Many organizations are on a journey towards optimizing their finance departments in order to provide better services to their internal and external clients. KPMG supported Triodos Bank, one of the world’s leading sustainable banks, in that journey. Triodos is taking their finance department to the next level by optimizing their planning, budgeting and forecasting process through technology-based solutions. Key lessons learned from this client case are shared to provide practical insights that can also be applied to other organizations.

Introduction

Triodos Bank is a unique and admirable financial institution, with a central ambition of promoting “human dignity, environmental conservation and a focus on people’s quality of life”. It seeks to realize this ambition through conducting business responsibly, exercising transparency, and using money as consciously and effectively as possible ([TRIO17]). Triodos sees resilient and effective business operations as one of the enablers of this ambition, and as such one of its current objectives is to make its internal processes more efficient, thereby “creating more value for clients and reducing internal waste” ([TRIO17]).

It’s not surprising that the effectiveness, efficiency and transparency of the organization’s budgeting and forecasting process are important topics of conversation for Triodos management. A budgeting and forecasting process that is well designed and facilitated by appropriate technology is a critical element of effectively managing an organization’s performance. It enables reliable performance expectations, timely decision-making, and clear organization-wide comparability over time.

The starting point for Triodos’ journey

Triodos has experienced sharp growth over the last five years. Its total assets under management grew from €8.0 bn in 2012 to €14.5 bn in 2017 ([TRIO12], [TRIO17]). Such rapid growth requires a high level of maturity in an organization’s internal processes, and Triodos was no exception to this.

Prior to starting its search for a better solution, Triodos’ budgeting and forecasting process was almost entirely spreadsheet-based. Separate spreadsheet files were produced and maintained for each head office department, each country branch, and for the investment management business unit. Workflow was managed through emailing these spreadsheet files to the Group Controlling team for processing at head office level, where manual checks were performed and where the files were manually uploaded into a Consolidation system.

In principle the process was logical, there were several underlying issues however:

- spreadsheet models are error-prone;

- manual data checks are unreliable as they are subject to human error;

- workflow is difficult to oversee and track via email;

- in a process of this nature, there is a chance that the information being submitted is not entirely consistently defined and as such not comparable.

The primary catalyst for change, however, was simply that the entire process was too time-consuming. Controllers at Triodos wanted to spend less time producing their budgets and forecasts, and more time analyzing those budgets and forecasts to produce value-adding insights (e.g. scenario analysis, sector profitability, etc.).

Tackling the problem

There are, of course, several ways of approaching such a problem. Triodos concluded that the issues would be best addressed by facilitating the budgeting and forecasting process with appropriate technology. Jan Bert de Nood, Senior Controller at Triodos Group, is based at the organization’s global headquarters in the Netherlands and has been heavily involved in the initiative. He describes the reason for starting the search for a technology-based solution as follows:

“We wanted to automate the budgeting and forecasting process to enable us to analyze consolidated budgeting and forecasting results more quickly and easily, and to improve our ability to run scenarios on those results. We also wanted to improve the quality of the outcome of the process, as the existing process was manual and error-prone.”

This started an extensive tool-selection project, which culminated in Triodos selecting CCH Tagetik’s Budgeting & Planning module. Jan Bert recollects:

“We went through a thorough process through which we eventually made a shortlist of three possible suppliers. In the end we chose CCH Tagetik because of its flexibility as a tool, which makes it the best match for our requirements. Other important criteria included the prior experience of the technology provider in the European banking sector, and the technology provider’s fit with Triodos in terms of its size and way of working.”

In addition to this flexibility, another benefit of CCH Tagetik is that it is a unified cloud-based platform for financial applications. This helps to ensure that Triodos’ finance organization is future-proof, as the functionality and performance of the tool is constantly being improved. Since November 2017 Triodos has – with the help of a KPMG team – been designing, building and implementing a CCH Tagetik application that optimally facilitates their process. The first phase of the project involved implementing CCH Tagetik as the budgeting system for one of the Head Office departments and the Investment Management business unit. A traditional waterfall approach was used during the first phase. The entire application was first designed, after which configuration, testing and go-live took place.

