Leasing companies need to anticipate for smaller and larger disruptions in the market, not solely because of the COVID-19 pandemic. The aim of this article is to highlight some key developments and challenges in the car leasing business that we currently observe, based on a number of interviews with industry leaders.

Introduction

Leasing companies need to anticipate smaller and larger disruptions in the market, not just because of the COVID-19 pandemic. The aim of this article is to highlight some key developments and challenges in the car-leasing business that we currently observe, based on a number of interviews with industry leaders.

We will discuss some short-term and long-term possible effects. Are leasing companies rethinking or accelerating their strategies? What kind of tools and/or tactics are they using to support strategy implementation? Is the pandemic a game changer or an accelerator?

Based on discussions held, key developments include:

- COVID-19 broadens the product offering for leasing companies, with an increasing interest for products like “secondhand car lease” as well as administrative mobility solutions to support clients with new upcoming travel allowance regulation;

- COVID-19 accelerates acceptance and implementation of fully digitalized processes to enable remote working, both in front and back offices;

- COVID-19 changes the portfolio mix (more EVs) and business model (as a result of the uptake of mobility products and services).

Looking at the three developments above, these short-, and long-term developments are not due to COVID-19 alone. These developments were already initiated, planned and (partly) implemented. So far, real new (and revolutionary) products were not identified, apart from evolutionary products and a shift in behavior. Examples are the continuous upward shift in demand of electric vehicles (EVs) and customers seeking a different and better customer experience than currently delivered in the market.

The pandemic crisis fast-tracks the emergence of digitization but did not start it! COVID-19 resulted in –20% car sales and is expecting to result in a shakeout due to the unprecedented external factors that have such a huge impact on businesses. The most recent National Business Mobility Survey ([VZR20]) states that by 2020 the number of business kilometers driven by cars will decrease by 24 percent. Employees work more from home, make fewer face-to-face business appointments and cycle (with electrical or old-fashioned leg-power) farther and more often. Corporate fleets are shrinking and cars require less maintenance as mentioned above, seriously impacting the profitability mix of leasing companies. This was also evidenced by the 2020 Q3 results of some major global car lease companies that showed the COVID-19 impact and a decline in profit and number of new leased cars.

The automotive and leasing industry is part of a larger transformation into “mobility”, where the car (asset) is only one of the possible ways of transport. More often, the question will be: do we want our own car, for ourselves or a shared car based on subscription and/or part of a mobility mix product? To remain successful and to anticipate potential impact, a strong vision and guiding strategy, including the necessary adjustments in its operation model, will help leasing companies to adjust and stay relevant in doing what they do best; managing the asset. In the end somebody needs to manage the asset, shared asset or not.

When integrated mobility services come into play, engaging in partnerships and benefiting from platform economics become essential for achieving economies of scale:

- Aggregating different forms of mobility and offering this under one umbrella, in one app where data integration at all levels is necessary. Ideally, it enables planning, booking, paying and travelling in the same environment.

- To make this possible, mobility aggregators are needed to take on this role (with no preference regarding type of mobility or vendor). At the core of that business model is the processing of a large number of mobility transactions at a low price per transaction.

Services offered via platforms tend to have a lower profit margin per transaction than financing cars. Therefore, lessors need to rethink their propositions and business models, increasingly in collaboration with partners to realize the necessary volumes.

This article will discuss the above areas in which we have also included the insight of the industry leaders for whom leasing is their daily business.

The end of (corporate) leasing?

Leasing dates to ancient civilizations where lease agreements were already used for agricultural machinery and land. In the 1700s, leasing agreements on wagons, buggies, and horses began to emerge in developed communities across the western world. More serious leasing agreements were recorded in the US in 1870 when people started leasing trains and railroad cars. Modern leasing of cars started in 1918. Renting already took place before Hertz and SIXT were founded, and long-term leasing of cars was made possible in 1941. In 1962, the first car leasing company was formed by an American-based corporation. Other leasing firms developed in Western Europe during this time. This officially marked the beginning of modern-day car leasing, across Europe and the rest of the world.

So, leasing has been around for quite some time. Meanwhile, more efficient and effective public transport emerged and possibilities to work from home and remotely have existed for a while too. Leasing a car (regardless of taxation) remained a welcome alternative to buying a car. Will COVID-19 be the end of (corporate) leasing? We don’t think so.

And the authors of this article are not alone, as the persons we have interviewed, being CFO, CIO, CDO and others from some of the top 10 leasing companies in the Netherlands also expressed their belief that car leasing will remain. We asked the above-mentioned executives with respect to some recent news headlines and asked for their opinion. None of them believed that the leasing of cars will be over, but change is certain and more radical than the previous 100 years. What will this change be, and what do market experts think?

