Mobility is undergoing one of the most transformational social, technological and economic shifts of a generation. As incumbents, new entrants and startups compete for a share of the mobility ecosystem, each should consider where to play and how to win. However, we currently observe many “obvious” initiatives in strategies performed by different organizations, whereas “differentiators” are most needed. This article outlines why your strategic and digital agenda demands more than the obvious to win and where you should start.

Introduction

The transformation of the mobility and transport landscape has only just begun, fueled by key technology-driven, disruptive trends. Trends in which electric vehicles, other alternative powertrains and sustainable energy will substitute fossil fuels, and connected and autonomous vehicles (CAVs) could improve efficiency, safety and social inclusion, and trends in which multimodal Mobility-as-a-Service (MaaS) and mobility services provide “on demand” and detailed solutions rather than inefficient asset ownership (even though COVID-19 will slow this development down, at least temporarily). For mobility companies, this means that sector boundaries will blur and sectors transform into interconnected ecosystems.

This transformation to an integrated ecosystem of mobility takes place within the age of the customer, where switching costs are low, demands are high and continuously evolving, and where conventional margin structures are under pressure. Besides, platforms will increasingly arise to orchestrate such ecosystems and fight for customer relationships. For those who wish to stay relevant and seize opportunities in this changing domain, a distinguishing proposition is most needed. Doing nothing is, most likely, not an option. For most companies that are active in the area of mobility, current trends in mobility are well-known – at least on a high level. We do see, however, that many companies that play a role in the mobility domain (such as OEMs, distributors, car dealerships and insurers) currently arrive at comparable “strategy shortcuts” on how to respond to these developments. Although these companies start from different positions, each with their own unique assets and capabilities, they attempt to move towards similar positions and initiatives in the mobility ecosystem compared with each other: initiating the “obvious”. For instance: “offering a broad mobility services platform for end users” is a well-known aim of incumbents. And in a winner-take-most environment for any given ecosystem position, many companies aiming to occupy the same position becomes a problem.

This indicates that your strategic and digital agenda demands more than the obvious to maximize value, distinguishing power, customer activity and retention. In the first section of this article, we will start by determining “the obvious”: five common strategic aims and associated pitfalls which we frequently see happening. In the second section, we will elaborate on what you should do to effectively distinguish yourself in the future of mobility by following six steps in (re)shaping and implementing your strategic and digital agenda successfully in this domain.

Initiating “the obvious”: what is the problem?

We see many comparable, strategic aims of incumbents in their journeys towards the future of mobility, where we acknowledge five key patterns which we frequently see happening.

Figure 1. Acknowledging five “obvious” patterns in the future mobility space. [Click on the image for a larger image]

A. Escape the “red ocean” with a Horizon-III obsession

As it seems the only way to cope with disruptive changes, mobility companies have a tendency to focus on transformational innovation through Horizon-III initiatives rather than investing in core (Horizon-I) and adjacent (Horizon-II) products, markets and business models – following McKinsey’s defined three horizons of innovation ([Bagh99]). This is often fueled by expected disruption in conventional sectors, where incumbents seek to “escape the red ocean” to be disrupted. Such a red ocean highlights competing in existing markets while exploiting existing demand ([Kim17]). For an automotive incumbent, such a red ocean can be defined as conventional sales and aftersales of vehicles with combustion-powertrains. But as mobility shifts from a primary B2C to a B2B(2C) activity ([KPMG19a]), with a focus on sustainable powertrains and other modes of transport, existing touchpoints and longstanding revenue pools are impacted.

Incumbents often seek to “escape” the anticipated disruption of exisiting value streams by obsessively focusing on Horizon-III initiatives. A frequently seen example of such an escape is described by incumbents as “launching a new platform for X”. However, such transformational innovations often require the creation of new markets and changing customer beliefs and behavior by appealing to latent needs that these customers often cannot yet envision, let alone express. Such strategies are time and capital consuming with a low certainty of success – a feat normally only granted by investors to public companies with visionary leaders, a strong track record and/or considerable reserves, or small startups that sit in a much broader portfolio of venture capital (VC) firms.

