokens that exist on a blockchain and cannot be replicated. NFTs can represent real-world items like artwork and real-estate, in addition to luxury products. They can even represent individuals’ identities, property rights, and more. “Tokenizing” real-world tangible assets such as watches makes buying, selling, and trading them more efficient while reducing the probability of fraud.

The Drivers behind the adoption of Blockchain

An increasing number of brands are adopting Blockchain to grow their Direct-to-Consumer (DTC) channels, which is made possible by digitalization of the relationship between brands and their customers. Social and consumer behavior trends are behind the key drivers behind digitalization.

The customer base of luxury watches has been getting younger. Nowadays, as reported in the McKinsey study, affluent young consumers prefer buying their watches directly from mono brand retail channels. They have a much greater knowledge and culture of watchmaking, which allows them to consider an online purchase without having to visit a store.

The success of the online auctions in 2021 reflects changing social and consumer behaviors: younger generations are more open to purchasing luxury goods online, a trend that was only facilitated and accelerated by the pandemic effects. A snapshot of online auctions buyers and participants shows a large number of them being newcomers (e.g. Phillips 40%; Sotheby’s 44%; Christie’s over 20%), a majority of them being under the age of 40, and bidding from over 80 different countries.

The pandemic has accelerated the digitalization of the relationship between luxury watch brands and consumers. The lockdowns and restrictions caused a temporary stoppage of production and distribution and considerably affected business in the entire high-end watch industry. As a result, many consumers turned to the online market to satisfy their desire for a luxury watch.

Most brands are also moving into the pre-owned market. The pre-owned market was the industry’s fastest growing segment in 2021. It is expected to reach 20 to 32 billion USD in sales by 2025, up from 18 billion USD in 2019, which will be more than half the size of the first-hand market at that time. That’s an 8 to 10% per year increase compared to the 1 to 3% market increase for new watches. High-end watch brands see the pre-owned market as an opportunity to allow new clientele to experience the brand or enter the luxury market in general. Technologies like Blockchain and Artificial Intelligence are helping with authenticity and in creating secure, and intelligent user-friendly e-commerce platforms that establish trust in digital transactions and combat counterfeiting.

A “Digital Passport” for all watches

A “Digital Passport” is essentially a digital certificate of authenticity and ownership of a watch stored on a blockchain. The passport represents a means to monitor and control the long life cycle of watches: from production, to sale, to resale, and to the recycling the materials from the watch case. Blockchain is used to record information (data, photos, documents) characterizing a collector’s watch for example – from point “zero” in time (issue of the certificate) throughout the life of the watch, and in a fully secure and non-falsifiable manner, while also maintaining the anonymity of the owner.

Take the case of this year’s Bulgari Octo Finissimo Ultra limited edition (see Figure 2), a technological excellence with its case of only 1.8 mm thickness. The Italian watchmaker part of the Richemont group announced that each one of the 10 pieces produced has a QR code laser engraved on the barrel and visible on the dial. When scanned, the QR code yields access to a unique NFT representing digital artwork and serving as a method of authentication. The launch of the Octo Finissimo Ultra and its digital passport was made in partnership with LVMH-founded AURA Blockchain Consortium.

Figure 2. The Octo Finissimo Ultra by Bulgari. It carries a laser engraved QR code on the dial which gives access to its digital passport. [Click on the image for a larger image]

By creating a unique digital ID for each watch, the AURA Consortium delivers proof of authenticity and ownership, product history information, and access to improve after sales services for clients. It establishes client trust and protection against counterfeiting, transparency as to the material and standard used to produce the watch, and ability to monitor the life of the watch through pre-owned markets.

Using “Digital Passports”, brands connect directly with their customers and get access to consumer data bypassing intermediaries like multi-brand retailers, enabling them to implement more effective marketing and product strategy.

The case of Breitling

In October 2020, Breitling announced that all its new watches would come with a Blockchain-based digital passport. Since then, each new Breitling watch is assigned a unique unforgeable digital certificate that proves authenticity and is also capable of storing information about all events throughout the life cycle of the watch (i.e. repairs, change of ownership, etc.). The solution creates a direct, secure, permanent, and anonymized communication channel between Breitling and its products, and its watch owners.

As explained by Breitling on their website, the goal of embedding its new watches with a digital blockchain technology is to transform its customer relations and watch owner experience by delivering transparency, traceability, and tradability.

