In recent years, much emphasis in the climate change debate has been placed on renewable electricity and the transition to electrified houses, industry and mobility. In itself, very positive developments to move away from fossil fuels, but we still face several challenges in making society and economy more sustainable. Energy carriers like wind and solar include high volatility of generation (imagine the impact on a windless or cloudy day). On the other hand, the demand for electricity is also characterized by volatility due to specific patterns during the day. As a result, moving towards fully sustainable energy production is a comprehensive transformation with many associated challenges. Moreover, these challenges also mark opportunities for hydrogen, which could be a potential problem solver for such arising challenges as a new, sustainable era is dawning.

In this article, we examine the potential for hydrogen to play a significant role in the low-carbon economy of the future and, in particular, as part of the future mobility landscape.

Challenges of the current generation of battery electric vehicles (BEV)

Today, electrification is undoubtedly at the top of OEMs’ agendas. Almost every major automaker has pledged significant investments in electric technology. OEMs are striving to expand their EV development and production as quickly as possible. However, there are several significant challenges involved with the large-scale electrification of mobility.

Financial challenges

The investment costs involved in replacing current fossil fuel-oriented infrastructure with electrical infrastructure are significant. A major component is the cost of developing a sufficient public and private charging infrastructure to support mass usage. The electricity distribution network in Europe will not be able to support mass (battery) electrification without extensive investment, as demand for electricity will approximately double if all passenger vehicles move to BEVs. For the automotive industry, hefty costs will be involved in developing new electric drivetrains and in obtaining the scarce raw materials needed for batteries. Meanwhile, for individuals the total cost of ownership (TCO) of a BEV is likely to remain relatively high compared to ICEs given the high price of BEVs themselves. On top of which come the costs of the energy needed to actually power these vehicles, as well as associated taxes for usage (although these additional costs are currently limited due to zero-emission incentive programs).

Technical challenges

The transition to a lower-emission economy is, in some circumstances and parts of the world, technically very difficult. Primarily because the ratio between energy storage capacity and associated mass of batteries is limited. BEVs are still hampered by technical limitations for which solutions will need to be found. These include the time currently needed to recharge/refuel (one or more hours) and the range currently possible on a single full charge (400 km for a passenger car, but only 200 km for a truck). Additionally, the scarce raw materials required for mass adoption could be a bottleneck for electrification.

Socio-economic challenges

In order to replace fossil fuel alternatives, an enormous amount of technically skilled labor will be needed. But these skills are scarce within the workforce, which could be a serious limitation to achieving a transition within the planned timescale. This matters because in order to meet CO2 reduction targets, it is crucial to tackle all challenges on time. Another barrier may include persuading all individuals or companies to shift away from fossil fuels. Financial incentives may be needed, as well as effective communication and education to overcome issues such as “range anxiety” – which is known as the anxiety that users of battery electric vehicles experience when battery range is fairly limited. Without widespread and rapid adoption, there is a high risk of targets not being met.

Hydrogen as a potential solution in specific segments

Given the financial and timing constraints of investments to support BEVs, focus on battery electrification only will hamper reaching the greenhouse goals that have been set.

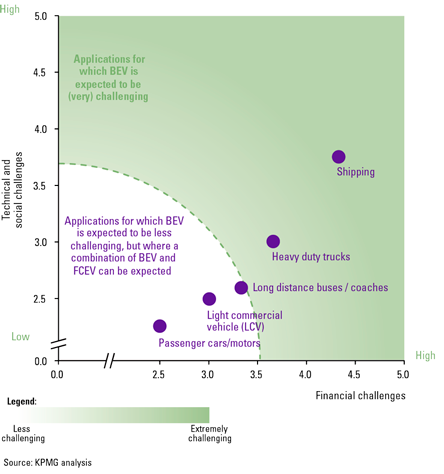

In particular, commercial vehicles such as LCVs, HGVs and buses face significant limitations with the current generation of BEV technology, such as the associated weight of batteries for a sufficiently long range. Technically and financially, heavier vehicles face more problems with (battery) electrification than passenger vehicles as can be seen in Figure 1.

Figure 1. Electrification of consumption, challenges analysis. [Click on the image for a larger image]

That is why other powertrains must be developed in conjunction with electric batteries – and hydrogen-based fuel cell electric vehicles (FCEVs) could hold a significant part of the answer. Globally, around 25,000 FCEVs were out on the roads ([KPMG20a]) in 2019. Currently, a small but growing number of hydrogen stations are in operation. In Europe, around 100 hydrogen stations are available in Germany, for example. The EU has the ambition to achieve around 3,700 hydrogen refueling stations across Europe by 2030.