Horizon-I and II should therefore not be forgotten while both exploiting and targeting new profit pools and initiatives, as related opportunities could potentially be seized quicker and more easily based upon existing core capabilities. This could give incumbents a head start over new entrants, which we describe as an “unfair advantage”. We have seen clients successfully using a rule of thumb in order to allocate their investment portfolio with 50-80% for Horizon-I, 20-40% for Horizon-II and 10-30% for Horizon-III. Nevertheless, this differs per sector and industry and should be balanced and detailed accordingly.

B. Own customer relationships and initiate highly frequent customer contact

Driven by the all-too-familiar “data is the new oil” adagio, there is an increasing competition to control customer relationships and the associated data in a dynamic context of emerging value chains, the breakdown of sector boundaries and the rise of aggregator business models. In a fully digitized mobility universe, where having far-reaching customer insights based on real-time data and being top-of-mind of customers is essential, it seems a logical reaction to survive. As a result, we observe many companies seeking to unlock new ways of (highly frequent) customer contact in order to retain maximum control over customer journeys and touchpoints. They often try to do this by building their own digital channel or customer-facing platforms. However, brands that traditionally sell products that customers do not use or think about very often, such as an insurance or energy company, need to conquer a new area of attention in these customers’ minds to be able to make such efforts successful. While many companies envision that they can have a much broader relevance to their existing customers, the hypothesis that their customers will deem them credible or even desirable compared with existing players in the space is all too often not well validated. And if so, the question of actual adoption remains. Research from App developer SimForm among customers shows they only use a fraction of installed apps on a frequent basis: on average around 15, with 25 for young adults down to 10 for seniors ([Shah20]). This underpins the difficulty of achieving continuous engagement and retention. Breaking into that small circle is hard and requires at least a world-class offering, which is not something you can do “on the side”.

C. Partner with and do business with “everybody”

The mobility journey of today and the future is increasingly a multimodal game, resulting in a complex web of interconnected value chains. A unique combination of cross-sectoral capabilities is required to build enduring solutions to move people and goods. In short: collaboration is not an option, but a necessity. For instance, service bundling could improve your company’s position; we have already seen different new mobility concepts. For example, a global operating car leasing provider just started to sell energy contracts for electric vehicles. Also, different German car manufacturers have already started to collaborate with joint investments in a pan-European charging infrastructure: Ionity ([Petz17]).

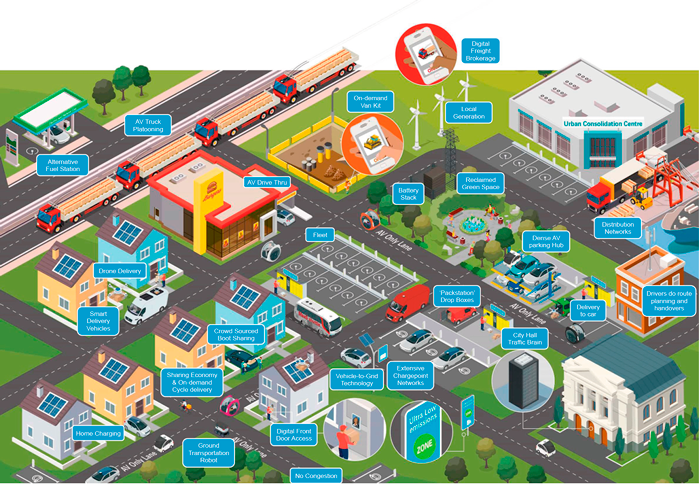

What’s more? We also see that “everybody” wants to partner or do business with “everybody”, mainly to secure the right partnerships and acquisition targets. There is a genuine “fear of missing out” in the board room. We are often asked to help identify “white spots” in the inventory of possible partners. But as the area of future mobility becomes abundant with increasingly numerous niches such as in EVs & infrastructure, CAV-technology, MaaS, micro mobility, finance & insurance, hardware & materials, with even more different players per niche, this seems hardly the relevant problem to tackle. “How should we decide which ones are best for us?” seems to be the more relevant question here. In Figure 2 you will find an example of different niche types in a future mobility ecosystem; specifically from the perspective of moving goods.