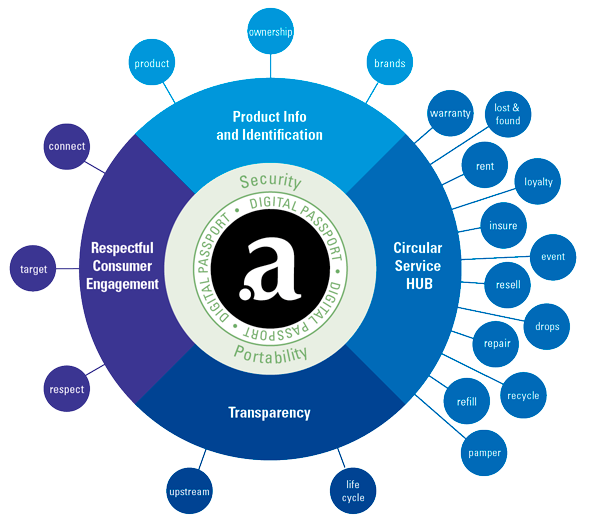

The digital passport ecosystem (see Figure 3) enables Breitling to deliver a series of digital after-sales services to its customers starting with the full digitalization of the warranty program, customer support (e.g. repair & service, lost & found, insurance), transparent tracking of the history and transactions of the watch, while ensuring watch owners to maintain control over their personal data and remain anonymous. The innovative approach by Breitling includes connecting the community of Breitling owners via a trade-in platform where they can transfer the ownership of their watches, enriched with real time estimates of the watch value.

Figure 3. The Breitling-Arianee “Digital Passport” Ecosystem. [Click on the image for a larger image]

Breitling’s digital passport is secured by Arianee technology. Arianee is an independent participatory organization created in 2017 providing a global standard based on Blockchain for the digital certification of authenticity of luxury watches. For Breitling’s watches with a Arianee certificate, watch owners can scan the QR code on the e-warranty card using their smartphone and then claim ownership of the watch’s digital passport.

In addition to Bretiling, Vacheron Constantin and other luxury watch brands like Audemars Piguet, Roger Dubuis, and MB&F have also subscribed to Arianee’s digital passport.

Conclusion: What’s next? Non-fungible watches are here!

Consider non-fungible watches (NFWs) as the final frontier of watchmaking. A non-fungible watch is essentially a purely digital watch: a non-fungible token (NFT) sold in the form of a video, image, or the intellectual property to a watch prototype. Where watchmakers like Breitling are using NFTs to store on the blockchain the digital passports of a physical watch, other market players have begun using NFTs to store a digital watch not linked to a physical item and sell it or auction it.

Beyer Chronometrie, the world’s oldest watch store located in Zurich, Switzerland, for example, has launched in 2021 one of the market’s first NFWs collections. In collaboration with FTSY8 Fictional Studio, Beyer has designed and created a selection of collectible NFWs called Time Warp Collection (see Figure 4). In the words of Beyer, the collection “explores the intersection between traditional watchmaking and the aesthetics of technology, gaming, fashion, and street wear”. Beye’s NFWs can be purchased via the retailer’s website and can be traded on the OpenSea platform, the largest digital platform for NFT sales and auctions.

Figure 4. NFT Watch Allevio from the Time Warp Collection by Beyer Chronometrie and FTSY8. [Click on the image for a larger image]

A NFW is not linked to a physical watch in the real world; it represents a unique item in the blockchain and as such it is valued for its scarcity. Where a watch collector will value the quality of craftsmanship and technical complexity of a mechanical watch, the owner of a NFW will enjoy possession of a unique digital watch that cannot be damaged or stolen. Whether NFWs point to the end of mechanical haute horlogerie as we know it, or they simply represent a hype, only time – measured from a real watch – will tell us.

References

[Aria22] Arianee (2022). Website of Arianee. Retrieved from: https://www.arianee.org

[Aura22] Aura Blockchain Consortium (2022). Website of Aura Blockchain Consortium. Retrieved from: https://auraluxuryblockchain.com

[Beck21] Becker, S., Berg, A., Harris, T., & Thiel, A. (2021, June 14). State of Fashion: Watches & Jewelry. McKinsey & Company. Retrieved from: https://www.mckinsey.com/industries/retail/our-insights/state-of-fashion-watches-and-jewellery

[Beye22] Beyer Chronometrie (2022). The first Beyer NFT Drop – limited to 100 pieces. Retrieved from: https://www.beyer-ch.com/en/blog/the-first-beyer-nft-drop-limited-to-100-pieces/

[Brei20] Breitling (2020, October 13). Breitling becomes the first luxury watchmaker to offer a digital passport based on blockchain for all of its new watches. Retrieved from: https://www.breitling.com/us-es/news/details/breitling-becomes-the-first-luxury-watchmaker-to-offer-a-digital-passport-based-on-blockchain-for-all-of-its-new-watches-33479

[Bulg22] Bulgari (2022). Octo Finissimo Ultra. Retrieved from: https://www.bulgari.com/it-ch/orologi/uomo/octo-finissimo-orologio-titanio-grigio-103611

[Chia19] Chiap, G., Ranalli, J., & Bianchi, R. (2019). Blockchain: Tecnologia e applicazioni per il business. Hoepli.

[Gala19] Galanti, S. (2022, January – March). Lo stato del settore orologiero svizzero nel 2021. La Rivista n.1 – Anno 113, p. 44.

[LVMH21] LVMH (2021, April 20). LVMH partners with other major luxury companies on Aura, the first global luxury blockchain. Retrieved from: https://www.lvmh.com/news-documents/news/lvmh-partners-with-other-major-luxury-companies-on-aura-the-first-global-luxury-blockchain/