The banking industry is in full digital transformation with big change agendas on customer experience, regulatory & compliance and operational excellence. To accelerate its change delivery, Triodos Bank implemented a scaled agile approach to work more together across the six countries within the group. The approach taken has enabled Triodos Bank to move quickly and start the journey in a way that keeps everyone on board. This article analyzes the key aspects of this agile journey.

Introduction

Triodos Bank is one of the world’s leading sustainable banks. It finances companies, institutions and projects that add cultural value and benefit people and the environment, with the support of depositors and investors who want to encourage socially responsible business and a sustainable society ([TRIO18-1]). As a European mid-sized bank, Triodos is active in six countries.

Triodos Bank has experienced sharp growth over the past years, with total assets under management almost doubling from €8.0 bn in 2012 ([TRIO12]) to €15.5 bn in 2018 ([TRIO18-2]). An important part of Triodos Bank’s success has been the relative decentralized model, driving local entrepreneurship in the different business units.

Aware of the challenges of increasing digitalization and regulation in banking, Triodos Bank wanted to accelerate its digital transformation in order to stay relevant for its customers and on-par with the market. This challenge was addressed last year, as part of the strategy development process for the new three-year plan. The objective was to radically improve the operating model of the organization by leveraging One Bank principles and Digital for cost reduction and improved customer satisfaction.

Starting point for Triodos Bank’s journey

The need for change was quite clear: client expectations have shifted; they expect the (full) potential of digital possibilities. Just like they would expect from any other bank. In addition, with increasing scale and complexity, the need for efficiency became more urgent. And finally, regulatory requirements have also increased over the past years, making standardization of processes desirable.

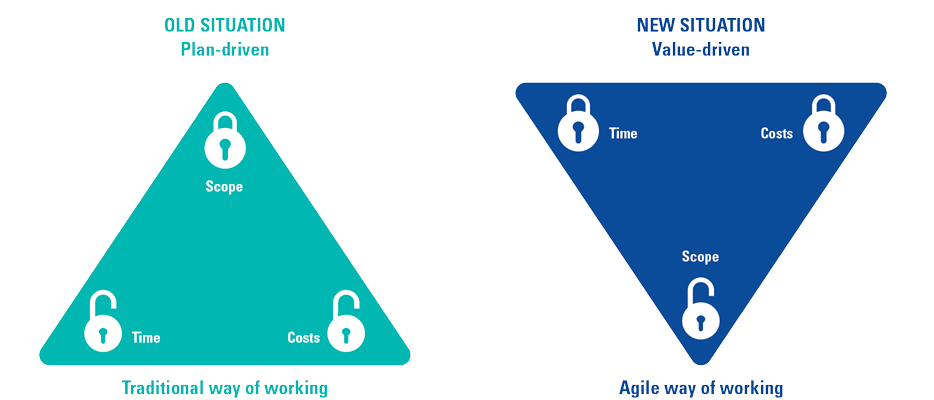

As part of the strategy review process, a joint Triodos-KPMG team, led by Triodos Bank’s ICT director, analyzed these challenges and developed an ambition to work more together across the group, become more digital, and ultimately realize more impact for clients and society. Key to this ambition was to start small and to use a phased and iterative approach to transformation, adopting agile principles. The team therefore analyzed how to organize the change part of the organization in a more agile way. This meant a move from a portfolio of Prince2 based projects with agile scrum teams within IT, towards working in scaled agile teams organized in Domains (like value streams in SAFe or tribes in the Spotify approach) on a multi-country level. More specifically, this meant a shift from managing deviations within a fixed plan to managing business value (see Figure 1). This ambition was supported by a value case on the expected benefits in accelerated change and realized business value.

Figure 1. From a plan-driven to value-driven approach. [Click on the image for a larger image]

The ambition tagline: “More Together, More Digital, More Impact” provides good insight into the journey.