Figure 2. “Accountably many niches in a future mobility ecosystem, but how do you decide which partnerships could suit your organization optimally?” [Click on the image for a larger image]

D. Become data-driven and monetize data points

The problem of choice in a world of abundance does not only manifest itself with potential partners, but also in the field of data. Data – the key foundation of future mobility – presents huge opportunities for organizations across the emerging interconnected ecosystem. Mobility providers depend on digital platforms and databases to execute their services. Here, data can be a lifeline to optimize a product or service, to exploit the full potential of an organization, to realize operational efficiency and to serve as a catalyst for business innovation. “It is always about the data” is a well-used mantra. However, understanding the key data for a company to achieve its strategic objectives is less clear.

By starting with the no-regret move of deploying data lakes and data & analytics platforms, many companies start to drill down in the data with use cases to look for value in order to “monetize their data”. But contrary to oil, the value of data is context dependent. This means that a set of data can be extremely valuable to solve certain problems, and quite useless for others. Diving into data to answer questions or solve problems that do not very closely align to your strategic agenda becomes a bit of a hit-and-miss approach. Consequently, few data initiatives actually deliver the value that companies had hoped for. In addition, the best ways to monetize the data are often not yet well understood as many companies equate data monetization with selling data. However, only a handful of companies engage in the business of actually selling data. The vast majority of famous tech companies monetize data through selling the service they built on top of that data. For example, Google’s major source of revenue does not come from selling user data to the highest bidder, but by selling the AdWords service that leverages this data for targeted advertising.

E. Becoming the integral and digital mobility platform

Currently, many examples exist around the world already where customers can travel using different mobility modes (from different providers) via one platform, such as Uber, ViaVan and even Google Maps. Although such services are typically restricted to public transport companies, new, integrated private/public versions are emerging. OEMs and independent platforms are both introducing new subscription schemes, and testing out new business and operating models, with the joint BMW / Mercedes-Benz SHARE NOW carsharing proposition as an example ([SHAR20]).

We see an intensified desire of organizations to become an integral and digital mobility platform. Due to winner-take-most dynamics of the platform economy, just being “a” platform is not sufficient and should be substituted for “the”. But what are the consequences of transforming your existing business model into “the” mobility platform? And is this the most desirable positioning for your organization, given your unique assets and capabilities? It requires “deep pockets” and a long investment horizon, usually not available at the size of VC-funded competition. These are high-risk, high-reward investments, and only a viable option for organizations with sufficient investment possibilities and accompanying risk appetite.

Decisions made now are likely to determine the future for many companies. Companies only have a small window of opportunity to get ahead and position themselves to shape the future ecosystem. This means that you have to move quickly, secure the most beneficial partnerships and acquisition targets, and structure internal financial, business and operating models.

Decisions that are made now are likely to determine the future for many companies, with some positioned for success, and others facing a fight for survival. Very interesting, especially with many comparable strategic aims and initiatives, whereas “differentiators” are most needed.

As we already have outlined, many incumbents do observe and play into the broader trends in the mobility ecosystem. However, they also tend to mimic each other’s movements, which could lead to a lack of focus, underleveraging of their current strategic positioning and “unfair advantages”, possibly resulting in unrealized value potential and a weakened rather than strengthened competitive position. So instead of initiating an obvious strategy, it is all about determining a well-grounded point of view on your organization’s right to play and, more importantly, the ability to distinguish yourself in a sustainable manner. Investments in digital technology should be guided by the overall company strategy, not the other way around. But where do you start?

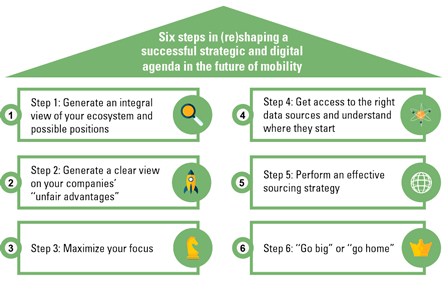

Six steps in (re)shaping and implementing your strategic and digital agenda successfully

Figure 3. Six steps in (re)shaping and implementing your strategic and digital agenda successfully. [Click on the image for a larger image]