The FCEV market is only in its infancy but shows incredible potential and appears a key component of a greenhouse emission-free mobility model. In 10 to 15 years’ time, the picture may look very different from today, with the number of FCEVs moving from the tens of thousands to the tens of millions.

An FCEV/hydrogen fuel cell vehicle is a type of vehicle that uses a hydrogen fuel cell to power its on-board electric motor. It does not release any greenhouse gas (GHG) emissions during vehicle operation – only water vapor and warm air – unlike diesel and gasoline powered vehicles.

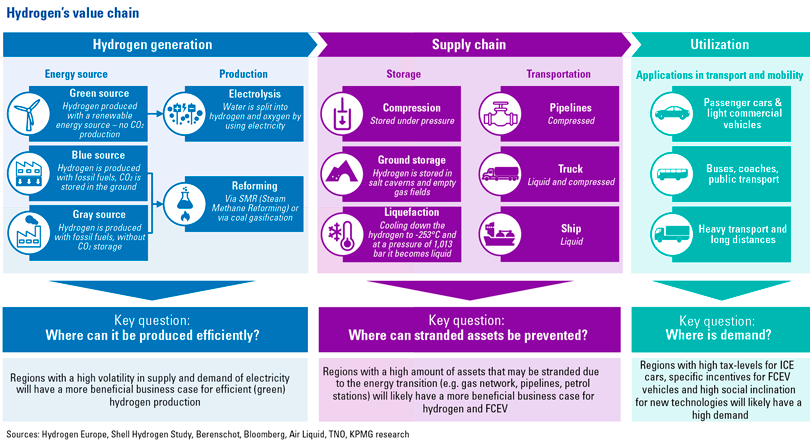

To identify where hydrogen can be a success, these three main areas need to be observed (see Figure 2).

Figure 2. The three pillars of Hydrogen success. [Click on the image for a larger image]

To enable true CO2-free mobility, greenhouse gas emissions should not only need to be reduced to zero during vehicle operation, but also during energy production. Consequently, without green energy sources, green mobility does not generate the benefits it is supposed to deliver. This means that electrification requires renewable sources, be it renewable electricity for BEV or green hydrogen based on renewable electricity for FCEV. Luckily, renewable electricity has so far been the cornerstone in the energy transition. Production in Europe is expected to be seriously ramped up over the course of the next decade.

The three pillars to make hydrogen a success

To overcome the challenges and to stimulate hydrogen adoption, there are three key pillars that we will examine in turn: production, supply and utilization. Each of these must support and reinforce each other if FCEVs are to reach their full potential over the coming years.

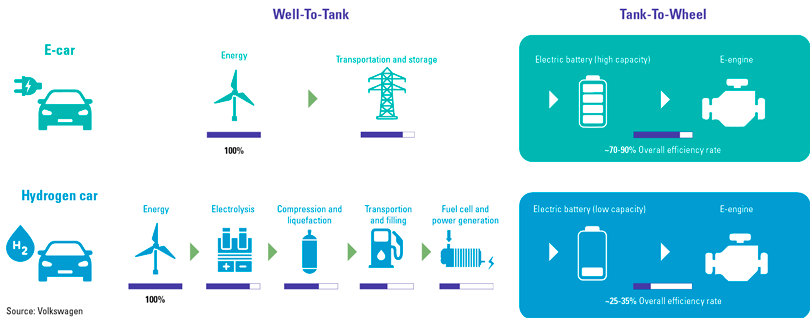

Pillar 1: Hydrogen generation

As we already have outlined, the usage of renewable energies seems crucial for a climate-friendly transition from internal combustion vehicles to electrified mobility. The uptake of renewable electricity generation forms, particularly wind and solar, is resulting in temporary oversupply. Consequently, in order not to lose electricity that has been produced, this electricity needs to be stored temporarily. Hydrogen is considered to be the most effective and versatile means for medium and long-term storage of electricity (> 1 day): even though the energy efficiency is lower than with batteries (25% – 35% vs. 70 – 90%) due to energy losses in the electrolysis process ([Volk20]). In addition, the ability to scale is less dependent on scare resources as resources for hydrogen (water) are nearly infinite, while batteries require scarce metals (see Figure 3).

