The implementation of a business strategy is often impeded by a lack of reliable information. In the past few years, circumstances have been so turbulent and unpredictable that companies have had to constantly seek insight into market trends more intensively than ever before. In addition, companies must prove flexible enough to be able to react quickly. An increasing number of organizations are investing in business intelligence solutions, but many are not achieving the possible – and anticipated – benefits.

Introduction

Organizations throughout the world are spending enormous sums of money on business intelligence. However, many people are wondering if these investments in business intelligence solutions do genuinely lead to more manageable organizations. In everyday practice we see that organizations that attempt to solve their “information problem” by means of large investment in IT tools are booking only limited results. Organizations that pick up the problem in a more comprehensive way, looking at strategic starting points as well as elements of data governance and infrastructure, are obtaining much better results. This article provides an integral approach to your “information problem.”

In the current economic climate, enterprises are beginning to realize that they will have to change if they wish to be successful. A recent worldwide survey by KMPG indicated that half of all participating organizations have plans to implement a new business model in the near future. This implementation of new business models will be supported by large-scale investments in IT solutions.

However, enormous investments in IT do not necessarily guarantee better information. It is more important to effect a fundamental change in the way in which data is gathered, processed and presented.

Commissioned by KPMG, Cambridge University performed comprehensive research on business intelligence, in order to determine the extent to which enterprises are ready for this fundamental change. The outcomes of this research seem to show that many of the companies examined were not able to realize the anticipated advantages of business intelligence, such as improved insight into customer behavior and operational results, despite a total annual investment of around 60 billion dollars.

The following reasons were determined in the research.

- Less than ten per cent of the organizations were successful in improving the organizational structure and technical infrastructure with the help of business intelligence.

- In more than fifty per cent of the organizations, business intelligence projects did not produce the expected benefits.

- Two-thirds of the executives find the quality and consistency of the data insufficient. In addition, it is not always accessible on time.

- Seven out of ten executives do not receive the information necessary to make operational decisions.

- Almost half of all managers have no faith in the management information they receive from their own company.

In short, despite substantial investment, the resulting effects are rather meager. It can also be stated that much of the collected data is inaccurate – an adverse effect that makes the decision-making process even more risky.

The good news is that those enterprises that have effective business intelligence do realize five per cent more yield on their own capital than the rest of the market does. On the basis of our practical experience, we too come to the same conclusion: enterprises that regard information as their most important asset, and which set up an information architecture in which information flows are not obstructed and are used effectively, manage to achieve more success in terms of profitability and capacity to respond to new developments in the market.

Enterprises that embrace business intelligence are more capable of providing the right information to the right people at the right moment. In addition, by doing so, they gradually become aware that this form of information provision really does give a competitive advantage at strategic and tactical levels, and at a lower cost price.

Embedding business intelligence in your organization

The success of a business intelligence project depends on a number of factors. One of the most important of these is ownership. This should not be the domain of the IT specialists; it is better that the business intelligence solution be embedded in the line and among the owners of the organization’s business processes. Another important factor is the managers’ acceptation of the fact that they must cease to formulate their “own” reports, because these are often based upon sub-information that is qualitatively inadequate. A third important precondition for success is the connection of the business intelligence solution to the performance management strategy, so that KPIs (key performance indicators) gain in terms of importance and relevance.

To realize this, it is necessary to adopt a more holistic perspective:

- Start from the needs of the users and owners of the information, do not start with the possibilities offered by technology.

- Change the process of collecting, measuring and reporting information by creating an information architecture that ensures the appropriate performance indicators.

- In the apportioning of resources, give priority to the improvement of quality of the data, rather than to technology.

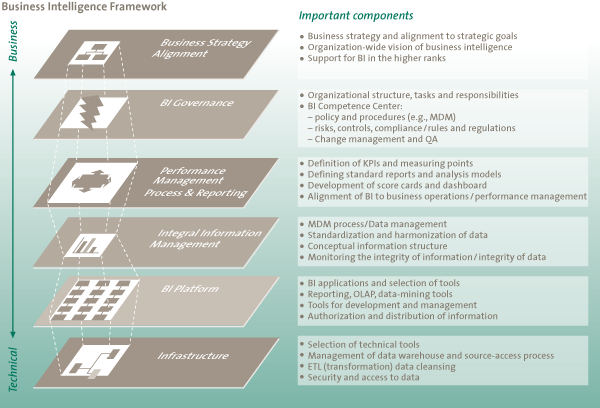

KPMG’s Business Intelligence Framework provides a solid framework for finding the right balance between investing in your technical and your organizational infrastructure, in order to gain optimum yield from investment in your information facilities. This framework consists of six “components” that are related to one another but can be applied separately.