Step 1: Generate an integral view of your ecosystem and possible positions

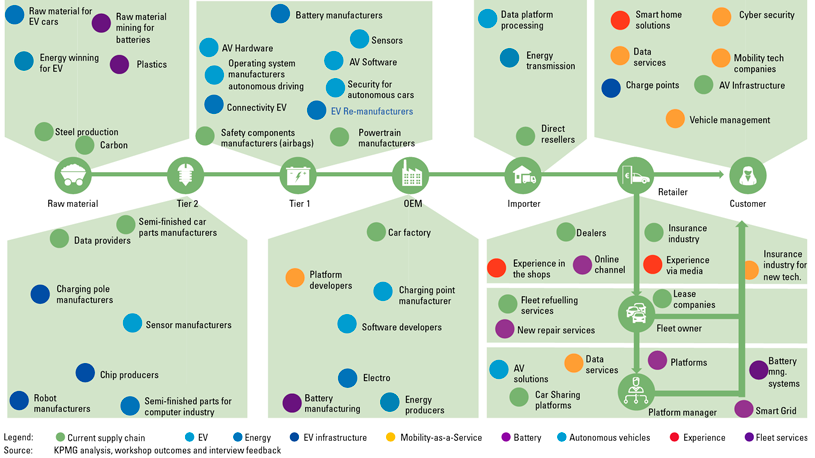

Industry barriers are blurring due to a higher level of technological integration between different parties to increase mobility options for customers. With this, new mindsets are needed: focusing less on simply selling products and more on creating value with ecosystems. Therefore, the first challenge for many businesses is to generate an integral view of the ecosystems they are part of. As mentioned earlier, traditional sector boundaries are blurring, and mobility associated sectors are transforming into an interconnected ecosystem. The traditional value chain no longer exists, where many new entrants impact touchpoints of incumbents (see Figure 4 as an example).

Figure 4. Future mobility ecosystem, the Automotive value chain example ([KPMG19b]). [Click on the image for a larger image]

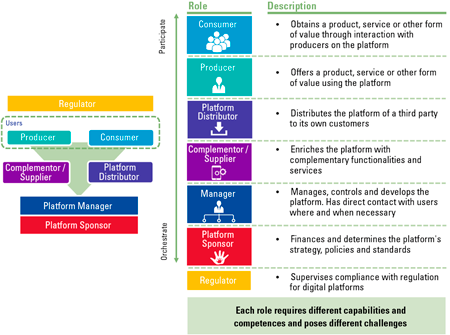

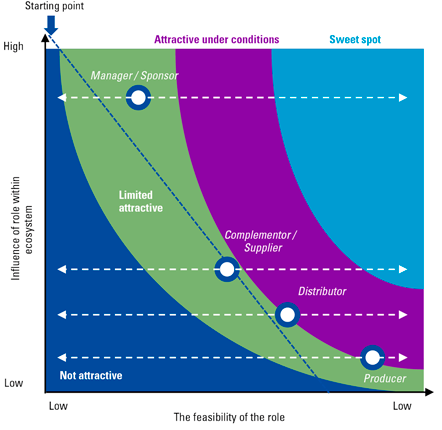

Therefore, companies will have to reassess the addressable market, including the value pools to be targeted. It is essential to also explore different roles in different ecosystems. Besides being the party that builds and manages a customer platform, it can be very lucrative to supply supporting services to such platforms. Consider for example Adyen, which has grown into a multi-billion euro payment platform enabling many large customer-facing marketplace platforms ([Adye20]). Alternative roles are becoming a supplier/complementor that enriches the platform with complementary functionalities and services (such as insurance or financing products as part of a mobility solution offered on an external marketplace) or a distributor that distributes the platform of a third party to its own customers. In Figure 5, you will find all potential platform roles that your organization could play. In any case, be mindful that choosing the right ecosystem role always involves a trade-off between the degree of influence in an ecosystem and the feasibility of attaining that influence. While assessing your optimal role, challenge whether you already have experienced a “Copernicus moment” due to ecosystems. Before Copernicus’ revolutionary heliocentric view, there was no doubt about the fact that the earth was at the center of the universe. In other words: be critical in assessing whether your offering could become the center of the mobility universe for consumers, compared to the next best alternative.

Step 2: Generate a clear view on your company’s “unfair advantages”

As acknowledged, it is essential to create a clear view on core assets and capabilities which could give incumbents a head start compared with competing ecosystem actors and VC-funded new entrants. For example: is it your brand, existing customer and supplier bases or available datasets? For P&C insurance companies, such an “unfair advantage” could be the deep-rooted expertise in risk calculations and modelling which have been built up through decades of experience and optimization of the core business model processes. This could be increasingly exploited “as a service”, integrated in pay-per-use mobility solutions and potentially also shift to subject- and behavior-based insurance rather than conventional asset-based insurance.

