Blockchain as the new infrastructure standard is argued to be a sure thing. Compact interviewed Jeroen van Oerle, portfolio manager at Robeco, to discuss his view of this future and to find out more about the blockchain and its advantages and obstacles.

Introduction

A desk in the average office of forty years ago looked completely different than it does today. Space was needed to make room for all the tools and information required to be able to do your job. Nowadays, having a full and unorganized desk is unnecessary. The turning point came a few decades ago; stacks of paper, calculators, pens and pencils, notepads, and the agenda were replaced by just a computer and a mobile phone (see Figure 1 on the IT evolution). Excel was released by Microsoft in 1985 and made most of the physical administration tools redundant. Organizing and sharing your work became easier. However, efficiency and security of administration have not yet reached their optimal state.

The next step in the evolution of the desk is unlikely to be so visible. Nevertheless, its impact could penetrate even deeper into our everyday work and private lives. The blockchain is expected to bring this disruption and has been a hot topic for some years. It is interesting to now know what are the key advantages and obstacles that need to be taken into account.

Compact spoke to Jeroen van Oerle at the Robeco office in Rotterdam. Jeroen is currently a trends analyst within Robeco’s trends investing team, focusing on innovation in the financial sector.

In addition, he is the portfolio manager of the recently launched Robeco Fintech Fund. Robeco has already been investing in fintech for six years via their New World Financials portfolio, in which the subtrend represents approximately 38 percent. But with the launch of the fintech fund, this theme has become a focused strategy.

What are the current top concerns in the asset management or finance domain?

The Robeco trends investing approach uses a framework that identifies three main drivers of change: technological change, social change, and regulatory change. The first of these offers the most investment opportunities.

The main challenge in the asset management industry is that on the one hand fees are coming down, and on the other hand costs are going up. Operational, regulatory and back office operations costs are increasing, and these cannot be passed on to customers. This squeeze on margins forces companies to invest in technology from an efficiency perspective. Along with this, investments are required to prepare for trends, such as the movement from defined benefits to defined contributions in pensions, and from institutional to retail customers.

Consequently, where small asset management firms can specialize in order to survive, and larger firms can diversify to deal with higher costs, the asset managers of medium-sized companies are stuck in the middle, being forced to choose or lose; become a boutique or consolidate to increase scale.

Moreover, once robo-advice becomes bigger it will create opportunities for specialized IT companies that do not necessarily have the financial expertise themselves. Since being able in due time to compete against large tech companies is certainly not unimaginable, the technology you are working with should be as optimal as possible. These companies have all the technology at their disposal and are extremely customer focused. Note that, despite their lack of financial expertise, we see tech companies, such as Apple, Samsung and WhatsApp, joining the financial domain market by introducing payment systems and they could expand this line of work even further in the future, for example, to asset management.

Where can blockchain play a role to address these concerns?

The margin squeeze in asset management requires more efficient operations. Blockchain is a new way of administration. This started with pen and paper, was followed by automation and will in the future be potentially revolutionized by blockchain, or more generally speaking Distributed Ledger Technology (DLT).

DLT creates efficiency gains on the one hand by pushing down customer onboarding costs and time by providing documentation at a cheaper and faster level. On the other hand, it increases efficiency in back-office operations. For example, the post-trade process currently takes two to three days, while DLT can reduce this to two hours at lower costs. At Robeco, we verified this in an implementation-only proof of concept, meaning that we kept all parties of the value chain in the system, but replaced the processes with distributed ledger technology. Time savings result from all parties working from one dataset, which is available to all participants. The reduction in costs can be explained by the fact that reconciliation is the most expensive activity. With the blockchain you eliminate reconciliation as you create certain documentation only once, as it is already registered within the system. In a DLT ecosystem everyone works from the same ledger, which is the single truth. A lot of information is readily available, saving time and costs.

Additionally, real-time settlement reduces counterparty risk, because we have real-time prices, real-time assets, and-real time cash.