More Together

As of 2010, IT software development was already working in agile teams. However, the teams struggled with their alignment with the business and local product ownership. Thereby traditional project governance (according to Prince II) and scrum methods were both used in projects within IT. This often led to inefficiencies. It was recognized that facing the mentioned challenges can best be done together, because Triodos believed that together they could learn more, do more and achieve more. Therefore, Triodos aimed to work in group-wide multidisciplinary agile Domain teams that will handle all changes for a certain business area. Furthermore, this theme connected to the overall desire to operate more harmonized as a group: one European bank.

More Digital

Personal contact has always been the focus for Triodos Bank and integrating digital into that experience has been a challenge. However, the organization recognized that a major step was required to live up to customers’ expectations and stay competitive in a rapidly changing world. Seeing digital as a true enabler for realizing its impact and making use of digital technologies in a way that fits Triodos’ values, is the real challenge. Triodos aimed to bring digital for its community alive by combining the human touch with digital possibilities. As digital investments required are high and capabilities are in high demand, this is better done together. Ultimately, this will create more lasting impact.

More Impact

Triodos Bank has been a leader in sustainable banking for almost forty years. Aiming to both finance change and change the finance industry itself, it welcomes (in fact, stimulates) other banks to also become more sustainable and invest responsibly. A more nimble, agile organization is required to be able to keep making the impact that Triodos Bank aims for, namely keeping up with the market in developing Triodos’ current products and services to be attractive to customers, and to be able to be more innovative and create and scale up new activities as a frontrunner in sustainable finance.

Based on the ambition and the value case, leadership decided mid 2018 that the organization would start working agile in Domains per January 2019 to accelerate change and its overall digital transformation. This meant that the core team and the organization had less than six months to realize the transformation, while this was not the only priority for the organization.

How to get started?

The transformation towards a scaled agile model was managed as an agile program, called Starlings. Both to stay true to the nature of the change and to ensure flexibility in realizing the transformation.

As part of this agile program, a transformation approach was created, that consists of four key principles:

- co-creation across the group to harness the expertise and strength within the organization;

- phased approach to be able to start and learn-by-doing;

- culture, leadership and skills are key to realize and sustain the change;

- fact-based decision-making to optimize group business value.

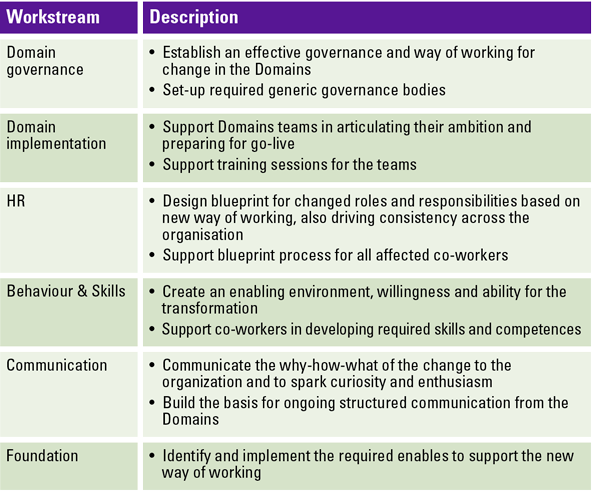

Seven workstreams have been defined that together cover the full scope of the transformation (see Figure 2 and Table 1). Each workstream has defined their required epics and a roadmap in working towards the deadline of January 2019. And when it all comes together, the benefits can multiply.

Figure 2. Seven workstreams to drive the transformation. [Click on the image for a larger image]

Table 1. Explanation of the workstreams of the Starlings program. [Click on the image for a larger image]

Throughout the transformation the following five aspects were crucial.

1. Strong Executive Board involvement and several leadership conferences

Agile transformation brings an extra dimension to the well-known success factor of leadership involvement in every change project. It’s not just that they must support, sponsor and lead the change; agile requires leaders to make a major shift in their own mindset and behavior as well. They have a crucial role to act as role models to foster and reward desired behavior.

A scaled agile approach to change is fundamentally different from project-based approaches. It is a relatively new way of organizing the delivery of change which is more flexible and therefore better able to cope with today’s complexity and uncertainty in the business environment due to ever-increasing and changing customer expectations, increased competition and technological possibilities. When moving from steering on individual projects to relatively stable and autonomous teams that handle all change for a certain area, the role of leadership changes drastically:

- From command and control to give trust and autonomy to the teams. Teams have clear accountability and responsibility to optimize business value. This requires from leaders that they manage the teams based on outcomes instead of deviations from (detailed) project plans (less detailed planning on paper, and more doing in incremental steps).