Make sure you assess how the disruptive forces in mobility will impact your business model and how you can capitalize opportunities based upon your “unfair advantages”. Perform a core competence and asset assessment against both current and likely competitors, including companies that have not started yet. Cast a wide net in terms of where possible competitors can come from, including scale-ups that can leverage EUR 100M+ in VC funding. And be critical when you decide to play in a national or potentially international market.

Step 3: Maximize your focus

As tapped on earlier, maximizing focus is important in order to distinguish yourself from your competition. If your business model involves a platform, assess the core interaction on that platform and the purpose which your platform upholds to maximize retention. What is the right to play with regard to the customer problems which your innovative mobility solution solves? This demands a deep-rooted view on scenarios for the future in relation to existing capabilities.

Moreover, understand your customer demands beyond thoroughly and determine how the demands of your customer are continuously evolving. We have already seen mobility shifting from a traditional B2C activity, where conventional asset sales were rampant, to a B2B activity where private buyers shift to concluding (private) leasing agreements, as well as using assets and mobility solutions (B2B2C) as a service.

If your value proposition interactions are primarily business-to-consumer, then exploit non-linear design thinking methods to generate an understanding of your customers’ needs. Start by understanding and empathizing with your customers’ problems and then iteratively define, develop, prototype and deliver your product, while continuously engaging with your customers to validate the key value hypotheses that make or break your business model. Use personas as fictive customers to detail your proposition to serve your customer base optimally. Also map integral customer journeys and place them in the perspective of your ecosystem, including other participants which could complement your products or services.

For organizations that are mainly focused on business-to-business interactions, for instance when exploiting a technology platform, then engaging with the developers’ community is essential, as well as the capability of your proposition to connect as many APIs of new customers as possible. In the case of such a platform business model, this enables users to build services on top of your infrastructure and have access to an extensive community of platform suppliers.

It will be of increasing importance to integrate the front-, mid- and backend of organizations to transform into a “Connected Enterprise”. Here, silos are taken down to improve operational efficiency and to be closer positioned towards the customer in order to maximize customer experience and to realize a minimized time-to-market based upon evolving customer demands. Organizational agility stands out in a time where competitive markets are challenged by decreasing customer loyalty and increasing demands.

Figure 5. Which role and how to play in the platform economy? ([KPMG20]; [Park16]; [Tiwa14]) [Click on the image for a larger image]

Step 4: Get access to the right data sources and understand where they start

Start by mapping the connections from a bigger perspective in order to determine where customer demands are concentrated and where new market fragmentation will arise. Your customer and market evolve continuously, which results in new value pockets to target. Assess which data points are accessible and ensure an “outside-in” view regarding your data strategy. Where do future value pools arise, which margins will decline, and which will rise?

Provide a solid data fundament based on both accessible and reliable data sources which contribute to making confident strategic decisions. Evaluate the data quality continuously based on completeness, validity, uniqueness, consistency, timeliness and accuracy in order to safeguard that your data is suitable. Also explore opportunities for exchanging data in your ecosystem in case a mutual customer has to be served, which could for instance be relevant in shaping a multimodal and seamless Mobility-as-a-Service (MaaS) customer journey.

When developing a data strategy, make sure that your organization is able to scale up the data strategy and has the right (advanced) analytics capabilities in order to leverage external and internal data to the fullest extent possible.

Step 5: Perform an effective sourcing strategy

From the perspective of developing a strategy, it is important to strategically assess the “crown jewels” of your organization: unique assets and capabilities which differentiate your organization. We recognize a common problem in too much attention for investments which do not complement the distinguishing power, combined with non-focused partnering and a sourcing strategy that does not suit the “unfair advantages” of your organization. For instance, leasing companies have access to valuable capabilities to effectively determine residual values of corporate leasing cars based on data. Such a capability should not be outsourced. Simultaneously, benefits and efficiency can be realized by implementing market standards and best practices in the backend of your operating model. For instance, by applying a standardized ERP solution. With such a sourcing strategy, full attention is given to where your organization differentiates itself compared with competitors and it also paves the way for value-adding innovation.