Figure 3. Efficiency rates for hydrogen and electric driving ([Kane20]; [Volk20]). [Click on the image for a larger image]

Regions with high volatility in supply and demand of electricity will therefore have a better business case for efficient (green) hydrogen production. High volatility produces higher storage needs. In addition, hydrogen is expected to become more cost-effective in the coming decade (compared to its gas equivalent) as a result of improved hydrogen production technologies and the supply of renewable energies.

In Europe, Germany, the United Kingdom and the Netherlands have an interesting energy mix composition with a relatively large share of solar and wind energy. Therefore, these countries could profit at an earlier stage from hydrogen applications as can been derived from the existing capacity of renewable energy sources published by the International Renewable Energy Agency ([IREN20]). Generally, countries with a high share of renewables simultaneously face higher production volatility. This is particularly experienced with significant shares of wind and solar energy, which therefore also require a higher storage/balancing capacity.

Pillar 2: Supply chain

The generation of electricity is transforming from conventional centralized sources to a decentralized model with renewables. But this electricity supply is volatile, as it is heavily affected by the prevailing weather conditions.

As the share of EVs and the number of charging point locations are expected to grow exponentially in the coming decade, capacity problems on the grid will arise and potentially become acute. In the Netherlands, for example, we already see variations between local grids – capacity issues are very much a localized issue, with each grid needing to manage its own demand and supply. Capacity problems are already arising, such as in the north of the country where some solar parks ([NOS19]) are only able to connect to the grid at certain times and where 20 completed solar parks are not able to be connected at all. The current infrastructure is unable to transport sufficient amounts of renewable energy to areas where it is needed. Elsewhere, some corporates with large car fleets are already at the capacity limits of how many cars can maximally be charged during the day. This implies that if additional EVs are added to their fleets, simultaneous charging of the entire fleet will not be possible anymore.

For this reason, it is essential for electricity to be generated (locally), distributed and/or consumed in a smarter way. Again, hydrogen can provide an advantage, as it not only allows for effective energy storage, but also for efficient and effective transport, bypassing the electricity grid. Both financially and technically, with some changes, existing gas pipelines could be used to distribute hydrogen. Indeed, the Netherlands and Germany are currently studying the feasibility and best way of doing this. By re-using existing gas pipelines and gas infrastructure (including existing salt caverns and empty gas fields for storage), hydrogen can prevent existing infrastructure becoming obsolete (stranded assets) as a result of the energy transition away from gas. Shell, Gasunie and the EU are commencing initiatives in this area ([Shel20]).

All in all, the issue of temporary oversupply of electricity, combined with the ability to re-use existing infrastructure at risk of becoming obsolete, is expected to make hydrogen cost-competitive in the mobility domain within the coming decade.

Pillar 3: Utilization

The global FCEV market is currently at a nascent stage, accounting for only 0.01 percent of total vehicle sales in 2019. However, according to the International Energy Agency ([IEA20]), this share is expected to reach 17 percent by 2050, with 35 million annual unit sales. Key factors that would drive this growth include rising environmental concerns and supportive government policies in various countries, to increase the use of eco-friendly vehicles.

In addition, a focus on developing the required infrastructure such as hydrogen refueling stations is also likely to drive penetration of FCEVs and push vehicle manufacturers to develop more hydrogen-powered vehicles. Efforts and attention in the nascent FCEV market are currently primarily focused on passenger vehicles, but commercial vehicles are expected to catch up. In China for instance, commercial vehicles such as buses, trucks and vans constitute more than 99 percent of existing FCEV sales. In Europe, truck manufacturer Daimler recently announced that hydrogen-based fuel cell trucks are a key part of its electrification strategy ([Daim20]). Key countries expected to drive the growth of the FCEV market include the US, UK, South Korea, Japan, China, Germany and France.

It is expected that when FCEVs become more widespread, the balance will move decisively to long distance and heavy-duty transport such as HGVs and public transport, where the size and weight of the vehicles mean that hydrogen fuel cells are a significantly more attractive and practical proposition than electric batteries.

Government incentives and regulation

While deployment of FCEVs is low compared with plug-in hybrids (PHEVs) and BEVs, several countries have announced ambitious targets towards 2030, amounting to over 7 million FCEVs and 12,000 refueling stations.

The US has been the frontrunner in the adoption of hydrogen as an alternative fuel and has formulated various laws and policies. However, Europe and other countries like China and Japan have also come up with hydrogen strategies.