Figure 1. The first phase of the project required a traditional waterfall approach. [Click on the image for a larger image]

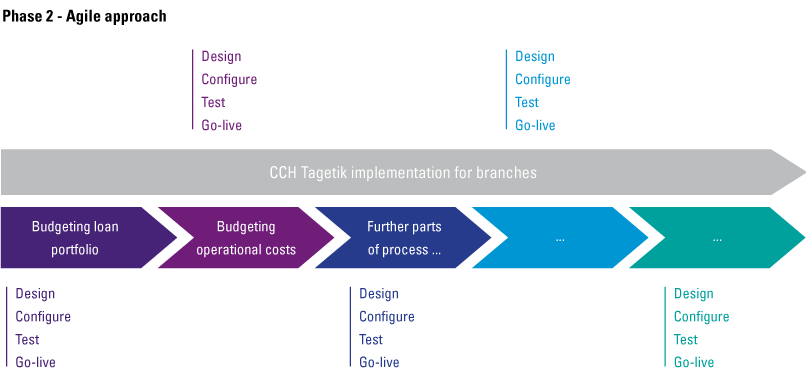

The second phase of the project involved implementing the tool for the remaining head office departments and the country branches. An agile approach was considered more appropriate for the second phase given the complexity of the branch processes and the aim for further alignment of those processes. As such, the branch processes were split into digestible components (e.g. budgeting Loan Portfolio, budgeting operational costs, etc.) which are being designed, configured and tested one-by-one.

Figure 2. The second phase of the project required an agile approach. [Click on the image for a larger image]

An important reason for using two different approaches within the project is that there were differences in the need for flexibility between the two phases. In the first phase, the requirements for what was to be configured in the application were clear and could be easily defined prior to starting configuration. This lends itself very well to a waterfall approach as the requirements and resulting design for the application can first be documented, providing a blueprint to work towards during the configuration stage.

In the second phase, however, it became apparent that the implementation of the process for the branches required a more flexible approach. As has been noted, there are multiple parts to the process. Some of these are quite complex and are subject to further alignment between the branches. There is a high probability that any requirements defined at the start of the second phase will be subject to change. Under such circumstances, a waterfall approach is inefficient and constraining. Furthermore, as the process for the branches can be split into relatively independent components, an agile approach can provide efficiency gains for the organization more quickly than a waterfall approach. This is because one part of the process can reach full implementation without being held up by analysis and design of other parts of the process.

High effort, high impact

An initiative of this scope requires significant effort. Jan Bert points out that the project has required a considerable amount of time from Triodos controllers:

“All of the branches and business units are involved, both in the Netherlands and abroad, and the implementation has to be done in parallel with the regular day-to-day activities of the controlling departments. Given the size of Triodos, this is a challenging, but interesting process.”

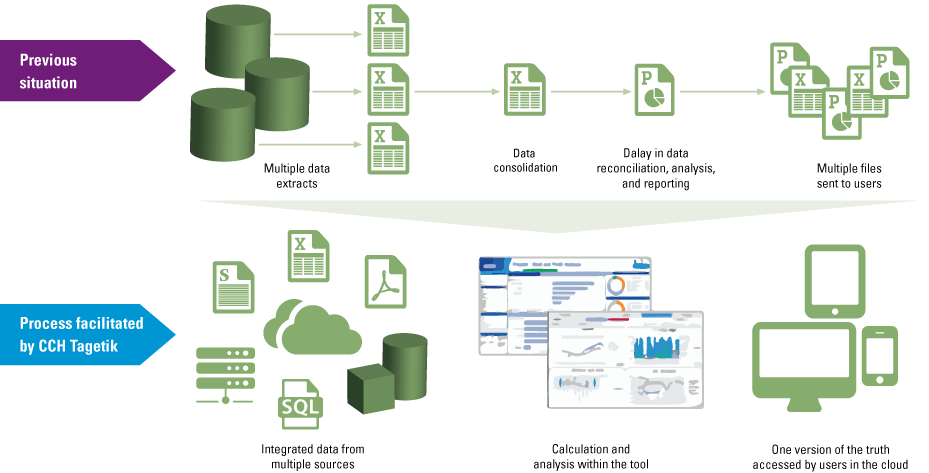

This should not be seen as negative – widespread involvement in the project results in widespread ownership of the solution. The effort is also rewarded with significant additional benefits. Triodos is moving from error-prone spreadsheet models and calculations to the CCH Tagetik infrastructure of data entry forms and automated driver-based calculations. The process workflow is now centrally managed and easily traceable – transparency in the process has improved and a full audit trail is available. Data checks and validations are automated, and entities can only submit information if these validations are passed. In addition, reports, calculations and data definitions are refined, further improving the reports and insights that come out of the process.