Figure 1. KPMG’s Business Intelligence Framework. [Click on the image for a larger image]

Business Strategy Alignment: link between business strategy and business goals

It is essential that the information used for business operations be explicitly linked to the business goals. This ensures that the management function is directly related to the strategic objectives. Accordingly, it is crucial that the management attempt to realize a situation in which the information facilities support all operational decisions. The business intelligence strategy should therefore fit seamlessly to the business strategy.

BI governance

The aim should be to realize an organization within which people can confidently make use of one and the same collection of data. This requires:

- clear ownership of data and information;

- clear ownership and management of processes and systems that generate information;

- clear insight into who makes use of the information and why.

This approach can contribute to more consistency in the method of reporting and measuring within the organization, which will lead, in turn, to more transparency, relevance and focus, by means of which achievements within the organizations can be compared in a significant way.

Performance Management Process & Reporting

Research has shown that only 23 per cent of the enterprises actually measure the “properly relevant” aspects. As a consequence, staff are often assessed and rewarded on the basis of activities that do not contribute to the realization of business objectives. For this reason, it is essential to develop scorecards that support proper behavior in the organization.

Integrated Information Management

For the successful establishment of a BI platform, it is necessary to embed a number of elements from the Enterprise Data Management “stack” (EDM)[We refer the reader to the article “Enterprise Data Management: value and necessity.”] in the organization. We summarize these elements under the term “Integrated Information Management.” We shall deal with the topic in more detail shortly.

Business intelligence platform

A business intelligence platform is not a stand-alone software package, but rather a part of an integrated network. A good business intelligence solution consists of various applications and makes it possible to extract and cleanse data from diverse (custom-made) systems. This produces a uniform and reliable picture, enabling personnel to obtain better insight that supplements business strategy.

Business intelligence infrastructure

Unnecessary expense ought to be avoided when setting up the IT architecture for business intelligence applications. One should take care to preclude excessive information demands, vague organization structures and an abundance of applications. Through smarter configuration of business intelligence, the costs of IT architecture can be substantially reduced, even by as much as forty per cent, according to some estimates.

Connection between business strategy and business intelligence strategy

Your organization can only benefit from information that enables you to take the right decisions. By linking your need for information to your strategic requirements, the basis is created for the good measurement of achievements, business intelligence that is competitive, and effective decision-making.

Until now, the promises of the “information era” have scarcely materialized. One of the greatest myths is that more data leads to better achievements. On this basis, organizations spend millions on the modernization of information systems that have intrinsic flaws. This results in a situation in which management is inundated by an ocean of data, while the intention was actually to gain better insight into the available data. Therefore it is essential that management information make a contribution to the most important strategic and tactical decisions. Double work should be avoided in the formulation of management information, so that an information overload is avoided and the costs of supplying information remain within reasonable boundaries. An effective approach requires that the managers who are responsible for the information flow first ensure that they have good insight into the way in which the enterprise creates value. Financial information is generally effectively reported, but other, less tangible aspects such as “churn” (customer loss to others) and the health of a project as a whole are more difficult to chart. Nevertheless, effective management of these intangibles is often the factor that creates most added value.

Enterprises that have insight into the decision-making process that steers this value creation can arrange that their entire information flow supports these crucial activities. This also makes it possible to reduce the number of reports produced, which considerably lowers the costs of IT implementation and other costs.

Case study: Aligning business and KPIs

Is it possible to be more effective and efficient at the same time? A global automotive supplier has learned that a sharp focus on what matters can provide more incisive information at a significantly lower cost.

Rather than the classic systems approach of collecting masses of conflicting business requirements and then trying to reconcile this into a coherent set of requirements, this global supplier chose to start with the core information required to enable the business model. This involved a detailed analysis of the existing business model and the strategy. By re-defining the measures that reflect real value, KPMG’s Business Intelligence practice helped the company set new key performance indicators (KPIs), covering performance from a financial, operational, and risk perspective. Reports were standardized and the number and size of documents were reduced, eliminating unnecessary information.

The result was a significant reduction in the number of reports and less duplication of redundant information. The client can now navigate the internal organization and external market much more effectively, forecast quickly and produce information at a lower cost. The client is now aware that, to steer the business and to support its strategy, it needs more than just KPIs: it must harmonize its planning, forecasting, and reporting so that all link into the same information.