These initiatives – along with incentives to promote the purchase of FCEVs and to stimulate further research and development of the technology – will be important catalyzing factors in the growth of FCEVs.

Similar to the introduction of PHEV and BEV are governmental incentives in the form of subsidies or tax benefits – these are expected to become an important driver of the FCEV ramp-up. We can expect this in particular in countries where BEVs are expected to face significant challenges, countries where volatile renewable electricity production will be a large part of the electricity mix, and those with an advanced established gas infrastructure.

All aboard the hydrogen bus

Transit buses do not require an extensive refueling infrastructure as they operate within city limits and can refuel at a central location. This makes fuel cell buses well-suited for the present situation (relatively few refueling stations), leading to their rapid adoption across the globe. The Hydrogen Council, a global industry body set up in 2017, has set a target to manufacture and sell 50,000 fuel cell buses globally. H2Bus, an industry consortium, plans to deploy 1,000 fuel cell buses in Europe including the first 600 across the UK, Latvia and Denmark by 2023. Transit agencies in the US have also started operating fuel cell buses in the last couple of years.

Commercial applications are being introduced

An increasing number of OEMs are actively producing FCEVs today, with Toyota and Hyundai currently being the clear market leaders. We can already add names such as Honda, Renault, Maxus (SAIC) and, on the commercial side, manufacturers such as Yutong, Foton and Dongfeng. A growing list of other major OEMs – including Mercedes Benz, BMW, Audi and Kia – have FCEVs in testing or in concept development stage. Alongside this, a number of major players in the automotive sector are investing heavily in either developing their own fuel cell technology or acquiring companies that already have a presence in the FCEV value chain. A race is developing, with a growing number of mergers & acquisitions (M&A) as a result. In addition, partnerships are proliferating, mostly aimed at sharing knowledge, reducing the cost of developing required infrastructure, and obtaining data for research and validation. Partnerships are also being developed on a regional level – such as the consortium that has been initiated to create a hydrogen valley in the North of the Netherlands ([Rotm20]).

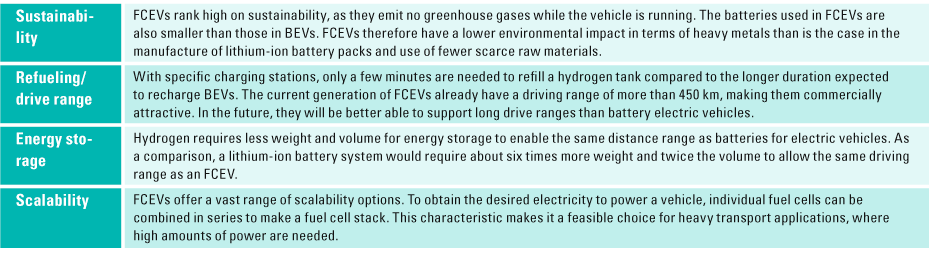

Benefits and advantages of FCEVs

Some of the key benefits offered by FCEVs over other vehicles are faster refueling times, longer drive ranges, ease of scalability, lower space requirements for energy storage, lower vehicle weight as a result of not having large batteries on board, and environmental friendliness:

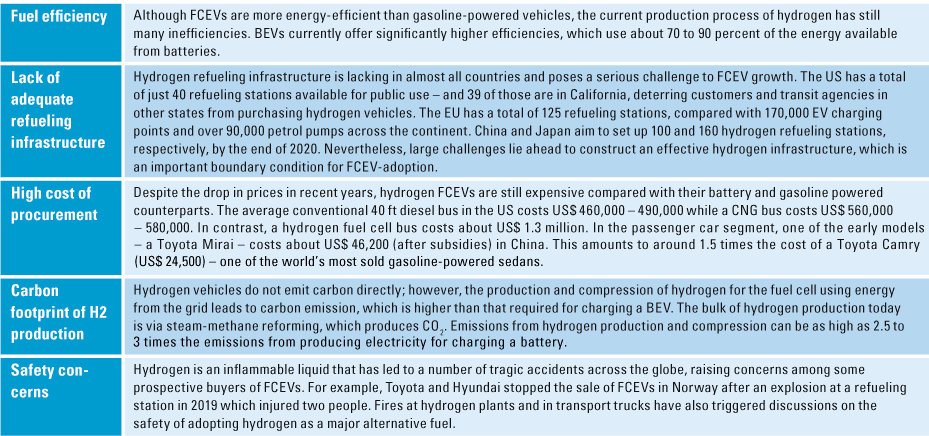

Challenges and (current) limitations

However, while the above advantages may seem compelling, at the same time there are a number of limitations and obstacles that will need to be overcome for the deployment of FCEVs to take off at scale:

Conclusion

The drive for low carbon mobility and transportation requires an accelerated transition to electrified vehicles. However, there are still some major limitations that hamper the implementation of BEVs at scale, especially for long distance and heavy-duty transport. FCEVs are an important piece of the puzzle.