COVID-19 accelerates innovation in the leasing market

For a long period of time the leasing market was a stable growing business, focused on operational excellence, extending the core lease product with services. Changes in recent years were already taking place due to trends like electrification, sharing and platform economy and “Mobility” as a service concept with both private lease and business car sharing options already on the agenda of many lease companies and respective products becoming available. These changes in recent years required rivals working together (e.g. BMW/Daimler). Being able to handle a mobility budget was a criterion in large tenders for the lease companies, but the customers/big corporates did not actually buy these new products. However, the COVID-19 pandemic has – as in many areas – become a big accelerator for digitization and innovation.

With people working remotely, the car is becoming almost absolute, except for groceries and package deliveries. People connect via phone and tools like Microsoft Teams, Discord and Webex, reducing business travel to a minimum. Not being allowed to go to the office and having to work remotely resulted in a big push for digitization, such as digital contracts, digital signatures and orders via internet. Next to front-end, back-end processes are also becoming highly digitized and simplified, for instance by applying RPA (Robotic Process Automation). Car sharing was on the rise before the pandemic, but car sharing and mobility services using public transport via platforms that were starting to get momentum have now been lower in demand. Business travelers now choose to use their own car, resulting in a further increase in secondhand car lease and private lease. Secondhand car lease and private lease require more handling, have lower profit margins (often cheaper cars) and often require direct communication with the driver instead of the (corporate) customer – which leads to increased communication and administrative overhead costs.

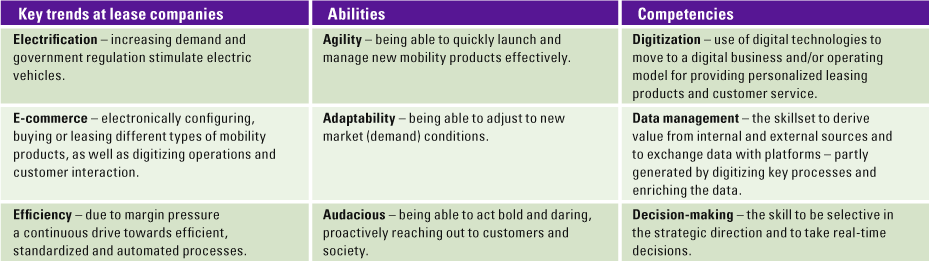

How can leasing companies cope with the main trends? In Table 1, we have summarized the main trends and the abilities and skill sets or competences that leasing companies need to have and mobilize to cope with these trends.

Table 1. Trends, abilities and competencies. [Click on the image for a larger image]

Leasing companies require more and more data, that they partly generate themselves. However, as part of further digitization, external data is gathered as well. By combining internal and external data they are able to gather and/or have insight in the detailed information that is required more and more. Our interviewees mentioned that they collect data from multiple different external data sources, especially data that can be used for benchmarking. As most are in unprecedented territory, they are really looking for answers and benchmarks to have insight in whether they are performing on par with others in the leasing market. For instance, is the (residual) value of my assets still in line with my bookkeeping and with what my customers really want?

We spoke with new entrants, who are working on providing real-time market and trend information about market values, (future) residual values and current prices of used cars. They execute algorithms on large amounts of data in real-time about online sales prices, price adjustments, standing days and sales numbers of used cars. This is how this type of leasing market data becomes more transparent and better comparable.

Define a strategy – back to the future

Back in 2012, KPMG organized a seminar with a group of leasing companies business leaders (see Figure 1). Although strategic partnerships were mentioned, electrification (Tesla) and platforms were not on their radar screens yet, even though these are currently two major transformation drivers in the mobility and automotive industry – with the COVID-19 pandemic as accelerator – as discussed in the previous paragraph. The market constantly explored new concepts and methods to meet the developments in customer demand, but key market players also tried to create further demand. Challenges were the increasing demand for electric transport and the entry of new market parties, which mainly distinguish themselves in terms of technological ability, but also changing business models. Tesla initiated changes in:

- production and logistics: simplification of product offering;

- decrease in dealerships: no sales and maintenance via dealers, but delivery stations and harbor areas where you can collect your car;

- decrease in profitability by having less maintenance: limited, as no combustion engine; and

- decreasing numbers of petrol stations: by reduced demand for petrol/diesel and being able to charge at home.

Figure 1. Cartoon of the future of leasing. [Click on the image for a larger image]

Mobility and electrification are, like the leasing products (private lease, short lease, second-hand car lease) not invented during the pandemic.

Based on the discussions we have had with business leaders, we see differences in expectation on volumes, some anticipate a slight increase (predominately private lease) and others a sharp decline (often country differences also apply). Many developments that happened were unexpected although leasing companies already have the tools and products to overcome these issues.

As discussed, most leasing products already existed or are derived from other products. What we do see, is that the product mix is changing, and next to that, as a result of increased digitization, the customer journey and customer experience as well. The acceptance of remote working, remote interaction with customers on the commercial side and more automation within the operational processes are currently high. It can be safely said that the level of digitization would not have been at the current level without the push factors resulting from the pandemic. Would people really use Zoom and Team to have daily meetings from their home office without the pandemic? Probably not. So, the pandemic drove change and accelerated the implementation. Some of our interviewees stated an accelerated implementation of their strategy, where others (mostly captives) also rethink their strategy as they had just imitated major mobility concepts and car sharing.