Step 6: “Go big” or “go home”

No shortcuts endure in the way to sustainable distinguishing power and low-risk innovation does not exist either. As described earlier, strategic partnerships can contribute to optimizing and innovating your products and services, as long as such a partnership follows your strategic positioning and goalsetting. Traditional incumbents, such as large insurance companies, need to find innovation before innovators find distribution themselves. As the transformation towards the future of mobility impacts existing customer touchpoints, new propositions should be developed by incumbents based upon these developments to continuously serve the customer base. Making the right strategic decisions is of vital importance, as the timeframe to position your organization successfully in the ecosystem compared with competitors is strictly limited. This requires an “all-in strategy”: full attention and determination to effectively determine the optimal positioning. This could also be performed as part of a collaboration or an investment strategy.

When investing in ecosystems, make sure you perform an analysis on the influence of the role in the ecosystem and the feasibility of accomplishing that influence with your potential role regarding your investment target (see an example in Figure 6). In such a mobility platform investment analysis, unique assets, competencies and the strategic fit with the investing company are assessed in search of a “sweet spot” in the market. With this, an optimal platform role (following one of the options as outlined in Figure 5) of your organization with regard to the investment target is determined.

Figure 6. KPMG mobility platform investment analysis ([KPMG20]). [Click on the image for a larger image]

To keep momentum going regarding the distinguishing power, your strategic and digital agenda should be interconnected. Make sure that your organization embraces a “client obsession”, also focused on latent customer needs, and maximize a purpose-driven vision on the market and the organization’s role. And finally, build a culture in which your organization and people can continuously learn, evolve and improve. Digital technology merely upholds an opportunity; people make it excel in benefit of your customers and organization.

Conclusion

Mobility is undergoing one of the most influential social, technological and economic transformations of a generation. Sectors are being disrupted, with new markets emerging, while others are converging, and some are disappearing entirely. The winners are likely to be those that can truly understand the impact and timing of disruption and seize the right emerging opportunities. This means that you need to swiftly adapt business and operating models and secure the right partnerships and acquisition targets. Sources of value should fundamentally shift both within value chains and across the ecosystem. As incumbents, new entrants and startups compete for a share of the mobility ecosystem, each should consider where to play and how to win. We have seen many similarities and “obvious” initiatives in strategies performed by different organizations over the last years, whereas “differentiators” are most needed. Therefore, we believe that companies which carefully (re)shape and implement (six of the suggested items on) a strategic and digital agenda successfully, are likely the ones that will win.

One thing is clear: developments are rapidly emerging and companies only have a small window of opportunity to get ahead and position themselves to shape the future ecosystem.

References

[Ady20] Adyen (2020). Adyen at a glance. Amsterdam: Adyen.

[Bagh99] Baghai, M., Coley, S., & White, D. (1999). The Alchemy of Growth: Practical Insights for Building the Enduring Enterprise. New York: Basic Books.

[Kim17] Kim, W., & Mauborgne, R. (2017). Blue Ocean Strategy. Brighton: Harvard Business Review Press.

[KPMG19a] KPMG (2019). Mobility 2030: Are you ready to rise to the challenge? Amstelveen: KPMG.

[KPMG19b] KPMG (2019). KPMG Mobility 2030 analysis – the Automotive sector. Amstelveen: KPMG.

[KPMG20] KPMG (2020). KPMG Mobility Platform Analysis. Amstelveen: KPMG.

[Park16] Parker, G.P., Alstyne, M.W. Van, & Choudary, S.P. (2016). Platform Revolution: How Networked Markets Are Transforming the Economy and How to Make Them Work for You. Grand Haven: Brilliance Audio.

[Petz17] Petzinger, J. (2017). Europe’s new super-charging network could encourage more people to buy e-cars. Retrieved from https://qz.com/1119770/german-carmakers-and-ford-launch-ionity-joint-venture-to-set-up-a-european-network-of-ultra-fast-ev-charging-stations/

[Shah20] Shah, H. (2020). App Usage Statistics 2020 that’ll Surprise You. Retrieved from https://www.simform.com/the-state-of-mobile-app-usage/

[SHAR20] SHARE NOW. (2020). About. Retrieved from https://www.share-now.com/nl/nl/

[Tiwa14] Tiwana, A. (2014). Platform Ecosystems: Aligning Architecture, Governance, and Strategy. Amsterdam: Elsevier Science & Technology.