- Consider the change agenda more strategically instead of on an individual project basis by having the right conversations to make sense of market dynamics, own strategy and the current state of the organization (and its people, processes, systems) to be able to reach a joint priority setting.

- Be more actively involved to drive priority setting and implementation as change is delivered in smaller iterations (sprints), instead of in big, infrequent project go-lives.

Leadership (both at group level and at country level) has been strongly involved in the case for change and ambition setting. This strong engagement of leadership has proven crucial to foster the right level of understanding and support at leadership level for More Together, More Digital, More Impact. This was done through leadership conferences at several stages in the process, starting with creating the awareness and case for change. Key concern in these discussions was the balancing of group and local needs, especially in the light of the “More Together” team to drive more harmonization across the group.

Based on the leadership support created in the awareness phase, the decision was made to execute the implementation. The transformation program started in June with an initial focus on governance and domain ambitions. Close involvement of leadership continued in this phase, with a leadership conference to challenge domain ambitions and governance. In addition, a (virtual) roadshow along the leadership teams was organized per country to ensure a good understanding of the program and to collect feedback. Furthermore, training sessions were organized to prepare leaders for their role in governance.

After implementation, management assumed their roles in governance with the country Managing Directors (MDs) and a selection of Group Directors to manage the group’s change portfolio at strategic level, and the group directors and local heads to prioritize and drive the change within their Domains.

As management has been involved for a while, they understand that this is a journey. And everyone is enthusiastic to learn and adapt together, making the Domains deliver change more effectively step by step. As such, strong Executive Board involvement and several leadership conferences have proven crucial to foster the right level of understanding and support at leadership level.

2. Motivated core team supported by a strong and diverse SteerCo

A motivated core team (both consisting of KPMG and Triodos Bank) was crucial to design and drive the change. This dedication helped to deliver against the relatively short timelines and to support the Domains in their preparations towards go-live. By delivering the transformation program in an agile way, the team was able to stay flexible and prioritize swiftly when required. Having core team members from Change and portfolio management, IT and HR, ensured that we were able to “build” on existing practices within the organization and get the right perspective on challenges that needed to be overcome. Having daily core team meetings really helped to think and deliver fast, in short iterations in which deliverables were jointly created. This ‘shoulder-to-shoulder’ approach has proven to be crucial to overcome many barriers and to make great steps together.

Agile within Triodos Bank also started in IT, as in most organizations. To take the next step towards working in Domains, stronger business involvement was crucial to make it a success. Recognizing this, sponsored by the COO, the IT director installed a SteerCo to coordinate the transformation, and to drive stakeholder engagement. The SteerCo consisted of the group directors of IT, HR, relevant Domains and one of the country MDs ensured considering all relevant perspectives. The bi-weekly SteerCo meetings proved important for decision making, but even more for reflection and steer on important topics to enable the program to move ahead.

3. Use it as accelerator for change, not as efficiency measure

When an organization accelerates change through agile, one can either deliver more change with the same group of people or deliver the same amount of change with less people. Triodos Bank has clearly chosen the first, which results in a more positive transformation with a lot of enthusiasm, shorter implementation timelines and makes it easier to make the journey together.

We hear from organizations that they expect a 30-40% efficiency gain of running change in a scaled agile way. This efficiency comes from:

- Less overhead in planning process by fixing capacity per Domain, reducing the need for detailed planning, re-planning and extensive project management processes. This reduces the need for project management and PMO resources;

- Stable teams that work together for longer periods within a certain business domain driving team efficiency. This drives higher quality and performance as a team and the business feels more ownership, experience fewer ‘switching costs’ and are better able to learn and adapt;

- Improved prioritization based on business value as prioritization happens across all change within a business Domain. This allows teams to focus on user stories or tasks that have high business value, instead of working on lower value activities that must be done simply because they are part of a project brief that was committed.