BI governance

Truly valuable business intelligence is generated when organizations clearly define the owners, users and formulators of the information, and the way in which the information is presented. Strict definitions of ownership and management help ensure consistently accurate reports and make it possible to compare achievements in a frank and fair way (“like for like”).

Many enterprises are faced with an abundance of miscellaneous data in various formats, which makes it difficult if not impossible to compare them properly. Even a concept such as gross turnover, which would appear to be a lucid concept at first sight, can have several definitions. All too often, the responsibility for the generation and presentation of data rests with numerous individuals and/or groups, and there are no company-wide principles or norms. This not only to the detriment of the evaluation of achievements, but prognoses also become less reliable because divergent approaches are used for sales, company activities, financing and production. Here, too, it is the case that large IT investment alone is not the solution: it only ensures that bad habits are prolonged.

Effective governance means a definition of the owners of information. For example, Global Marketing in head office may be the owner of the data on the top-ten products, whereas the data on the other products may belong to the regional marketing sections. And the marketing teams at national level may be the owners of the promotional packages. If one wishes to change the definition and usage of information, such a step will have to be authorized by one of these parties.

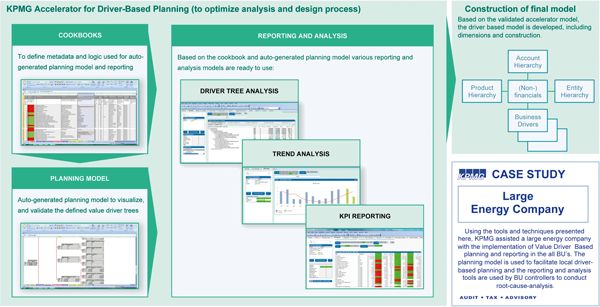

Case study: Value-driver-based reporting

Aligning business, finance and KPIs: Is it possible to be more effective and efficient at the same time?

A large energy company has learned that a sharp focus on what really matters can provide more incisive information and better understanding of the true drivers of business performance. Rather than taking the classic approach of reporting financials and operational management information in separate processes, this energy company chose to improve its business performance reporting by supporting management with “Value Driver Trees” where the financials are connected to the underlying business drivers.

Automated value-driver trees and management dashboards containing the key value drivers supported the introduction of driver-based steering and reporting.

This new way of steering the business resulted in improved performance dialogues in the underlying Business Units, better understanding of the root cause behind the financial performance, and improved maturity of the business-controlling function on its road to becoming a real business partner.

The implementation of this improved and driver-based reporting was supported by flexible BI tools that combined the financials from the local general ledgers with a direct drill-down function to the underlying operational drivers extracted from the core operational business systems.

Performance Management Process & Reporting

The achievements of concerns and of the group as a whole must be clearly connected to the strategic priorities of the enterprise. This can only be achieved by measuring and rewarding activities that contribute to the success of the enterprise.

The financial crisis of the past few years has raised serious questions about the way in which performance has been measured and rewarded. Apprehension about this is not confined to the financial sector alone. In most sectors, enterprises measure a multitude of factors that have little or no influence on the realization of the strategic goals.

Within most organizations, the cycle of performance assessment consists of numerous processes: strategic planning, the allocation of portfolios, the planning of capital administration, the formulation of targets, budgets and prognoses, and the execution of monitoring. To ensure good management, it is essential that these processes link up well with one another. The reliability of the information is thus enhanced and sizeable cost-savings can be realized by selecting the proper KPIs, by planning reports in detail, and by further automating the processes.

Leading enterprises are aware that more effective prognoses enable better performance management, so that they can capitalize more quickly on market changes. They orient their efforts toward aspects that do genuinely create added value and, in doing so, involve the management staff who are directly responsibility

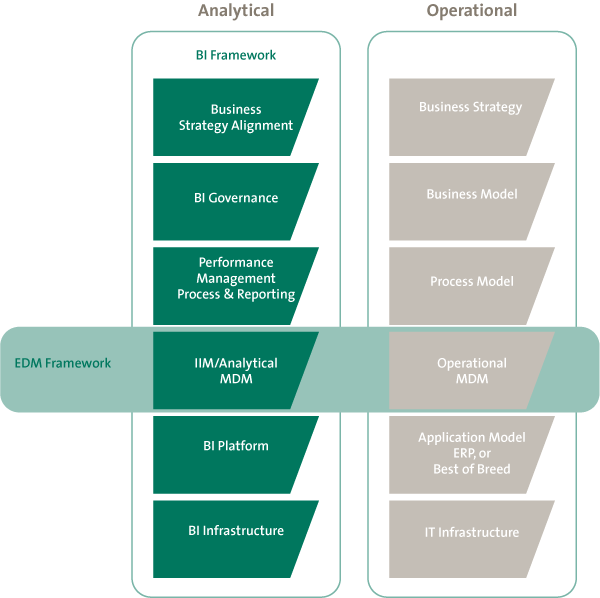

Integrated Information Management (IIM)