The mobility budget is “back”!

The big financial impact and downward trend in leasing cannot be called uniform in all aspects. For example, car sharing has come to a complete standstill, but private lease is undergoing an opposite development. Several market parties are recording “strong growth” in that segment, especially for the smaller models. Business travelers who previously took the train, now choose the car under pressure of social distancing; commuters rather drive their own (private lease) car instead of a shared car.

As mentioned, COVID-19 has also revived the secondhand car market, which we are now seeing in the lease market. Various parties are currently investing heavily in used car leasing and are also expected to achieve good results in the longer term. In addition, experiments are being conducted with flexible terms and short-term contracts. The dominance of long-term contracts was already slightly changing, given the rise of mobility concepts other than the traditional leasing. But quantitatively, the rise of mobility concepts has always been questionable in recent years. For example, the much-discussed mobility budget never broke through. Leasing companies were always expected to be able to offer that option, but employees often opted for a car anyway. Is COVID-19 going to change this preference?

The picture is mixed. There is still little progress, but on the other hand, large (Dutch) corporates may be preparing for a radical switch. This switch involves several forms: from providing a budget to employees to offering a MaaS solution (Mobility as a Service) – including a travel app for all employees. As part of the sustainability commitments that listed and other large companies have, they are also interested to offer this solution. In the meantime, leasing companies are also challenged from on IT and operating model perspective regarding these product implementations, which require increased connectivity with third parties and/or platforms. One important reason why mobility budgets also did not take off in large volumes is the taxation issue, as different mobility services have different taxation rules, making management, handling and invoicing complex. This issue has not been solved yet.

From a consumer perspective, remote, connected and digital is getting more and more common, with availability and speed in high demand. This requires highly integrated solutions that appear to be available in the front-end, but are often not fully integrated with the back-end. Effectively and efficiently managing a new product can be quite different from managing the current products. So, which tools can we use to accommodate multiple products and models?

Concepts and models side by side

In the most likely scenario, leasing companies are expected to be able to offer the different mobility concepts and models side by side. This poses major challenges, both strategically and operationally, because the number of models is only increasing, as was already clarified in our discussion above. Offering multiple mobility options requires investments in IT, people and partnerships and challenges within operations, margins and marketing.

- Firstly, it concerns the complexity in terms of business operations. Offering a broader and more diverse package of solutions has an enormous impact on the systems and requires more knowledge and experience from employees.

- Secondly, the question arises how profitability margins can be maintained. More flexible solutions are more expensive, less easy to robotize, but is the customer willing to bear those costs?

- Thirdly, leasing companies will have to change their marketing and communication approach. Replacing four or five-year contracts with, for instance monthly cancellable contracts requires customer communication at an entirely different level, both in terms of quantity and quality.

Digitization is, both internally and externally, inescapable in facing these challenges. Internally by increasingly focusing on lean process operations. Some parties are already quite mature, but others indicate that there are still financial benefits to be gained from their investments. Most IT landscapes at leasing companies are fragmented in nature, with many interfaces and not always easy to link to third parties or platforms. Externally, it is the customer journey that must be perfected with further digitization, also as the number of leasing companies’ customers may explode due to private lease and second-hand car lease. It is different for a leasing company to handle 1.000 private lease contracts than a single corporate contract (with 1.000 employees) as private leases are linked to 1.000 individual customers, each requiring their own credit check and communication, invoicing and debtor management. The new mobility models must go hand in hand with the choices that are made in marketing, with a focus on customers that add most value. From an IT perspective, the master data, data quality, (inter)operability and connectivity are key to being able to be part of a platform or becoming a platform. Although margins are lower, this approach will enable the renewed leasing company to accommodate large number of products, transactions and subsequently a sustainable business model.

Conclusion

The leasing sector has already been disrupted by the sustainability and technology-driven dynamics in the automotive sector. The COVID-19 pandemic has not made the playing field any easier, but at the same time, in this situation, the broad implementation of innovative solutions is getting closer. By making clear strategic choices, looking for the right partners to implement that strategy and applying strict discipline around the operational consequences of their revised strategy, leasing companies can emerge stronger from this crisis.

The total car lease portfolio will probably shrink but leasing companies are well-positioned to survive and find and exploit new opportunities and business models. The mobility needs and wishes of consumers and organizations will not diminish in the long term, they will, however, be different. The future of leasing companies depends on their abilities, combined with the skills and competences to manage the trends. Waiting is not an option and decisions and focus are key – a bit of everything in the end results in “nothing”.

Reference

[VZR20] Vereniging Zakelijke Rijders (2020). Position paper: Zakelijke mobiliteit na Corona. Retrieved from: https://www.trendsinautoleasing.nl/wp-content/uploads/VZR_Position_Paper_Zakelijke_Mobiliteit_na_Corona.pdf