Some organizations are tempted to take this efficiency gain as an efficiency measure, aiming to reduce the size of their change portfolio while still delivering the same amount of change. As this often involves headcount reductions, they first must go through a reorganization before they can start building again with the “new team”.

At Triodos Bank, and other medium-sized organizations, we see an agile transformation that is more positive from the start. These organizations welcome agile as an accelerator for change. They have often struggled with limited change capacity, while they recognize the need to speed up in response to further digitalization. In this context, getting more change from the same budget is a great deal.

This is a much more positive transformation that can be started faster and allows for more flexibility to make the journey together from the start. As this approach is more organic, it also makes it easier to learn-as-you-go and gradually improve in supporting areas such as data & information, collaboration tooling and organization culture.

Starlings – the name

So why name this project Starlings? A murmuration of Starlings is often used as a metaphor of an agile organization. It is fascinating to see how these birds move fast and agile, while acting as one group. They do so by following the three basic rules:

- Fly with the same speed: every starling within the murmuration flies with the same speed. Not necessarily in the same direction, but they fly all with an equal airspeed.

- Be in connection with each other always: every starling makes sure he (or she) flies with the seven nearest starlings in line. This creates a strong network within which information can be shared rapidly (with minimal loss of signal).

- Avoid possible danger immediately: as soon as there is a risk or a change observed within the environment, the starlings respond by changing direction immediately afterwards.

This equal airspeed, careful transfer of information and alertness on the environment, makes that the murmuration of starlings can respond to changes quickly as one group. Even more interesting is that they manage this all without any visible sign of a central leader: they manage changes themselves, as a self-steering flock of birds.

And finally, no birds are left behind. If one of the starlings can’t keep up with the pace, they get picked up later again.

4. Design and tailor, then focus on learn and adapt

There is no one size fits all, so although best practices and methods such as SaFe and the Spotify model where used in designing the domain governance it was tailored to Triodos Bank’s specific situation. And even more importantly, the team recognized it could never be set in stone and needs to evolve based on the learnings from the people working with it.

The key challenge in governance was to strike the right balance between group and local in six countries with their own P&L responsibility. Each country MD and their local heads support the journey towards working More Together, as they understand that the One Bank principles accelerate the required change to become More Digital. In addition, the country MD and local head also focus on representing the local change needs for their local market. The governance facilitates having the right conversations at different levels, ensuring local needs are properly represented and alignment is reached by the Domain Lead (PO-role), while avoiding side steer or conflicting prioritizations from different directions. Also, the set-up of the teams was based on both group and local roles, being multidisciplinary change teams that consider local perspectives and needs.

With the Domain Governance, a solid basis has been laid for effective functioning of the Domains. After the implementation beginning of 2019, the governance and way-of-working need to further evolve based on the learnings of the people working with it or to adapt to changes in the organization. This is a continuous journey to further grow and evolve and become more effective. The key in this journey is the openness and candor to have the right discussion and face the challenge. This has been organized in several ways:

- The Learn & Adapt cycles on different levels: team, Domain and group level;

- Agile coaching of the Domains in combination with a small multi-disciplinary core team;

- Evaluation and Learn & Adapt cycle on the Domain governance and way of working;

- Domain Lead alignment as a weekly stand up to learn from each other on the journey;

- SteerCo has changed composition and was re-purposed to a forum for the Domain Owners and the group director’s IT and HR, to reflect and challenge each other on the effectiveness of the Domains.