There has been an enormous increase in the amount and diversity of the data that organizations generate. To enterprises, it is now more essential than ever to manage their data as effectively as possible and to be able to rely upon the accuracy of this data.

In order to design and set up an effective BI platform, it is necessary to have a number of elements from EDM embedded in the organization. First of all, there must be an anchoring of a number of data management activities. Well-functioning data governance is perhaps the most important precondition. Data governance creates a management structure by embedding the management-related tasks and responsibilities in the organization. In addition, it brings a data management vision and strategy and provides policy and rules. Such elements form an important foundation for the development of a BI strategy that is supported organization-wide and is in line with other data initiatives within the organization. Furthermore, it is necessary to have a shared “data language” in which concepts, terms and definitions have been elaborated and are used consistently throughout the organization. It is also crucial that data from the different operating systems used by the BI platforms becomes available in a standardized (or harmonized) form.

Master data management ensures that processes, organizational structures and technology are available to realize IIM. The data architecture should be able to deliver data models to support the design process of the BI solution. This can all be summarized under the term Integrated Information Management, which can be regarded as a subset of EDM.

“Analytical MDM” versus “Operational MDM”

Successful BI implementations have incorporated master data management (MDM) as an integral component in the realization phase. In this framework, MDM forms an important pivot in the ability to integrate information originating from several source systems.

The incorporation of MDM in BI projects is crucial to the attainment of consistent, complete and reliable management information. However, with the integration of information originating from several source systems, the organization-wide master data issue is not yet solved. MDM as an element in the BI environment is primarily directed toward the analytical part (analytical MDM). This being the case, the scope is largely restricted by the management information requirements imposed.

Analytical MDM is primarily oriented toward the harmonization of data from various source systems, and the establishment of a central referential covering several data sources. This is needed, for example, to be able to present an unambiguous customer profile across several systems that contain customer data, combining data gleaned from sales, production and financial systems, for instance. In addition to ensuring a central referential covering different source systems, analytical MDM is also directed toward the determination of dimensional data, such as the recording of customer hierarchies that issue from the directional needs of a marketing section, for example.

In a BI environment, MDM fulfills two important functions: the harmonization of customer data to generate a clear customer picture and the recording of specific roll-up or pyramid structures (customer hierarchies) in order to execute the proper analyses / market segmentations.

Figure 2. KPMG’s Business Intelligence Framework and relationship to the EDM Framework.

Operational systems that serve as a source for BI have their own operational MDM process. In this context, we can mention the maintenance of account structures in a financial system or the specific composition of an end product in an ERP system. We refer to this as “Operational MDM.” The operational part of MDM is beyond the scope of BI. In conjunction with analytical MDM, it forms an integral part of EDM.

Business intelligence platform

A business intelligence-platform is not a stand-alone software package but a part of an integrated network. This type of platform often consists of diverse applications and enables the extraction and cleansing of data from all kinds of old systems. This produces a uniform and reliable picture, so that staff can obtain better insight into company activities. In this way, a link is established between the business strategy and its implementation. Technology is merely a means; it is seldom the cause of the failure of business intelligence projects.

It is all too easy to assume that the introduction of new BI applications will solve all your data problems. Before your organization actually makes an investment in IT, it is crucial that it should first determine which information it wishes to have available. The selection of the appropriate solution requires a controlled process, in which your organization deploys processes for the selection of software and ensures that it has effective support and commitment from stakeholders. This is all the more important in the choice of the correct reporting and analytical software. Organizations that wish to give their staff more insight into operations and wish to incorporate business intelligence seamlessly into their work environment must take care to choose applications that are user-friendly and are indeed used for the purpose for which they were developed. In addition, you will have to formulate a profile of your data. In this way, you can gain more insight into the quality of the data, and you will know exactly the volumes and the frequency of this data extraction. In the rollout of business intelligence, it is not only the technique that is important. It is also essential to pay attention to the new role that staff are allocated within the organization. This can be done by designing effective processes for the better management and guarantee of data quality, or by the establishment of new reporting teams. Whatever the situation, it is of crucial importance to implement a change project for both individuals and groups, in order to ensure that the rollout of the new business intelligence platform will be successful.