Apart from cost considerations, an important advantage of distributed ledger technology is the higher level of security it offers. In the case of a centralized ledger, cyber criminals focus on one target, increasing the chance of a breach. Furthermore, a blockchain does allow confidentiality, because not all members need to see every piece of information in a transaction. In our opinion, the private chain is the future, not the public chains underlying cryptocurrencies such as the Bitcoin.

You do see that the industry is currently moving away from bilateral clearing between individual parties towards centralized clearing. However, this is because the former is too expensive given the current technological standard. DLT could revert this trend.

What is the disruption due to BC? How will the current roles within the chain change?

Current regulation will not allow that all parties in between the buyer and a seller within a transaction will be cutout when implementing the DLT system. In the current design, the value chain remains intact, but you can question whether this will remain the case in the long run. The need for a party assuring a consistent standard remains and will always be a cost-benefit analysis. However, the parties that are involved will definitely see a change in their business model.

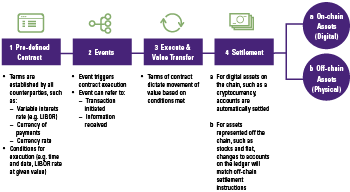

As an example, take the profession of the accountant. I expect the Administrative Accountant (AA) to disappear from the financial industry. Within a couple of years’ time, when the job becomes automated, there will be less need for manually constructed ledgers. This is likely as with DLT we will already be working from one book of truth and because it is very easy to design an automated program that simply puts the right amounts into the right ledger accounts (this is done via so called smart contracts; see Figure 2 on smart contracts).

The Register Accountant (RA), on the other hand, is going to become far more important. However, they will have to retrain in order to read smart contracts and read algorithmic outputs, instead of regular numbers.

An example closer to the asset management industry would be the change in the methodology of calculating the asset value of a particular portfolio. Because you have the assets and the price in real time, you can basically calculate a real-time NAV. This is currently very expensive. However, in the DLT design it is natural that all the data is freely and automatically available.

Because you have the real-time NAV, it is very likely that the settlement process of mutual funds as we currently know it will change and become more aligned to that of exchange traded funds.

Figure 1. IT evolution.

What are the top challenges to adopt blockchain?

First, you have to differentiate within the financial industry. Due to high cost considerations, banks are definitely ahead and will probably implement DLT first. Insurance funds will follow, using the design for fraud reduction. And finally, waking up from his very long winter sleep, the asset manager will come next.

Preparing for the future requires vision. Especially in an industry where margins are under pressure. The problem is that you do not know upfront where the gains are in terms of time and costs. This could result in a situation where asset managers pay the same fees we are paying today, while the service side already has a new design and can do it for a tenth of the price. However, to sit and wait is also very dangerous, because then the design is completely out of your hands and will be done by the ones you will rely on in the future. As an asset manager you want and need to be involved from the start.

There are three major issues that are most responsible for the restriction of wide scale adoption. The first is regulation, as it is not yet legal to have all your documentation on a DLT and in the process of a DLT. The second is the technological standard. It is not efficient to work with multiple chains, but it is not yet clear what the standard will be. The third is the absence of a network effect: the value of a network grows exponentially with the number of users and a strong network effect is required to solve the first two challenges.

Asset managers are not yet cooperating on a wide scale to create this opportunity. Whereas banks and insurance companies are used to working together, asset managers do not need to work together in this world. However, DLT asset managers must do so in order to achieve the needed efficiency.

I think the opportunity within the asset management space will be picked up by the service providers. They can provide a platform which both the sell and the buy side can connect to, fueling a large efficiency gain for those involved at an early stage.

Figure 2. Smart Contracts.

Where will we be in three years from now?

We are now in the proof of concept phase and we see banks are moving into the initial setup phase. We are not yet there for asset management, but in three years’ time we possibly will be. I think it will then proliferate in such a way that a very specific asset class will be led to onboarding first. This class will most likely lie within the fixed income segment, because it is very labor intensive, sometimes complex and low volume, so when you can create a DLT that services this asset class, it will already provide benefits. And from there, depending on the results of that specific asset class, the onboarding will continue for other asset classes and will eventually encompass the whole asset management market. Naturally, this process will take time.