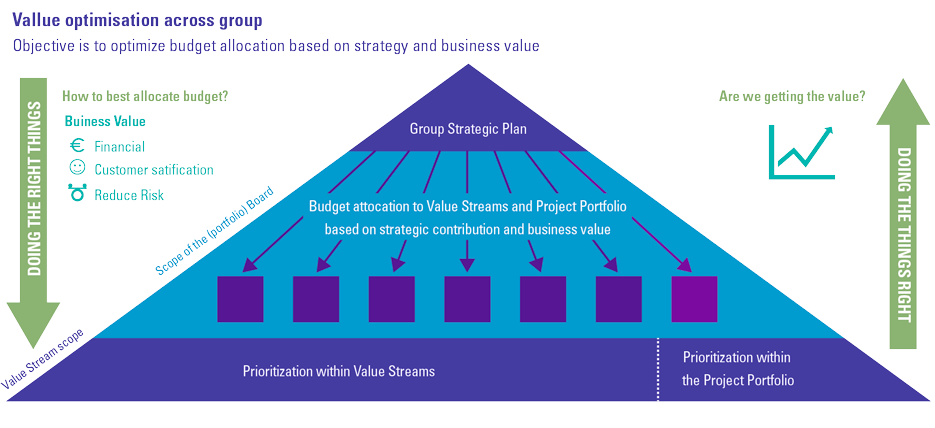

5. Focus on business value

The conversation on change has shifted from focus on (deviations from) planning and budget, towards business value. The business value perspective was first introduced in the ambition setting, where Domains outlined what they wanted to achieve in terms of business value (rather than purely financially driven statistics). The value was expressed in terms directly related to the key strategy KPI-themes: efficiency, better customer experience and more visibly in-control.

This value conversation is held both within the Domains and across Domains on group level in the Banking Committee.

Within the Domains, the value conversation centers around prioritizing all initiatives (key epics) and making trade-offs between group requirements that can all benefit from versus local requirements/needs that may be essential for just one branch. Thereby, having the value conversation helps the Domains to focus more on data-driven decision making. This discussion is primarily done in the Domain Board which consists of the group director, the local heads and the Domain Lead. As they are also accountable for the day-to-day business in their countries, this set-up assures they are fully invested in the discussion.

Besides prioritizing, the Domain Board also manages actual realization of the benefits, through agreed KPIs that are linked to regular performance reporting in the business. The objective of this conversation is twofold:

- Closing the loop on business value, to ensure actual delivery of benefits and to ensure the value discussion stays “healthy”, e.g. people refrain from overstating benefits to sell their ideas.

- Learn and improve. One could see benefits management as a sort of hypothesis testing, which makes it a joint sense-making process of what works and what doesn’t in an increasingly complex and dynamic environment.

Embedding the project in the business, the ongoing budget allocations and prioritization is decided in the Banking Committee. This is done based on the domain canvases in which the ambition and expected business value per domain is outlined and is expected to be relatively stable over time. Furthermore, the banking committee challenges the Domains’ performance and benefits realization, which also ensures the MDs hold each other accountable for actual delivery of agreed benefits.

Figure 3. Value conversation takes place at all levels. [Click on the image for a larger image]

6. Developing skills and talents

Lastly, we have seen that the impact of digital transformation on the employees and culture should not be underestimated. As such, we have seen that it is of great importance to define which skill-building programs are necessary to run the transformation. Examples of these programs are awareness and coaching sessions, agile boosters and leadership trainings. The reason to focus on skills and talents is threefold:

- to train new behaviors and mindsets;

- to develop required knowledge;

- to develop and enhance required capabilities to work according to the newly defined way of working.

Ultimately, the training offerings must be embedded in the organization (e.g. L&D curriculum, performance management).

Conclusion

Triodos Bank chose a pragmatic approach of introducing scaled agile to accelerate its change ability to be able to realize its digital ambition. Workings in Domains has established the right conversations and brought focus to realizing the digital agenda.

After they started to work in Domains per January 2019, the organization and teams are getting more familiar with the approach and new way of working. Based on a Learn & Adapt approach, Triodos Bank will continue the journey towards an effective change organization that is able to respond effectively to today’s challenges and continue its role as frontrunner in responsible finance.

References

[TRIO12] Triodos Bank, Annual Report 2012, Triodos.com, https://www.triodos.com/downloads/about-triodos-bank/annual-reports/annual-report-2012.pdf.

[TRIO18-1] Triodos Bank, Our purpose: sustainable banking, Integrated Annual Report 2018, http://www.annual-report-triodos.com/en/2018/our-group/our-purpose-sustainable-banking.html.

[TRIO18-2] Triodos Bank, Annual Report 2018, Triodos.com, https://www.annual-report-triodos.com/en/2018/servicepages/downloads/files/annual_report_triodos_ar18.pdf.