Business intelligence infrastructure

An effective technical infrastructure forms the framework that ensures that accurate information is available at the right moment. The infrastructure must be secure and also flexible enough to adapt to new criteria.

Organizations must prevent being confronted by an unnecessarily complex technical infrastructure. The starting point is a clear line in the information strategy. This prevents people having to compensate flaws in the architecture, often at great cost. However, investing in business intelligence by introducing new technical architecture is no guarantee of added value. Only architecture that meets the following four characteristics leads to value creation:

- Scalable. The architecture of the business intelligence application must be sufficiently flexible and balanced to meet the information needs in a cost-effective way, in both the short and long term. Please note: what is most cost-effective in the short term is not always most cost-effective in the long term, and vice versa.

- Available. The architecture must take account of the requirements relating to the availability of the system. For example, the current systems may not need to run for 24 hours a day. But if the enterprise wishes to expand internationally, this may lead to different demands on availability, because production must be increased or services must be provided to customers in other time zones for example. Periods of unavailability due to nocturnal system back-ups must also be taken into account.

- Secure. Effective security means that access to the data is monitored and controlled in an appropriate way, observing the application regulations with regard to privacy and the storage of data. The security solution is a tailor-made configuration. In this, a good balance must be found between the need to share as much information as possible with as many parties as possible, and the necessary security of commercially sensitive information and an adherence to rules and regulations.

- Maintenance-friendly. The cost and ease of maintenance of the environment must also be taken into account, as defined by the application architecture. The rollout, monitoring and troubleshooting aspects must be straightforward and the environment must harmonize with the existing back-up and archiving processes.

References

[AMRR] Spending on Business Intelligence and Performance Management to Top $57.1B in 2008, AMR Research, May 13.

[Bloo07] N. Bloom, R. Sadun and J. Van Reenen, Americans do I.T. Better, CEP Discussion Paper 788, London School of Economics, 2007.

[Caic07] Carlos F. Caicedo, Mark D. Mitchke and Jon Vander Ark, How to build top-performing auto dealerships, McKinsey & Company, 2007.

[Chen05] R.H. Chenhall, Integrative Strategic Performance Measurement Systems, Strategic Alignment of Manufacturing, Learning and Strategic Outcomes: An Exploratory Study, Accounting Organizations and Society 30(5), 2005, pp. 395-422.

[Gate99] S. Gates, Aligning Strategic Performance Measures and Results, New York, NY: The Conference Board, 1999.

[Grif07] T.D. Griffioen, De MIS-fit van de organisatie, Compact 2007/1.

[Grif08] R. Griffiths and A.D. Neely, Incentives and Managerial Experience in Multi-Task Teams: Evidence from within a Firm, SSRN Working Papers, 2008.

[Grif09] T.D. Griffioen, M. Gaus and A. Vreeke, Business Intelligence: Holistisch benaderen, stap voor stap implementeren, Compact 2009/0.

[Ittn03] C.D. Ittner and D.F. Larcker, Coming Up Short on Non-financial Performance Measurement, Harvard Business Review 81(11), 2003, pp. 88-95.

[Kapl07] R.S. Kaplan and D.P. Norton, Using the Balanced Scorecard as a Strategic Management System, Harvard Business Review 85(7-8), 2007, pp. 150-61.

[KPUK09] Collaborative study by KPMG in the UK and Cambridge University, 2009.

[Ling96] J.H. Lingle and W.A. Schiemann, From Balanced Scorecard to Strategic Gauges: Is Measurement Worth It? Management Review, 85(2), 1996, pp. 56-61.

[McGr08] Maura McGreevy, “Never catch a falling knife,” Global Business Survey 2009, KPMG International, 2008.

[Neel08] A.D. Neely, B. Yaghi and N. Youell, Enterprise Performance Management: The Global State of the Art, Oracle and Cranfield School of Management, 2008.

[Neil08] G.L. Neilson, K.L. Martin et al., The Secrets to Successful Strategy Execution, Harvard Business Review 86(6), 2008, pp. 60-70.

[Rayn08] N. Rayner, Measuring and Managing Corporate Performance: The State of the Art, Gartner, August 2008.