The FCEV market is only in its infancy but shows incredible potential and appears a key component of a greenhouse emission-free mobility model. In 10 to 15 years’ time, the picture may look very different from today, with the number of FCEVs moving from the tens of thousands to the tens of millions.

The combination of the technical challenges of BEVs, primarily in commercial vehicles, the challenges faced by many countries’ electricity grid networks to cope with more volatile electricity production and the need to meet mass BEV charging demands, will drive demand for alternative solutions for energy storage and distribution. In addition, with the risk of gas networks becoming obsolete – and major oil and gas companies investing heavily in hydrogen technologies – there are powerful commercial and public incentives to maximize the adoption of fuel cell technology as part of the mix. It is in meeting the strains caused by the above-mentioned combination of factors where hydrogen has its greatest potential for the future.

Countries that can reuse their existing assets, such as gas pipelines to transport hydrogen produced from renewable energy generation (e.g. wind and solar), could create a strong advantage. Such countries include Germany, the Netherlands and the UK.

We expect these countries, and others in Europe including France, to see the highest growth in FCEVs alongside China, Japan, South Korea and the US. These are likely to be the jurisdictions that lead the way with hydrogen FCEVs, primarily (or at least initially) for commercial vehicles and public transport modes.

As with the future of mobility, there still is enough room for play in the FCEV space – we have an exciting journey ahead of us.

Watch this KPMG video about the role of hydrogen for industry, housing and mobility in the transition towards renewable energy: https://vimeo.com/user112272715/review/477511673/dc8c4e3059

References

[Daim20] Daimler (2020, September 16). Daimler Trucks presents technology strategy for electrification. Retrieved from: https://www.daimler-truck.com/innovation-sustainability/efficient-emission-free/mercedes-benz-genh2-fuel-cell-truck.html

[EC20a] European Commission (2020, October 27). 2050 long-term strategy | Climate Action. Retrieved from: https://ec.europa.eu/clima/policies/strategies/2050_en

[EC20b] European Commission (2020, October 27). Reducing CO2 emissions from passenger cars – before 2020. Retrieved from: https://ec.europa.eu/clima/policies/transport/vehicles/cars_en

[IEA20] IEA (2020, October 10). Global EV Outlook 2020. Retrieved from: https://www.iea.org/reports/global-ev-outlook-2020

[IREN20] IRENA (2020, March). Renewable Capacity Statistics 2020. Retrieved from: https://www.irena.org/publications/2020/Mar/Renewable-Capacity-Statistics-2020

[Kane20] Kane, M. (2020, March 28). Battery electric hydrogen fuel cell effficienty comparison. InsideEVs. Retrieved from: https://insideevs.com/news/406676/battery-electric-hydrogen-fuel-cell-efficiency-comparison/

[KPMG20a] KPMG (2020a). Analysis on global FCEV market.

[KPMG20b] KPMG (2020b, June). Obvious automotive key trends. Retrieved from: https://automotive-institute.kpmg.de/GAES2020/megatrends/obvious-automotive-key-trends

[NOS19] NOS (2019, January 11). Geen plek voor nieuwe zonneparken op stroomnetwerk. Retrieved from: https://nos.nl/artikel/2266953-geen-plek-voor-nieuwe-zonneparken-op-stroomnetwerk.html

[Rotm20] Rotman, E. (2020, March 12). Groene waterstof Groningen. Duurzaam bedrijfsleven. Retrieved from https://www.duurzaambedrijfsleven.nl/energietransitie-business/33455/groene-waterstof-groningen

[Shel20] Shell (2020, February 27). Grootste groene waterstof project van Europa start in Groningen. Retrieved from: https://www.shell.nl/media/persberichten/2020-media-releases/grootste-groene-waterstofproject-van-europa-in-groningen.html

[Volk20] Volkswagen AG (2020, October 10). What is more efficient? Hydrogen or battery powered? Retrieved from: https://www.volkswagenag.com/en/news/stories/2019/08/hydrogen-or-battery–that-is-the-question.html#