Figure 3. CCH Tagetik brings the process together, resulting in one version of the truth. [Click on the image for a larger image]

The most important benefit, as far as Jan Bert is concerned, is the re-allocation of time that the solution will allow:

“In the end, the application will save us a lot of time, which enables us to improve the balance between producing and analyzing the budgeting and forecasting results.”

This allows the controllers at Triodos to increase the focus on their primary goal of producing value-adding insights.

Most valuable lessons learned

What insights did Triodos gain as it has moved through this process? What has been learned that might also be useful to other organizations as they consider technology-based solutions to optimize their budgeting and forecasting processes?

Simplify

For Triodos this initiative provided an opportunity to simplify and align some elements of its data structure, and to re-assess parts of its process. Jan Bert touches on this:

“The most important lesson we learned was to keep the data model and design of the application as simple as possible. This limits the number of fields that need to be populated in data entry forms. We adjusted our process to fit the tool, rather than the other way around.”

Various elements of the head office process were simplified as a result of implementing the tool. In some cases, reviewing the process for the purpose of implementation revealed unnecessary complexity. In other cases, simplification was the result of better practices developed by KPMG during other similar engagements.

Simplifying steps in the process can feel counter-intuitive, as we often associate simplification with reduced accuracy. While accuracy is very important, we must remember to continually consider whether the cost of a given decision is worth the benefit. In many instances, accepting a slightly reduced level of detail yields significant improvements in efficiency, while causing an immaterial loss of accuracy.

Align

If a single data model and process is to be used across all branches, then the branches must first have agreed on a harmonized process to be implemented. Jan Bert comments:

“We learned that aiming for one aligned data model across the organization is ideal, with limited possibilities for local adjustments.”

In general, it is beneficial to aim for an aligned process across the organization to the largest extent possible, and to agree on that process early.

Co-build

Another important insight gained was the benefit of using the ‘co-build’ approach. This is an approach in which the implementation provider (in this case KPMG) works shoulder to shoulder with the organization to design and configure the tool, rather than independently configuring the tool with subsequent review by the organization. Jan Bert is very positive about this approach in his reflections on the project:

“We chose the ‘co-build’ approach in which we did the configuration together with KPMG. We did this because we wanted to be closely involved in the realization of the tool. It gave us the opportunity to take advantage of KPMG’s expertise, while also benefiting from a steep learning curve ourselves.”

Furthermore, prior experience with similar projects teaches that using the ‘co-build’ approach is one of the key ways in which acceptance and absorption of the tool into everyday business activities is achieved. It makes the transition to the new process and tool more gradual, and gives the organization ownership over what has been developed.

Where to from here?

The steps completed so far have already taken Triodos a long way in achieving its overarching goal of making its finance organization more efficient, but there is still more work to be done. Aside from completing the implementation of the Budgeting & Planning module, Jan Bert mentions several additional items he sees as crucial to realizing the Triodos finance efficiency objective:

“In the next phase of the initiative, we intend to also start running our Consolidation process in CCH Tagetik, in order to have both actuals and budget figures in the one tool. Furthermore, we want to optimize connections to dash-boarding tools to enable smoother reporting, expand the use of our Enterprise Data Warehouse to improve the level of integration in our reporting, and further align finance processes throughout the organization.”

It is no simple task, but Triodos is tackling the challenge head-on. By obtaining the right technology, advice and support – and through maintaining their improvement-oriented attitude – Triodos is moving its finance function to the next level.

References

[TRIO12] Triodos Bank, Triodos Bank N.V. 2012 Annual Report, April 2013, available at: https://www.triodos.com/downloads/about-triodos-bank/annual-reports/annual-report-2012.pdf (accessed 13 August 2018).

[TRIO17] Triodos Bank, Triodos Bank N.V. 2017 Annual Report, March 2018, available at: https://www.triodos.com/downloads/about-triodos-bank/annual-reports/triodos-bank-annual-report-2017.pdf (accessed 13 August 2018).